The Weekend Edition includes a market update plus Morningstar adds links to two highlights from the week.

Weekend market update

On Friday, US markets confirmed their best week for a month as the S&P500 rose 3.1% while NASDAQ was even stronger, up 3.3%.

From AAP Netdesk: The local share market ended the week with a flourish, with strong gains by tech stocks and lithium players helping offset weakness in the energy sector. The benchmark S&P/ASX200 index gained 28 in the final hour of trade to finish Friday up 50 points, or 0.8%, at 6,578.7. The ASX200 finished up 1.6% for the week, its best performance since the week ending March 18.

The index is down 8.8% in June to date, putting it on track for its worst monthly performance since March 2020, with four trading days still to go. Tech stocks were the biggest gainers on Friday, collectively rising 6% cent for their best performance since 13 May. Xero rose 7.5%, Nearmap soared 18% and Afterpay owner Block rose 10.9%.

The sector has been boosted by a drop in bond yields, which makes the risky high-growth sector seem more attractive. Australian 10-year bond yields hit an eight-year high of 4.1% after Reserve Bank Governor Philip Lowe gave a hawkish interview to the ABC, but tumbled to 3.7% this week amid fears the pace of rate hikes will trigger a recession.

In the mining sector, the iron ore giants were mixed. BHP and Rio Tinto both dropped 1.2% while Fortescue added 0.2%. The energy sector was down 1.5% as oil prices continued to move lower on concerns about global growth. Woodside fell 1.7% to $30.61 and Santos declined 1.8% to $7.22. Three of the four big banks were down, except CBA which rose 0.5% to $90.16. Consumer discretionary stocks rose 2.2% with Wesfarmers climbing 1.8% and property trusts gained 2.5%.

From Shane Oliver, AMP: Share markets saw a decent rebound from oversold levels over the last week as there were no new hawkish surprises from central banks and weak economic data saw bond yields fall taking pressure of share market valuations, despite increasing worries about recession. For the week US shares gained 6.4%, Eurozone shares rose 1.8% and Japanese and Chinese shares rose 2%. The $A remained around $US0.69 as the $US fell slightly.

The macro story remains the same with more higher inflation readings in the past week (in the UK where it rose to 9.1% yoy and in Canada where it rose to 7.7%), more hawkish comments from central banks (the Fed, ECB and RBA and a 0.5% rate hike in Norway) and ongoing fears of recession. We remain of the view that a global recession can be avoided but with central banks hiking rates aggressively the risks have increased to the point that it's now a close call.

While money market expectations for the RBA cash rate have fallen sharply over the last week (from 3.86% for year end to 3.19%) in response to Lowe’s comments and recession fears, at 4% in a year’s time they still look too high. Very weak consumer confidence and slowing credit and debit card transactions as reported by various banks so far this month suggest that consumer spending is starting to slow significantly already. Which all means that the scale of interest rate hikes expected by the money market is unlikely to happen.

***

Next week is the 30th anniversary of the Superannuation Guarantee (SG) system which has enhanced the retirement savings of millions of Australians. Initially set at 3%, the SG requirement for employers to make contributions into a super fund for their employees rises to 10.5% on 1 July 2022 on its way to 12% by 2025. For all its complexity and shortcomings, it's an exceptional policy achievement which forces most people to save for their later years and boosts the capital and savings of the country.

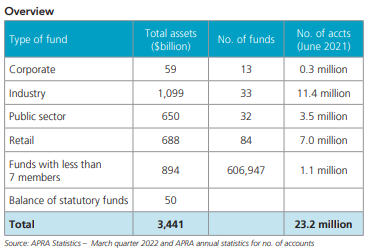

On 1 July 1992 when SG started, total super balances from other schemes totalled $148 billion. The 23 million accounts are now worth about $3.4 trillion. The architects of the scheme would be amazed to see industry funds ($1.1 trillion) and SMSFs ($894 billion) so far ahead of retail funds ($688 billion) in managing super assets. More on this milestone next week.

There is another major superannuation event next week when superannuation funds (but not SMSFs) must deliver retirement income strategies tailored to the needs of their members. The Covenant is the next phase in the development of Australia’s retirement system, and super funds are required to help members:

- Maximise their expected retirement income

- Manage expected risks to the sustainability and stability of their expected retirement income and

- Have flexible access to funds during their retirement.

There are obvious difficulties. Every person is unique, especially in their retirement plans. Many pre-retirees don't know when they will give up paid work. Some retirees will aim to spend their money before dying, while others want to leave a substantial bequest. The Bank of Mum and Dad may be open in certain families but not others. Some retirees are happy taking market risk while many are terrified. The age pension is anathema to some but a sacred right to others. Most people will reach a stage where health becomes as important as wealth. How does a policy on a website cater for such infinite variation?

A key point often overlooked is that at best, the super fund may know how much the member holds in superannuation, but retired members usually own substantial assets outside super, including the family home. A recent Investment Trends/Vanguard SMSF survey gives some insights into this inside super/outside super balance.

How will all these cohorts be recognised in a broad policy issued by a large fund with millions of members? Anyone rushing to the website of their fund on 1 July is likely to be disappointed. It's the first step on a multi-year journey, and next week is more likely to include a statement of principles and a plan to do something more in future than offer bespoke solutions to individuals.

APRA's implementation pathway looks like a stretch given 1 July 2022 is only one week away:

Within superannuation funds, there is doubt about what can be achieved with such a scatter gun approach, and it's not clear how super funds meet the legislation obligations without running foul of personal advice regulations.

This point was emphasised to me recently in a discussion with the Chief Investment Officer of a major superannuation fund. He was complaining about a C-suite meeting where the Chief Marketing Officer (supported by the other Cs) had presented a new marketing campaign about engagement with members. The CIO's view was that most of their members would benefit from less information about fund options and balances. He said people should leave their super alone to build over time while they concentrated on other things in their lives. He was frustrated that the same communication imploring members to take a long-term view and 'stay the course' also explained difficult market conditions and switching options.

Should members reading their letters for 30 June 2022 be worried that their super balances have dropped for the first time in a dozen years (yes, both bonds AND equities are down) with more falls to come? Will they switch to cash or is the lesson that it's not a time to sell despite the threat of significantly higher interest rates and a recession? Most professionals don't know what to do so what chance a member who reads a glossy communication a couple of times a year? As John Lennon wrote:

"Life is what happens to you while you're busy making other plans."

***

As markets correct from the excesses of 2021, a lot of people who jumped on the get-rich-quick bandwagons are paying the price. Among the more egregious practices, we previously warned against following the advice of actors and influencers paid to promote crypto. What does anyone really know about the value of a cryptocurrency, never mind a Hollywood star. We highlighted Matt Damon declaring "Fortune Favors the Brave" in a lavish Crypto.com ad in October 2021, and Bitcoin's price is since down 70%. Still feeling brave? The broad crypto economy has wiped out trillions of dollars since its November 2021 high, with a lot of scammers making money at the expense of punters.

And now this, for those desperate to own a Cristiano Ronaldo digital image:

The losses in many hyped-up companies in the US are extreme, with 10% of all companies in the Russell 3000 down over 80% from their highs, losing over US$1 trillion in value. Many of these companies, such as DocuSign, Block, Roku, Rivian, Coinbase, Beyond Meat, Virgin Galactic and Robinhood are well known to Australians and were supposed to become global disruptors. Some companies are now wondering whether their next capital injection will cover ongoing trading losses.

The Australian market often follows broad US trends, and the impact of inflation on US consumers is dramatic, where many typical household costs in the May CPI statistics were up a remarkable 26% in a year, near the all-time peak year-on-year inflation in 1980.

Our own central bank Governor, Philip Lowe, spoke to the American Chamber of Commerce this week. He pushed up his forecast for inflation to 7% by the December 2022 quarter, but more optimistically, gave three reasons why inflation will moderate in 2023:

- Pandemic-related supply-side problems in the global economy are gradually being resolved.

- Inflation is the rate of change of prices, not a measure of the level of prices. For inflation to stay high, prices must continue to increase at an elevated rate.

- The tightening of monetary policy around the world, including in Australia.

He made a commitment to push inflation back to the 2% to 3% range as "it is important that the higher rate of inflation this year does not feed through into ongoing inflation expectations."

During question time, he conceded that the market had been better forecasters of inflation and interest rates than the Reserve Bank, but he was highly doubtful that the 4% built into forward rates towards the end of 2022 is likely. It would require “the sharpest and quickest tightening of monetary policy that we’ve ever experienced in the inflation targeting regime” and the Board "would have to increase interest rates by 50 basis points at the remaining six meetings of this year, and have a 75 basis point increase in there as well”.

Although Lowe has been incorrect on rates for the last six months, it is difficult to disagree with him on these statements.

Graham Hand

***

In this week's articles ...

We mark 30 years of compulsory super with a deep dive into how SMSFs have blossomed and are now attracting a younger cohort confident in their own decision-making. Check how investment allocations inside and outside SMSFs differ for the same people.

Anton Tagliaferro was honoured in last week's Queen's Birthday awards, and we look back to an article he wrote in 2006 for remarkable similarities to the current day. Plus opportunities he is seeing in 2022.

Trent Koch writes that investments in assets such as toll roads, airports, railroads, utilities and renewables, energy midstream, wireless towers and data centres show their worth in turbulent market conditions.

Banks have been whipsawed as investors digest the positive impact of higher rates against the potential for bad debts to increase in a slowing economy. Hugh Dive believes bank shareholders will be rewarded for their patience by ignoring the current market noise.

Anna Hacker writes that whether you are seeking to appoint an attorney in the future, or have been appointed by a loved one as their attorney, it is critical to understand the full extent of this important legal framework.

The Australian housing market is seen as increasingly unaffordable, potentially putting home ownership beyond the reach of ordinary Australians. Kirsten Wymer and Edwin Lung provide an analysis of buying versus renting for Australians on the aged pension.

Tax time may be challenging this year given the number of changes. Mardi Heinrich outlines the key considerations for PAYG employees to be across given the COVID concessions that have been implemented by the Australian Tax Office.

In the additional articles from Morningstar for weekend reading, Lauren Solberg identifies eight electric vehicle opportunities which do not include Tesla, while Lewis Jackson shows there are far more highly-rated stocks in the Morningstar universe than lowly-rated.

Latest updates

PDF version of Firstlinks Newsletter

IAM Capital Markets' Weekly Market Insight

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Monthly Funds Report from Cboe Australia

Plus updates and announcements on the Sponsor Noticeboard on our website