Cuffelinks' introduction to Howard Marks, Chairman, Oaktree Capital

Howard Marks established Oaktree Capital in 1995, and is responsible for the firm's adherence to its core investment philosophy. Oaktree manages over US$90 billion and its mission is to provide highly professional management with a primary emphasis on risk control in a limited number of sophisticated investment specialties. Howard is best known in the global investment community for his ‘Oaktree Memos’ to clients which detail investment strategies and insights into the economy, and are available on the Oaktree website. In 2011 he published the book The Most Important Thing: Uncommon Sense for the Thoughtful Investor.

Howard Marks recently gave the following confidential presentation on risk to selected institutional clients, and Oaktree Capital has given permission for Cuffelinks to share the insights with its readers. The material remains at all times copyright of Oaktree Capital.

Risk Is ...

The Ultimate Test of Investment Skill

- It’s not hard to achieve investment return.

- That’s especially true when the market rises, which it usually does.

- The real achievement is achieving return with risk under control.

- The key questions when you see a portfolio perform well:

- Is it just a fair-weather portfolio?

- How will it hold up if the environment turns hostile?

An Essential Consideration in Assessing Investment Performance

- Return alone tells only part of the story about performance.

- Two investors with the same return didn’t necessarily do equally good jobs.

- Their performance has to be viewed in risk-adjusted terms.

- The key question is “How much risk did each one bear?”

Not Volatility

- Academics developing investment theory accepted volatility as the measure of risk. I believe they did this in large part because volatility is readily quantifiable.

- However, few people in the real world consider volatility the key risk.

- Risk premiums aren’t demanded in response to volatility.

Not Machinable

- Only volatility is fully quantifiable.

- Nothing can be substituted for volatility in investment theory’s calculations.

- But volatility alone isn’t a useful measure of risk.

The Probability of Loss

- This is what most people mean when they say “risk.”

- This is what people demand compensation for if they are to bear it.

The Probability of Falling Short

- Many investors face a return requirement. The ramifications of failing to achieve that return can be significant.

- Thus the risk of missing opportunities is another important risk.

- Since the requirement is unique to each investor, the probability of failing to reach it is situational, not a risk inherent in the investment or portfolio.

The Likelihood of Being Forced Out at the Bottom

- Many investors claim to be long-term oriented and thus immune to fluctuations.

- But bad-enough declines can make them sell:

- because they lose confidence

- because they receive margin calls or

- because of a need to fund real-world cash requirements.

- Some of the greatest pain in 2008 was felt by investors who had overestimated their ability to withstand volatility.

- Selling at the bottom – and turning a downward fluctuation into a permanent loss – is the cardinal sin in investing.

An Investment Consideration; It Should Be Distinguished from Managers’ Business Issues

- The possibility of lagging behind a benchmark and of performing worse than others aren’t investment risks, but rather competitive/business issues.

- A shortfall in relative performance doesn’t necessarily indicate that high risk was borne. It may, for example, result from the application of risk control in an overheating market. Thus it may indicate low risk, not high risk.

- Succumbing to “the tyranny of benchmarks” introduces the risk of allowing others to define desirable behavior for you.

- Eliminating the risk of deviating from a benchmark – as index funds do – may reduce business risk but increase investment risk. Index fund investors lose money every time their market goes down.

Unquantifiable In Advance

- Like any judgment regarding the future, the probability of loss can’t be anything but a matter of opinion.

- A variety of experts will view it and quantify it differently.

Unquantifiable After the Fact

- A profitable investment may (or may not) have been risky.

- Was it a safe investment that was sure to produce a positive outcome?

- Or was it a risky investment where the investor got lucky?

- Likewise, a losing investment may not have been risky, just unlucky.

- For the outcome of an investment to be an accurate indicator of its riskiness, return would have to be a function of risk alone. There are too many factors at play for that to be the case.

- The bottom line: it’s impossible to quantify risk, even in hindsight.

- Thus, in particular, it’s impossible to say high-returning portfolios were riskier and low-returning portfolios were safer. In fact, the opposite is often true.

Best Assessed through Subjective Judgment

- Since risk can’t be measured, gauging it has to be the province of experts.

- Imprecise, qualitative, expert opinion about the probability of loss is far more useful than precise but largely irrelevant numbers concerning volatility.

Counter-Intuitive

- When all traffic controls were removed from the town of Drachten, Holland, traffic flow doubled and fatal accidents fell to zero (Dylan Grice, Soc. Gen.).

- “Jill Fredston is a nationally recognized avalanche expert . . . She knows . . . better safety gear can entice climbers to take more risk – making them in fact less safe.” (Pensions & Investments)

- Thus the risk of an activity often lies not in the activity itself, but in how the participants approach it.

- Likewise, the degree of risk present in a market derives more from the behavior of the participants than from the companies, securities and institutions. Risk is low when investors behave prudently and high when they don’t.

- Prior to the subprime crisis, there had never been a nationwide wave of mortgage defaults. This convinced investors that mortgages were safe. This, in turn, led to a lowering of credit standards and the issuance of mortgages so weak that a nationwide wave of defaults was inevitable.

Perverse

- The riskiest thing in the world is widespread belief that there’s no risk.

- A high level of risk consciousness tends to mitigate risk.

- As an asset declines in price, making people consider it riskier, it becomes less risky.

- As an asset appreciates, making people think more of it, it becomes riskier.

- This perversity is one of the main things that render most people incapable of understanding risk.

Hidden and Thus Deceptive

- Even if it contains construction flaws, a house will stand until there’s an earthquake.

- Equally, an investment can be risky and still not show losses as long as the environment remains salutary.

- The fact that an investment is susceptible to a serious risk that will occur only infrequently – the “improbable disaster” or “black swan” – can make it appear safer than it really is.

- The riskiness of an investment becomes apparent only when the investment is tested.

- “It’s only when the tide goes out that we find out who’s been swimming naked.” - Warren Buffett

Something That Should Be Dealt with Constantly, Not Sporadically

- Risk produces loss when bad things happen; that’s when we need risk control.

- But we never know when bad things will happen, and thus when risk control will be needed.

- The right model for investing isn’t American football, where one team’s defensive squad tries to stop the other’s offensive squad for a while, and then they trade places. The right model is soccer, where pretty much the same eleven people have to play both defense and offense all game, and there are few stoppages or substitutions.

- Likewise, in investing no one tells you when to substitute defense for offense, and there are no stoppages during which to do it.

- Risk control is unnecessary when loss doesn’t occur, but that doesn’t mean it’s a mistake to have it. The best model is automobile insurance: do you regret having had it in a year without an accident?

Not a Function of Asset Quality

- A high-quality asset can be priced so high that it’s risky.

Largely a Matter of Price

- A low-quality asset can be cheap enough to be safe.

The Product of Uncertainty Concerning the Future

- “Risk means more things can happen than will happen.” – Elroy Dimson

- It’s challenging to come up with an estimate of an investment’s expected rate of return.

- It can be much harder to comprehend and describe the entire distribution of possible outcomes around the expected return.

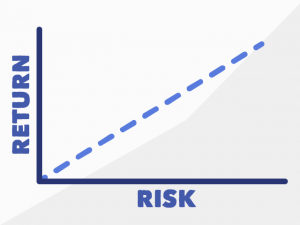

Not a Dependable Source of High Return

- It’s true that investments that seem riskier must appear to offer higher returns in order to attract capital.

- However, that’s very different from saying “riskier assets produce higher returns” or “the way to make more money is to take more risk.” These are traps into which most investors fall, especially in times when things are going well and risk taking is being rewarded.

- If risky investments could be counted on to produce high returns, they wouldn’t be risky.

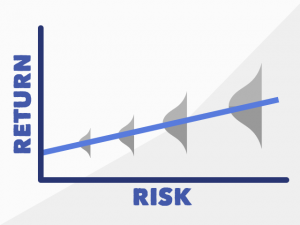

Best Thought of in Terms of the Distribution of Possible Outcomes

- As risk increases,

- The expected return rises,

- The range of possible outcomes becomes wider, and

- The worst outcome worsens and ultimately becomes negative.

- This is the way to think about the risk/return relationship.

A Function of Correlation, Not Just Each Asset Taken Individually

- Apart from the riskiness of individual assets, the risk of a portfolio will be a function of how connected the assets’ returns are.

- Effective diversification doesn’t mean owning different things, but owning things that respond differently to events in the environment.

- Estimating correlation is extremely difficult because of the many fault lines that run through portfolios.

Not Separable from Investment Management

- “Risk managers” are statisticians with little knowledge of underlying assets.

- So-called “risk management” organizes the thought process regarding portfolio risk, but its output isn’t any better than its inputs.

- The riskiness of a portfolio is best thought of as the left hand side of its distribution of probable returns; who’s most qualified to assess it?

- More people were probably being paid to manage risk in 2005-07 than at any other time in history. And yet the essential ingredients for the greatest crisis in almost 80 years were able to develop.

Capable of Being Borne Intelligently

- You can bear risk prudently if it is:

- risk you’re aware of,

- risk that can be analyzed,

- risk that can be diversified, and

- risk you’re well paid to bear.

Kept Under Control in Superior Portfolios

- Highly skilled investors assemble portfolios that will produce good returns if things go well and resist decline if things go poorly.

- Achieving an above average return with average risk is a significant accomplishment.

- Achieving an average return with below average risk is an equally significant accomplishment, albeit easily overlooked.

- Assembling a portfolio that incorporates risk control along with the potential for gains is a great accomplishment. But it’s a hidden accomplishment most of the time, since risk only turns into loss occasionally . . . when the tide goes out.

Something to Be Managed and Controlled, Not Avoided

- Risk control is indispensable.

- Risk avoidance is not an appropriate goal in investing.

- “You’ve got to go out on a limb sometimes because that’s where the fruit is.” – Will Rogers

The Bottom Line

You shouldn’t expect to make money without bearing risk, but you also shouldn’t expect to make money just for bearing risk.

Risk is best handled on the basis of accurate subjective judgments on the part of experienced experts emphasizing risk consciousness.

Outstanding investors are outstanding because they have a superior sense for the probability distribution that governs future events, and for whether the potential returns compensate for the risks that lurk in the distribution’s negative left-hand tail.

Howard Marks is an investor, writer and co-founder of Oaktree Capital Management. He is known in the investment community for his "Oaktree memos" to clients which detail investment strategies and insight into the economy.

Disclaimer and disclosure.

Oaktree Capital Management, L.P. (together with its affiliates, “Oaktree”) has granted permission to Cuffelinks to include this article on their website (www.cuffelinks.com.au). This article may not be copied, reproduced, republished, posted, transmitted, disclosed, distributed or disseminated, in whole or in part, in any way without the prior written consent of Oaktree or as required by applicable law.

This article contains information and views as of the date indicated and such information and views are subject to change without notice. Oaktree has no duty or obligation to update the information contained herein. Further, Oaktree makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, wherever there is the potential for profit there is also the possibility of loss.

This article and the information contained herein are for educational and informational purposes only and do not constitute and should not be construed as an invitation, inducement or offer to sell or solicitation of an offer to buy any securities or related financial instruments in any jurisdiction in which such offer or solicitation, purchase or sale would be unlawful under the securities, insurance or other laws of such jurisdiction. Responses to any inquiry that may involve rendering of personalized investment advice or effecting or attempting to effect transactions in securities will not be made absent compliance with applicable laws or regulations (including broker-dealer, investment adviser, or applicable agent or representative registration requirements), or applicable exemptions or exclusions therefrom.

Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Oaktree believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.