While some things are changing, many are remaining the same, and to some extent, the things that are changing are going back to what's happened before. It’s the last 10 or 12 years that were unique. At the start of this year, I thought interest rates would remain low until at least next year, as the Reserve Bank and Governor Philip Lowe were saying. So things have changed but they've changed back to what we've always had, which are investment and economic cycles.

Rising rates and inflation are not new

We now have interest rates going up which we haven't seen for a decade. If you've joined the investment industry in the last 11 years, this is the first time you've seen interest rates rising. But this is not unusual for those of us with a few grey hairs (or all grey hairs in my case).

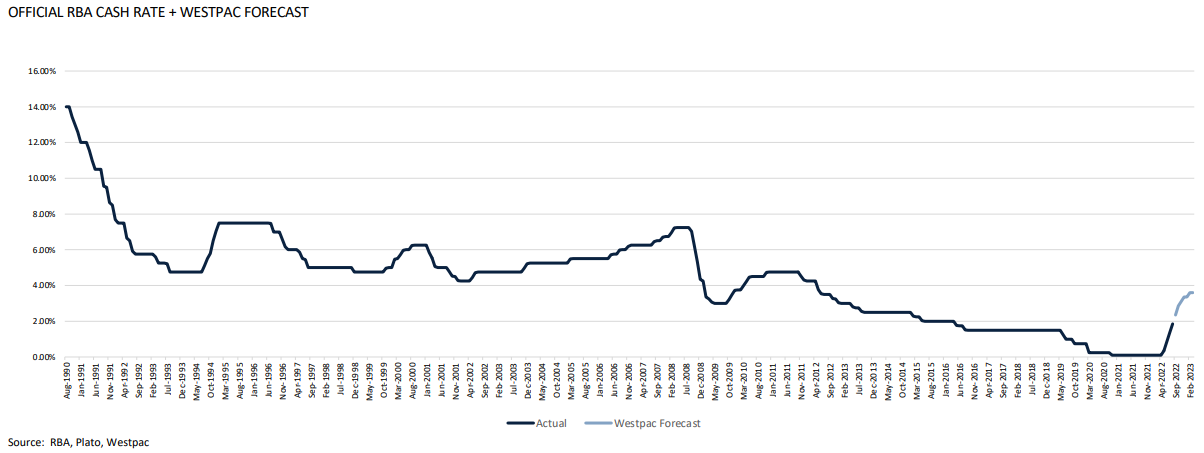

In fact, we haven't really seen interest rates rise much at all in 2022. If interest rates reach the high 3s as Bill Evans from Westpac's is forecasting at 3.6%, it will be the most aggressive tightening by the RBA ever. The following chart is the history of the RBA cash rate. The central banks only started affecting the overnight rate in 1990 and the tightening this time around may be larger than in 1994. And I think the current environment is similar to 1994 when global interest rates went up and inflation was rising, and we had negative returns on bonds and equities.

What happened to 0.1% until 2024? The cycle is back

But in 1994, inflation reached only about 5% so we have already cracked through that in Australia at 6%, and it's 10% in the UK, it's 8% in the US. While we're seeing 30-plus year highs in inflation, we've been there before. This is not new, it's called economic history.

Significant adverse changes for conservative investors

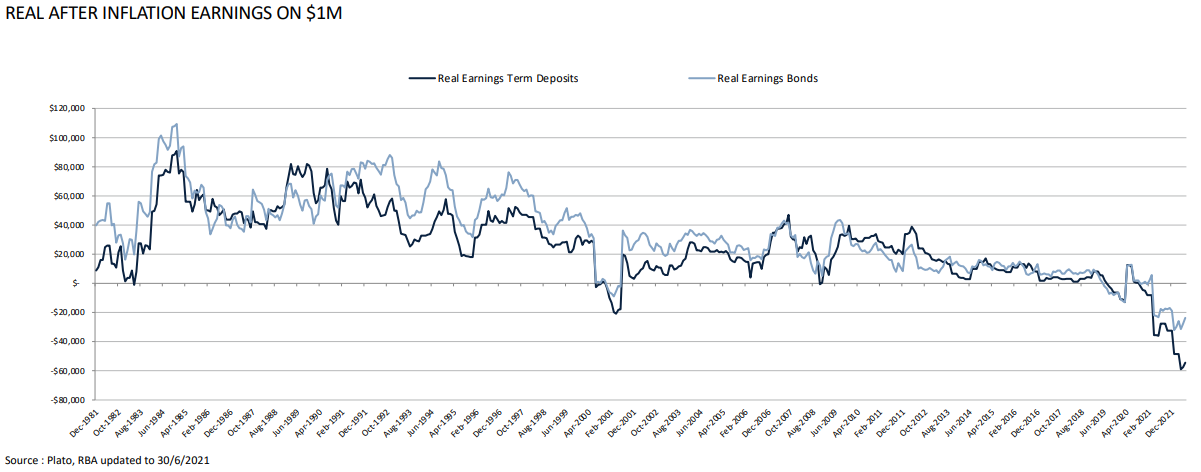

Income investors who are conservative with money in normal term deposits at a big four bank are going backwards. The numbers in the following chart are from the RBA, and with one-year term deposits at 1% or 2% with inflation at 6%, some investors are going back 4% to 5%. On $1 million, they are losing in real terms after inflation $40,000 to $50,000 a year and we've never seen that before. Back in the 1980s, interest rates were double digit and, yes, inflation was double digit, but actually interest rates were higher and so bank deposits gave a positive real return. My parents had fantastic returns off cash in the 1980s.

Safe assets now losing money big time

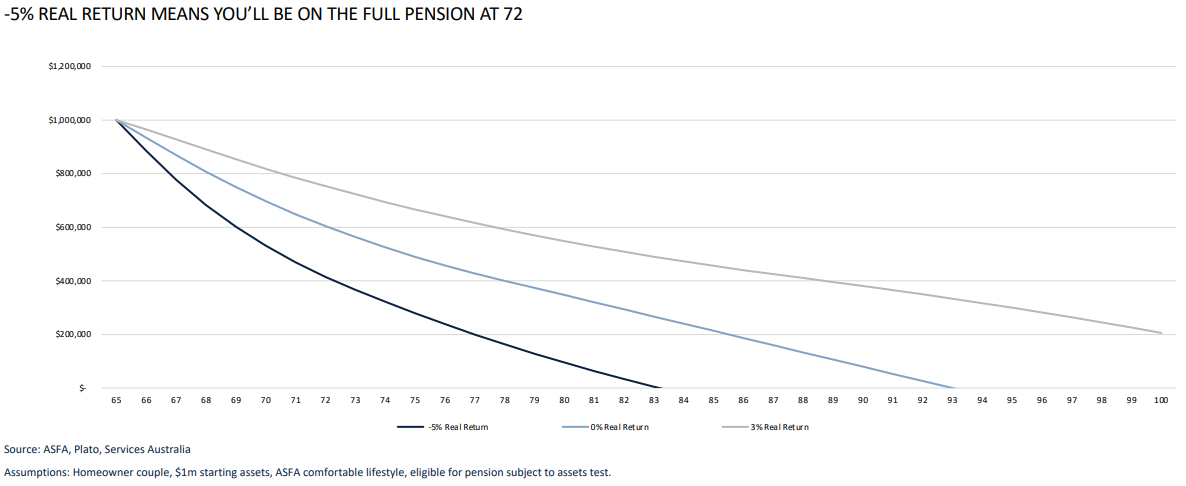

These numbers are based on real assumptions. Many couples with $1 million to invest on top of owning their home will retire at 65. They want a comfortable lifestyle and if they're investing at minus 5% real on that safe asset, the black line in the chart below is the balance of their retirement money in real terms. And it's going down and it only lasts until they are 83. But reality is that one of the people in a couple will probably live well into their 90s and or longer.

Negative real returns are a killer for retirement balances

The couple will start drawing an age pension. If they achieve a minus 5% real rate of return, they'd be receiving the full pension at age 72. I can't imagine too many retirees retiring with $1 million expect to be on the full pension at age 72. Within seven years, they will draw on that pension and live off it. It's challenging that safe assets are losing value. However, if they achieve just a zero real return, they reach 78 before drawing on the full pension, and earning 3% real return is looking pretty good. So, I believe this couple needs more growth assets, such as money in a balanced fund, not only in those safe assets.

The best of times, the worst of times

There is obviously a lot of uncertainty at the moment, but apart from the disaster in Ukraine, the doom and gloom seems overstated. On the negative side we have:

- Rapidly-rising inflation, the highest in 30 years (ex GST introduction)

- Rapidly-rising interest rates

- War and energy crisis in Europe

- Supply chain issues due to COVID

- House prices falling

- Bonds and equities selling off together, the worst since 1994

That is the glass half empty, but the other side of things is more positive:

- Australian economy is at full employment

- Official overnight cash rate is still close to ‘normal’ lows

- Corporate balance sheets are strong and debt levels low

- Some Australian companies well placed to benefit from war in Ukraine

- House prices still well above pre-COVID levels

- Many borrowers are well ahead on repayments, offset accounts at record levels.

Yes, as unpalatable as it may sound, the reality is some Australian companies are making a mint out of the war, such as gas and LNG exporters. Coal stocks are doing well and GrainCorp's making a lot of money from record year grain prices.

And although we've just had the third-worst year for financial assets and for superannuation returns, that followed the second-best-ever year. So, on average, it's about normal. The media like to beat all this stuff up.

What remains the same?

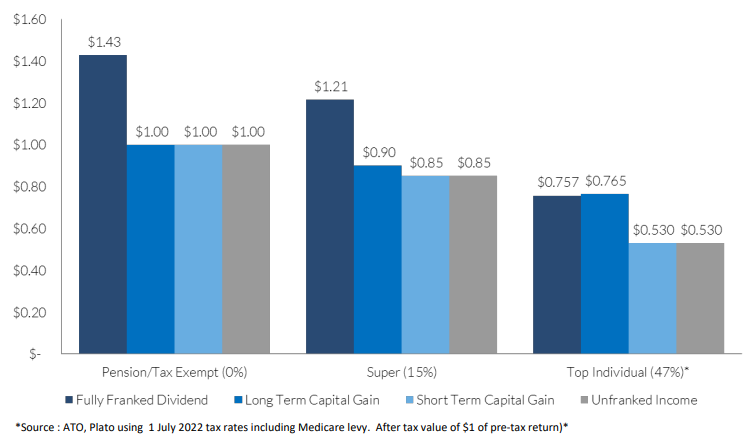

Franking credits have not changed, nor are they likely to. Franking credits are valuable for retirees, as for every dollar of fully franked dividend, investors receive $0.43 worth of franking credits. The chart below uses the ATO 1 July 2022 tax rates including the Medicare levy to show the after-tax value of a fully franked $1 of pre-tax dividend at various tax rates. The tax effectiveness depends on the investor’s marginal tax rate.

Franking credits remain valuable

We had a record year for buybacks last year which allowed a fund like the Plato Australian Shares Income Fund to make large distributions. The Westpac buyback was worth 12% for a tax-exempt investor, such as a retiree with less than $1.7 million in their pension phase of super. There were six other significant buybacks for the year. Plato’s process is very active, moving to where the dividends are. At the moment, coal and energy stocks such as Woodside are delivering strong dividends.

Another thing that hasn’t changed adversely is the income generated from shares over time. While there was a big dip in the pandemic year when many companies cut their dividends, there was a major bounce back last year and it will be even bigger this year. It continues a long-term trend.

Finally, the outlook for dividends looks good with a below average probability of stocks cutting their dividends. Despite all the uncertainty, it is nowhere near the likes of the GFC or during the pandemic. Based on our statistical model which is a bottom-up look at all the dividend payers in Australia, dividends should still underpin Australian equity income.

Dr Don Hamson is Managing Director at Plato Investment Management. Plato is affiliated with Pinnacle Investment Management, a sponsor of Firstlinks. This article is general information and does not consider the circumstances of any investor.

For more articles and papers from Pinnacle and its affiliates, click here.

For a video presentation version of this content, click here.