The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Anyone looking for a guide to future Government policies might check two recent speeches, but it is clear which one will dominate actions. Prime Minister Anthony Albanese gave the keynote address at the Labor Party National Conference on the weekend before last, and he made it clear that policies mattered little if Labor was not in power. He used words like “a plan for progress over the next decade” and “the difference between a moment of progress or a lifetime of opportunity” and "the difference between laying the foundation and finishing the build." In other words, there is a time for policy bravery but it is not now.

A speech a few days later at the Press Club by Treasurer Jim Chalmers was full of visionary intention but devoid of policies to support the ambition. In responding to the Intergenerational Report (IGR), he spoke of this moment in time when crucial decisions are required, such as:

“Moving from a younger to an older population is something we’ve known about for some time now. And it’s true that this will put a strain on our Budget. In fact, around 40% of the projected increase in spending that’s outlined in the IGR is due to us getting older. Here, at this generational fork in the road, we can shape the future on our terms. We can turn these turbulent twenties into the right kind of defining decade.”

So according to Chalmers, we are at a "generational fork in the road", but it is 'kicking the can down the road' without policy responses. The Prime Minister made it clear that there is little room for unpopular decisions with an adverse impact on sufficient voters. For example, although the Labor Conference agreed a motion to increase social and affordable housing "with funding from a progressive and sustainable tax system, including corporate tax reform”, there was no indication how this will be achieved. The IGR says we are heading for personal tax raising an unheard of 60% of all taxes.

In the meantime, the Government boasts of tiny incrementalism to avoid scaring the voters. The new tax on super balances over $3 million will not even raise the forecast $2 billion a year after SMSF trustees change their investments, but Chalmers cites it as reform.

According to the Australian Bureau of Statistics (ABS), there are 4.1 million retired Australians, and they have at least as many children expecting to inherit their wealth. As Labor’s now-dumped election policy directed at changing franking credit treatment in 2019 proved, it is not only the older generation scared by changing tax policies. Opposition Leader Bill Shorten admitted after the lost election that he “misread” the level of anxiety caused by the policy, and Anthony Albanese is determined not to make the same mistake. There is no way Shorten would have run with the policy if he had understood the consequences, and there are many tax issues in the same bucket.

Given the outcry about the strain on future generations, what are some of the current tax settings that are compromising future affordability while at the same time making the Government scare away from major changes? We summarise 10 ways Australians can avoid paying tax, most of which are so commonly understood that every financial adviser in the country would offer them to their clients without blinking. They are all legal and popular ways to manage tax which makes changing them difficult.

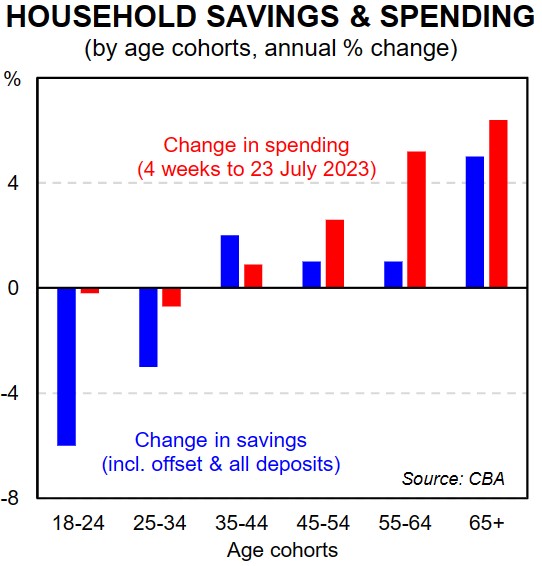

The intergenerational consequences are already evident. This revealing chart from CBA shows the change in saving and spending by age groups over the last 12 months, and it is older people sustaining economic activity. They are earning more on their deposits and are not burdened by high mortgages.

***

The most-commonly quoted index of the US stockmarket is the S&P500. As an index of the biggest companies, it covers about 80% of overall US market capitalisation. A better measure of the entire market is the Russell 3000, which measures the 3,000 largest listed companies and covers about 97% of the total market value, capturing small and mid cap stocks. This index is arguably more exposed to the US economic performance as investors tend to turn away from smaller companies when conditions are difficult, preferring larger companies with big balance sheets.

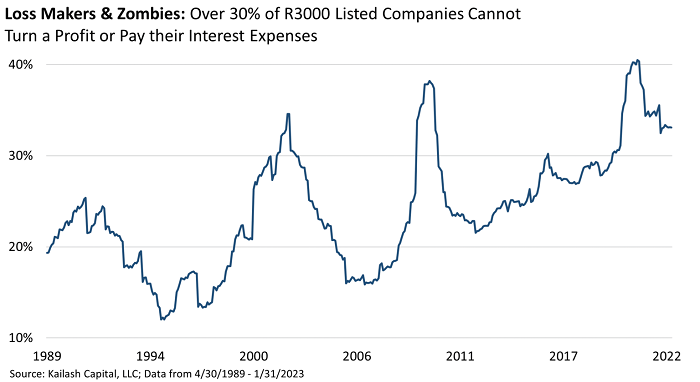

Australian investors can readily access fund managers who specialise in global small and mid caps, and over the two decades (2003–2022), global small and mid cap stocks outperformed larger companies. This has since reversed with the dramatic surge in the values of the largest companies in 2023. While opportunities abound in the small and mid cap space, it's also more volatile. This chart shows that about one-third of all companies in the Russell 3000 are not profitable or cannot meet their interest expenses, and this is despite many locking in lower rates of interest on their debt. Good stock picking will be essential as debt rolls into higher interest rates, creating more zombie companies.

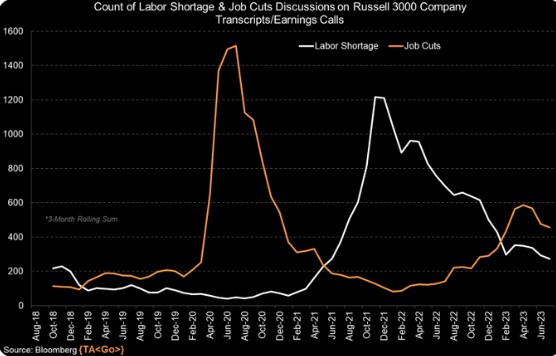

It's also fascinating to see how quickly companies in the US have adjusted to changes in the labour market in recent years. In their earnings calls, they have gone from cutting jobs in the pandemic to labour shortages a year later, to not mentioning labour shortages to rising job cuts. They seem to have reached a levelling where both cuts and shortages are common.

***

Back at home during results season, even analysts who follow companies closely are often surprised in half-yearly results. Although companies are scrutinised each day by brokers and fund managers, the market reacts surprisingly strongly to variations from expectations. Watching a feed from CommSec for a couple of days, these jumped out:

Smartgroup (ASX:SIQ) down 16%, Telix (ASX:TLX) up 12%, Core Lithium (ASX:CXO) up 7%, Tabcorp (ASX:TAH) up 9%, Costa (ASX:CGC) down 18%, Eagers (ASX:APE) down 7%, Ramsay (ASX:RHC) down 8%, Judo Capital (ASX:JDO) down 16%, Insignia (ASX:IFL) down 14%, Battery Age (ASX:BM8) down 13%.

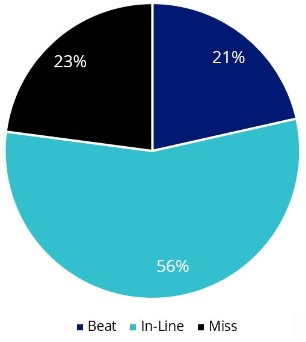

The overall results show most companies reported in line with expectations but there's a lot of money made and lost on the others.

S&P/ASX 200 August 2023 earnings result split

Source: Bloomberg, Index Weighted, as at 25 August 2023, ±5% range for beat/miss

Also checking my emails a few days ago gave another reason why it is difficult to select active managers. It's not only their ability to pick stocks, but their overall outlook for the market. Within an hour, I received these two views.

From Schroders:

"Register now to hear from Martin Conlon, the Head of Australian Equities, and senior members of his team as they unpack:

- Why they believe this market bullishness can't last

- How caution is driving their portfolio positioning"

From Bell:

"While it might seem somewhat counterintuitive to adopt a bullish tone when markets are where they are, however, we find ourselves in a situation where we see quite material upside in specific areas of the market."

Top down or bottom up. Should an investor only allocate to an active manager who agrees with their overall market view, or trust their stock picking?

***

The latest inflation numbers increase the likelihood that the final meeting of Philip Lowe as Reserve Bank Governor next week will not result in another cash rate increase. The Governor is probably glad of that. The ABS reported:

"This month’s annual increase of 4.9% is down from 5.4% in June. Annual price rises continue to ease from the peak of 8.4% in December 2022. The most significant contributors to the July annual increase were Housing (+7.3%) and Food and non-alcoholic beverages (+5.6%). Reducing the July increase were price falls for Automotive fuel (-7.6%) and Fruit and vegetables (-5.4%) ... When excluding these volatile items, the decline in annual inflation is more modest at 5.8% in July, compared to 6.1% in June.”

Fuel, fruit and vegetables down? Not where I spend.

Graham Hand

Also in this week's edition ...

People love new things, and investors are no different. Yet there’s something to be said for valuing things which have endured. Because the longer something’s lasted, the longer it’s likely to last. James Gruber takes a look at nine ASX stocks that have stood the test of time with proven formulas for success.

On a related topic, Joachim Klement asks the question: how would you invest if you could live forever? Endowment funds and others such as Bridgewater's All-Weather portfolio have tried to address this question. Klement has a different take on how individual investors can build a portfolio that lasts generations.

There are two articles on income investing this week. The traditional approach to income is buying high-yield, dividend-paying stocks. First Sentier's Rudi Minbatiwala doesn't believe this is the best approach and explains why. Meanwhile, Shane Woldendorp of Orbis Investments suggests that in a market enamoured with growth stocks, he's finding good value in dividend-yielding shares.

What does the recently-released Intergenerational Report mean for the aged care sector? Assyat David of Aged Care Steps does a deep-dive into the report and suggests that the trends highlighted reinforce the need for Australians to consider their aged care needs now rather than wait for a crisis.

Private markets are all the rage among institutional funds yet they've been slower to catch on with individual investors. Patrizia's John O'Brien says private markets make better returns than public markets on average, and he advises on the ways that individuals can build their own private markets portfolio.

Two extra articles from Morningstar for the weekend. Christine St Anne sees some positives from Wisetech's results while Adam Fleck finds stocks that can absorb a potential debt reckoning.

And in this week's White Paper, the World Gold Council reports on gold demand trends and how central bank buying reached record levels in the first half of the year.

***

Weekend market update

On Friday in the US, a bear-steepening selloff in Treasurys headlined proceedings as the long bond jumped nine basis points to 4.29%, while stocks gave back early gains for a second straight day, settling just above unchanged on the S&P 500. WTI crude powered to new year-to-date highs near $86 a barrel, gold stayed put at $1,940 an ounce and the VIX settled at 13.

From AAP Netdesk:

The local share market on Friday closed lower as traders took profits from four days of gains. The benchmark S&P/ASX200 index on Friday finished 27 points lower, or 0.37%, at 7,278.3, while the broader All Ordinaries dropped 27.9 points, or 0.37%, to 7,489.9. For the week, the ASX gained 2.3%, its best week since a 3.7% gain the week of July 10-14.

Eight of the ASX's 11 sectors finished lower on Friday. The two biggest movers were energy, which gained 1.6%, and health care, which dropped 1.4%.

In the heavyweight mining sector, Fortescue Metals fell 5.3% to a three-month low of $20.30 after losing its 11th senior executive in the past three years. Chief financial officer Christine Morris's departure follows that of CEO Fiona Hicks, whose abrupt exit was announced on Monday after less than six months in the job. Former Reserve Bank of Australia deputy governor Guy Debelle also left his role on the board of Fortescue's green energy arm on Thursday to take a similar role at Tivan, a $120 million critical minerals company whose shares soared 33.3% to a two-month high of 7.6c on the news.

Elsewhere in the sector, BHP dipped 0.3% to $44.74, Rio Tinto added 1.2 per cent to $114.23 and Bluescope Steel gained 2.1% to $21.44.

Santos gained 1.8% to $7.81 after restructuring its sale of a minority interest in its Papua New Guinea LNG project to PNG's national oil company. Kumul Petroleum will now buy a 2.6% stake in PNG LNG for $US736 million, rather than a 5% stake for about twice that, after Kumul apparently had trouble lining up financing.

All the Big Four banks were lower, with CBA dropping 0.8% to $101.35, ANZ falling 0.6% to $25.17, Westpac retreating 0.7% to $21.79 and NAB dipping 0.2% to $28.90.

Judo Capital rose 3.3% to 95c after disclosing that the business-focused neobank's CEO, Joseph Healy, bought nearly another $1 million worth of shares during a board-approved trading window on Tuesday.

From Shane Oliver, AMP:

- Global share markets rose further over the last week helped by US data showing a softening jobs market and continuing moderation in underlying inflation in the US and Europe adding to expectations that the Fed and ECB will leave interest rates on hold in September. For the week US shares rose 2.5%, Eurozone shares rose 1.4% and Japanese shares rose 3.4%. The further rise in US shares over the last week curtailed a 4.8% fall earlier in August to a 1.8% loss for the month. This followed strong gains in June and July though. Chinese shares also rose 2.2% over the last week helped by a halving in stamp duty costs for share transactions which usually provides a temporary boost but also the roll out of more property stimulus measures and expanded tax breaks. Following the solid global lead and helped along by lower-than-expected Australian inflation data adding to confidence that the RBA will leave rates on hold, Australian share gains were led by consumer discretionary, material, finance and industrial shares. Bond yields eased further as expectations for further central bank rate hikes continued to ease. Oil, metal, iron ore prices and the $A rose despite a slight rise in the $US.

- On the global central bank front – better news for the Fed, less so for the ECB. US data showing more signs of a cooling jobs market – with payrolls remaining in a slowing trend and unemployment rising in August - and a moderation in monthly inflation add to confidence that the Fed won’t have to raise rates again. By contrast Eurozone headline inflation was a bit stronger posing a dilemma for the ECB. We see both central banks leaving rates on hold this month, but the risks of another hike are higher in Europe.

- Australian inflation fell more than expected in July adding to the likelihood that the RBA’s cash rate has peaked. From its peak of 8.4%yoy in December, the Monthly Inflation Indicator has now fallen to 4.9%yoy in July. This was less than consensus and our own expectations. The bad news is that inflation is still too high and several key areas are still seeing very strong and accelerating inflation – notably rents, electricity and insurance costs - and higher petrol prices may boost inflation again in August. However, the good news is that the trend in inflation including for underlying inflation is down, and the 3 month seasonally annualised rate of inflation at 2.7% is now within the RBA’s target range.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly Bond and Hybrid updates from ASX

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website