The Weekend Edition includes a market update plus Morningstar adds free links to two of its most popular articles from the week, including stock-specific ideas. You can check previous editions here and contributors are here.

Weekend market update

From AAP Netdesk: On Friday, shares had their best daily performance at the end of a lockdown-plagued week on the Australian market. Energy, consumer discretionaries and industrials gained more than 1% in a broad-based rally. The benchmark S&P/ASX200 index closed up by 43 points, or 0.6%, to 7309 but the indices were barely changed for the week. The Australian dollar was buying 74.64 US cents on Friday afternoon.

From Shane Oliver, AMP Capital: While the US share market rose 1.7% to a new record high over the last week helped by a goldilocks jobs report, other global share markets fell with concerns about a renewed rise in coronavirus cases. Eurozone shares fell -0.5%, Japanese shares lost -1% and Chinese shares fell -3%. The latest coronavirus outbreak and new lockdowns also weighed on the Australian share market which was flat over the week with gains in telcos, retail and resources stocks offset by weakness in utilities, IT and property shares. Bond yields and metal and iron ore prices fell and the US dollar rose which weighed on the $A. Oil prices rose though due to an OPEC dispute which threatens to derail an increase in oil production.

While some headlines have noted that Australian share prices saw their best financial year gain in 2020-21 since the euphoria of 1987, the comparison is a bit misleading in that while the share market (as measured by the All Ords) returned 30.2% in 2020-21, this followed a loss of -7.2% in 2019-20 whereas 1986-87 saw a 54% return after a 42.5% return in 1985-86.

***

There is a similarity between the projections for 2060 for Australia described in the Intergenerational Report (IGR) and the net-zero climate change debate for 2050. In both cases, we can ignore the threats because they are too far in the future to worry about now, or we can start to make policy adjustments to manage the transition. We are not 100% sure about the accuracy of the projections but there is enough science behind the numbers to force decisions soon.

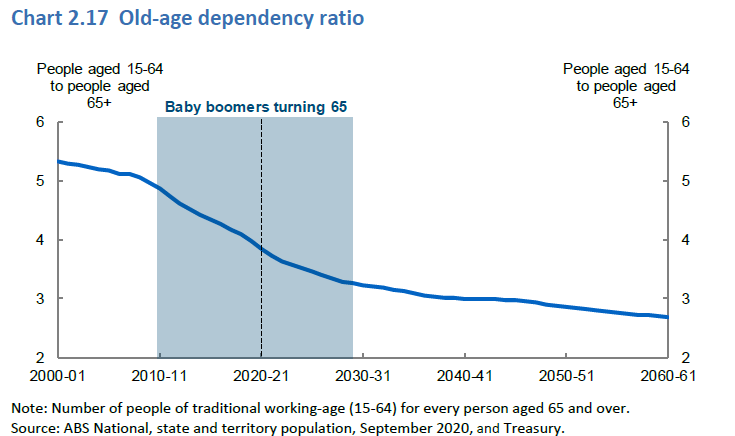

Instead of our daily focus on the latest virus and lockdown announcements or weekly preoccupation with central bank vicissitudes, both net-zero and the IGR are opportunities to think about how Australia might look in 30 to 40 years. The IGR projects a population of 40 million people, only 2.7 workers for every person over 65, health demanding a quarter of the federal budget and 8 million people on the age pension despite 70 years of superannuation.

We start this week with a review of the IGR and the big pictures on superannuation, demographics, health, welfare, spending and migration. Gone are the days of budget surpluses. Highlighting that the cost of superannuation will exceed the cost of the age pension is sure to arm super critics.

Among the dozens of interesting charts in the IGR, this one sums up the major demographic change (and identifying over 65 as 'old-age' is revealing). With the boomers 'retiring' and a dependency ratio of 2.7 by 2060, what happens to personal income tax rates - the largest source of government revenue - to pay for health and pensions?

The biggest challenge for most retirees is making the money last in this world of increasing life expectancy, low interest rates and likely lower returns from equities in coming decades (notwithstanding that the All Ords index rose 26% in FY21, its best performance in over 30 years). It's easy to say 80/20 is the new 60/40 but that comes with added risk. The chart below (for the US market but Australia would be similar) shows that for most of the last 50 years, a portfolio could significantly allocate to bonds and still achieve a reasonable 6% return. Now the portfolio needs to rely on share dividends. One day, this extra risk will end badly for conservative investors who will then realise that the new role of term deposits and bonds is to protect capital.

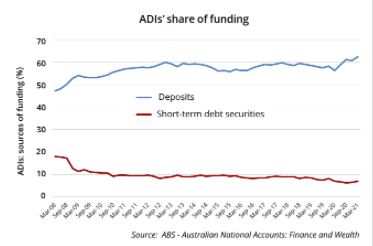

After providing a wonderful source of long-term cheap funding in response to the pandemic, the Term Funding Facility (where the Reserve Bank lent to banks for three years at 0.1%) ended yesterday. Although the final results are not yet issued, Peter Sheahan of Curve Securities who watches these things closely believes the banks have drawn the full $200 billion in a last-minute rush. For someone like me who spent much of his banking career on asset/liability management and sourcing deposits and long-term funding, the lack of reliance on short-term wholesale deposits is a massive improvement in bank funding resilience, as shown below.

In other articles this week, Don Hamson weighs into the debate on the merits of Listed Investment Companies (LICs) by describing the requirements of a good LIC. LIC managers and investors should check his list.

Matthew Davidson looks at the surprising strength of residential property prices to see if it can continue, and as important, the implications for Australian bank share prices.

Lewis Jackson has trawled through the Morningstar database to identify a few Australian stocks which screen well for dividends, valuation and favourable ESG characteristics, suggesting there may be a place for them in portfolios needing more income.

Australian investors have accepted the benefits of an allocation to global equities to access broader opportunities, and Stan Shamu describes how to assemble global assets for diversification and income.

Still on portfolio construction, Jordan Eliseo shows how gold can sit in a superannuation portfolio, even with a modest allocation, to improve the risk and return characteristics over time.

Over the next three weeks, we will publish a series of articles on modern retirement income products, starting with David Orford's contribution. The Government and the Retirement Income Review have called for the superannuation industry to develop products that address longevity for retirees, and useful additions to the landscape are starting to appear. Next week, we will examine Magellan's FuturePay.

Two bonus articles from Morningstar for the weekend as selected by Editorial Manager Emma Rapaport.

The ASX welcomed its biggest IPO since 2019 in Pexa Group. It was a wobbly start for the property settlements platform, dropping as much as 4.3% at the open. Link retains a near 43% stake in the company. Could this be a better way to gain exposure? Morningstar's Gareth James thinks so. And Lewis Jackson charts the ASX 200's best performing financial year in decades.

Our Comment of the Week comes from 'ST' who provided a simple example of the shortcomings of the Your Future, Your Super legislation which comes into effect today (and the comparison tool is now on the ATO website):

"Another example is fund C: it has a 100% equity SAA but buys out of the money put options to protect against drawdowns. Let’s say that protection costs 1% (net of any benefit from brief drawdowns in markets, if you want to be technical). Markets return 10%, the fund returns 9%. The trustee thinks they have done a good job – they have benefited from strong equity markets and perhaps reduced the volatility, they even delivered better returns than Fund A or Fund B. But Fund C has delivered 1% below its benchmark, is marked as underperforming and must write to its members to think about changing funds. Those members think, ‘yes we need to switch funds’, and move to Fund A."

Thanks to the almost 2,000 people who tuned into our new podcast, Wealth of Experience, and for the encouraging feedback. A new episode will be posted next week.

This week's White Paper from Fidelity examines the 'wealth effect' for Australia and its households, especially due to rising residential property prices.

Finally, two quick shout outs.

First, my former colleague at Lazard Asset Management, Rob Prugue, is actively involved with PROP (People Reaching Out to People) which does great work on mental health. With nationwide lock downs, many people are doing it tough, and the PROP website includes videos and tutorials to help people. Please forward to anyone who may be struggling.

Second, when I joined CBA in 1979, Investment and Economic Research Department (and later Treasury) was run by Peter Wilson. He guided many careers when the Australian market was changing dramatically and CBA dominated liquidity and trading. Sadly, Peter died on 14 June 2021 at the age of 90. Well done for your professionalism, humour and contribution to many careers and the financial market.

Graham Hand, Managing Editor

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from Bell Potter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

LIC Monthly Report from Morningstar

LIC/LIT Monthly Report from Risk Return Metrics

Plus updates and announcements on the Sponsor Noticeboard on our website