Will house prices fall by 20% or more, as many pundits are predicting? Those predictions go against the historical record and against economic reasoning. It is more likely that house prices will suffer single digit percentage falls, and then remain flat (in real terms) for an extended period of a decade or more.

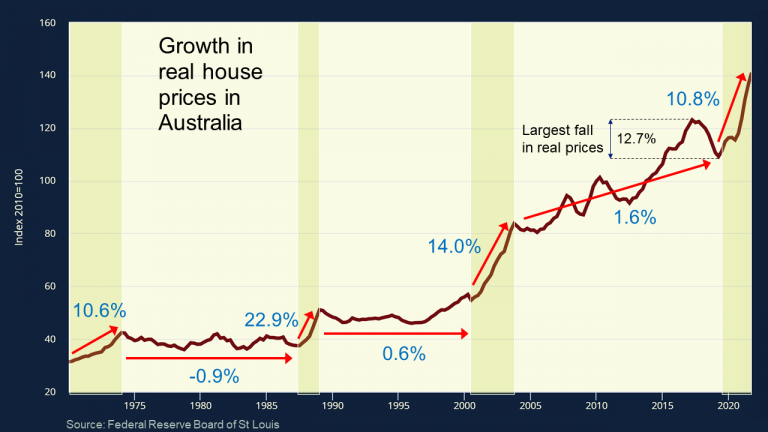

The graph below shows real (inflation adjusted) house prices in Australia from the beginning of 1970 until the end of 2021. There is an obvious pattern in the graph of house prices zooming up and then staying flat for a long period of time. That pattern is not just an accident of the data; it occurs for a particular economic reason, and the same pattern occurs in other countries. House prices in Canada, for instance, follow a strikingly-similar pattern.

How shares and houses differ in response to demand

Why do house prices evolve in an up-and-flat pattern rather than up-and-down like shares?

The difference between the housing market and the sharemarket is in how they respond to a fall in demand.

In the share market the supply of shares available for sale (the float) is essentially fixed and unchanging with the level of share prices. When the demand for shares falls, then to get back to the equilibrium of demand = supply all the change has to come from prices adjusting. Prices have to fall until some investors switch from thinking shares are over-valued to thinking that they are under-valued. There is no reduction in supply to help get back to equilibrium. All the adjustment is in prices.

The residential property market is different. When the demand for houses falls, then prices start to fall. As prices fall, the supply of houses available for sale declines because some sellers pull back from the market. Many homeowners are reluctant to sell into a falling market, or even to accept a price below the high water mark that their property had previously reached.

For instance, homeowners who were thinking of selling their home in Malvern and moving to the Sunshine Coast now delay that plan. Likewise, the empty nesters who were thinking of downsizing from their home in Randwick withdraw until prices improve.

Because supply falls as prices fall the market gets back to an equilibrium of demand = supply without all the adjustment having to be in prices. On the flip side, when demand rises after a period of flat prices, then supply expands. It then takes a substantial increase in demand to soak up the extra houses for sale before prices start increasing.

Have you noticed how much attention is paid to the volume of sales in the market and the number of houses available for sale? Realtors know the importance of the supply data. Moreover, they know that entry and exit of sellers is a response to price changes rather than the cause of housing price changes.

What to expect

Australian house prices rose sharply from late 2020 onwards in response to the sharp fall in interest rates engineered by the RBA in response to the Covid crisis. What we should expect now is that house prices fall by single digit percentage amounts, or perhaps a bit more, but not by 20-25%. There is no precedent for those kinds of falls in Australian housing prices in normal circumstances.

Real housing prices suffered very large falls during the Great Depression of the 1930s and during WWII and its immediate aftermath. But we are not talking about depressions or world wars here.

The largest fall in real house prices since 1970 was the 12.7% decline between mid-2017 and mid-2019. A 20% fall in nominal house prices (no adjustment for inflation) over the next year would be a 27% fall in real house prices if inflation runs at 7%. 27% is more than twice the largest fall we have seen in real house prices (12.7%) since 1970. It could happen, but it is very unlikely.

However, investors should not expect real house prices to rise either for a decade or more. There might even be a slow decline in real house prices, as happened from 1974-1987. There is something to work through here and that will take a long time.

Inflation expectations

The doomsayer pundits also seem to have a misunderstanding of the role of interest rate expectations in setting house prices. Homeowners are for the most part thinking about how high, or how low, interest rates will go in the long term, not the very short term. Homeowners are not easily convinced that interest rate changes are permanent.

In 2019, the Reserve Bank of Australia (RBA) cut the cash rate from 1.50% to 0.75% by 1 October 2019, or three months before the first Covid fatality in Wuhan in January 2020. But the property market did not respond quickly. Even after the cash rate was cut to 0.10% in mid-2020 in response to the Covid crisis, the market still took its time to be convinced that the rate cuts were long term.

The same will happen in this cycle. Housing market participants will look at rising mortgage rates and think they are not obviously permanent. Rising inflation might be pushing rates up now, but inflation will fall away and then rates will fall with it.

The point is that house prices won’t respond rapidly downward due to rising mortgage rates until households think those rates are higher for the long term. We can see in bond prices that the bond market thinks inflation and interest rates will fall away quickly over the next 12 months. Long bond rates have fallen significantly in recent months. The money market is expecting the cash rate to rise to about 3% and then be lowered again in 2023.

The doomsayers of 20-25% property price falls are focusing too heavily on short-term interest rates.

Other misunderstandings

There are other misunderstandings leading to these bearish predictions.

One is an exaggerated view of the mortgage stress that will arise if the cash rate goes to 3% of more. The danger of forced sales of properties adding to supply is being seriously overstated. Another misunderstanding is just how constrained the supply of new housing is in Australia.

There is no doubt that house prices in Australia have reached highly-elevated levels. The total value of the housing stock is 480% of GDP in Australia versus 180% of GDP in the US. Moreover, average house prices are more than 6 times average household disposable income, up from a multiple of 2.5 times in 1990.

Nonetheless, homebuyers and investors should be sceptical about predictions that house prices will fall by 20-25% in the next 12-24 months. There are sound economic reasons to expect that house prices will suffer much more modest falls, and also to expect that real house prices will stay flat for a decade or more. Investors need to position themselves for a long period of low growth in house prices.

Dr Sam Wylie is Director of Windlestone Education, and a Principal Fellow at Melbourne Business School. This article is for general information only and does not consider the circumstances of any individual. Dr Wylie runs a 10-week online investment course via live Zoom, Finance Education for Investors, and the next course starts on 3 October. For enrolments, see his website.