The Weekend Edition includes a market update (after the editorial) plus Morningstar adds links to two highlights from the week. On Friday in the US, Fed Chair Jerome Powell delivered a shock to the market with his firm resolve to raise rates to control inflation despite short-term pain.

There’s a well-known Irish joke about a tourist in the countryside who asks a local for directions to Dublin. The Irishman replies: ‘Well sir, if I were you, I wouldn’t start from here’. It's the same with investing. If I were on a long-term investment journey, I wouldn't start from here. But like the tourist, there is no choice, because all that matters for future outcomes are the decisions made from here and now - buy, hold or sell. We can't go back or make a deal with God, and get him to swap our places.

Which brings me to Kate Bush. Ms Bush and I were born a few months apart, and it's great to see her discovered by younger generations with the most-streamed song in the world in July 2022 and top of the Billboard Global 200 chart. It took 'Running Up That Hill' 37 years to reach the UK Number 1, the longest time it has ever taken a song. As new fans (due to use of the song in Stranger Things on Netflix) acclaim Kate, it's sobering to realise that 'Wuthering Heights' was released in 1978 when she was 19.

While every generation faces different challenges and opportunities, from an investment perspective, I would not swap places with anyone from a younger generation, unlike the words from her hit song.

"And if I only could

I'd make a deal with God

And I'd get him to swap our places

Be running up that road

Be running up that hill

Be running up that building

If I only could, oh"

Chorus from 'Running Up That Hill (A Deal With God)' by Kate Bush

(There's a fantastic version sung by thousands in the Brisbane Pub Choir).

I've previously described the favourable conditions enjoyed by Baby Boomers in an article which has been viewed 20,000 times and received (with follow ups) hundreds of comments. Free education, generous superannuation, rising property prices, economic growth ... on it goes. For 30 years, falling interest rates ensured that even the defensive part of a 60/40 allocation performed well.

As the chart below from Vanguard's Digital Index shows, for a Baby Boomer who started investing in 1970, the long-term (nominal) returns of 10% pa to 12% pa on equities and around 8% on fixed interest made investing easy. Pick a balanced fund and enjoy 10% pa for 50 years. The value column shows the amount reached by the end of 2021 of $10,000 invested in 1970.

Start with $1,000 and invest only $1,000 a year for 50 years at 10% pa and the balance will grow to $1,281,299 of which $1,230,299 is interest. Now that's the astonishing power of compounding, and our article on bank hybrids shows some current opportunities. The table below uses the calculator on the Moneysmart website. The dark blue shows the money contributed and light blue shows the interest.

Investors now face the highest inflation in the US for 41 years, a major war after decades of relative peace, a transition to zero carbon during an energy crisis, reliance on Russian gas threatening previously strong countries like Germany, China with expansion plans and the military to support it, and recession looming. No, an investor would not to choose to start from here.

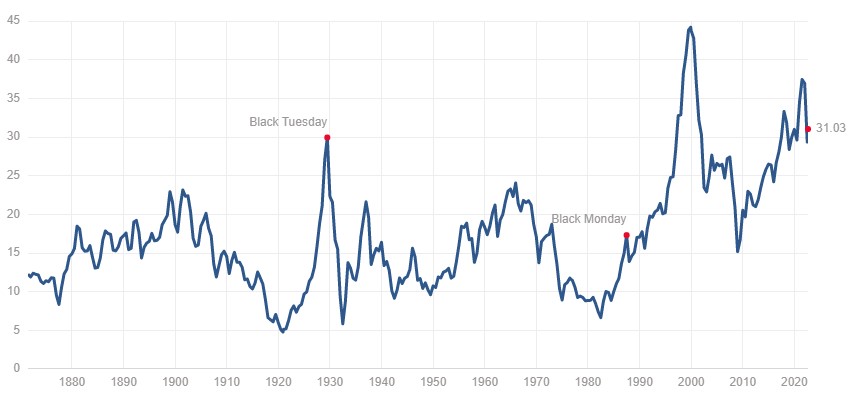

Despite all this, the Shiller P/E ratio for the S&P500 which has a long-term mean of 17 and a median of 15.9 remains highly elevated at 31 even after the recent market falls.

Shiller Price/Earnings Ratio for the US S&P500

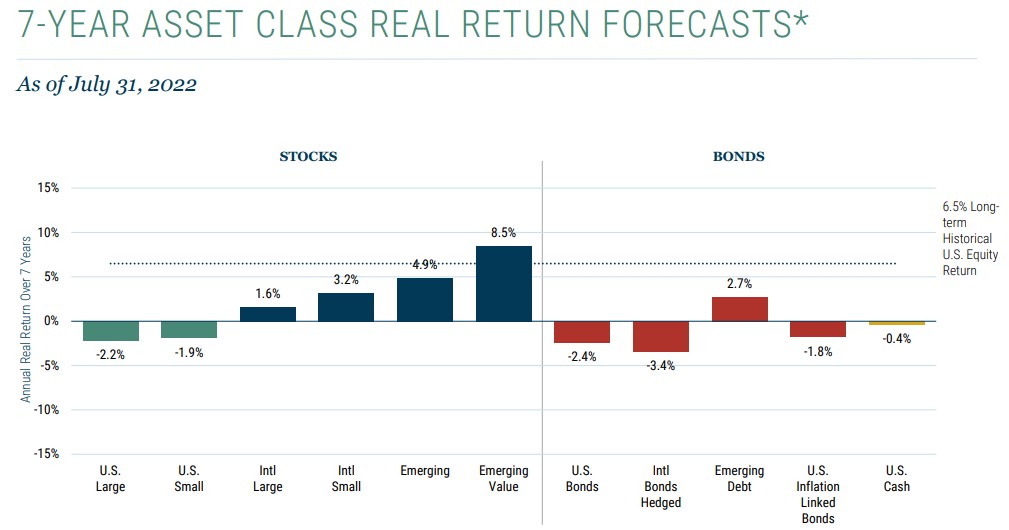

This week, the Asset Allocation team at GMO issued their seven-year forecasts for real (after inflation) asset class returns. They identify the long-term historical US equity return in real terms as 6.5% but expect US and developed markets to deliver significantly less in coming years, including negative in the US.

Rick Friedman from GMO said:

"Despite valuation compression across all countries, U.S. equities remain expensive relative to their history and other countries. We still prefer non-U.S. equities to U.S. and find Value especially attractive outside the U.S. in places like Japan and Emerging ex-China. That said, we believe the cheapest parts of the U.S. market have become more attractive."

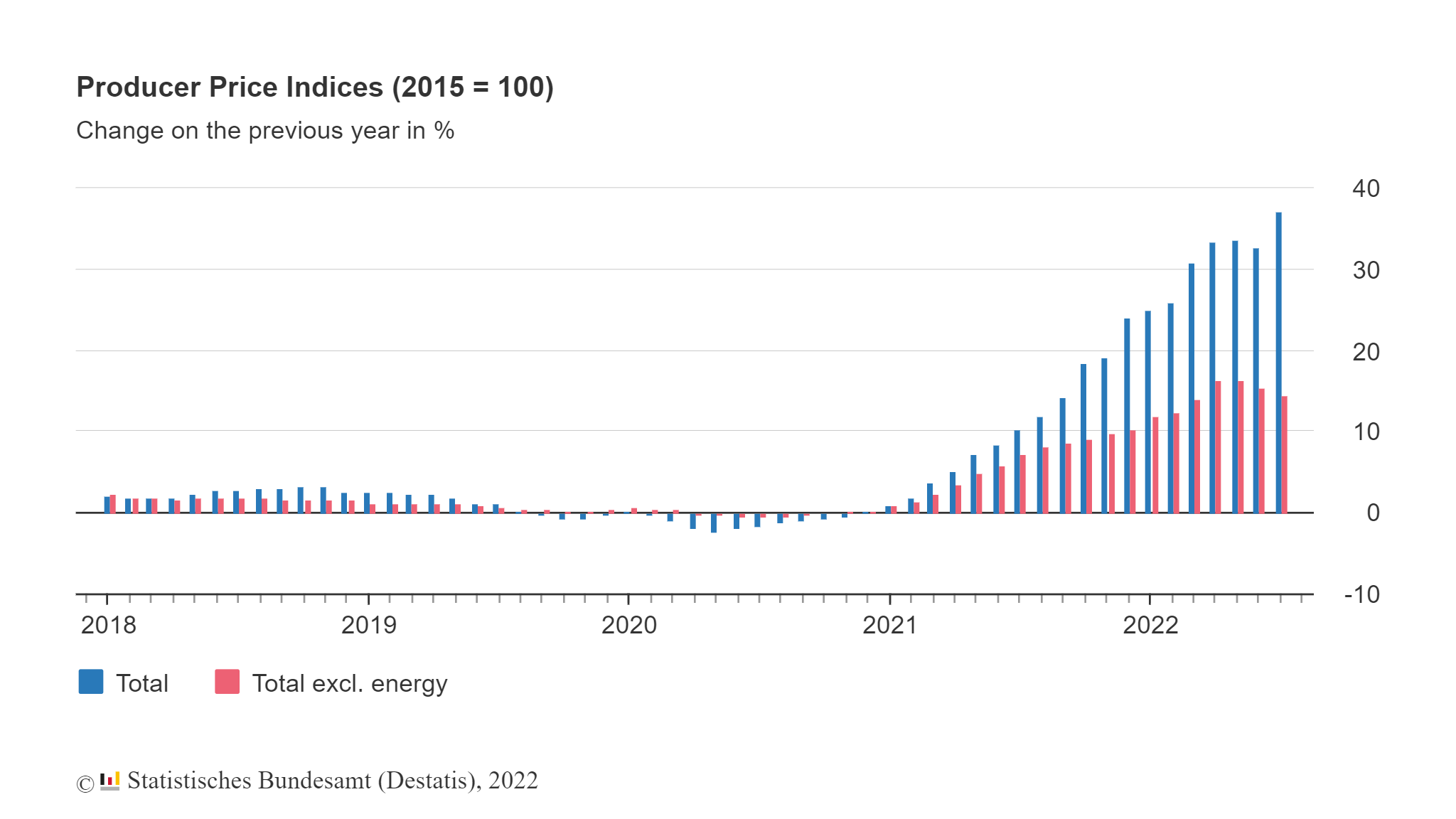

There are few hints yet that we have seen the bottom of the current market cycle. While stockmarkets fell heavily between January and mid-June 2022, then rose for a few optimistic weeks, but pessimism has returned. The German Producer Price Index released for July 2022 was up 37.2%, the biggest increase ever recorded due to rising energy prices, as shown below.

While the medium-term outlook is not encouraging, we have three articles this week to guide positioning of portfolios.

Nick Griffin of Munro Partners says nobody waves a red flag when it's time to buy, but he is watching three main factors to determine when the worst is over. He also picks out a couple of favourite stocks.

Christophe Braun of Capital Group explains the sectors and companies that can do well during inflation, saying it's a time to rely more on dividends than share price rises.

And Sawana Tanna from Perth Mint highlights the particular issues with stagflation (inflation with slower growth) for asset allocation.

Then three articles that help to understand how products or regulations work.

First, the returns on major bank hybrids are reported as over 7% (enough to allow a doubling of an investment in only 10 years), a far cry from only a year ago when such income from strong banks was unattainable. Yes, hybrids come with more risks than a deposit but where does the 7% yield come from when the bank bill rate is only around 1.9%?

Meg Heffron continues her popular series on managing an SMSF with the response to a reader question. The intriguing look at withdrawals from pension and accumulation accounts and the use of partial commutations looks like a little-known secret.

Following last week's article on the perils of financial advice, former Managing Director of Norwich Union, Rob Garnsworthy sent Firstlinks a note saying it's all too complex for most young people starting a journey. When he said he had written a one-pager for his 18-year-old grandchildren, many of you wanted to see it. So did we, and he obliged.

There has been much controversy about the reported performance of balanced superannuation funds in FY22, where despite heavy market falls in both equities and bonds, three funds - Hostplus Balanced, Qantas Growth and Christian Super - recorded positive results. Annika Bradley from Morningstar looks at the debate about the way unlisted assets are revalued. Chief Investment Officer at AustralianSuper, Mark Delaney, said of his current positioning:

“After more than 10 years of economic growth, our outlook suggests a possible shift from economic expansion to slowdown in the coming years. In response, we have started to readjust to a more defensive strategy, as conditions become less supportive of growth asset classes such as shares.”

In two additional articles from Morningstar for the weekend edition, Johannes Faul shares a three-minute video (with transcript) on the major factors affecting supermarket revenues, while Nicola Chand checks Morningstar's stock screener for three undervalued companies from the less-researched world of small caps.

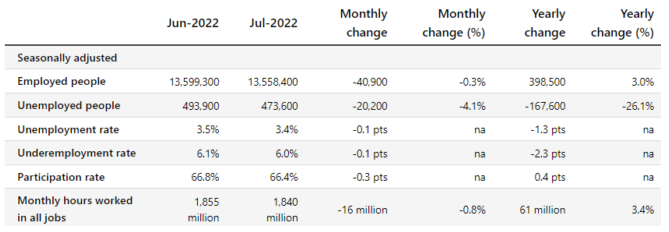

Finally, some comments on jobs data, which the Reserve Bank says is critical in its decisions on interest rates. Although the July 2022 unemployment rate fell to its lowest since 1974 at 3.4%, it hides the fact that the number of people employed fell by over 40,000, as shown in the ABS table below. The unemployment rate fell due to a decline in participation. Dr Brendan Rynne, Chief Economist at KPMG, said:

"Overall, with momentum in the economy now easing and global inflationary pressures falling, particularly in commodity markets, the outlook is suggesting that the economy may require less of an interest rate handbrake from the RBA in coming months than financial markets are currently assume."

While it's good news that there are 167,000 fewer unemployed people than a year ago, especially the long-term unemployed, the Reserve Bank will be watching the number employed as well.

Last week's article on financial advice drew dozens of comments, and it's well worth returning to them to see what many advisers and clients think. ASIC released updated figures this week showing six Australian banks have paid $3.6 billion in compensation to customers due to fees for no service misconduct or non-compliant advice. It's a pity for the availability of financial advice that such large financial institutions could not make advice a sustainable business.

Graham Hand

Weekend Market Update

On Thursday in the US, prior to the speech by Fed Chairman Jerome Powell at Jackson Hole, the S&P 500 rose 1.4% and NASDAQ was up 1.7%. Investors clearly expected a dovish tone. For example, the Senior Economist at Pictet Wealth Management, Thomas Costerg told the Financial Times:

"Powell is likely to remain vague about the next steps, but we still expect him to indicate that the bias is for a downshift in the pace of hiking rates.”

Within a day, he wanted to take back those words. On Friday, US share markets were hit when Powell said: “ … we must keep at it until the job is done”. The S&P500 finished the day down 3.4% and the NASDAQ lost 4%. Powell said the Fed is influenced by events in the 70s and 80s and “multiple failed attempts to lower inflation”. The ASX futures lost 98 points or 1.4% indicating a weak start in Australia on Monday.

From AAP Netdesk (Friday close in Australia): The local share market finished higher for a third straight day ahead of a key speech by America's top central banker. The ASX/S&P200 index on Friday finished up 56 points, or 0.8% to 7104.1. For the week, the ASX was down 10 points, or 0.15%, its first losing week since July 11-15.

Every sector of the ASX was higher on Friday expect for telecommunications, which dropped 0.3%. Energy, materials, consumer staples and healthcare were all up by more than 1%. The big banks were all higher. A number of companies announced earnings during the last full week of reporting season. Wesfarmers gained 0.7% to $47.95 after announcing a full-year net profit after tax of $2.3 billion, down 2.9% from last year but beating consensus expectations. The KMart and Bunnings owner also said it would pay out a better-than-expected final dividend of $1 per share. Bega Cheese rose 11.8% to a two-month high of $4.18. PolyNovo fell 18.8 per cent to a four-week low of $1.64. Elsewhere in the heavyweight mining sector, BHP was up 1.7% to $42.90, Fortescue Metals was up 2.3% to $19.58, and Rio Tinto added 1.2% to $98.40.

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Monthly Funds Report from Cboe Australia

LIC Quarterly Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website