The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

With an election in the offing, the 2025-26 Federal Budget was always going to be more of a political document than an economic one. So it came to pass.

Inevitably, it sought to address a key sore point for voters: the rapid increase in everyday costs over the past 2-3 years. And it tried to do this without blowing a hole in the Budget. Hence, why the Treasurer Jim Chalmers has sold the measures as “modest but meaningful” relief for households.

The key surprise from the Budget was a promise to deliver personal tax cuts for all Australians. Most of the other measures were announced earlier.

Let’s look in more detail at the key Budget initiatives:

Cost-of-living relief

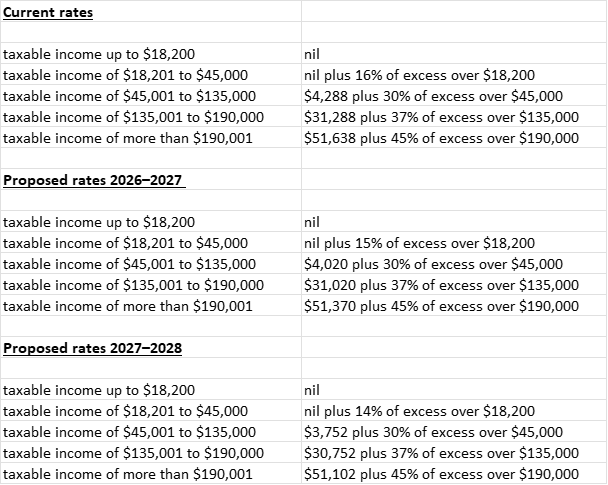

- Tax cuts: the marginal tax rate for the bottom tax bracket will be lowered from 16% to 15% from 1 July 2026 and then to 14% in 1 July 2027. It will give an average wage earner an additional $268 a year in 2026-27 and $536 a year in 2027-28. The measure is expected to cost $17.1 billion. Here’s how it will look for each tax threshold:

Source: Australian Treasury, Firstlinks

- Energy bill relief: every household to get $150 off their power bills over the next two quarters.

Health

- More bulk billing: incentives for doctors to increase bulk billing, costing $8.5 billion over four years.

- Cheaper medicines : Pharmaceutical Benefits Scheme (PBS) medications will be capped at $25 each, down from $31.60.

- Public hospital funding: a one-off injection of $1.8 billion to public hospitals nationally.

- Urgent care clinics: 50 new Medicare Urgent Care Clinics to open across the country.

Housing

- Help buying a house: an additional $800m will go towards expanding the Help to Buy scheme by increasing the income caps for eligibility to $100,000, from $90,000, and $160,000, from $120,000, for single and joint applicants, respectively. Under the Help to Buy Scheme, the Government provides first home buyers with between 30-40% of the purchase cost of a property, with only a 2% deposit required from a buyer. It’s capped at 10,000 places per year.

Childcare

- Three day guarantee: most families will receive three days of subsidised childcare per week from January 2026, at a cost of $427 million.

Education

- Student debt cut: those with HECS and HELP debts will see a 20% reduction in what they owe.

- National school funding: a plan to fully fund public schools in line with the 2011 Gonski review recommendations, costing $406 million over the next four years.

Infrastructure

- Bruce Highway upgrade: Queensland’s major highway gets a $7.2 billion redevelopment.

- Melbourne Airport Rail link: an upgrade to Sunshine station will cost $2 billion.

Communications

- NBN expansion: 622,000 premises will get full fibre access to the NBN, costing $3 billion over seven years.

Savings

- $2 billion in cutbacks: there are cuts to consultants to Government and “reprioritising” spending.

Deeming rates

- Another freeze to these rates.

One important thing to note from the Budget was a ‘non-announcement’. There were no changes to the proposed revenue that the Government is expecting to raise from the proposed $3 million superannuation tax. This would suggest that it’s still on Labor’s agenda, should it win the election.

But the Division 296 bill is still in the Senate currently, and if the election is called before the measure is passed, the bill will lapse and it will need to be reintroduced in Parliament after the election.

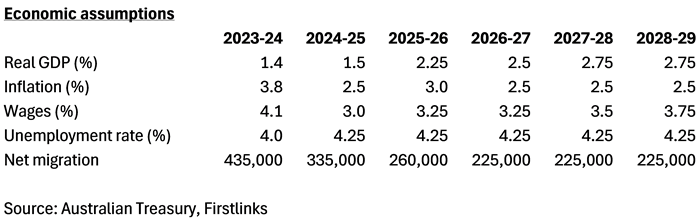

Economic assumptions

The Government forecasts a pick-up in economic growth, despite current uncertainty from Trump’s tariff measures. It predicts GDP growth will increase from 1.5% this financial year, to 2.25% next year, and 2.5% and 2.75% in the 2027-28 and 2028-29. These forecasts, especially in later years, look a stretch given the tepid growth of recent years.

The Government sees inflation remaining in the 2-3% target range, helped this year by energy subsidies reducing CPI by around 0.5%.

It’s marginally reduced unemployment forecasts to 4.25% going forward.

And, interestingly, there are large falls expected with immigration numbers in coming years. The Government expects net immigration of 335,000 this financial year to drop to 225,000 in two years’ time. If right, that would mean population growth would fall to 1.2% in 2026-2027, from a peak of 2.4% in 2022-2023.

The Government has kept its medium-term iron ore price assumption at $US60/tonne. With iron ore are closer to $US100/tonne, this remains a source of potential upside for Budget revenue over the next few years.

Budget position

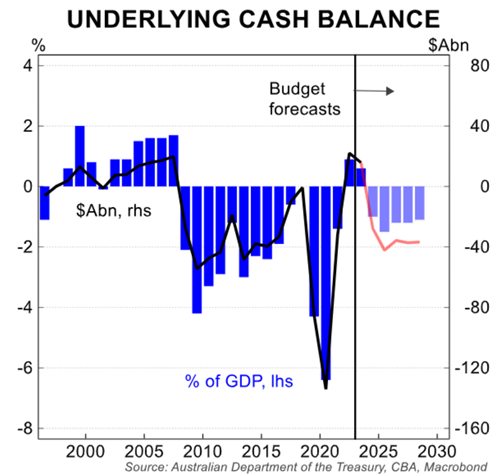

Over the past two years, the Government has delivered two consecutive Budget surpluses, thanks to extra revenue from tax receipts due to higher employment and better-than-expected commodity prices.

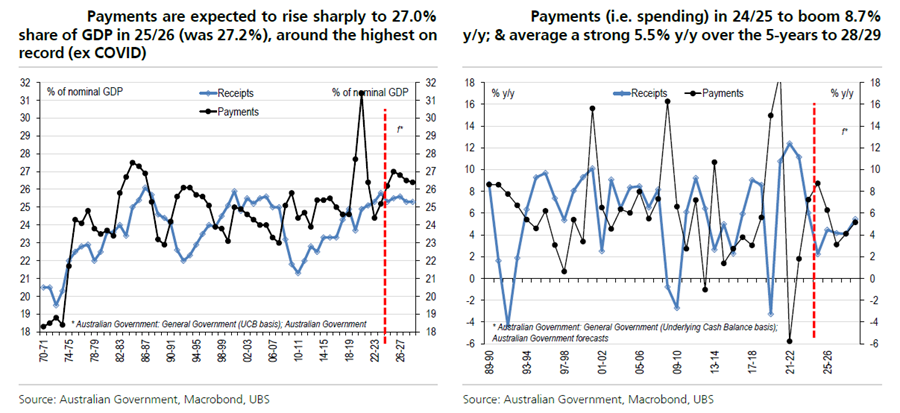

The Government forecasts that the surplus will disappear and there’ll be deficits equivalent to 1% of GDP in 2024-25 and 1.5% in 2025-26. That’s primarily down to the conservative iron ore prices assumed, as well as the increased spending initiatives.

Economists have bemoaned the forecast of deficits for the next decade as well as the increased spending as part of that. Indeed, spending is expected to rise by 8.7% in 2024-25 and by an average 5.5% over the five years to 2028-29.

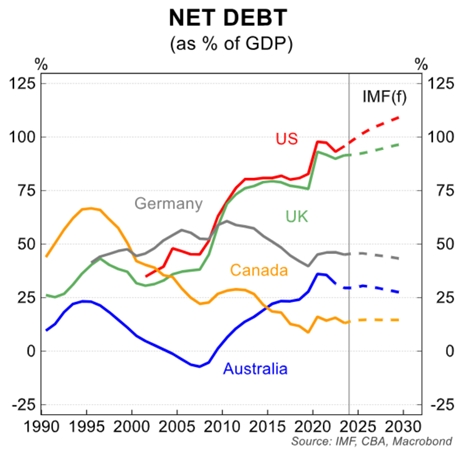

The economists have a point, to a degree. However, the deficits are still relatively low and Australia’s debt-to-GDP also remains healthy when compared to other OECD countries.

Impact on investors

The main takeaway from this Budget for investors is that the tax cuts and other initiatives may boost consumer spending. That could help retailers and other companies on the ASX exposed to domestic spending.

Of course, the big shadow looming over this Budget and markets is the impact that Trump’s tariffs will have on global trade and economic growth.

My two cents

I’m not as concerned as most about the deficits. Yes, we’ve had good times which have brought in higher-than-expected revenue and it would be good to put more aside for a rainy day. But the deficits are still relatively small and manageable.

A much bigger issue is that the Budget doesn’t do anything to promote business and economic growth. Business growth is the backbone of the economy. Without it, there are less jobs, less taxes and less money to pay for public goods and services. And a lack of business investment is the key reason why Australia’s real GDP growth has stalled over the past decade.

Earnings growth for ASX 200 companies has also flatlined during the past three years because costs have risen more the revenues. To address this, we need to cut red tape, reduce energy prices, keep wages growth in check, and promote innovation and research and development.

****

It strikes me that many people live according to others’ expectations of them, leading to poor choices including with their finances. My article this week looks at how you can live life by design rather than by default.

James Gruber

Also in this week's edition...

The recent market dip has naturally got many investors thinking about how resilient their portfolios are and whether they need more defensive exposure. Jamie Wickham offers a timely overview of the different defensive asset classes and how they might help deliver on your goals and increase the reliability of your desired outcomes.

While on the topic of defensive assets, the Government has not-so-subtly been pushing for lifetime income streams as a potential solution to retirement income challenges. A common question from Firstlinks readers has been: what are the hard numbers that annuities can deliver for retirees? Kaye Fallick has followed up and done the maths, and what's she's discovered is that apples-to-apples comparisons are tough and the Government should perhaps be prioritising other, more pressing problems.

Hybrids have been a defensive go-to asset for many investors, but now they're being phased out, what are the alternatives to replace them? One is subordinated debt, and Macquarie Asset Management's Blair Hannon provides a useful primer on what this debt entails and what role it can play in portfolios.

The Big Four banks have had a recent reality check after they delivered staggering shareholder returns of 33% in 2024. Airlie's Jack McNally drills into the fundamentals to see whether value is emerging in these banks.

Europe is back! After badly trailing many markets over the past decade, especially the US, Europe has roared back to life in 2025. Alantra's Francisco de Juan and Jacobo Llanza believe the rally is sustainable because Trump has awoken European Governments, which are now determined to both increase spending in areas such as defence and explore ways to insulate themselves from the impact of Trump's tariffs. They think European small caps are likely to soon follow larger caps higher.

Founder-led companies have been in the news of late for all the wrong reasons, as Mineral Resources and WiseTech deal with governance issues surrounding Chris Ellison and Richard White. Lawrence Lam delves into the attractions and challenges of investing in founder-led companies and how to identify those that will succeed in the long-term.

Two articles from Morningstar this weekend. Esther Holloway highlights an emerging ASX technology winner and Margaret Giles lists ten attractive growth picks from the US.

Lastly in this week's whitepaper, RQI extends its previous paper on extreme market concentration and looks at the implications for Australian and Emerging Markets' equity investors.

****

US stocks on Friday were clubbed by 2% on the S&P 500 and 2.6% on the Nasdaq 100, leaving those gauges lower by 5% and 8%, respectively, in the year-to-date with one session remaining in the first quarter. Treasurys rallied sharply with the policy-sensitive two-year yield dropping eight basis points to 3.89%, matching its 2025 nadir, while WTI crude fell to US$69 a barrel and gold vaulted another 1% and change to US$3,082 per ounce. Bitcoin sank below US$84,000 and the VIX settled close to 22, up just under three points on the week.

From AAP:

The Australian share market on Friday edged higher after incoming tariffs and concerns over a potential hung parliament made for a choppy day's trade. The S&P/ASX200 gained 0.16% to 7,982, while the broader All Ordinaries rose 0.12% to 8,195.5. It was the second week of gains for the benchmark index, up 0.7% since last Friday, but it's still about 8% down from mid-February's 8,615.2 all-time high.

With markets already shaky ahead of next week's US "Liberation Day" tariffs, the announcement of a May 3 Federal election threw more unknowns into the mix.

With only Monday's session to go, the local bourse needs to rally more than 2.2% to avoid a second consecutive month of losses, which has not happened since mid-2023.

Seven of 11 sectors finished higher in Friday, helping offset a more than 2% bloodbath in IT stocks.

Embattled logistics technology company WiseTech sold off sharply, shedding more than 4%, taking its total losses to more than 34% since founder Richard White retook the reins of the company. Earlier this week superannuation giant AustralianSuper announced it had unloaded its $580 million stake in the company over governance concerns.

Financials helped lift the bourse on Friday, up 0.5% and the big four banks overcame a rocky session to finish on top. The sector is more than 2% higher than a week ago but still down almost 10% from its peak in mid-February, when disappointing earnings prompted a banking sell-off.

Materials edged 0.4% higher, with iron ore giants BHP, Rio Tinto and Fortescue eking out gains thanks to a 0.5% lift in ore prices, but it was gold miners that continued to shine. Northern Star, Newmont Corporation and Evolution Mining all rallied more than 2.8%.

Energy stocks continued to move higher, up 0.8% and more than 2% for the week.

Real estate stocks slipped 1.5% and are down more than 4% on a month ago with future policy uncertainty doing no favours for the sector. The sector still has a long way to go as it continues its bounce from three-year lows plumbed earlier in March.

Curated by James Gruber and Leisa Bell

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Plus updates and announcements on the Sponsor Noticeboard on our website