The S&P/ASX Small Ordinaries Index (ASX Small Ords) has surged by over 10% in the last three months on a seemingly new upward trajectory despite what was a fairly mixed reporting season. For the month of October 2017 alone, the Index delivered a gain of 6%.

While the return looks impressive, closer analysis shows that this surge in the Small Ords has been led mainly by concept and momentum stocks, a rather narrow foundation. Leading the charge upwards has been the small cap resource sector, several technology stocks and ‘soft commodity’ plays with exposure to China. We refer to them as ‘concept ‘stocks.

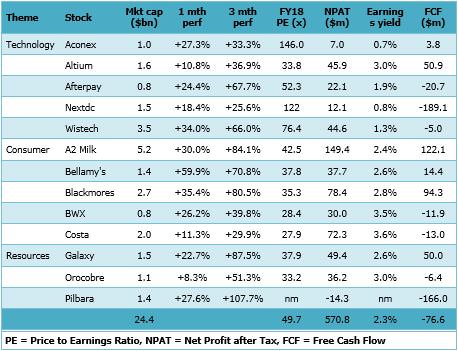

The table below highlights the valuations, free cash flow produced as well as these concept stocks’ contribution to the Small Ords performance over the last three months.

Recent key movers on the S&P/ASX Small Ordinaries Index (Small Ords)

Based on share prices at 31 October 2017

Some interesting facts:

- While the Small Ords Index was up 10.3% for the three months to 31 October 2017, these 13 stocks accounted for over half of that return.

- This group accounts for $24.4 billion of market capitalisation. This market cap is expected to generate an aggregate of $571 million of reported profit in FY18e - on average a PE of over 40x forecast 2018 earnings and a forecast dividend yield of 1%.

- In addition, these companies are expected to generate an aggregate Free Cash Flow of MINUS $76.6 million or a free cash yield of MINUS 0.3%.

What does this mean for the rest of the market and for prudent long-term investors?

It appears that in the current market, fundamentals have taken a back seat to momentum, unbounded optimism and the fear of missing out on the next big thing.

On the other hand, quality well-established companies that may have any sort of short-term earnings concerns are being sold down regardless of value. While this is creating great opportunities to buy quality stocks at attractive prices, it is hurting the performance of fundamentally based portfolios such as IML’s, particularly given our distinct preference for stocks that meet our quality and value criteria as opposed to concept type stocks.

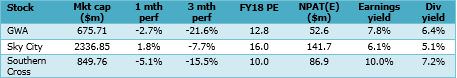

In the table below are examples of long-established, good quality companies and their fundamentals. The share prices of these companies have actually gone backwards in the last three months.

Based on share prices at 31 October 2017

We believe investors should focus on the long term and not to get caught up the latest market fad, particularly at times like this when momentum and optimism has taken hold of some sections of the Australian sharemarket. By investing in companies that demonstrate strong competitive advantage, recurring revenues, with long term growing earnings and that are trading at reasonable prices, more consistent investment returns are expected over the longer term.

Anton Tagliaferro is Investment Director and Simon Conn is Senior Portfolio Manager at Investors Mutual Limited. This information is general in nature and has been prepared without taking into account of the objectives, financial situation or needs of any investor.