“Countries don’t go bankrupt.” Walter Wriston, former head of Citibank

“There is a myth that floated around the banking community not many years ago that governments do not go bankrupt. I cannot imagine who dreamed that one up.” Gordon Tullock, Economist

Sovereign restructures have been witnessed for Russia, Argentina, Greece, Iraq, Uruguay, and many others, with investors taking ‘haircuts’, some ranging from 50% (Russia) to nearly 90% (Iraq). Expensive haircuts those, but for what is purportedly a defensive asset class, investors flock back again with renewed vigour: “This time, it will be different.” So said Argentina, who, by some estimates, has defaulted eight times on its sovereign debt. In 2017, jaws dropped as Argentina issued US$2.75 billion of bonds at 7.9% (in US$) on a 100-year maturity, and then, with inflation running at 40% per annum and the peso falling, sought IMF assistance in May 2018.

Perhaps some money managers are so hungry for yield today, that they underplay the risk of haircuts tomorrow.

But fixed interest investors only need worry about banana republics not paying them back, right? Think again. We are entering uncharted investment waters, a world in which great republics may repudiate their sovereign debt, setting off a chain of catastrophic corrections. And the greatest republic is the United States.

Will the USS Titanic hit the iceberg in 2028, or before?

When the US Congressional Budget Office (CBO) released its 10-year budget and economic outlook in April 2018, it reported that:

“The budget deficit will near one trillion dollars next year, after which permanent trillion-dollar deficits will emerge and continue indefinitely.” The national debt, CBO said, “… is rising unsustainably.”

However, several economists have long argued that the CBO vastly understates the problem. Boston University Economics Professor Laurence Kotlikoff contends that CBO’s debt estimates do not take into account the full financial obligations the government is committed to honor, especially for future payments of Social Security, Medicare and interest on the debt. That ‘fiscal gap’, according to Kotlikoff, a net present value (NPV) of future obligations (written into current law) less expected revenues is well over US$200 trillion. In 2017, US GDP was US$19.4 trillion.

The International Monetary Fund (IMF) also has a more pessimistic opinion. The IMF’s view is that by 2023, the US debt-to-GDP ratio could be on par with Italy’s, both well above 100%.

Audits of sovereigns

We justly require an independent financial audit of corporations. Sovereigns should be subject to a similar discipline, with auditors chosen by a lower house majority and affirmed by the upper house (in democracies).

The vast majority of sovereigns are incessantly running budget deficits. The power to tax is constrained by the ‘Laffer Curve’ realities: Taxation revenue falls when tax rates become too high due to evasion, reduced incentive to work and economic deterioration.

If auditors applied the same tests as they do to corporations, many sovereigns may not pass the test of solvency.

Indeed, the Bureau of the Fiscal Service (BFS), a US government agency, says that as at 30 September 2017, the US Government’s liabilities exceeded its assets by US$20 trillion. This is a ‘as at a date’ calculation, not an NPV of a future cash flow stream.

The US Government Accountability Office (GAO), an independent, nonpartisan agency that works for Congress, adds: “… policymakers will need to consider policy changes to the entire range of federal activities, both revenue and spending (entitlement programs, other mandatory spending, and discretionary spending)”.

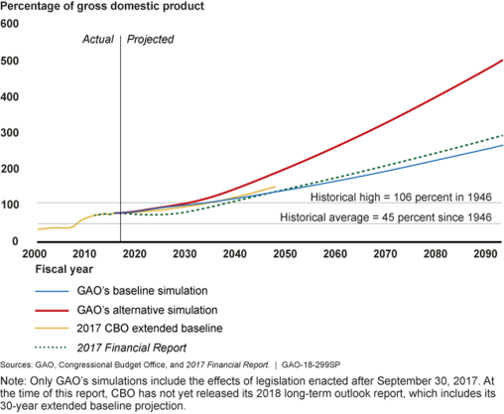

The chart below compares the GAO, CBO and BFS projections on the ratio of US Government debt (limited to that held by the public) to GDP:

The US is not alone … the rumblings in Europe and Asia

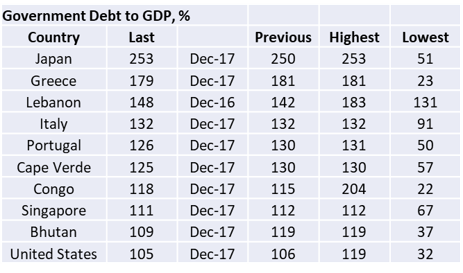

Trading Economics produces a Debt/GDP ratio table by country. Here are the 10 worst:

Unsurprisingly, the worst offenders are trading at or close to their highest ever ratios.

Meanwhile, here is Forbes magazine on the top offender, Japan, December 2017:

“By 2041, assuming tax revenue remains constant and there won’t be any economic shocks, Japan’s interest repayments will exceed tax income. Note that we also assume [the] interest rate to stay at 1.1%, because if this figure increases then the government will default more quickly.”

And here’s the IMF (January 2018) on China:

“International experience suggests that China’s current credit trajectory is dangerous with increasing risks of a disruptive adjustment and/or a marked growth slowdown … A disorderly correction from such an expansion could have far-reaching implications on financial stability and growth.”

In Italy, all the main political parties are promising sweeping tax cuts, higher public pensions and a boost in welfare provisions. With a straight face, the politicians also say they will cut the national debt at the same time, in a Don Corleone “we will make them an offer they can’t refuse” style. Voters agree, but not Roberto Perotti, an economics professor at Milan’s Bocconi University, who cried out: “They are just trying to trick us, they are throwing out random numbers that make no sense.”

Kicking the can down the road

Raising taxes or cutting welfare is the surest recipe for removal from office.

Borrowing from the next generation, as long as capital markets allow, is one way to kick the can down the road. The nation’s banks must hold sovereign bonds as liquid, ‘low-risk’ assets by regulation. The central bank reduces interest rates because the Keynesians think that’s stimulatory. Yet they have been near-zero in many advanced economies, after non-stop diminution for 30 years.

Saving rates plummet, but the yearly interest bill is low, courtesy of low rates, and principal repayments and ongoing deficits are met by ever-more borrowing. When the markets do not buy enough, the central bank itself starts buying – sovereign bonds at first, then mortgage assets, corporate bonds, equities - whatever is required to keep the markets afloat.

A debt feast of that nature does not end until markets force it to or when even interest payments cannot be met. By this point, the austerity required is so high that it’s politically unmanageable.

Repudiation is the better course of action. It does not destroy the currency or the economy, but hurts those who bought the bonds in the first place. However, besieged countries may choose a bit of everything: a little austerity, high inflation, and an offer of an expensive haircut.

When everyone is both the rescuer and the rescued

Relentless Quantitative Easing has created some US$13 trillion of assets across the US Federal Reserve (the Fed), the European Central Bank (ECB) and the Bank of Japan (BoJ), plus several trillion more with other major central banks. As equity underwriters to an IPO who are stuck with a lot of stock know, a large overhang that stands at ‘ready to offload’ creates a price ceiling. The US central bank balance sheet is now 23% of GDP, a level nowhere near seen since just post WWII, while BoJ’s assets are over 50% of GDP.

Between them, the Fed, the Bank of England (BoE), ECB, BoJ and other central banks have bought not only their own sovereign bonds and financed their government’s deficit, but also other sovereign bonds, mortgage securities, asset-backed securities, corporate bonds, and even outright listed corporate equity.

European banks hold other European sovereign risk to a significant degree. They intertwine and entangle their fortunes. In Europe, we may see no one on the pier, hauling the drowning out. A more likely scenario is a circle of sovereigns (and their central banks) holding hands, each assuring the one on their left, “No worries, I’ve got you, mate,” as market currents push them all out to sea.

Can investors insure against Black Swan events?

Downside correlations among asset classes can be much higher than upside correlations, upsetting diversification metrics. Even worse, in Black Swan events, asset classes could be as together as Jack and Jill tumbling down the hill. We know that from the GFC. Global fixed interest manager PIMCO opines that activist central banks make for stronger correlations across asset classes. Old correlations do not hold as paradigms shift.

Some insurance portfolios include customised strategies and inverse exchange-traded funds (ETFs), which profit when markets go down. Some investors may prefer physical gold, gold ETFs, or long volatility trades (positions which profit from higher market swings). Such insurance involves ongoing opportunity costs and risks.

A comparison of the risks, costs, and strategies of such investment insurance policies is beyond the scope of this paper.

The year 2029 will mark the centennial anniversary of the Great Depression. It’s not just a bad omen, the fundamentals point to a severe correction sometime over the next decade, but the lack of certainty over timing makes the events hard to insure against.

Vinay Kolhatkar is Assistant Editor at Cuffelinks. This article was written for educational purposes and to stimulate debate and is not intended to be financial advice. Analyses from professional investment managers which address the insurance issue are welcome.