With Firstlinks’ editor James Gruber out sick, I had the privilege of editing this week’s edition for you.

For those of you who don’t know me, I write about investing for Morningstar Australia. I guess you could say my route up to this point has been quite eclectic.

I started off in an intern role promoting America’s role in European security. I then traded frozen seafood in London for a while. I then set up a business writing adverts and other marketing material for various clients before specializing in investments.

As a freelance “gun for hire”, I sold everything from refurbished computers to fitness classes and giant personalised soccer gifts. Like any other job, the easiest way to get better was to seek wisdom from the industry’s greats. So with world domination in mind, I read everything I could from geniuses like David Ogilvy and Claude Hopkins.

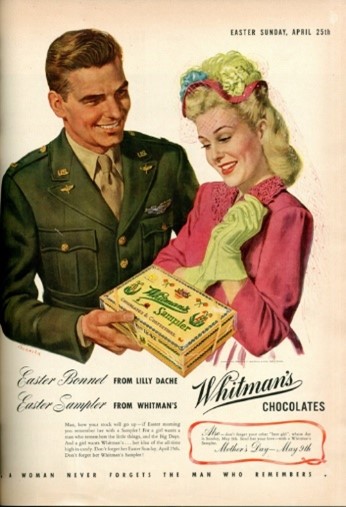

One thing I picked up was that great advertising – no matter the era it comes from – speaks to the mood and ambitions of people in society. This makes looking at an era’s advertising one of the best ways to understand what was going on in society at the time.

You don’t need to look at an advert from the 1940s to know there was a war going on. But the era’s adverts offer a different window into the norms and emotions of the era. Look at adverts from the 1980s and the awe inspired by new technology jumps off the page.

When people look at our generation’s ads, what will they think? They will probably think we spent a lot of our time ordering takeaways, gambling and watching trash TV.

If they look at Australian ads in particular, they may pick up on your love for utes. They might also pick up on how big ‘Big Super’ has become and the daily battles being fought to attract retirement assets. I say that because I have never seen retirement products advertised as much as I have here.

Before moving to Australia, I had never heard an investment fund being touted on the radio. Tune in here and you’ll hear a fund’s average 10 year return in between Taylor Swift songs.

Watch the footy and there’ll be ads from HostPlus, Cbus and other giant super funds at half-time. Again, something I never saw in the UK.

When the game is on, there’ll also be super fund logos on the advertising hoardings. Super fund logos on one of the team’s shorts. Super fund logos plastered around the coach’s box and on their laptops, ready for the camera panning there after a try. I’ve never seen anything like it.

Maybe I am just in a state of hyper awareness. After all, I recently chose my first super fund. It might be like when you buy a new car and start seeing the same model everywhere. But maybe it isn’t just me.

An AFR article in December 2023 estimated that the top 8 industry funds spent a combined $197 million on marketing over the previous 12 months. It’s hard to know exactly what is included in that number – I think it includes big payments to labour unions too. But it isn’t that far from the $238 million gambling firms spent on TV, radio and online ads in the year to May 2023, according to Nielsen.

Giant super funds are now giant ad buyers. And these ads aren’t being placed for the fun of it. Their presence suggests that Aussies are engaged enough with their retirement goals for the investment to pay off – an assumption that appears to be backed up by survey data.

MoneyMag’s Love Your Super study in 2023 suggested that almost half of Australians check their super balance monthly and that 17% check every day.

A different study by Findex found that 30% of Australians had only a “vague or no idea” of their Super balance, meaning 70% have a better than vague idea. That’s a lot better than in the UK, where a study by Standard Life suggested that 75% of people don’t know how much they have in retirement savings.

I think these higher levels of engagement are partly a result of having more to lose.

At the end of 2022, the Global Pension Assets Study estimated that Australia’s 26 million people had total retirement assets under management of 2.1 trillion (in US dollars). The UK had about 25% more assets with 2.6 trillion. But this amount came from over two and a half times the number of people. That’s a huge gulf on a per capita basis, even if the UK number was depressed by the gilt crash in 2022.

By moving here from the UK, I’ve gone from being ahead of the average retirement balance for my age to being behind. You Aussies (and your huge compulsory contributions) are obviously far too responsible for us Brits to keep up with.

The effect of this has been that I’ve found myself thinking more about my retirement pot and how to grow it than ever before. Here’s to this edition of Firstlinks keeping you one step ahead.

Joseph Taylor

In this week’s edition…

Most people would prefer to have more money than less of it. But at what point do the trappings of wealth and success start to outweigh the benefits of striving for more? Mark LaMonica urges you to think about what financial success really means to you. Arriving at a clearer and more personal definition of this won’t just change the way you invest, it could change the way you approach every aspect of your life.

Inflation has been front of mind for policy makers, investors and mortgage payers for three years. Yet while commentators obsess over every monthly inflation print, they seem to have forgotten what causes it in the first place. Warren Bird charts the impact of money supply on inflation and what it suggests is coming next. Fortunately, the picture looks cheerier than the reaction to May’s monthly data.

Valuations in developed equity markets have looked stretched for some time. Meanwhile, emerging markets look cheap versus history. The set up looks compelling but investors shouldn’t ignore the huge differences between countries and companies housed in emerging market indices. Shane Woldendorp from Orbis Investments highlights three tailwinds that selective investors can benefit from in the coming years. As well as some common pitfalls to watch out for.

Houses have never been more expensive relative to the average person’s salary. This is often used as evidence that young Australians have it harder than their parents for the first time. According to Ken Atchison, there is more pain on the way for a very different reason. He identifies two policy oversights that benefit today’s Australians at the cost of tomorrow’s taxpayer.

On one hand, nuclear power is a source of zero emission energy that is far more reliable than wind power. On the other, building reactors includes massive up-front investments that take several years to bear fruit. As Roger Dargaville from Monash University shows, a switch to nuclear power could also leave Australian households and businesses paying even more for their electricity.

The early results of our 2024 Reader's Survey are in. The importance of independent views, having a wide range of topics to pick from and being able to read your fellow readers' thoughts were common threads. For a selection of reader comments and details on how to have your say, see Leisa Bell's summary here.

Two extra articles from Morningstar this weekend. Mark LaMonica highlights that many of the ASX’s biggest income plays now look like dividend traps and asks what income investors can do. Shani Jayamanne looks at when dollar cost averaging your investments works, and when it doesn’t.

This week’s white paper gives you VanEck’s view on the market outlook for the second half of 2024.

Curated by Joseph Taylor and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly Bond and Hybrid updates from ASX

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website