In February and March 2020, the COVID pandemic caused a quick and deep plunge in global economic conditions and created widely held expectations of a severe and long-lasting recession. Investors panicked as average share prices dropped by more than a third in five weeks and interest rates fell to record lows.

Governments and central banks soon eased policies on an unprecedented scale. Many businesses found ways to cope with the effects of lockdowns and social distancing. Then the discovery and mass production of vaccines further raised economic confidence, particularly in China, the US and Britain.

As a result, the global economic slump was not only sudden and steep, but it was short-lived and uneven. Many countries are experiencing strong rebounds. Forecasters including the International Monetary Fund expect global growth of 6% over 2021, the fastest rate yet recorded in a calendar year. Employment is picking up quickly. Share prices have climbed to record highs.

Lessons from the recession, the panic and the rebound

Despite the abundance of negative comments from the many naysayers, global growth has resumed and accelerated. We saw the deepest and narrowest V-shaped slumps yet experienced in GDP, jobs, consumer spending and average share prices. Once again - as happened in 2008, 2000, 2001, 1987, 1974, 1960 and 1952 - the combination of gloom, despair and financial crisis proved to be a time to buy quality shares cheaply and a terrible time to sell them.

Alas, many investors will still not have that lesson front-of-mind when the next financial crisis comes along.

Of course, there’s a lot to worry about. Mutations could seriously diminish the effectiveness of vaccinations. Case numbers and deaths are increasing in many developing countries. Europe is dealing with third and fourth waves. Valuations are stretched. And, over time, the highly stimulative fiscal and monetary policy could leave a new set of problems in their wake, among them the high level of debt and inflation.

It’s harder framing an investment strategy now than a year ago

Many equities now have stretched-to-expensive valuations, especially in terms of price to earnings (P/E) multiples. In my view, low interest rates and accommodative monetary policy will support a few more quarters of strong share prices despite today’s stretched valuations.

The combination of abundant liquidity, near-negligible interest rates and market momentum is producing froth, failure and over-pricing, including for digital currencies, Gamestop, Archegos, Tesla, and the huge gains investors now expect when companies list. At times, correction of the excesses in some parts of the market will likely damage investor confidence across the board.

Investors also need to consider whether the huge fiscal boosts will be sustainable or will they end in write-offs, defaults, and fiscal cliffs. Will the huge budget deficits remain for decades and push interest rates to high levels, or will we see the return of uncomfortably high inflation?

In my view, there’ll be urgent need to start winding back the massive budget deficits in a year or two.

Also, there’s the parallel question of whether the super-low interest rates and unconventional monetary policies are sustainable. The US and Australian central banks say they’ll keep interest rates at negligible levels 'until 2024 at least', and have maintained this ‘guidance’ even as economic growth has accelerated, jobs growth has surprised on the high side, and some shortages of labour have re-appeared.

For the first time in years, inflation is a risk

For at least a decade, inflation has been negligible, and stubbornly lower than most central banks have been targeting. Reasons include globalisation, technological change, the impact of the GFC on inflation expectations, and slow rates of increase in wages. Relatively few investors now have direct experience of how quickly inflation can change or the costs and uncertainties inflation can generate.

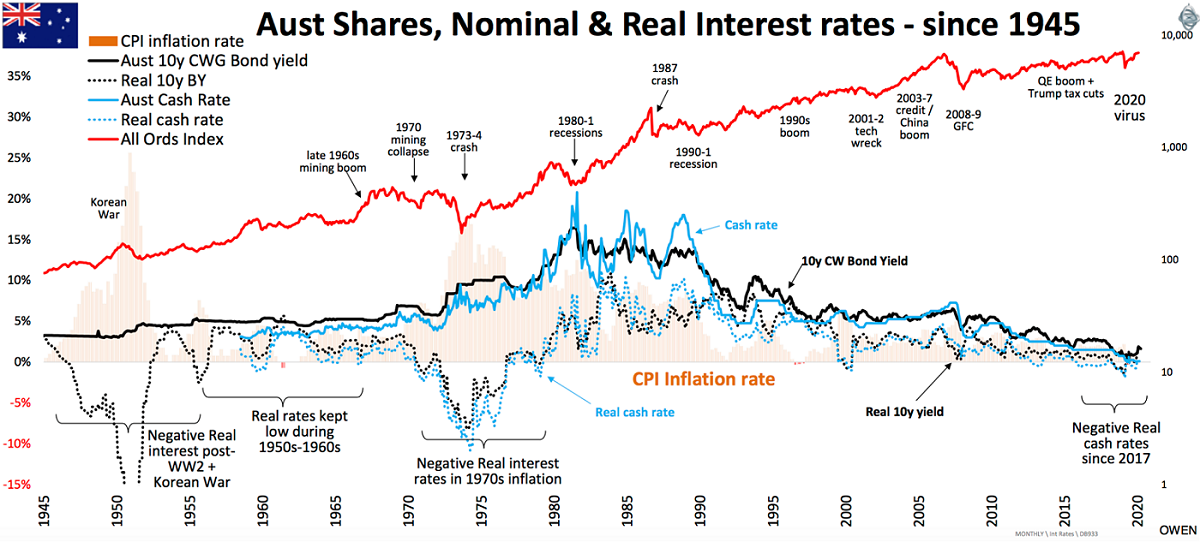

Investors under 50 years old might like to learn about the courses inflation has taken in the US and Australia since 1945 from this informative graph prepared by my colleague, Ashley Owen.

Last year, the risk of inflation returning, even over the the long run, was seen as minimal, mainly because of the pandemic-led global recession.

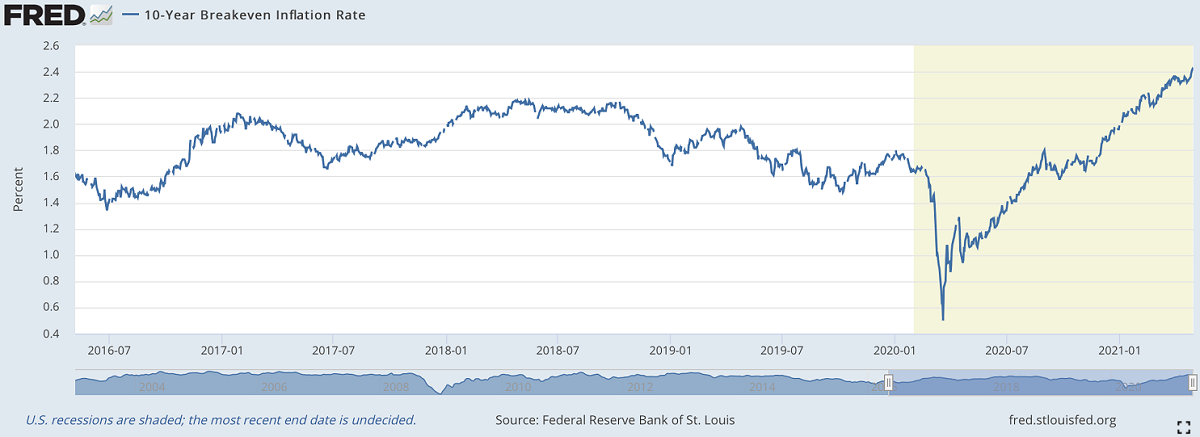

In recent months, bond investors have revised upwards their expectations for inflation. In my view, we’ll see further upward revisions in anticipated inflation in the next year or two. The chart shows an important measure of what US bond investors expect annual inflation will be in the coming decade. This measure of inflation expectations is derived from the market pricing of US bonds. Specifically, it’s the gap between the market yield on a conventional 10-year US bond and the market yield on a 10-year US bond that has its principal and interest adjusted for inflation.

In April 2020, the average US bond investor expected inflation to average 0.5% a year for a decade. That expectation has since risen to 2.4% a year. Expected inflation in the US now exceeds the yield on a 10-year conventional bond (which at time of writing is 1.6%), suggesting an investor buying a 10-year US bond is looking at a negative real return over the life of the bond.

This real return would be even lower were average inflation to exceed 2.4% a year over the decade, or if the investor was to sell the bond prior to its maturity after market interest rates had increased.

What causes inflation?

The key influences on inflation are summarised in the following list, though in practice they interact:

- Demand influences in the overall economy or in key sectors.

- Cost influences, including wage increases, rises in commodity prices or government taxes and charges.

- In general, rising productivity helps to constrain inflation.

- Competition and technical change. Globalisation has helped to check inflation, and so has the internet, which makes it easier for buyers to compare prices and shop around.

- Inflationary expectations, which both reflect inflation and cause inflation.

The outlook is for rising inflation

In my view, inflation in the US and Australia will likely appear contained or benign for another year or so, but then climb to between 3-5% in 2024, as the net outcome of these influences:

- Another year or so of above average economic growth, fuelled by large budget deficits and highly accommodative monetary policies, bringing about a quickening in wage increases and enabling some firms to raise selling prices.

- Both the US and Australian central banks will tolerate inflation settling above their target levels for a time as they focus on actual inflation, not forecasts for inflation. Most important, both monetary authorities are looking to achieve a significant reduction in unemployment and would like to see modest increase in average wages.

- Commodity prices are at high enough levels for some commentators and investors to refer to the return of the ‘super-cycle’ in the demand for many commodities.

The implications

Provided vaccination programmes and confidence are not seriously affected by mutations of the virus, it will soon be time for governments and central banks to reduce the scale of their policy boosts if the world is to avoid severe economic disruption in a few years’ time.

In the next year, we could see a kick up in inflation and inflationary expectations, pushing bond yields a little higher and further signalling the end of the bull market in bonds that’s ran for 30 to 40 years.

Don Stammer has been involved with investing for many decades as an academic, a senior official of the Reserve Bank, an investment banker and the chairman of nine companies listed on the ASX. He is currently an adviser to Stanford Brown Private Wealth. This article is general information and does not consider the circumstances of any investor.