The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

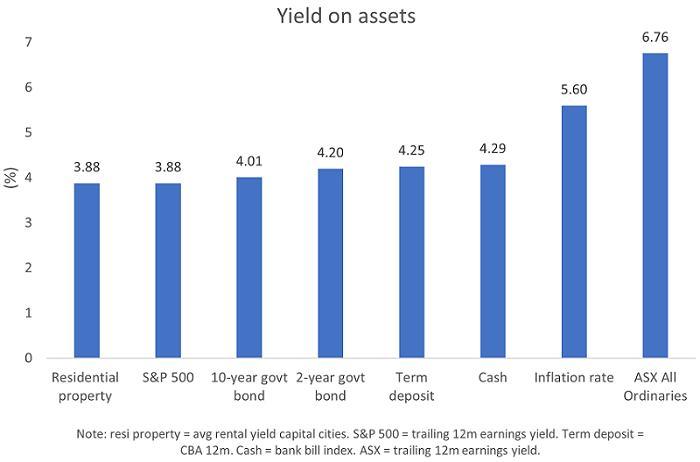

I give an update about every six months of the yields offered on key asset classes and how they compare. Here’s the latest chart for the four major asset classes: cash, bonds, property, and stocks. And I’ve included the inflation rate as a point of comparison.

You’ll quickly notice that the yields on cash, bonds and property are closely aligned, though they remain well below the inflation rate. In other words, these three asset classes are currently offering negative real yields (inflation rate minus asset class yield).

On the face of it, this doesn’t make sense. You’d normally like to invest in an asset class that has positive real yields so you can keep pace with, or exceed, inflation. Yet Australian 10-year bonds for instance, offer a yield of 4.01%, well below the inflation rate of 5.60%. If you buy a 10-year bond at par at that yield and hold onto it for the next decade, and the inflation rate remains at current levels, you’ll lose money in real terms. That is, your money will have less purchasing power at the end of that period.

The question is: why are assets such as bonds priced at these levels given where inflation is? Much of the answer lies with expectations that inflation will fall. These expectations were buoyed from recent figures showing the consumer price index (CPI) rose 5.6% year-on-year in May, compared to economist forecasts of 6.1%.

After the CPI rose from close to 0% at the start of 2021 to almost 8.4% in December 2022, it’s fallen sharply over the past six months.

CPI

Inflation bears will argue that the COVID induced supply chain issues reduced the supply of goods while demand spiked partly from government money printing and handouts, resulting in significant price increases and inflation issues. These factors are receding, and inflation should head back towards the RBA’s target range of 2-3%.

Inflation bulls will tell the bears: hang on a moment. While the latest CPI report is welcome, the seasonally adjusted CPI was higher at 5.8% and the trimmed mean CPI was at 6.1%. On the supply side, the fraying of globalization could mean supply chains may not return to what they were pre-COVID. And pricing pressure will remain given significant wage increases being pushed through at the start of July, rental increases, while easing, remaining high, house prices rising off their lows, food inflation increasing at the major supermarkets and energy prices showing no sign of abating as the transition to green energy proves difficult and costly.

The inflation bulls will also point to research from Research Affiliates’ Rob Arnott that suggests once US inflation reaches above 8%, as it did last year, history shows that reverting to 3% usually takes 6 to 20 years, with a median of over 10 years. Where the US goes, Australia normally follows.

Most asset classes need inflation to fall towards the RBA’s target, otherwise current pricing doesn’t make a lot of sense.

Cash is sexy again

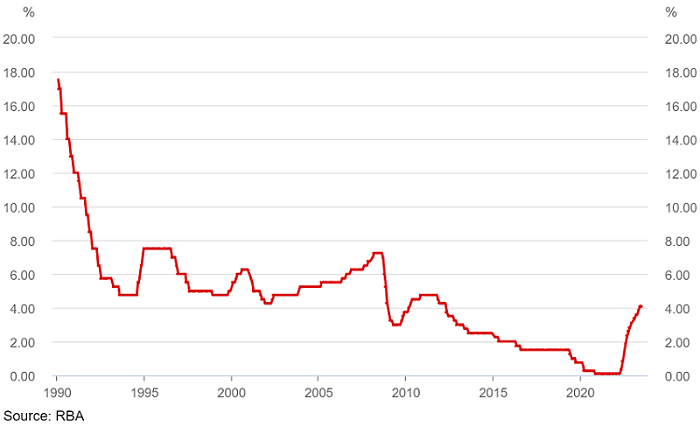

Just 18 months ago, cash was trash. Now, it’s back in a big way. That’s thanks to the RBA lifting interest rates from a low of 0.1% in April last year to 4.1% today. It’s been a wild ride over the past 14 months!

RBA cash rate

You can now get a Commonwealth Bank 12-month term deposit rate of 4.25%. Other banks pushing hard into the deposit space offer better. Macquarie Bank has 12 term deposit rates of up to 5% while Judo Bank has term rates of up to 5.3%. These can come with terms and conditions, so make sure you do your homework.

Are bonds back, or is it just a furphy?

Bonds had a disastrous 2022 and investors ran for the exits. Bonds have steadied so far this year, and many fund managers are proclaiming that bonds offer good value.

I’m not so sure. After all, you can get more yield in cash than in 2- or 10-year government bonds. There’s also the problem of high inflation. Sticky inflation is bad for bonds as it erodes the purchasing power of a bond’s future cash flows.

Switched-on readers may have noticed earlier that 2-year bonds yield more than 10-year bonds. In economic terms, that’s an inverted yield curve as short-term yields are higher than long-term yields, so the yield curve slopes downwards. An inverted yield curve can mean investors believe interest rates in future will be lower than the current rates.

In the US, an inverted yield curve has been a prescient harbinger of a coming economic recession because central banks reduce policy rates in response to lower economic growth and inflation, which investors may correctly forecast will happen.

In Australia, an inverted yield curve has been less reliable as an indicator of a future recession.

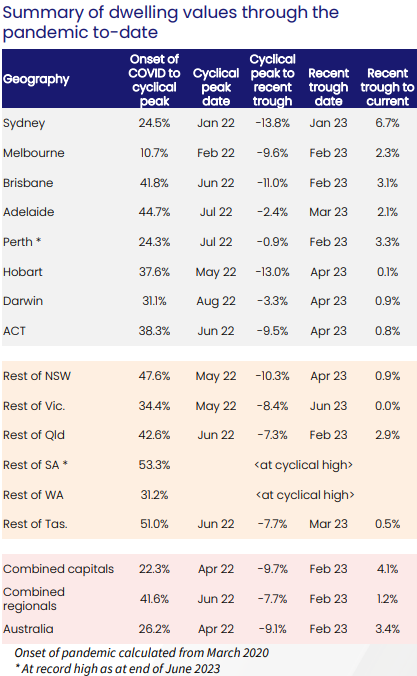

Is residential property set for a double dip?

The size of the residential real estate market in Australia boggles the mind. At $9.6 trillion, it dwarfs the likes of superannuation and listed stocks.

The latest figures show that residential property continues to bounce off lows. Nationally, home values increased 1.1% in June, and are up 3.4% from their bottom in February. Sydney has led the way, with property prices 6.7% higher from the trough. The ACT, Tasmania, and the Northern Territory, have lagged, barely rising from their lows.

Source: Corelogic

Where do prices go from here? On the one hand, the extraordinary migrant intake is likely to prop up demand for both home purchases and rentals. Record low unemployment will also help. On the other hand, the bulk of fixed income mortgages are expiring this year, and that will provide a large hit to people’s disposable income and ability to buy a home.

What is unarguable is that rental yields on residential property remain terrible. At gross yields of 3.88% nationally, homes are effectively priced at 26x earnings. And that’s before costs which can bring those gross yields down 1% or more.

It’s not a great deal from an investment viewpoint. For it to work as an investor (as distinct to buying a home to live in), you’re banking on strong rent rises continuing well into the future, which could well happen.

Source: Corelogic

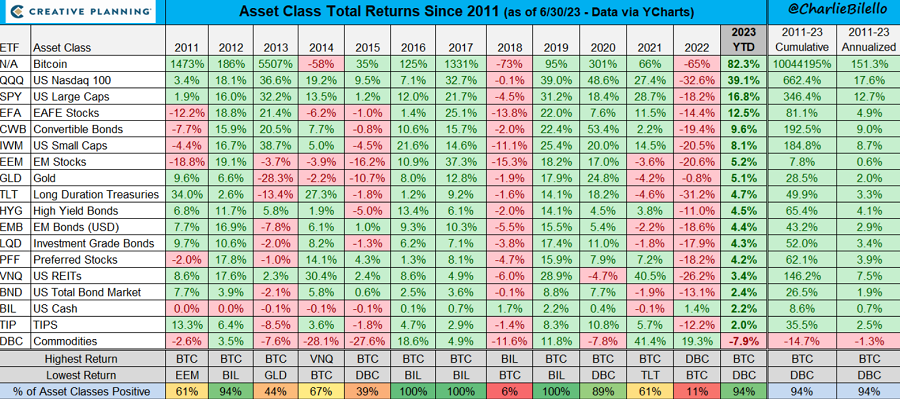

What a comeback for US stocks

At the start of this year, many pundits were predicting more doom and gloom for US stocks and, not for the first time, were wrong. Very wrong. After diving 18% and 33%, the S&P 500 and Nasdaq have roared back in the first half of 2023, returning 17% and 39% respectively.

What’s driven the turnaround? Declining inflation rates and a potential pause in interest rate increases have certainly played a part. So has the rise of Artificial Intelligence and investor enthusiasm for anything related to this technology.

Eight stocks have driven much of the S&P 500’s rise to June 30:

|

Nvidia +190%

|

Apple 50%

|

|

META + 138%

|

Netflix +49%

|

|

Tesla +113%

|

Microsoft +43%

|

|

Amazon +55%

|

Alphabet +36%

|

This compares to the S&P 500 equal weight ETF (RSP) rising 7% in the first half of the year.

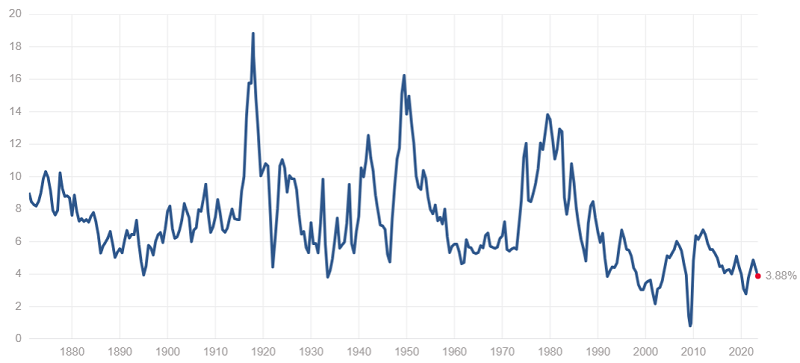

The rally has made US stocks look very expensive, once again. The S&P 500 trades at an earnings yield of 3.88% or a price to earnings ratio (PER) of almost 26x.

S&P 500 earnings yield based on trailing 12 months earnings

Source: Robert Shiller

And on a cyclically adjusted PER, using average inflation-adjusted earnings from the previous 10 years, things look worse. At 31x, it’s 80% above its long-term average of 17x, and is at levels only seen in 2000 and 1929.

Cyclically adjusted PER or CAPE ratio

Source: Robert Shiller

And with the US 10-year bond yielding 3.85%, US stocks offer no premium to the risk-free rate. Note that investors normally demand a premium to the risk-free rate, sometimes a substantial premium, for them taking on the risk of buying stocks. That’s not the case now, and it doesn’t bode well for future returns for US stocks.

ASX stocks: the value play?

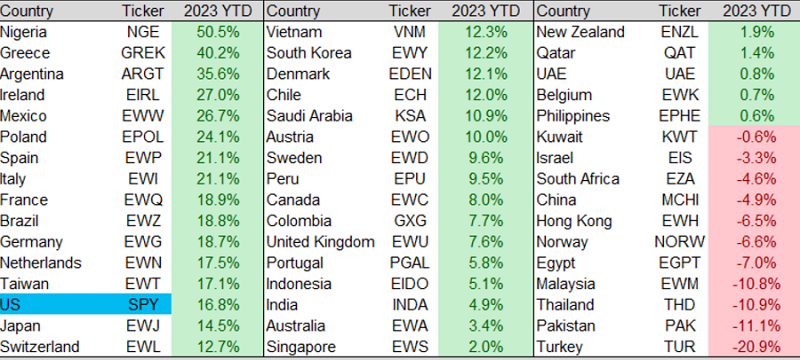

The Australian stock market has had a dull time of it compared to other markets. It’s had a small gain this year, trailing most developed markets.

Country ETF returns in 1H23

Source: Charlie Bilello

The ASX been held back by the performance of the heavyweight sectors in banks, energy, and materials. Banks have underperformed as profit margins are getting crunched from increasing the interest rates paid on deposits due to political pressure and competition for deposits.

Meanwhile, energy and mining stocks have struggled as the prices of oil, iron ore, gold, copper, and lithium have all retreated from their peaks of last year.

Source: Viridian Financial

Yet, the ASX stocks are one of the few assets that look reasonably priced. At an earnings yield of 6.76%, the All Ordinaries is priced close to its long-term average. And it offers a nice premium to risk-free bonds.

Of the four major asset classes in Australia, stocks seem to offer the best value at this point.

James Gruber

Also in this week's edition ...

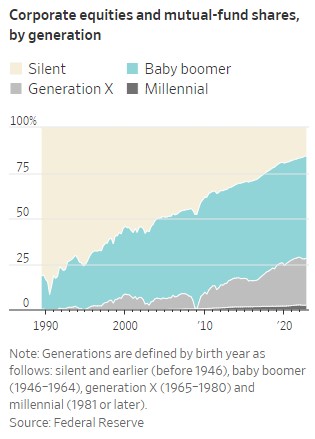

We examine the many segments of the global and Australian wealth industry to check how they fit together, the enormous sizes of the many parts and who are the major players. Graham Hand looks at the trillions and billions and puts Australia and its fund managers into their place. Did you know only one Australian fund manager ranks in the top 100, and that global funds under management total over $200 trillion? Yes, $200 thousand billion. We like to think our superannuation indusry at $3.5 trillion is massive but it's a drop in the global ocean. About 55% of funds under management globally are managed by US companies, over $100 trillion. The chart below shows it's currently the Boomers and older who are the owners of all this money, and while much of the wealth will pass to Gen X and Millennials over coming decades, the money is not yet there.

We hear a lot of how to retire happy, but what does science have to say on the topic? Dr Michael Finke outlines the data behind the financial and non-financial dimensions of retirement satisfaction. And he throws up some fascinating facts including that the happiest retirees are women who divorce between the ages of 60 to 65.

There aren't many optimists left when it comes to the Australian office property market. That's especially after Dexus sold an A-grade office tower at a 17% discount to book value. Yet, Colin Mackay from Cromwell Property Group, says many concerns about the sector are overblown. One for the contrarians, perhaps?

Janus Henderson Investors' Matt Peron is sticking to his view that a global economic slowdown is coming. He says the concentrated nature of 2023’s equities gains, especially in the US, hides increasing vulnerability in equity markets. Peron believes it's time to get defensive and buy quality stocks.

Australia’s population rose by 497,000 in 2022, driven by a record net overseas migration of 387,000. It's a mind-blowing number that's captured the media's attention, yet less talked about is the continued decline in our fertility rates. Emma Davidson of Staude Capital says fertility rates are the real long-term concern.

How should investors go about picking a fund manager? Morningstar's Michael Malseed suggest the key attributes to look for include strong stewardship and the ability to deliver long-term returns.

RBA Governor Philip Lowe has been banging on about economic productivity of late, suggesting that slow gains in this area threaten to undermine economic growth and lead to sticky inflation. Professor Stephen King of Monash University thinks Lowe is correct and wide-ranging reforms are needed.

Two extra articles from Morningstar for the weekend. Shani Jayamaynne highlights three high conviction ASX stock holdings from Gold Medallist fund managers, Morningstar investor subscribers, Joshua Peach looks at 11 stocks offering great value.

This week's whitepaper from Realindex Investments, of the First Sentier Investors Group, investigates the pervasive but misunderstood price effects of stocks in the period surrounding their dividend payments.

***

Weekend market update

On Friday in the US, it was a failure to launch for the bulls as a late selloff on the S&P 500 erased a mid-day rally to leave the broad index 1.2% lower for the holiday-shortened week. It came after June payrolls came in lighter than expected for the first time since April of last year. Treasurys steepened with two-year yields declining four basis points to 4.95% and the long bond rising to 4.05% from 4.01% on Thursday. WTI crude reached a six-week high near $73 a barrel and gold rebounded a bit to US$1,931 per ounce. The VIX slipped back below 15.

From AAP Netdesk:

On Friday in Australia, the share market suffered its worst day of losses since March as rising bond yields deter equity investors. The benchmark S&P/ASX200 index on Friday finished down 121.1 points, or 1.69%, at 7,042.3, while the broader All Ordinaries fell 120.9 points, or 1.64%, to 7,244.1. The local bourse finished the week 2.24% lower, wiping away gains made since the start of the year.

Consumer discretionary stocks took a beating as a result, down 2.4%. Online fashion platform Cettire sank 6.5% and internet retailer Kogan dropped 3.5%.

Real estate stocks were the worst-performing sector, down 2.7%, with industrial property landlord Goodman Group falling 3.8%.

Afterpay owner Block led the losses for the IT sector, down 5.5%, while logistics software company Wisetech slipped 2.3% to $75.05.

Heavyweight miners BHP, Rio Tinto, and Fortescue slid 1.5%, 0.9% and 0.4% respectively.

Gold miner Northern Star dropped 3.8% and Aeris Resources fell 16.3% after withdrawing earnings guidance for 2022/23 due to production shortfalls at two of its mines.

Paladin was 2.7% lower after aborting the attempted sale of its Michelin joint venture project in Labrador, Canada. The company said it was pleased to retain a 75 per cent stake in the uranium deposit

Regis Resources was a green drop in a sea of red for materials stocks, up 1.6% after the gold miner reported a record haul of 458,354oz.

CBA was the worst of the big four banks, down 1.7% to $98.73 a share. Westpac shed 1.4%, NAB dropped 1.2% and ANZ was 1.1% lower.

Oil and gas producer Woodside weakened 1% and health care heavyweight CSL was 2.1% lower.

In positive news, medicinal cannabis and psychedelics developer Incannex was on a high, up 9.1 per cent after receiving ethics approval to start clinical trials for a sleep apnoea drug.

From Shane Oliver, AMP:

- Global share markets fell sharply over the last week on concerns that stronger than expected US economic data will result in higher for longer interest rates not helped by somewhat hawkish US Fed meeting minutes. Despite a weaker than feared rise in US payrolls, US shares still fell further on Friday as wages growth was stronger than expected leaving the US share market down 1.2% for the week. For the week Eurozone shares fell 3.2%, Japanese shares fell 2.4% and Chinese shares lost 0.4%. The weak global lead saw the Australian share market fall 2.2%, despite the RBA’s decision to leave interest rates on hold. Bond yields rose sharply on the back of higher for longer interest rate expectations with the Australian 10-year bond yield breaking up to its highest since 2014. Oil prices rose on the back of Saudi Arabia saying it will extend its production cuts into August and Russia saying it will cut its oil exports. Metal prices rose but iron ore prices rose fell. The $A rose as the $US fell.

- After a strong run in June and over the last financial year, shares remain vulnerable to a pull back. The global share market surge in June contained some positive signs for the direction setting US share market: gains have broadened out from tech to include more cyclical sectors; years that have seen a 10% plus gain in US shares the first half of the year have gone on to deliver strong returns for the year as a whole in 19 out of 23 times since 1945; the strength in US shares so far this year is consistent with the strength normally seen in US shares after mid-term election years; and the US share market since its low in October last year is continuing to trace out a pattern of rising highs and rising lows. From a fundamental perspective we continue to see global and Australian shares doing okay on a 12-month view as central banks ease up as inflation cools.

- However, the risk of a near term correction in global and Australian shares remains high as: the strong US share market rebound in June left US shares a bit overbought and vulnerable; while lagging economic indicators (like jobs data) are still strong, leading indicators continue to point to a high risk of recession; major central banks, including the RBA, remain hawkish and continuing strength in jobs data as seen in the US in the last week increases the risk that they will over tighten; reflecting this, bond yields appear to be breaking higher which could pressure share market valuations anew; China’s recovery continues to disappoint; and the period out to September/October is often rough for shares.

- The RBA opted to leave rates on hold in July at 4.1%, but the pause looks temporary. While contrary to our assessment that it would hike rates again its decision to hold was sensible given the degree of tightening we have already seen and the lagged impact of this on the economy. However, the RBA’s accompanying commentary was similar to what it said in April after a pause before hiking again in May: pausing provides time to better assess the outlook but “some further tightening of monetary policy may be required”. In particular, the RBA appears to be waiting for the June quarter CPI at the end of this month and its next round of forecast revisions in early August (which are likely to revise up its wages forecasts) and Governor Lowe may mention this in a speech this Wednesday. So given the RBA’s ongoing concern about inflation being too high, sticky services inflation, the tight labour market and rising wages growth, barring a sharp downside surprise in coming jobs and inflation data we are allowing another 0.25% hike in August and a final 0.25% in September taking the cash rate to a peak of 4.6%.

Curated by Leisa Bell and James Gruber

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website