There is an old adage in the stock market, that a listed public company will release bad news ‘after market’ or late on a Friday, or better still, on Christmas Eve. This is based on the reasonable expectation that no one should be watching, and the financial press would have vacated their desks.

This is what makes the announcement by Australia's Department of Finance (“Finance”), on Christmas Eve 2024 - of a significantly improved “actual” budget outcome for the first 5 months of FY25 - most intriguing. The announcement was published on its website and without much fanfare.

The update contrasted with Treasury’s benign Mid-Year Budget (MYEFO) that was released by the Treasurer just a week earlier.

The differences were stark and significant for the FY25 budget position as we enter a pre-election period. Indeed, the differences highlighted that Treasury forecasts (on Budget night) have been consistently wrong over the last three years, and by big margins. Indeed, the difference between the budget forecast and the budget outcome have amounted to tens of billions of dollars representing a significant 1% to 2% of GDP. Far too large to dismiss as mere aberrations.

This is concerning because markets and investors rightly consider and then react to budget projections that are reported in both budget forecasts and outcomes. The declared positioning of Government fiscal policy will support or detract from economic growth and the confidence in the outlook for economic growth.

For instance, a 1% fiscal deficit (to GDP) will have growth repercussions that are not as significant as those of a surplus budget. Inflation fears may be stoked or dampened by declared fiscal policy and the difference between budget revenue (tax) and expenses. Interest rate guidance and the cash settings of the RBA will be adjusted and based on fiscal outcomes that support or detract from economic activity.

What did Treasury and Finance state and how were they different?

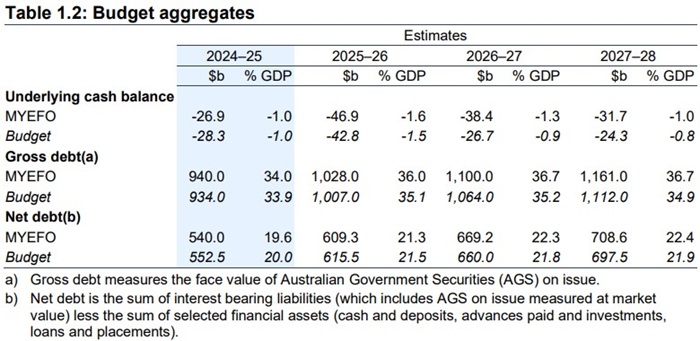

In its mid-year update Treasury forecast only a slightly improved deficit for FY25 of $26 billion (down from the May budget forecast of $28 billion). It also forecast that the budget would be unlikely to reach an annual surplus inside a decade and noting (see below) that the trajectory of the budget would further deteriorate over the next three fiscal years.

Source: Budget 2024-25 Mid-Year Economic and Fiscal Outlook 2024–25

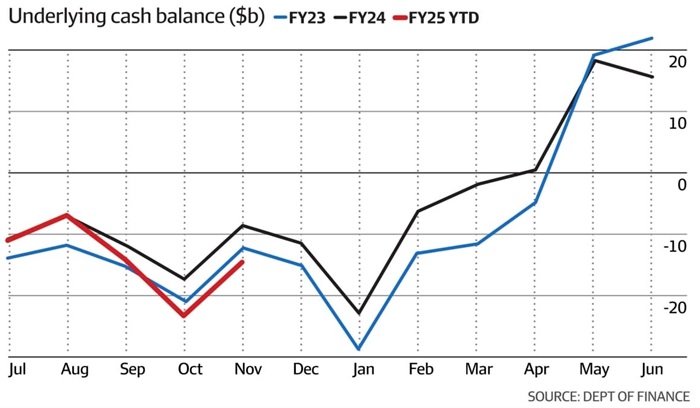

A week later, on Christmas eve, the Finance update showed that the current year deficit for five months to November was just $5 billion and barely different to the positions seen at the same point in FY23 and FY24 which produced budget surpluses of around $20 billion.

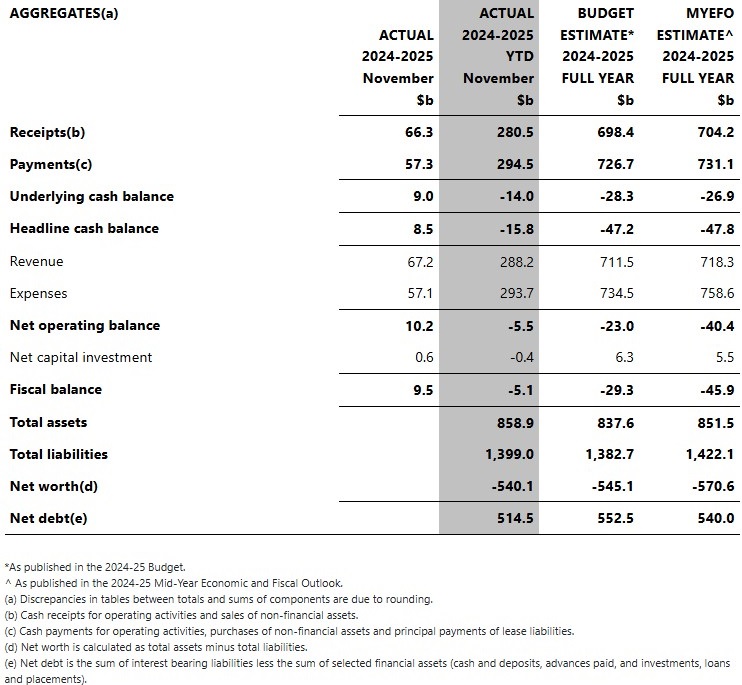

As at the end of November the 'net operating cashflow balance' was $14 billion better than forecast in the original budget (May) and the updated forecast in the MYEFO.

Source: Australian Government General Government Sector Monthly Financial Statements for November 2024

The improvements are seen below in the Finance report of December 2024. Year to date:

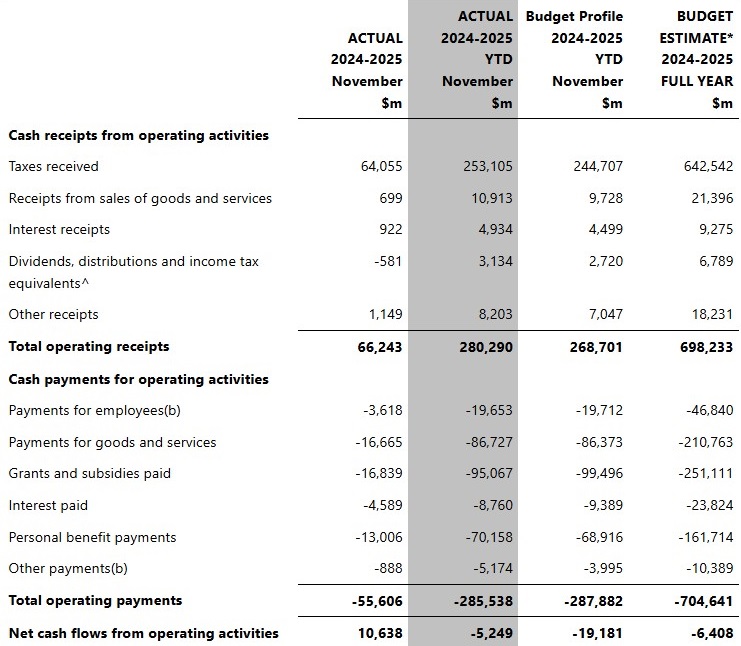

- Total receipts were $11 billion better than expected.

- Taxation receipts (mainly PAYG) were $8.4 billion than expected; and

- Expenses were $2.3 billion than expected.

Source: Australian Government General Government Sector Monthly Financial Statements for November 2024

In summary, tax collections make up the bulk of the difference with an extraordinary $8 billion (above forecast) drawn from individual income tax payments – and that is after the tax scale adjustments of 1 July. Company taxation collections are $0.5 billion better than forecast. Notable was that the budget forecast was for company taxation collections to fall.

Therefore, what does it suggest that Treasury has wrongly forecast?

- Higher actual employment numbers i.e. more people are working and therefore paying PAYG. Remember the unemployment rate may rise but more people can be working. The latest employment release showed that 56,000 jobs were added to the economy in December 2024 whist the unemployment rate ticked up. Australia’s employment participation rate has never been higher. Clearly immigrants like to work!

- A lower AUD that holds export revenue. Treasury, like many other forecasters, do not acknowledge that the surging inflows into superannuation are driving super capital investment flows to offshore markets and weakening the AUD more so than the surging USD; and

- The maintenance of higher iron ore export prices which remain 50% higher than budget forecasts – a feature common in budget forecasts for at least the last five years.

I draw some conclusions from the above which will be contested by many:

- The tax cuts for low-income workers from 1 July should have been larger and they should have been set with an agreement for lower wage claims across the Government sector (Commonwealth and State). The elevated wage claims flowing across the economy, notably in the state government sector, are symptomatic of a poorly structured and un-coordinated wages income tax policy.

- Electricity rebates should have been greater than $300, and this would have driven reported inflation lower. So too would have been a reduction in petrol excises. The indexing of petrol excises without a review mechanism, after inflation has surged, is a nonsensical policy given it further adds to both the cost of living and the cost of doing business. Most current Government sector wage claims are focused on the recovery of the cost-of-living increases.

- There is now capacity for the Government to offer pre-election and vote buying gifts that will not upset the original forecast budget estimate ($28 billion deficit). For instance, we should expect the extension of energy rebates amongst other short-term giveaways. The Opposition can join the giveaways if it can understand what has changed in the budget outcome; and

- Alternatively, the FY25 budget outcome (if untouched by the Government) will be significantly better than forecast and could even approach a surplus. The Government can claim that it is a superior financial manager – but unfortunately (for them) the budget outcome will be seen after the election votes are counted.

Federal budgets have always been political documents but the discrepancies that are appearing between Treasury forecasts and actual outcomes needs greater scrutiny. This suggests that the claims of each political party, that they have better fiscal management discipline, will need to be treated with extreme scepticism in the forthcoming election.

Neither party seems capable of explaining the drivers of budget outcomes and the budget adjustment opportunity to the Australian population. Neither party have declared plans to adjust fiscal policy to check the cost of living inside a coordinated plan to lift real wage outcomes (after tax).

A proper review of the illogical (in many respects) taxation laws of Australia remains stalled leading to excessive taxation payments by workers.

The immense growth opportunity of Australia remains untapped as politicians argue inanely with each other.

John Abernethy is Founder and Chairman of Clime Investment Management Limited, a sponsor of Firstlinks. The information contained in this article is of a general nature only. The author has not taken into account the goals, objectives, or personal circumstances of any person (and is current as at the date of publishing).

For more articles and papers from Clime, click here.