Royals

“I've never seen a diamond in the flesh

I cut my teeth on wedding rings in the movies

And I'm not proud of my address

In a torn up town, no postcode envy …

And we'll never be royals

It don't run in our blood

That kind of luxe just ain't for us

We crave a different kind of buzz

Let me be your ruler

You can call me queen bee

And baby, I'll rule

Let me live that fantasy.”

Extract from 'Royals' by Lorde

(Royals lyrics © Peermusic Publishing, Sony/ATV Music Publishing LLC, Kobalt Music Publishing)

***

Thousands of age pensioners who never aspired to become ‘royals’ are now wealthy beyond their wildest dreams. Many toiled hard in working class jobs without extra money for luxuries and their superannuation balances are modest. Now in retirement, they qualify for full age pensions which for a couple is about $38,000 a year with supplements.

They did one brilliant thing that set them up for life and retirement. They bought a house 30 or 40 years ago. There was no ‘postcode envy’, as Lorde calls it, of wanting to buy in Sydney’s eastern suburbs or north shore. They bought where they could afford, in inner west industrial suburbs of Leichhardt, Marrickville, Camperdown, Redfern and Alexandria, and their equivalents in other cities.

Next time you fly into Sydney over these inner west suburbs, spare a thought for the house owners down there. Only this time, don’t sympathise about the flight path noise, the crowded streets or the unrenovated dwellings shared with light industry. The owners of many of those houses are living the Great Australian Dream of home ownership in places now worth $3 million to $4 million despite little being spent on them for decades.

Sydney prices have risen 19.3% in a year, Melbourne is up 15% and Canberra 19.1%, taking houses beyond affordability for many younger people.

This week, the Reserve Bank Governor, Philip Lowe, said using interest rates to stop surging house prices was not on his agenda. Rather, among other factors, Australia should look at "the design of our taxation and social security system" as a structural cause.

Australia’s pension and taxation systems encourage people to buy homes, even more than putting money into superannuation. Australians love our homes, a sacred right. Jeremy Grantham, famous fund manager and the Founder of GMO, said:

“Tell a European you think there’s a housing bubble and you’ll have a reasonable discussion. Tell an Australian and you’ll have World War III. Been there, done that!”

Here are 10 reasons it’s finally time to include part of the value of expensive homes in the age pension assets test.

1. Welfare should go to poorer people who need support

Welfare and social security are essential to look after the disadvantaged but they are supposed to be a safety net for the relatively poor.

The full pension is paid when a homeowner couple’s combined assets are less than $405,000 excluding their home. The pension cuts out completely when non-home assets reach $884,000. These amounts are about $216,000 higher for non-homeowners.

Pensioners are also entitled to free or discounted health services and medicines, amongst other things, through the Pensioner Concession Card and the Commonwealth Seniors Heath Card.

The recent dramatic rise in property prices has taken the inequity of this government support to another level, no longer confined to a few affluent locations but spread across hundreds of Australian suburbs.

I have inspected five houses in Sydney’s inner west recently and attended their online auctions. You must see it to believe it. The terrace in Rozelle with no parking, price guide $3.2 million, sold for $3.99 million. The Haberfield house on only 285 square metres, guide at $2.95 million, sold for $3.57 million. The unrenovated house on busy Marrickville Road for $3.5 million. An Alexandria home just topped the suburb record at $4.16 million within 24 hours of listing.

Some homes in these inner suburbs have increased in value by $500,000 to $1 million in a year. At the upper end, that’s 27 years of age pension payments which could be funded from one year of capital appreciation.

These are not prestige homes. The $3.5 to $4 million houses have only one bathroom and a 50-year-old kitchen, and it looks like the people living in them do not have much money. The houses need $1 million spent to bring to a high standard. There’s a decent chance they are owned by people on an age pension. Where a sale is a deceased estate, $4 million will pass to the children or estate tax-free.

Is it fair that a welfare safety net applies for a couple sitting on a $4 million asset? Or in more expensive suburbs of cash-poor, asset-rich people in houses now worth $10 million or $20 million? An agent told me last week his average sale price this year was over $7 million. Any age pensioners in there?

What about the "I've paid my taxes, I deserve a pension" argument? Well, lots of people pay taxes and never go on welfare. Noel Whittaker wrote an article in 2015 refuting the claim that a proportion of taxes was once paid to a personal welfare fund. He concluded social security benefits are paid from Consolidated Revenue and "no taxpayer had a separate balance in their own name, so there was no possibility that monies paid in would be allocated to a particular contributor."

2. A new policy should include a generous threshold

A policy change should protect people who live in ‘average’ homes, in recognition of the basic principle that it is wealthy people who should not need a social security net. The majority of pensioners would not be affected by the change. What might be an appropriate level, as 'expensive' and 'wealthy' are relative terms?

In 2015, the Productivity Commission issued a detailed 232-page report entitled ‘Housing Decisions of Older Australians’. It quotes the following survey results:

“A recent survey of 1,413 people by The Australia Institute (2015) found that two in three people consider a home worth $1 million or more to be ‘expensive’, with one in three also considering that a home worth $750,000 or more is ‘expensive’.

Three-quarters of people surveyed thought that retirees living in ‘expensive’ homes should still be able to access some form of age pension - 46% favoured access to a part age pension, and 29% thought that those living in ‘expensive’ homes should be able to receive a full age pension. Only 16% of those surveyed believed that those living in ‘expensive’ homes should not be able to access any form of age pension.”

The Productivity Commission looked at the impact of changing the pension asset test to include the amount above a threshold of $440,000 (the median house price using data from 2010). At the time, about 11% of current age pensioners would face some pension reduction, while about 3% would lose eligibility totally.

The current median house price in Australia is $956,000 (Sydney $1.41 million). While far more work would need to be done on a number, setting a threshold above $1 million to $1.5 million might be in the ballpark.

A couple with a house worth $1.5 million and other assets of $405,000 would retain full pension entitlement, and the pension would not cut out until other assets are over $884,000.

Is it too much to ask that someone with around $2 million or $2.4 million in assets should reduce their welfare payments?

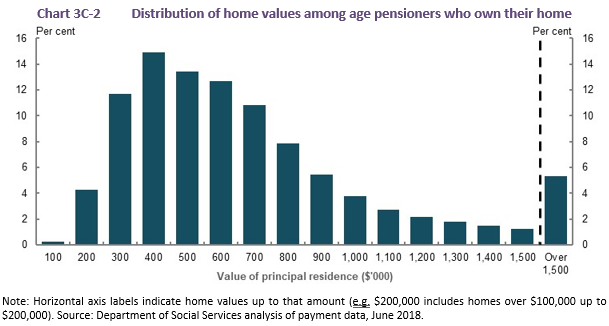

As the following table using 2018 data from the Retirement Income Review shows, about 5% of age pensioners own a home worth over $1.5 million and about 15% over $1 million. It’s likely to be much higher now given home prices have risen 18% across Australia in 12 months.

3. Cash needs can be met by an equity access scheme

Nobody would be forced out of their home or required to live on less money, but what does an asset-rich, cash-poor person living in a $2 million house do for cash flow? They could access a programme similar to the Pension Loan Scheme (PLS) or similar offered by the private sector.

We will not go through all the details here but the current PLS allows anyone of age pension age to draw up to 150% of the current age pension. The $38,000 a year could be marked against the value of the house and taken from the estate. There would be additional protections such as no negative equity and perhaps a person would only be required to borrow to a maximum of 50% of their house value or until the residual value is say $500,000. There is no asset easier to borrow against than residential real estate.

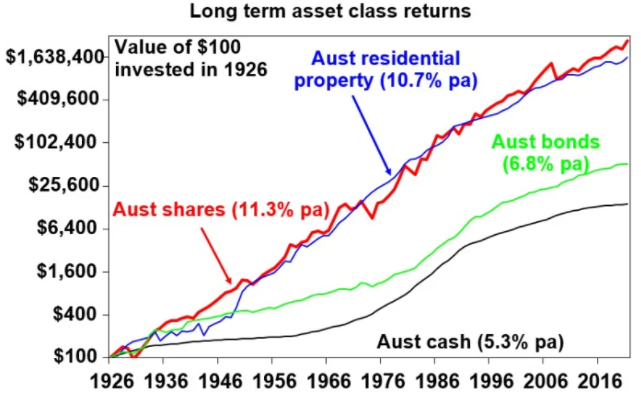

The current PLS rate of 4.5% could be reduced to say 2.5% as part of the change. So after 10 years, drawing $1,458 each fortnight at 2.5% would create a debt of $430,000. And $982,000 after 20 years. The expectation is that the value of the house would rise even more, as Australian residential property has increased at 10.7% per annum over the long term.

The Grattan Institute writes in a paper called ‘Housing affordability: reimagining the Australian dream’:

“The impact on low-income retirees with high-value houses could be mitigated by encouraging them to continue to receive the pension, but reclaiming the over-payment when their house is eventually sold. If retirees responded rationally, the reform would have almost no effect on them – instead it would primarily reduce inheritances."

Or perhaps when they learn more about a scheme that allows them to access 150% of the age pension, they might enjoy a higher standard of living in retirement rather than leaving more money to the kids. The Government could also facilitate private sector provision, although at least initially, acceptance of the scheme would be encouraged by government provision.

4. Pensioners have already benefitted from favourable policies

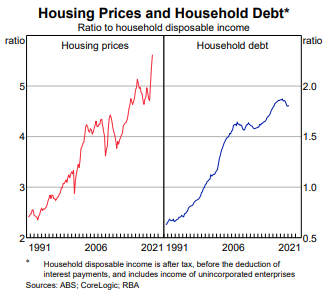

Since 1975, according to CoreLogic, the amount of time it takes an average Sydney homebuyer to save a deposit has increased from three to nine years. The average home cost has risen from four times annual household income to 13 times.

It has been a great run for homeowners, as shown in the chart below. Government policies on capital gains and means-test exemptions have encouraged Australians to buy houses.

When COVID-19 hit in February 2020, most economists expected house prices to fall, some by as much as 30%, due to the decline in immigration and rising unemployment. In fact, massive government stimulus packages, all-time low interest rates and $200 billion of funding injected into the banks under the Term Funding Facility created massive demand for homes accommodated by easy credit.

It was government and central bank policy which created the housing boom and owners have benefited big time. Giving a little back in the form of tighter age pension eligibility is sharing these gains as at some stage in the future, debt will need repaying. Should future generations not only face expensive homes but also the burden of paying off our debts?

Source: AMP Capital

5. The Retirement Income Review recommends accessing home equity

Both the Government and its Retirement Income Review have promoted access to home value as a pillar of retirement income policy.

Deborah Ralston of the Review wrote a detailed article in Firstlinks on accessing equity in the family home. Here are some extracts:

“This (baby boomer) generation has also had the benefit of rising property values over recent decades, with the consequence that a large proportion of their wealth resides in the family home.

In examining the three pillars of the Australian retirement system - the age pension, compulsory superannuation and private savings - the Review pointed out that:

“As housing is exempt from the age pension assets test and capital gains tax, for many it is a preferred form of retirement savings. At present, around 15% of age pensioners live in homes valued at more than $1 million, although the vast majority of these are in Sydney or Melbourne where property prices have escalated over recent years.

For median homeowners at retirement, home equity represents around three to four times as much wealth as superannuation (median superannuation balances at retirement are around $200,000, while median home equity of retirees is $750,000). With the family home constituting such a large component of private saving, accessing equity in the family home is an attractive means of increasing retirement income and continuing to age at home.”

6. Pension asset test is unfair to some people who created businesses

Let’s say the couple who rent next to the pensioner’s house are migrants who disembarked from the same boat in the same year the house was bought. They didn't have much money but they also rented a factory and created jobs, and when they finally retire and sell the business, they will not be eligible for an age pension.

Both couples worked hard but one took business risk, employed people, struggled through recessions and market setbacks. The other enjoyed living in their own home, and now, their assets are worth exactly the same. But the government pays one couple an annuity of $38,000 indexed for life, while the other couple will need to self-fund their retirement.

The asset test exemption encourages Australians to invest in ‘unproductive’ assets when the capital could be directed towards income-producing assets or activities. This is an economic argument to modify the exemption.

Even someone with the same assets in superannuation rather than a home would not qualify for a pension.

7. House prices have risen far quicker than incomes

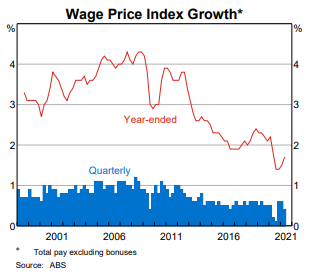

House prices have doubled in real terms over the last 20 years while wages have stagnated. A large proportion of a generation of Australians has less chance of buying a home.

House price growth has also far outstripped household disposable income. As shown below, the ratio of house prices to household income has risen from around 2.5 to the current level over 5.5.

8. Governments need to spend less to repay debt

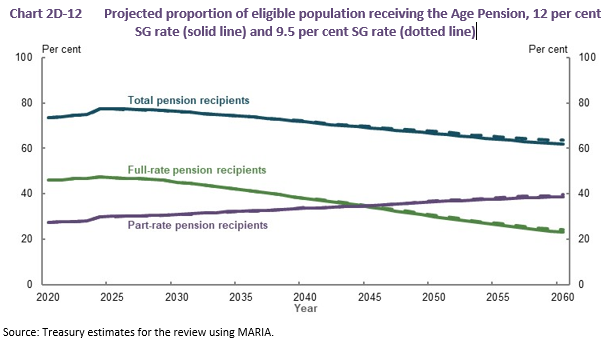

A country facing the budget ravages of a pandemic and a trillion dollars of debt needs to find ways to raise money or spend less. While full-rate pensioners have fallen to about 45% of the eligible population, the proportion drawing part-rate age pension is expected to rise continuously until 2060.

Source: Retirement Income Review, Consultation Papers, November 2019

9. There is widespread expert support for a revised test

Here are the brief views of some leading commentators:

a) Chris Richardson from Deloitte Access Economics on 7.30

"You have some people who have incredibly valuable homes and yet qualify for the pension. The politics are horrendous, but it (including some home value in the assets test) is still the right thing to do."

b) Grattan Institute paper entitled, 'Money in retirement: more than enough".

“- Change the age pension assets test to include the value of a home above some threshold – such as $500,000.

- Extend the Pension Loans Scheme so that people disqualified from the age pension by their assets can borrow income up to the rate of the age pension against the security of their home.”

John Daley from Grattan told the Lateline programme:

“We’re seeing an older generation [that has] benefited from a combination of quite generous tax and welfare treatment and has also been in the right place at the right time as interest rates came down. Therefore asset prices rose and we have a quite wealthy older generation, indeed an older generation that’s much more wealthy today than people of that age, say, 20 years ago.”

c) The Henry Review

The Henry Taxation Review in 2010 supported a cap on the exemption from the assets test of the principal residence. It argued there is a primary role of housing in providing shelter, but beyond this basic function, housing represents an asset that people purchase with an expectation of generating a future return. Henry estimated that a cap of $1.2 million would result in approximately 10,000 age pension recipients facing assessment.

d) National Commission of Audit

The National Commission of Audit proposed in 2014 that from 2027-28, the threshold for the inclusion of the principal residence in the age pension means test should be set at the indexed value of a residence valued at the time of writing at $750,000 for couples and $500,000 for a single pensioner.

e) Rice Warner

In 2015, Rice Warner recommended a threshold of $1.5 million for the principal residence and up to $500,000 for all other assets (including superannuation) to be eligible for the age pension. Those with more valuable homes would need to borrow against the property to reduce their net equity position to $1 million.

f) Centre for Independent Studies

Cowan and Taylor (2015) advocated including the entire value of the principal residence in the age pension assets test. This was part of a three-pronged approach which also included legislating for a default reverse mortgage product to be offered by banks but guaranteed by the Australian Government, as well as deeming income from the reverse mortgage product and including it in the age pension income test.

10. Senior Australians encouraged into more appropriate housing

Some older people stay in their houses because if they sold and moved to a cheaper place, their pension would decrease. The Decisions of Older Australians Report says:

“The exemption from the age pension test creates an incentive for over-investment in principal residences, discourages downsizing and generally reinforces the perception that the family home should not play a role in the retirement funding mix. In effect, by giving home ownership a special status, the means test distorts and constrains the range of accommodation and retirement income choices of older Australians. The exemption is also inequitable - it favours home owners over non-home owners, who are typically less wealthy and possibly in greater need of assistance.”

OECD Report on Australia

The OECD released a report on the Australian economy this week, saying:

"Tackling structural factors that might skew Australian household balance sheets towards residential property investment could reduce vulnerabilities and improve household wellbeing."

Specifically, the OECD suggested excluding inherited properties from the capital gains tax discount system in the absence on an inheritance tax.

But here is the OECD clincher (page 41 of the Survey):

“Age pension payments have risen more markedly than other social benefits, such as those for the unemployed. In addition, the prolonged boom in house prices have inflated the wealth of many pensioners without impacting their pension eligibility given that the value of the family home above a modest threshold (AUD210,500) remains outside the means test. Half of the government’s spending on the age pension goes to people with assets more than AUD500,000. Indeed, the recent Retirement Income Review highlighted that the distribution of age pension expenditures is much less skewed to lower wealth quintiles than other payments.”

Take our short survey ...

There are clearly two sides to this argument, and we include a survey to allow everyone to put their case. All results and comments will be published (subject to avoiding abuse). There is a strong case for introducing the change gradually to allow people to plan and adjust their retirement decisions.

Regardless of personal views on this change, we all know that where a good policy runs into politics, it’s usually the latter that wins. But while a couple worth $2 million might not be 'royals', they do not need social welfare.

Please complete this short, two-question survey on age pension eligibility to gauge opinion on this topic.

Graham Hand is Managing Editor of Firstlinks. This article is general information and does not consider the circumstances of any individual.