The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Residential property prices have defied almost all predictions in 2023. According to CoreLogic, home prices bottomed in February 2023 and have recovered 6.6% across Australia with Sydney up 9.2%. Defying rapidly-rising interest rates, the trifecta of high immigration, increasing rents and shortage of supply have brought FOMO back to the market. A significant reduction in borrowing capacity is often covered by selling every other investment, accessing super under the FHSS or the Bank of Mum and Dad kicking in even more to avoid the dreaded queue of people inspecting rental properties on a Saturday morning.

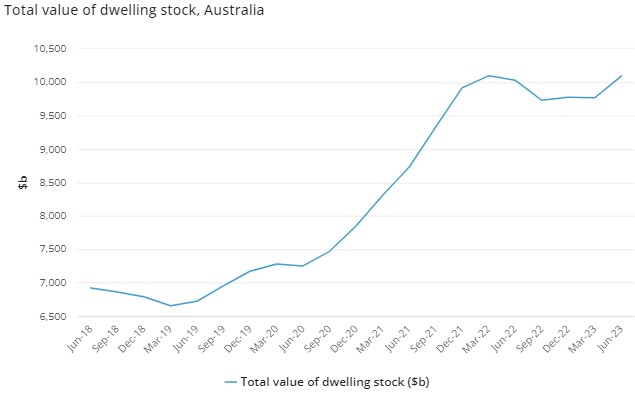

And so we are back above $10 trillion in total value, according to the ABS, up $325 billion in three months, with $9.8 trillion owned by households. Relatively few of the 11 million residential properties are owned by institutions. It's the place where most Australian wealth is held, with superannuation dwarfed at $3.5 trillion and the market value of all listed equities at only $2.5 trillion.

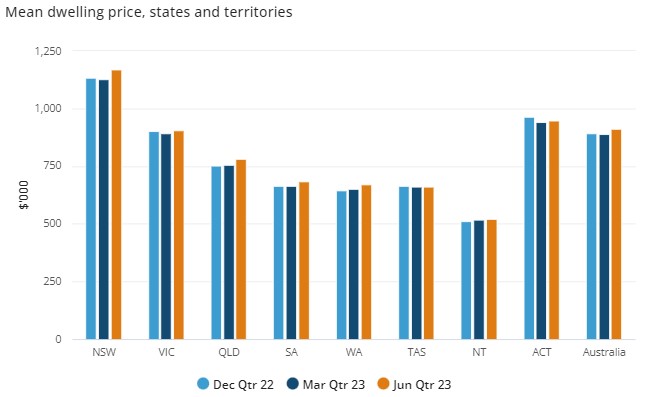

Also from the ABS, further evidence that many young people must be totally frustrated by the housing market, especially Sydney. A mean dwelling price near $1.2 million tells thousands of people they will never own a house.

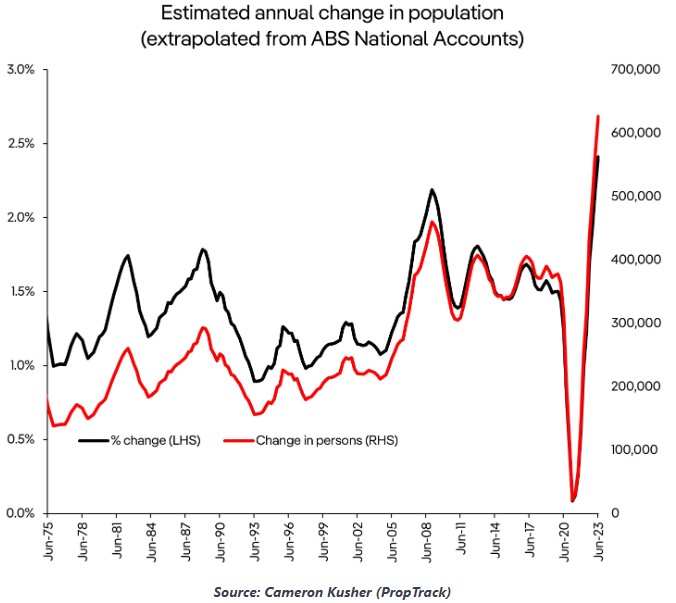

The main reason for the growth is the extraordinary recovery in immigration driving population growth, as shown below.

It leaves Australia with a different economic dynamic than many countries, such as China, Japan and most of Europe. China has been the world's growth engine and factory for two decades, but now faces the opposite of Australia - falling house prices, an ageing demographic and high unemployment, especially of young people. Its growth has slowed and the market is pessimistic about its prospects, as the chart below shows with record negative news articles tracked by Bloomberg. Fund managers such as Platinum's Andrew Clifford argue that China offers compelling valuations and the Government is injecting major stimulus.

***

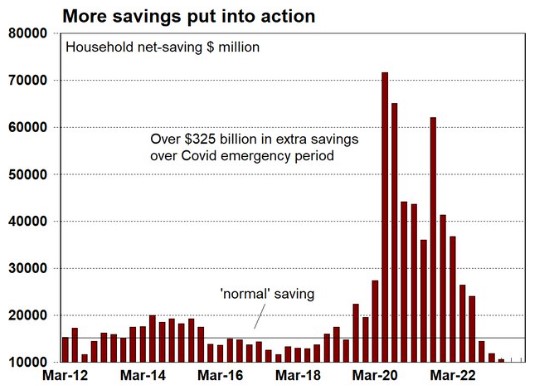

A fascinating chart from CommSec shows how much households saved during the pandemic and how this has protected them from higher interest rates and inflation, but that money is now gone. CommSec says Australians saved around $325 billion more than 'usual' over the emergency period.

This week, we look at how anyone can invest in a wide range of funds for free, or paying very little, a few basis points. Yes, investing can be free, even in managed portfolios. And for anyone wondering about constructing their own portfolio, here is the ABS data on how institutions are allocating their assets. There's an ongoing switch to overseas assets and less to domestic shares and deposits, reducing the traditional home country bias.

Tomorrow is the final day of Philip Lowe as Governor of the Reserve Bank. His time is best summarised in his own speech to the Anika Foundation on 7 September. He admitted:

"the issue that has defined my term more than any other is the forward guidance about interest rates that was provided during the pandemic. That guidance was widely interpreted as a commitment, rather than a conditional statement, that interest rates would not increase until 2024."

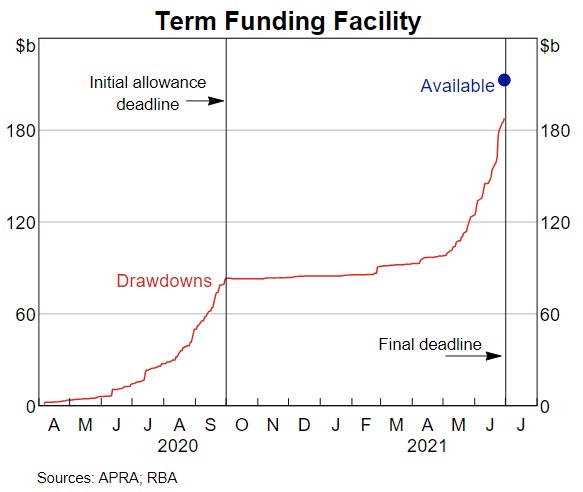

He also recognised that the combination of stimulus measures used by the Reserve Bank during the pandemic was excessive. The one that I considered most generous was the Term Funding Facility which provided $188 billion to the banks, representing 6% of bank credit. It added fuel to the housing market pushing it further from the reach of many first homeowners, including $51 billion to the Commonwealth Bank, the least-likely bank in Australia to have any funding problems. Said Lowe:

"With the benefit of hindsight, my view is that we did do too much."

Finally, our apologies if you made a comment on Friday or the weekend and it did not appear on our website. We did a system upgrade on Thursday night and it left a glitch in the comment process. Please feel free to comment again as we always enjoy a civilised debate.

Graham Hand

Also this week ...

Schroders' Martin Conlon surveys the market environment and is mostly bearish. He says interest rate hikes are hurting younger people and intergenerational tension is rising; the market seems frothy given rates have rapidly risen yet investors are still piling into some of the same tech stocks that they were when rates were near 0%; yet on the positive side, China's problems seem fixable.

Man Numeric's Michael Dowd is also a sceptic when it comes to the current love for tech stocks, especially those with exposure to artificial intelligence. For him, history shows that even in the throes of excitement over new technology and its potential, asset prices may creep ever higher in the short term, but often disappoint in the longer term in the face of elevated expectations.

Blake Henricks of Firetrail says that with all the market attention on tech stocks, it might be time for a comeback in traditional old-world assets. It can be uncomfortable to buy unpopular stocks after a setback, but Blake picks two Australian companies that may have better times ahead.

Industrial real estate is an old-world asset with new-world drivers, so it might have the best of both worlds, according to Colin Mackay of Cromwell Property Group. Though industrial has been the standout real estate performer of the past decade, Colin believes constrained supply in the space means the good times are likely to continue.

Harry Chemay bluntly suggests that our superannuation system has turned into a giant tax shelter where wealth is captured and passed on to descendants. And he thinks the recent Intergenerational Report fails to address the elephant in the retirement room: falling home ownership.

The proposed new tax on super balances over $3 million has many people contemplating whether to withdraw large amounts in the next few years before the tax takes effect. Meg Heffron explains why this may not be a good idea.

Noel Whittaker asks whether access to super and pensions should depend on life expectancy. Noel thinks a recent court case on early access to pensions highlights the need to create conditions for equal lifespans for all.

Two extra articles from Morningstar for the weekend. Mark LaMonica looks at the 10 top ASX dividend stocks, while Erin Lash highlights a Warren Buffett stock that's nearly 40% undervalued.

Lastly, in this week's White Paper, MFS sees a regime shift of lower returns and higher volatility ahead, and believes investment portfolios will need to adapt to generate adequate future returns.

***

Weekend market update

On Friday in the US, stocks dropped during their final session of the week. The Dow was -0.8%, the S&P 500 -1.2%, and Nasdaq -1.6%. Liley reasons for the losses include concerns over union strikes in the auto industry, that the AI trade is overdone, and the expiration of $4 trillion in derivatives contracts. The yield on the US 10-year note rose 5 basis points to 4.33%, while the VIX surged 8% to 13.9. Oil continued its barnstorming run, with Brent crude finishing 0.6% higher at US$94.27.

From AAP Netdesk:

The local share market on Friday enjoyed its best gains in two months after the European Central Bank hinted that it might be done raising interest rates. The benchmark S&P/ASX200 index on Friday finished up 92.5 points, or 1.29%, to a 10-day high of 7,279.0. The broader All Ordinaries climbed 99.9 points, or 1.35%, to 7,482.6. For the week the ASX200 rose 1.7%, largely erasing the prior week's losses.

Every sector of the ASX finished higher on Friday, with mining up the most, by 2.5%.

BHP added 3.5% to $45.68, Fortescue rose 4% to $21.22 and Rio Tinto climbed 3% to $118.91.

The big four banks all gained ground, with NAB climbing 1.3% to $29.68, CBA rising 1% to $103.16, Westpac advancing 0.7% to $21.77 and ANZ finishing 0.4% higher at $25.70.

Just a dozen companies in the index were in the red. Metcash finished 0.5% lower at $3.70 as the IGA and Mitre10 supplier announced sales growth had slowed to 1.7% in the 18 weeks to September 3. Food division sales were only up 1.1% while wholesale prices grew 7.3 per cent during that time, suggesting volume declines.

From Shane Oliver, AMP:

- Global share markets were mixed over the last week. US shares initially rose as economic data provided confidence that the Fed won’t have to raise rates again but fell on Friday on concerns about an auto workers strike amidst various options expiries which can magnify volatility leaving them down 0.2% for the week. Chinese shares also fell 0.8% for the week amidst growth concerns. However, Eurozone shares rose 1.3% helped by a “dovish rate hike” from the ECB and Japanese shares rose 2.8%. Bond yields rose as did oil, metal and iron ore prices. The $A rose despite a rise in the $US.

- US inflation up in August, but trend remains down. Consistent with other countries inflation data for August, US inflation rose to 3.7%yoy from 3.2%yoy. However, this was mainly due to higher gasoline prices. Core inflation also came in slightly stronger than expected at 0.28%mom compared to an expectation for 0.2%mom, but the faster increase was mainly due to volatile airfares and annual core inflation fell further to 4.3%yoy from 4.7%yoy. Apart from transport services other core inflation categories – goods, shelter and other services - show ongoing downwards momentum.

- The ECB hiked their policy rates by 0.25% taking the main refinancing rate to 4.5% with higher inflation forecasts. It still has a mild hawkish bias, but its guidance implied this may be the peak. The hike was contrary to market expectations although it was a close call, but money markets see this as likely being the peak.

- Australia’s surging population growth. March quarter data showed that Australia’s population rose by 563,000 or 2.2% over 12 months, with 454,000 of that coming from immigration.

- The good news is that Australian governments led by Canberra appear at last to be serious about focussing on supply as the key to improving housing affordability, rather than first home buyer concessions which just add to demand. The target to build 1.2 million new homes over five years from July 2024 – or 240,000 pa – supported by: the now passed Housing Australia Future Fund the returns from which will be used to build 30,000 social and affordable homes over five years; the National Housing Accord with the states which aims to build 20,000 affordable homes over 5 years; along with various programs to incentivise states to build more homes are to be welcomed. Given that the Government’s commitments regarding new homes are a tiny fraction of the 1.2 million target the private sector will be relied on to deliver the bulk of them.

- On our estimates before the schemes start next year Australia will have a cumulative short fall of at least 165,000 dwellings. Underlying demand is running around 220,000 dwellings per annum but over the next year or so actual dwelling starts will be subdued at around 180,000 which means a new shortfall each year of about 40,000 dwellings adding to the already existing shortfall. Trying to make up for that short fall will be hard. So the focus should also be on capping the level of immigration to the ability of the property industry to supply homes for the new immigrants. Finally, similar supply side commitments have been announced in the past only to fail. Time will tell.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly Bond and Hybrid updates from ASX

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

LIC (LMI) Monthly Review from Independent Investment Research

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website