Hamish Douglass exclusive interview

Hamish Douglass sent an update to his investors on 18 March 2020, including:

"As you are aware, the COVID-19 virus is a fast-moving and fluid situation. The most likely outcome of the efforts to contain this health emergency is a near total shutdown of the world’s economy over the next two to six months. This is likely to lead to a near total collapse in demand for many (but not all) businesses over this period. For some, this could prove fatal, particularly for small businesses and for businesses that have high financial leverage or high fixed costs. Only governments can prevent these businesses from failing. The potential financial and social consequences are very concerning.

The shape of the economic recovery will depend upon the scale, timeliness and effectiveness of actions taken by governments and central banks to help businesses to survive and keep people employed over the next two to six months...

Over the past week, we have taken steps to increase the defensiveness of the Global Equity portfolio and have increased cash in the strategy from approximately 6% to approximately 15%. All cash is held in US dollars."

29 quality stocks at great prices

By Mark LaMonica, Individual Investor Product Manager, Morningstar

Great companies carve out a solid competitive advantage and as coronavirus rattles markets, many such names are trading at hefty discounts. Morningstar's list of 5-star rated stocks has expanded rapidly as prices fall and now includes 29 companies.

Market shocks can be cause for anxiety but if investors have the capital, such shocks can be an opportunity to pick up the stocks of great companies at discounts.

Investors define 'great' in different ways. From Morningstar's perspective, great companies are those that have carved out solid (and in some cases growing) competitive advantages that will allow them to thrive for years to come--in Morningstar parlance, they’ve built economic moats. Such companies are typically led by adept managers who have a record of allocating capital in ways that add value.

To find such exceptional firms, we looked for the following three qualities.

1. Economic moat: First, they need to boast wide or narrow Morningstar Economic Moat Ratings. In other words, these companies have strong competitive positions.

2. Exemplary stewardship: Second, they must earn our top Morningstar Stewardship Rating—exemplary or standard. In other words, these companies are led by exceptional corporate managers who have a proven record of making investments and acquisitions supporting the competitive advantages and core businesses of their companies--and they won't pay an arm and a leg to do so. They'll divest underperforming or noncore businesses. They'll find the right balance of investing in the business and returning cash to shareholders via dividends and share repurchases. And they'll assemble a portfolio of attractive operating assets and skilled human capital, and then execute well.

3. Discounted price: And lastly, the stocks of these companies must be trading at a decent discount to our fair value estimates, selling at Morningstar Ratings of 4 or 5 stars at the of writing.

We used the Morningstar Stock Screener to look for these qualities. Only three stocks made the cut. Don't think of this as a list of 'buys' though. Instead, think of it as a collection of names to investigate further. A 5-star rating does not suggest that the stocks won't drop further. The aim is not to pick the bottom, but to highlight to investors that they can pick names up at a discount.

The three companies are:

- Ansell Ltd: we view Ansell as well-managed and able to deliver a consistent, growing earnings stream

- Ryman Healthcare Ltd: We believe Ryman can roughly triple its annual revenue by the end of our 10-year forecast period, as the group expands the number and maturity of villages under its management

- Macquarie Group Ltd: Macquarie Group is a successful global asset manager and investment bank. Its main strengths are risk management, business unit interconnectedness and an ability to evolve and adapt to changing market conditions.

Although nobody know when the market will bottom, more companies are offering value than at any time in recent years.

Click here for access to Morningstar Premium for a free four-week trial, including portfolio management services from Sharesight and detailed research on 1600 global stocks as well as 450 ETFs and Funds, including the companies Morningstar currently rates as 5-star investments.

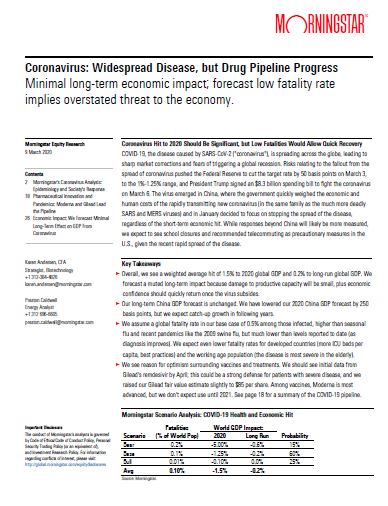

Coronavirus: widespread disease but drug pipeline progress

Morningstar's detailed research on coronavirus concludes there will be minimal long-term economic impact, with forecast low-fatality rates. It implies the threats to the economy are overrated, although please note this paper was first published to US subscribers on 9 March 2020. Click on the image for the full free paper.