There are many high-quality small companies operating across all areas of the Australian economy. Some of these companies will one day grow into large, mature businesses.

Identifying these stocks at the beginning of their journey provides investors with the potential for significant capital growth along the way. As small companies flourish, revenue and earnings growth are typically expanding at their fastest point in the company’s lifecycle. It is growth that larger, more mature companies would find difficult to replicate.

On the flip side there are, of course, many poor-quality companies in the S&P/ASX Small Ordinaries index. Some will spend years floundering, or fall victim to unfavourable market conditions or poor management decisions. Investing in these companies can result in significant (or total) capital loss.

Therefore, especially in small caps, the key is picking the winners and avoiding the losers.

Dispersion and amplification of returns

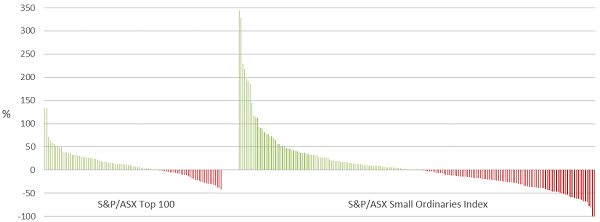

One-year share price performance – S&P/ASX 100 Index vs S&P/ASX Small Ordinaries Index

Company total returns of index constituents for 30 June 2018 to 30 June 2019 shown. Source: Bloomberg, 12 months ending 30 June 2019.

The chart above shows the one-year returns of companies in the S&P/ASX100 Index and the S&P/ASX Small Ordinaries Index. Return dispersion and amplification in the small caps universe is higher than in the large caps universe. Note the number of small company stocks which performed extremely well and the number that performed extremely poorly.

Out of 200 stocks in the S&P/ASX Small Ordinaries Index, 50 stocks – or one in four - lost 25% or more, including two that went into liquidation. In contrast, only 12 stocks in the S&P/ASX 100 lost 25% or more over the course of the year.

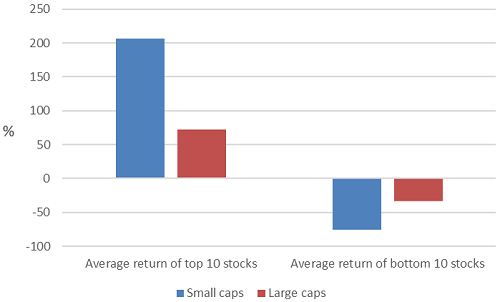

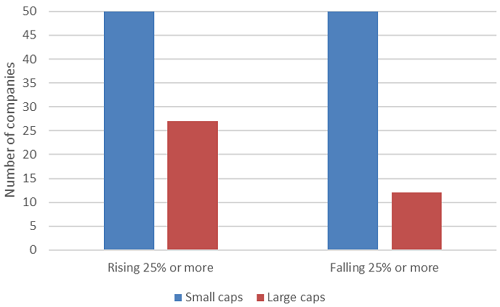

Dispersion of returns one year to 30 June 2019

Amplification of returns one year to 30 June 2019

Source Bloomberg, CFSGAM. At 30 June 2019. Small caps is S&P/ASX Small Ordinaries index. Large caps is S&P/ASX 100 index.

The amplification and dispersion of returns underlines the critical importance of careful stock selection in small cap investing and the importance of focusing on downside risk.

Given the inherent risks in individual stock selection, why not diversify and mitigate this risk by simply owning the index?

The importance of being active

In addition to the wide divergence of returns, history shows that the larger cap S&P/ASX 100 index regularly outperforms the S&P/ASX Small Ordinaries index and with less volatility. The chart below shows how the small cap index has underperformed the large cap counterpart in the last decade.

S&P/ASX Small Ordinaries Index returns vs S&P/ASX 100 Index returns, 10 years to 30 June 2019

Source Bloomberg, CFSGAM. Cumulative total returns 30 June 2009 to 30 June 2019.

In the S&P/ASX Small Ordinaries index, the negative returns from numerous low-quality companies often erode the value created from more successful businesses. Attempts to mitigate risk by diversifying across the index, for example, via passive investments or low active share, are often not the optimal strategy for investors with regards to the risk/reward outcome.

However, the comparison of returns from the S&P/ASX 100 index and S&P/ASX Small Ordinaries index is too simplistic. The index returns ignore the impact of ‘alpha generation’ that active managers can produce, which can be particularly significant in small caps.

Most stocks in the large cap S&P/ASX 100 index are extensively researched by the professional investment community. They are mostly well known, mature companies with a large shareholder base. Investors like to hold large, mature companies because they are generally considered more predictable and less risky than their small cap counterparts.

In contrast, small companies tend to be less well researched and understood. This provides the opportunity for skilled small cap managers to identify companies that have the potential to be future leaders, and companies that have the propensity to fail. By picking the winners and avoiding the losers, there is potential for significant alpha generation.

Capital preservation is key

To help avoid the losers, small company fund managers should have a strong focus on downside risk and be invested in a concentrated group of quality stocks, which collectively have a better return profile than the index. In aggregate, a risk-aware small cap fund is likely to have a larger allocation towards investments that have a clearly-defined, articulated investment strategy, supported by a strong capital position and a proven and capable management team. The long-term outcome of such strategies is typically a strong return on capital and free cash flow generation.

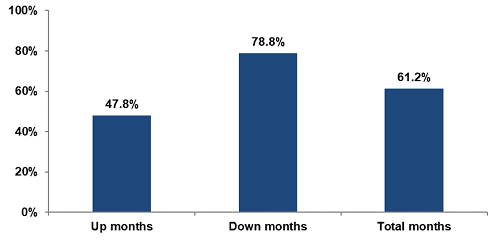

To show what is possible in this space, the chart below shows the percentage of months the CFS Wholesale Small Companies Fund has performed in rising markets, falling markets, and all markets over a period of 10 years.

Active asset selection, percentage of months outperforming (net)

Source: CFSGAM. The chart shows the percentage of months the CFS Wholesale Small Companies Fund has outperformed its benchmark (S&P/ASX Small Ordinaries Index). Net returns shown after fees and taxes, between 30 June 2009 to 30 June 2019. Past performance is not an indication of future performance.

The chart shows the Fund is more likely to outperform in down months (78.8% of the time over 10 years), due to the resilience of higher-quality companies during falling markets. It also demonstrates a propensity to avoid the biggest losers when times are bad.

During rising markets, the Fund outperforms less frequently. It does not chase returns or invest in the ‘next big thing’. Performance over multiple investment market cycles has proven the effectiveness of a focus on quality to pick the winners and avoid the losers.

Dawn Kanelleas is Senior Portfolio Manager, Australian Equities Small Companies, at Colonial First State Global Asset Management, a sponsor of Cuffelinks. This article is for educational purposes and is not a substitute for tailored financial advice.

For more articles and papers from CFSGAM, please click here.