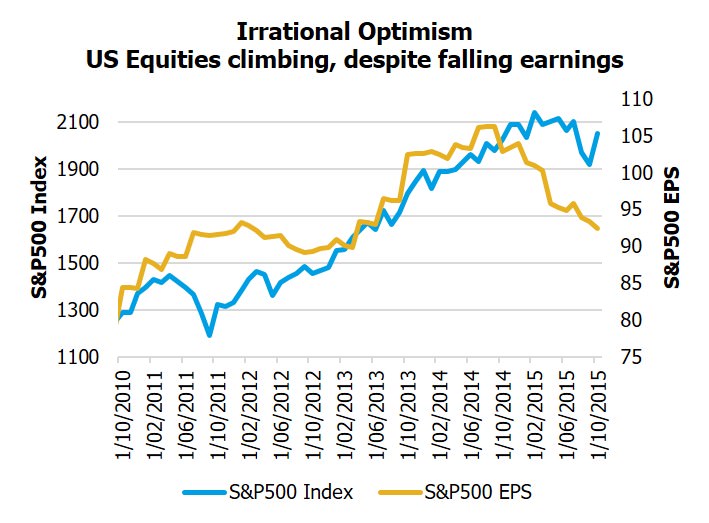

For some years, most analysts have been expecting stronger economic growth but it has failed to eventuate. The problem is that equity investors fail to recognise the market is over-heated because it has been propped up by ultra-low interest rates for so long. The big question is what happens when the US starts to increase interest rates? Slow economic growth is leading to slow earnings growth which doesn’t justify the current level of irrational optimism facing most markets.

Irrational optimism

The final phase of a bull market is typically signalled by irrational optimism. In this phase it doesn’t matter what news or data comes from the real world, the financial world can read it as positive.

That phase is well into its final throes right now, as illustrated by October’s ‘bad news rally’. This rally started with the poor employment figures from the US, followed by concerns expressed by some of the world’s most powerful central banks about the global outlook, and then rounded off by poor earnings growth figures from US corporates.

In essence, three events that should be a signal for a weak outlook for equities instead sparked a rally. This just isn’t rational.

Irrational economists

As each year has progressed since the GFC, optimistic forecasts have been revised downwards, then the predictions for the following year are for much higher growth, and around we go again.

This year was no different. At the start of the year, the International Monetary Fund (IMF) had forecast 4.0% per annum global growth. They have already reduced that forecast to 3.1%, and the reality is more likely to be 3.0% or lower.

There are two reasons for this persistent bullish outlook. The first is job security: no Wall Street researcher or bank economist wants to publish a negative outlook unless they are very sure about it. Negative outlooks do not encourage people to borrow more money or to invest more. Even the IMF has a positive bias because they don’t want to inadvertently reduce economic growth by scaring consumers and businesses into spending less.

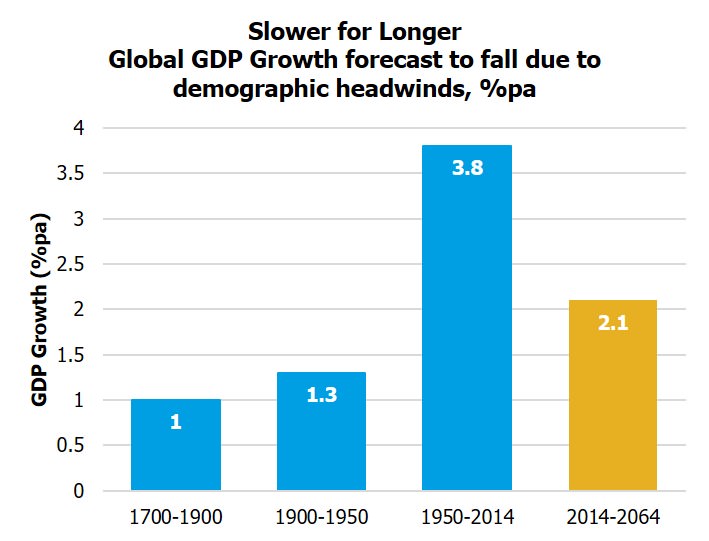

The second reason growth has been persistently lower than expectations is because everyone is assuming that conditions will revert to the way they were prior to the crisis. But the evidence is heavily against a return to historic averages, at least for the next ten years or more.

Three reasons to expect slower growth

Slower global growth is anticipated over at least the next decade due to:

- The western world’s baby boomer generation retiring over the next 10-20 years means less consumer spending and lower economic output. Assuming no major increases in productivity, for example, from technology, this factor alone will push global growth down to nearly half the pace of the last 60 years.

- Fiscal austerity across the US and Europe will continue.

- China’s inevitable but painful transition to a consumer-led economy has reduced emerging market growth, and will do so until India is able to pick up the reins in ten years or more.

A possible fourth but unpredictable cause of lower growth stems from the challenge of ending ultra-low interest rates in the US, Europe, UK and Japan. This has helped the US economy to climb out of recession and appears to be slowly working in Europe, but it has the undesirable side effect of encouraging borrowing to invest. It supports financial markets more than the real economy and therefore the wealthy over the less wealthy.

Source: FIIG Securities forecast.

At some time, central bank support must end, but markets have become addicted, so the withdrawal process could be highly volatile. Increase rates too quickly, and markets could collapse. Increase them too slowly and asset prices could rise even further, causing more damage when the bubble eventually has to burst. Witness for example the irrational response that Wall Street had in September when the US central bank decided the economy wasn’t healthy enough to increase interest rates. On the live coverage of the announcement from the Fed, Wall Street traders could be heard cheering in the background, despite the obvious negative implications.

Currency and bond markets predicting slow increase in rates

Unlike the stock market, bond markets have been telling us for some time now that growth will not return to pre-GFC rates and so interest rates will not rise to previous heights. Bond markets are currently predicting that interest rates will remain below long term averages for the next ten years at least. The US government’s 10 year bond yield is 2.02% p.a., implying their cash rates probably won’t rise above 3.5% p.a. over the next 10 years. Similarly, the Australian 10 year government bond yield is currently 2.65% p.a. which implies that the RBA’s cash rate probably won’t get above 3.75% p.a.

Similarly, currency markets have started to price in an expectation that rates will remain very low in Europe and Japan, and that even the US will keep rates much lower than the past despite its stronger economy.

The reason for this is the ‘currency wars’ raging globally, in which central banks are keeping interest rates low to keep their currencies low. A lower currency means that an economy’s exports are more competitive. The EU, Japan and China are all using this method, meaning that if the US were to increase rates rapidly, the USD would rise quickly against other currencies, their exports would become more expensive and therefore less in demand, and their economy would be hurt.

All of this adds up to interest rates being very low globally, regardless of the strength of the US economy, until Europe and Japan, and maybe even until China, can repair their economies.

Impact on Australian investors

A slower global economy and the already weak Australian economy are expected to lead to the Australian dollar falling to 65 cents. It could go lower if the slowdown in China worsens or if we have a steep housing market correction. Slower growth is also bad news for anyone expecting equity market returns to return to historic highs. Slower economic growth must lead to slower earnings growth, which eventually has to be priced in to share prices.

It’s a risky strategy to rely on bank term deposits to provide an income to live on. A slower global economy will mean that all central banks will hold interest rates very low for years. With this global backdrop, and with the Australian economy also weak, the RBA is unlikely to increase interest rates for many years to come. It is even possible that bond markets, despite setting their expectations low, are still being too optimistic about growth.

Year after year Wall Street’s equities-biased analysis predicts that growth will return, so they expect company earnings to rise, which justifies high equity prices. But year after year, they have been proven wrong.

My conclusion is that the global economy and equity earnings will remain stubbornly slower for the next decade at least. Low economic growth means bond yields will remain lower than expected. For investors, particularly those reliant on term deposit earnings or dividends to fund their lifestyle, it’s time to rethink your strategy.

Craig Swanger is Senior Economist at FIIG Securities Limited, a leading fixed interest specialist. This article is general information and does not consider the circumstances of any individual.