In the fiscal 2014 year, governments at all three levels in Australia will spend around $520 billion, derived from taxes, income from government business enterprises (GBEs) and borrowings. Around $125 billion (24%) will go on social security and welfare, which is not excessive in relative terms when compared to virtually all other OECD nations. Indeed, it is the lowest as a share of GDP.

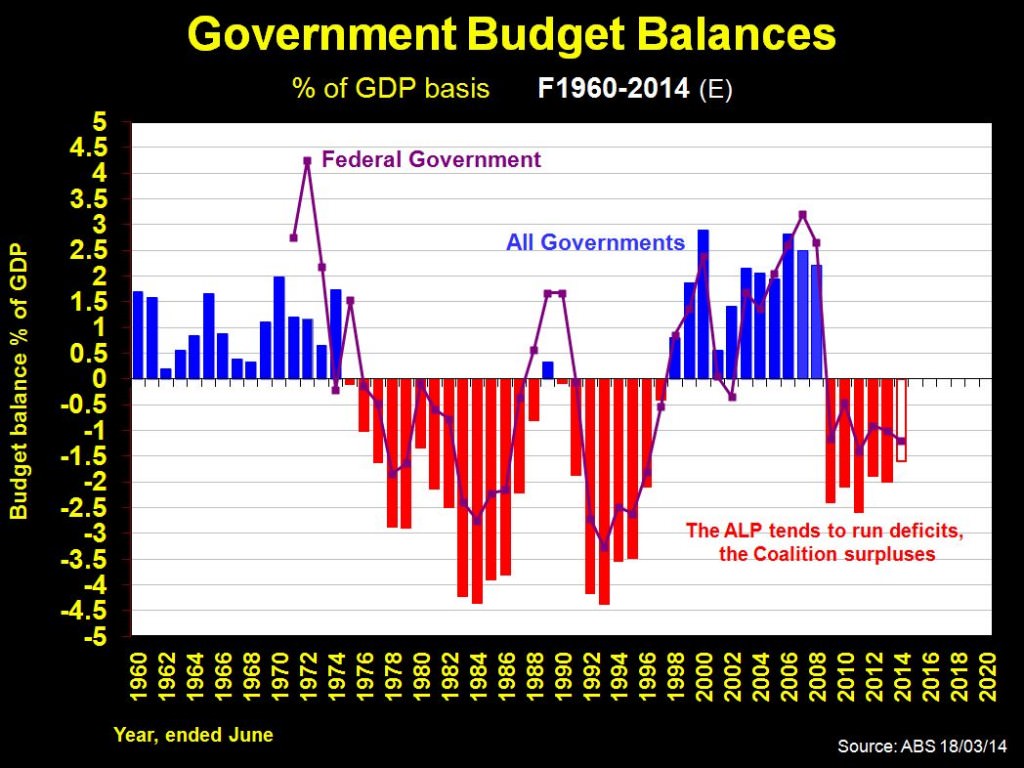

However, this year the nation will run yet another deficit, its sixth in a row, although not as deep as that of the Labor Governments in the 1980s and 1990s (Hawke/Keating Governments, and other Labor state governments). The only federal Coalition deficits over the past 60 years were under Malcolm Fraser, partly inherited from the Whitlam Labor Government. The first chart shows federal governments (purple line) and all governments (bars) surpluses and deficits since 1960.

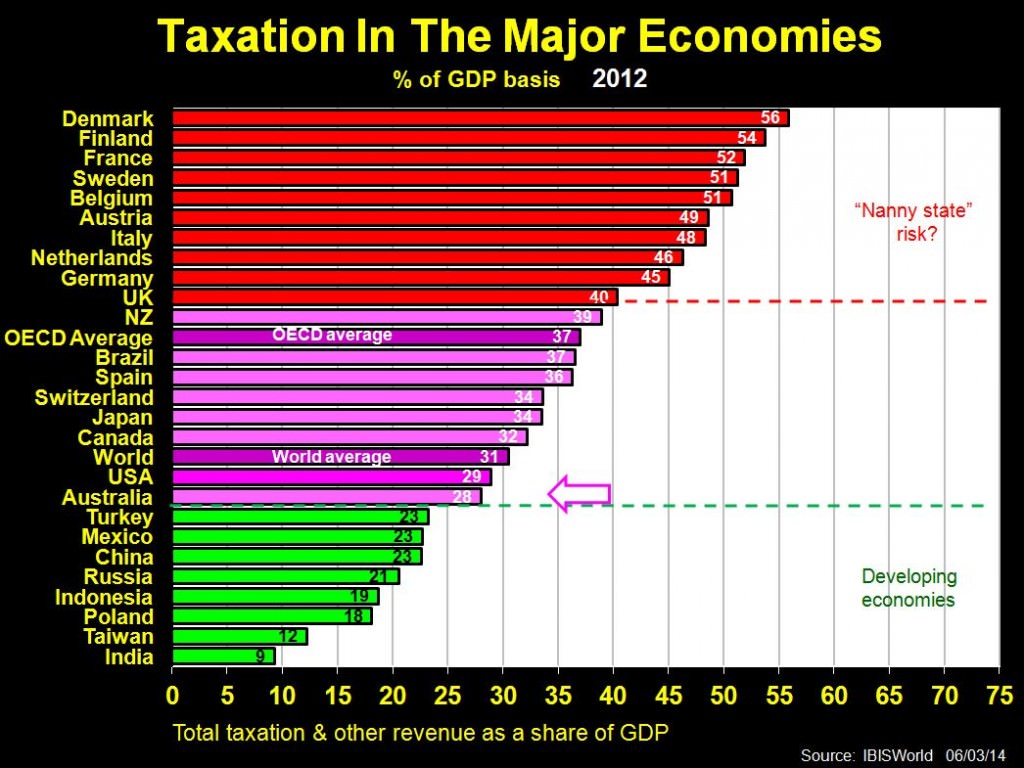

So, should the new Abbott Government and Coalition state governments cut deeply into spending in the 2015 financial year and later budgets to return us to surplus? To do this too harshly, whilst also introducing new welfare such as the proposed maternity allowance, seems unnecessary when we are already the lowest taxed nation in the OECD, smacking of ideology rather than common sense.

The debate about our taxes has been re-ignited often over the past several months, with a repeated denial by the Federal Government that there is any intention to raise our taxes, including the GST rate. However, taxes are currently 3% below where they were in 2007, then 31% of GDP, which was the last time we actually ran a surplus budget.

The second chart shows how taxation has fluctuated in recent years.

It may come as a surprise to taxpayers, be they personal or business, that Australia in 2014 is the lowest taxed nation in the developed world. At 28% of GDP in 2013, it is 9% below the OECD average of 37% of GDP, and exactly half the world’s highest taxed nation (Denmark) at 56% of GDP.

The third chart below shows that only developing economies, without the economic capacity to have higher taxes, sit below Australia’s tax rate.

So, to suggest to the electorate that our tax level is high enough as it is, or indeed too high, is difficult to justify. To also promise, as the Government has done, that Australia can introduce more welfare, without the funds to pay for it, is a fantasy, unless there is more than an equivalent reduction in other existing welfare. That sort of direction led to the debt problems that most EU nations and the USA now have.

The reality is that the nation is lowly taxed, indeed under-taxed. Raising the GST to 12.5% and removing some of the exemptions would restore our virtuosity, and still make us one of the lower taxed nations. We are nowhere near the so-called ‘nanny state’ levels where taxes are well over 40% of GDP.

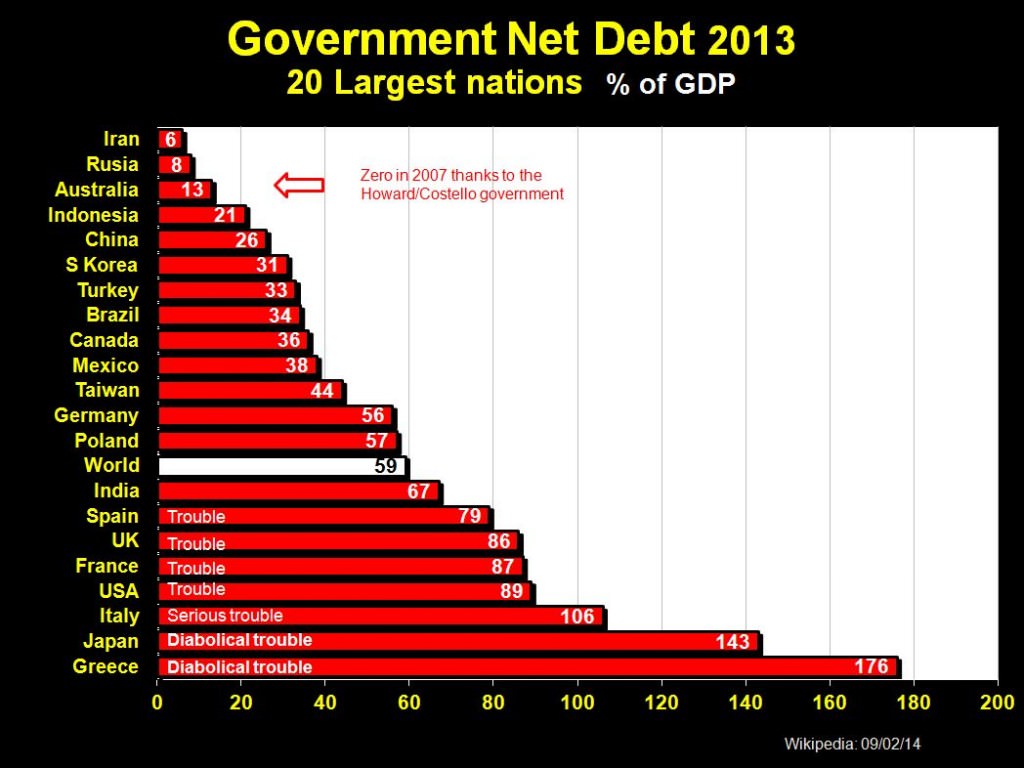

By world comparisons, Australia has the luxury of several years grace before becoming more serious about budget issues. We have a low government net debt - as the fourth chart shows - we are part of the biggest and fastest growing region in the world (the Asia Pacific), and we have relatively high consumer and business confidence. However, these attributes will not last forever in the absence of reforms.

Creating an Audit Committee with experienced captains of industry, and an Industrial Relations Review by the highly regarded Productivity Commission, are good initiatives. They will hopefully be heeded and have most recommendations implemented, unlike the previous government.

This brings the GST into the spotlight. As the final chart shows, Australia has one of the lower rates among the largest economies in the world, the 17th largest among 230 nations.

Our GST rate at 10% is nearly half the average (17-18%) and well below half of the five highest, all of whom have a rate over 20%. Yes, our personal income taxes sit higher than many in the OECD, but that advantage to individuals and households in those countries is offset by other taxes, including their higher GSTs.

Ken Henry, in his eponymous report on taxation in 2010, suggested a number of taxes should go in the interest of simplicity and streamlining business. They included payroll tax, insurance taxes, property transfer taxes, motor vehicle stamp duty, luxury car taxes and many others. These taxes would be replaced within the four pillars of personal income; business income; private consumption; and economic rents (natural resources and land). No argument from business on this goal.

Important points on taxation

Most importantly, the key messages on taxation are:

- we are lowly taxed

- we can and should raise them a little, preferably via the GST

- we can balance the Budget in the process

- yes, we should simplify and streamline the tax collecting regime.

We are living beyond our means, but we are not yet anywhere near a ‘nanny state’, and we do have some justifiable social security spending to maintain and expand (health services in an ageing society, support for maternity leave and some others). We can do all this while raising our taxes a little, and still remain close to the lowest taxed nation in the developed world.

Phil Ruthven AM is Founder and Chairman of IBISWorld, the world's largest independent publisher of industry research reports.