Apart from “what will home prices do?" and "where are the best places to buy a property?" the main debate around the Australian housing market has been about poor housing affordability, occasionally interspersed with a scare that home prices will crash. The most recent example of the latter was on 60 Minutes last week with a call by US demographer and economist Harry S Dent that Australian house prices could fall “as much as 50% in the coming years”. But how serious should we take forecasts for a crash? And more fundamentally, how do we fix affordability?

Basic facts on the Australian property market

The basic facts regarding the Australian housing market are well known:

First, after strong gains in home prices over many years, it’s expensive relative to income, rents and its long-term trend and by global standards.

Second, flowing from this, housing affordability is poor:

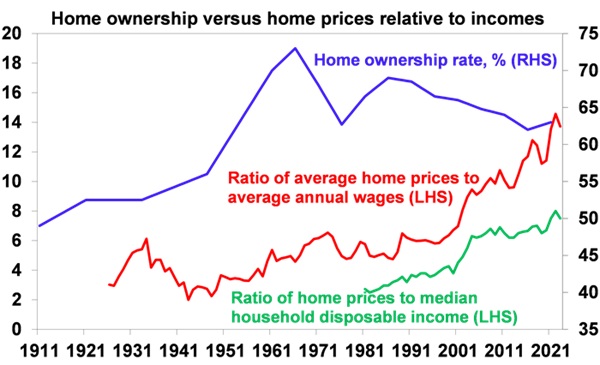

- The ratio of average dwelling prices to average wages (red line in the next chart) & household income (green line) has doubled since 2000.

Source ABS, CoreLogic, AMP

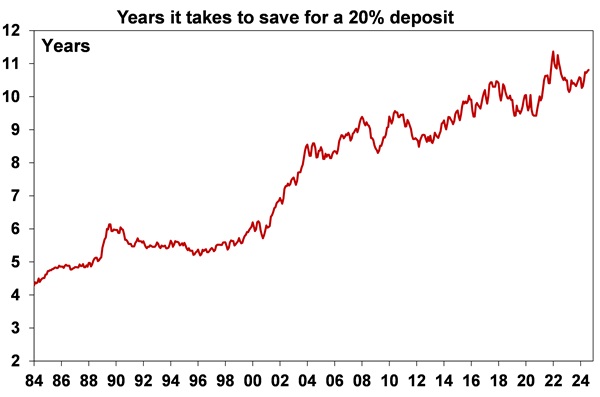

- The time taken to save for a deposit has roughly doubled over the last 30 years from five years to more than 10 years.

Source: ABS, AMP

- The portion of income needed to service a mortgage has hit an all-time high, thanks to the combination of the high price to income ratio and the sharp rise in mortgage rates starting in 2022.

Third, the surge in prices has seen our household debt to income ratio rise to the high end of OECD countries, which exposes Australia to financial instability on the back of high rates and or unemployment.

These things arguably make calls for some sort of crash seem plausible.

Crash calls for Australian property are nothing new

US commentator Harry S Dent’s forecast for an up to 50% fall in property prices is nothing new. Calls for an Australian property crash – say a 30% or more fall - have been trotted out regularly over the last two decades.

- In 2004, The Economist magazine described Australia as “America’s ugly sister” thanks in part to a “borrowing binge” and soaring property prices. At the time, the OECD estimated Australian housing was 51.8% overvalued.

- Property crash calls were wheeled out repeatedly after the GFC with one commentator losing a high-profile bet that prices could fall up to 40% & having to walk to the summit of Mount Kosciuszko as a result.

- In 2010, a US newspaper, The Philadelphia Trumpet, warned: “Pay close attention Australia. Los Angelification (referring to a 40% slump in LA home prices) is coming to a city near you.” At the same time, a US fund manager was labelling Australian housing as a “time bomb”.

- Similar calls were made in 2016 by a hedge fund: “The Australian property market is on the verge of blowing up on a spectacular scale…The feed-through effects will be immense… the economy will go into recession".

- Over the years, these crash calls have periodically made it on to Four Corners and 60 Minutes. The latter aired a program called “Bricks and slaughter” in 2018 with some predicting falls of as much as 40%.

- And Harry S Dent was regularly predicting Australian property price crashes last decade that didn’t occur.

Why a crash is unlikely?

Of course, a crash can’t be ruled out, but as I have learned over the last two decades the Australia property market is a lot more complicated than many “perma property bears” allow for.

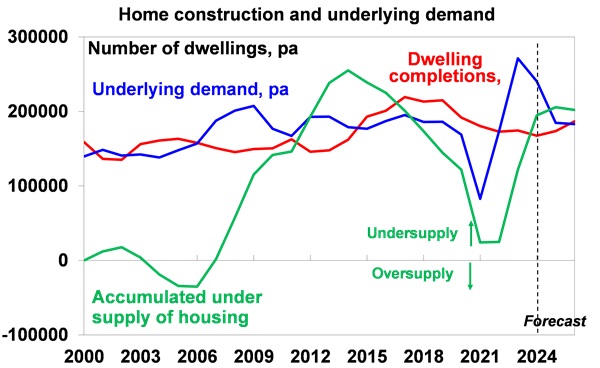

First, the property market is not just a speculative bubble fuelled by easy money and low interest rates. Sure low rates allowed us to pay each other more for homes but the key factor keeping them elevated relative to incomes has been that the supply of new dwellings has not kept up with demand due to strong population growth since the mid-2000s and more recently with record population growth resulting in an accumulated shortfall of around 200,000 dwellings at least but possibly as high as 300,000 if the reduction in average household size that occurred through the pandemic is allowed for. This partly explains why property prices have not collapsed despite the threefold rise in mortgage rates since May 2022.

Source: ABS, AMP

Second, the property market is highly diverse as evident now with strength in previously underperforming cities like Perth, Adelaide and Brisbane but weak conditions in Melbourne, Hobart and Darwin.

Thirdly, Australian households with a mortgage have proven far more resilient than many including myself would have expected in the face of the rate hikes in 2022 and 2023. This is evident in still relatively low mortgage arrears (of around 1% of total loans). This may reflect a combination of savings buffers built up through the pandemic including in mortgage pre-payments and offset accounts, access to support from the ‘bank of mum and dad’, the still strong jobs market allowing people to work extra hours and an ability to cut discretionary spending (suggesting definitions of what constitutes mortgage stress may be overstating things). Of course, arrears are starting to rise as these supports recede, so the continuation of this resilience should not be taken for granted.

Finally, the conditions for a crash are not in place. This would probably require a sharp further rise in interest rates and/or much higher unemployment. Sharply higher interest rates from the RBA are unlikely as global inflationary pressure is easing and global central banks are now cutting. Our inflation and rates went up with a lag versus other countries and are likely to follow on the way down. Higher unemployment – with jobs leading indicators pointing to less jobs growth – is the biggest risk though.

So, a property price crash is a risk, but would likely require a deep recession. Our base case for average home prices remains for modest growth ahead of a pick-up after rates start to fall.

What can be done to boost housing affordability?

Of course, a house price crash would improve housing affordability – but it’s also a case of “be careful of what you wish for” because a crash would likely also come with a deep recession and sharply higher unemployment which could see many lose their homes along with a hit to incomes. However, improving housing affordability is critical as its long-term deterioration is driving excessive debt levels and increased mortgage stress and contributing to a fall in home ownership (the blue line in the first chart). Of course, other factors have also driven falling home ownership since the 1960s including people starting work and family later in life, a decline in perceptions that owning a home is necessary for security and growth in other forms of saving beyond housing. But worsening affordability is likely a big contributor and falling home ownership due to this is something we should be concerned about as its contributing to increasing inequality and if it persists it could threaten social cohesion.

So, beyond crashing home prices, what can be done to boost housing affordability? My shopping list includes the following:

- Build more homes - relaxing land use rules, releasing land faster and speeding up approval processes, encourage build to rent affordable housing and greater public involvement in provision of social housing. The commitment by Australian governments to build 1.2 million homes – backed up by incentives and strong moves by at last NSW and Victoria over five years starting from this financial year is a welcome and big move down the path to boost supply. So far though approvals and commencements running at around 160,000 to 170,000 homes annually are well below the implied 240,000 target.

- Refocus on building more units – we will need more units (which are lower cost) than houses in the mix. The only time we consistently built more than 200,000 homes per annum was in the unit building boom of the 2015-19 period. Back then unit approvals were around 50% of total approvals whereas they are now about one third.

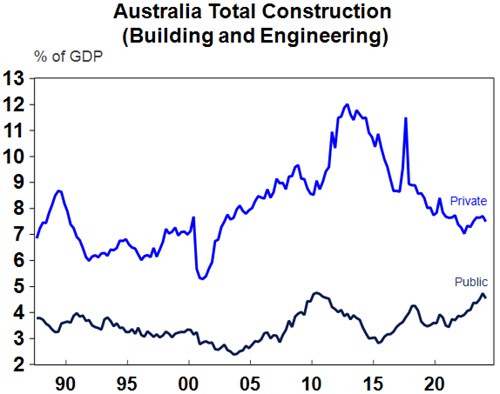

- Slow down infrastructure spending – home builders are now regularly complaining about the difficulty in building apartments. Apart from issues around approvals, much of this relates to cost blow outs and labour shortages and beyond the disruption caused by the pandemic an ongoing driver is the competition for resources from booming public sector infrastructure projects.

Source: Macrobond, AMP

- Match the level of immigration to the ability of the property market to supply housing - we have clearly failed to do this since the mid-2000s and particularly following the reopening from the pandemic, and this is evident in the ongoing supply shortfalls. Of course, we need to be careful to not over-react with the crackdown on student visas and numbers risking a lasting negative impact on our education sector which is our biggest export earner after iron ore and energy.

- Encouraging greater decentralisation to regional Australia – this should be helped along with appropriate infrastructure and of course measures to boost regional housing supply.

- Tax reform - including replacing stamp duty with land tax (to make it easier for empty nesters to downsize) and reducing the capital gains tax discount (to remove a distortion in favour of speculation).

Policies that won’t work, but are regularly put forward by populist politicians as solutions to poor affordability, include: grants and concessions for first home buyers (as they just add to higher prices); abolishing negative gearing (which would just inject another distortion into the tax system and would adversely affect supply), although there is a case to cap excessive use of negative gearing tax benefits; banning foreign purchases altogether (as they are a small part of total demand and may make it even harder to get new unit construction off the ground); and a large scale return to public housing (as a major constraint to more units is excessive costs and delays, and just switching to public housing won’t fix this).

Dr Shane Oliver is Head of Investment Strategy and Chief Economist at AMP. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs.