Our investment philosophy is to buy champion businesses of the future when valuations are depressed. Typically, reasons for the negativity are obvious. Our job as long-term investors is to look past short-term disruptions, and determine if the businesses possess strong economic moat which enable them to become champion companies in the future.

From this perspective, Chinese equities are exciting for us. After a three-year bear market, Chinese equites are well-and-truly out of favour. While the Chinese economy is facing multiple headwinds, quality businesses will continue to grow and become champion businesses in coming years. Right now is an opportunity to invest and take advantage of the attractive valuations.

The challenges

The economic headwinds for China are well-understood. The economy is reducing its reliance on the property sector for growth. It also has to cope with heightened geopolitical pressure and has spent the last few years purposefully reforming the economy.

All these negative factors are reversing to a certain extent for the better. However, it will take time for these measures to take hold and for the various sectors of the economy to heal. We believe that a muddling-through outlook is unfolding, with a generally stable and improving growth environment.

In the meantime, we are focussed on strong businesses with solid positions within the country that are still enjoying long term growth. Businesses like Tencent, Tencent Music or Kuaishou, all of which have an abundance of levers to pull by virtue of their dominance in the internet to maintain decent growth rates even in a slower economy.

Let’s go through a few of the issues that has worried investors.

1. The property sector

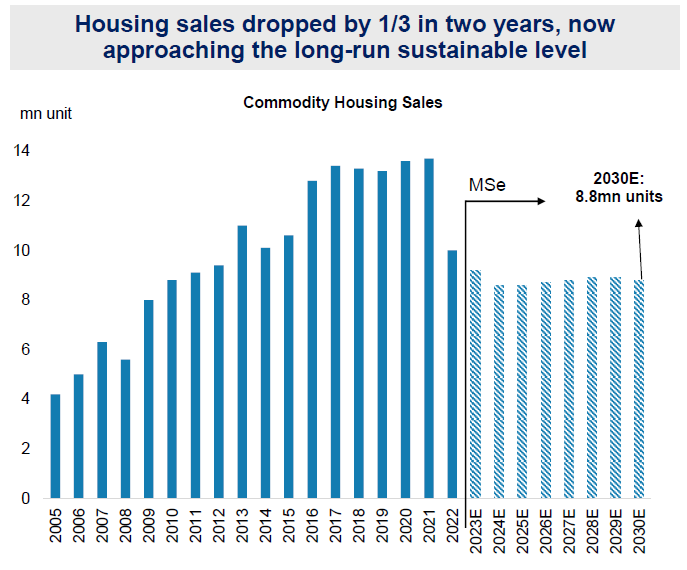

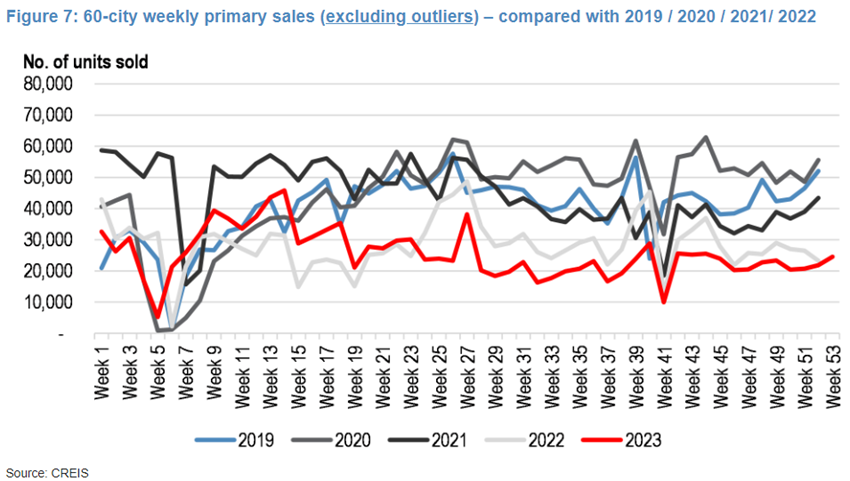

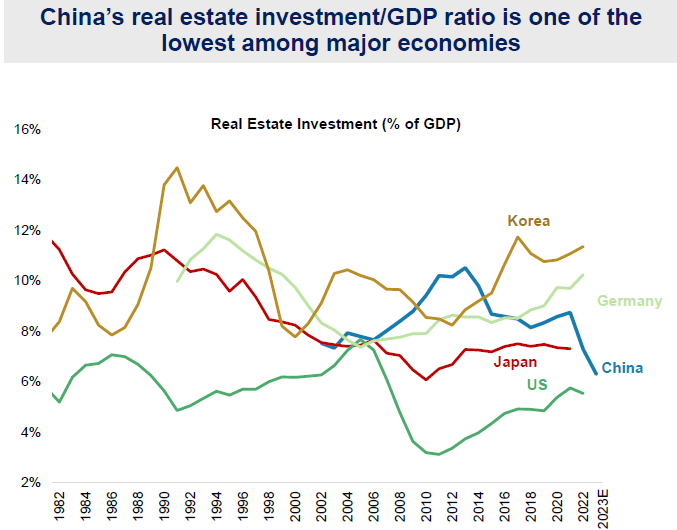

The much talked about property downturn is in fact quite advanced. Sales volumes of new residential properties are down 35-40% from peak sales a few years ago. With loosening of property policies, sales volumes are stabilising. Going forward, given the current backdrop, further decline in volumes is going to have smaller incremental impact on economic activities. According to Morgan Stanley Research, given the significant decline in activities, property investment in China as a percentage of GDP is already lower than that of Korea, Germany and Japan.

Source: NBS, Morgan Stanley Estimates

Source: NBS, Morgan Stanley estimates.

2. Hidden local Government debt

Another risk to the economy is the 'hidden debt' of the local Governments (also known as local government funding vehicles). Estimates have it totalling US$7 trillion (around 50% of China’s economy). While not a small sum, it is manageable, and the magnitude is well-understood by investors and regulators. The regulators are pursuing a combination of austerity, debt restructuring, assumption of debt by the central government and potentially money printing to tackle the problem. These initiatives should gradually work down the problem over time.

3. Government crackdowns on certain private sectors

Well-known examples of crackdown were on the after-school tuition sector and the internet sector. Firm rules were implemented to curb some of the activities that were deemed dysfunctional by the authorities.

The vibrant private sector has to shoulder the burden of economic growth under guardrails, and the Central Government has little appetite to introduce more tightening measures. The most recent episode involved a Government department official having to step down after releasing a consultation paper on additional tightening measures for the video gaming industry.

Source: SCMP

4. Money printing?

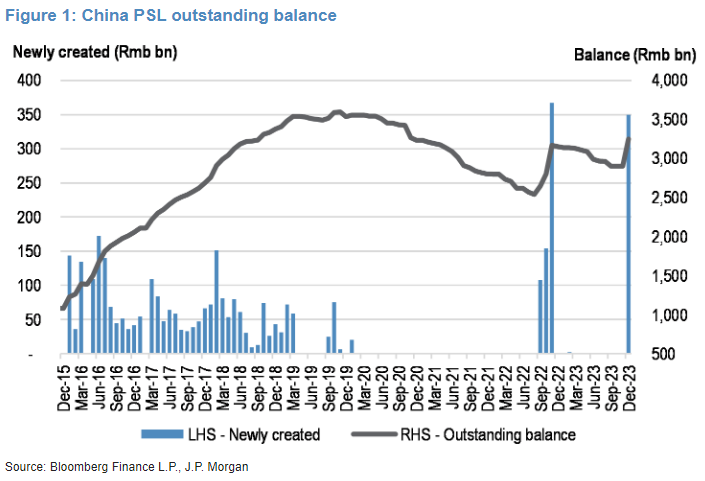

China’s version of “money printing” is called pledged supplementary lending (PSL). If the magnitude is eventually bigger than investors’ expectations, this will be a meaningful impetus for economic growth and cleaning up of the banking system.

5. Geopolitical Tension

Geopolitics tension is thawing. The meeting between President Biden and Xi shows the intention from both sides to restore bilateral relations and reducing near-term risk of escalatory confrontation. With the economy a top priority, China is adopting a pragmatic approach to dealing with geopolitical questions.

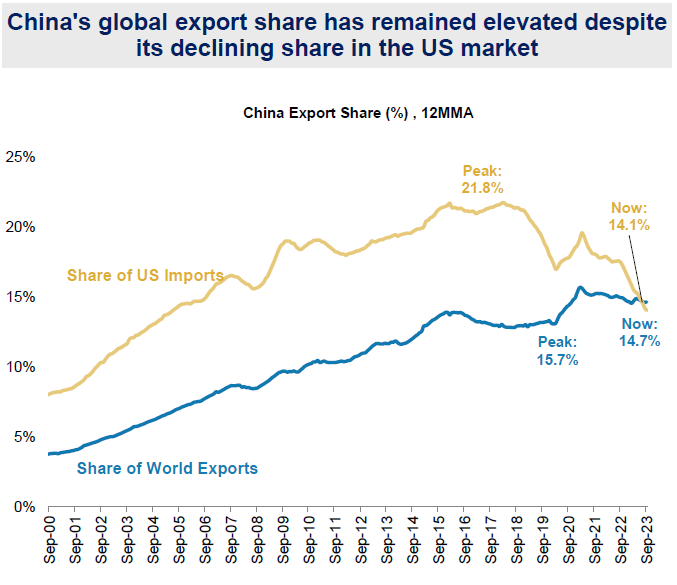

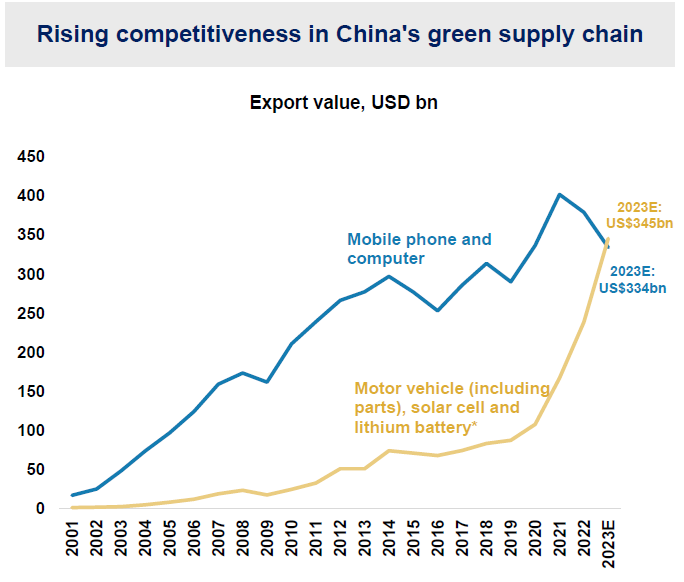

It is likely that continued technological competition will remain. Nevertheless, its manufacturing base remains second-to-none and cost-competitive, China will remain a key part of the global supply chain. New industries such as electric vehicles, renewable energy and automobile have become new drivers for export. China is diversifying exports towards the BRICS countries of the global south and remains the biggest exporter in the world.

Source: NBS, Morgan Stanley Estimates

Source: NBS, Morgan Stanley Estimates

Negatives seem priced in

The problems facing the Chinese economy are manageable. The bright spots are the huge domestic market that continues to grow. Indeed, real income for the consumers is growing, but with the weakness of consumer confidence, excess savings have built up. Improvement in confidence can quickly re-ignite consumer spending. Valuations have come down and are cheap on a historical and global basis.

Source: Bloomberg

Dr Joseph Lai is Founder and Chief Investment Officer of Ox Capital Management (ABN 60 648 887 914, AFSL 533828). This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe for interests, and the information provided is intended to be general in nature only. It has been prepared without taking into account any person’s objectives, financial situation or needs.