The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

This editorial has been warning for some time that markets have been overhyped and overvalued. A correction was overdue.

Yet, perspective is needed. As I write, the ASX 200 is off 6% from record highs. The index is back to levels reached in late May.

The US has been hit harder, especially the Nasdaq, which entered correction territory. However, the S&P 500 and Nasdaq are still up 9% and 8% year-to-date, and 15% and 16% over the past 12 months, respectively.

Of course, investors are looking for causes for the sharp recent declines, with various explanations, including:

- A bounce in the Yen catching out over-leveraged investors.

- Growing concerns of an economic slowdown in the US.

- A realisation that expectations for US tech stocks were excessive and won't match reality.

It's likely to be a combination of these factors and others.

The big question is whether this pullback is the start of something larger. As I noted last week, there are decent odds that a large rotation out of US tech stocks into neglected assets such as value and markets outside America will happen at some point. Whether that's now remains to be seen.

For investors with a plan, the past week's events shouldn't be of concern. The key is to stick to the plan. For those without a plan, it should hopefully spur them to get one ... fast.

----

A recent article in Firstlinks on the economic impacts of climate change has generated a lot of debate. What strikes me about comments on the piece is how polarised the debate on energy and the environment has become. There are climate change denialists on the one extreme, and fossil fuel abolitionists on the other, with little in between. And people appear intent on seeking out opinions and research that confirm their firmly held views.

Today is my attempt to get more facts on the table and less opinion. Hopefully, this can give readers greater context and nuance to the energy and climate change debate.

Latest figures on energy and emissions

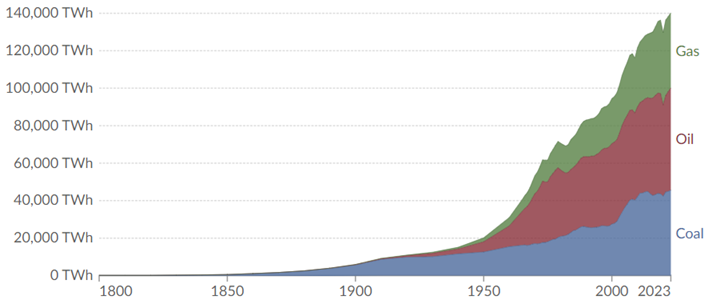

Despite what you may read in the media, oil and coal consumption grew to record levels last year. Oil demand rebounded strongly after China relaxed its Covid lockdown policies. That resulted in oil consumption breaking through the 100 million barrels per day level for the first-time ever. Coal demand beat the previous year’s record level, while natural gas consumption was flat.

Figure 1: Global fossil fuel consumption

Source: Our World in Data

According to the Energy Institute, that helped lift total energy consumption 2% above 2022, and 0.6% above its ten-year average as well as over 5% above its 2019 pre-COVID level.

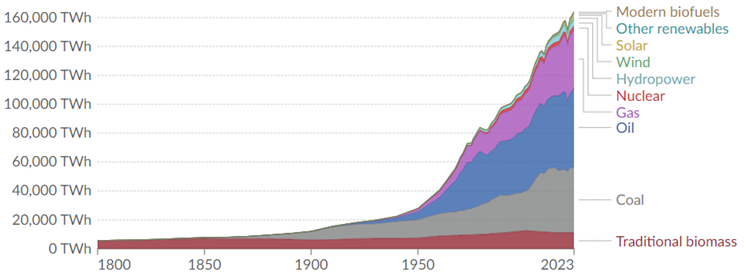

Meanwhile, renewable energy consumption grew at 6x the rate of total energy demand and electricity demand increased 25% more than total energy consumption.

However, fossil fuels continue to dominate our energy needs. As a percentage of total energy demand, fossil fuel consumption fell just 0.4% to 81.5% in 2023. Renewables’ share increased 0.4% to reach 14.6% of total energy demand. Nuclear makes up the remainder at close to 3% of global energy consumption.

Figure 2: Global direct primary energy consumption

Source: Our World in Data

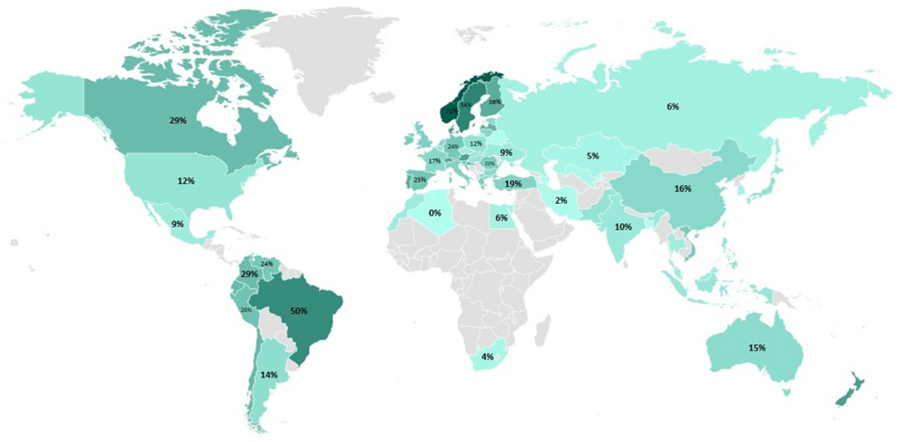

Here is a split of renewables usage by country below. As you can see renewables account for 15% of Australia’s energy consumption.

Figure 3: Share of primary energy consumption from renewable sources, 2023

Source: Apollo

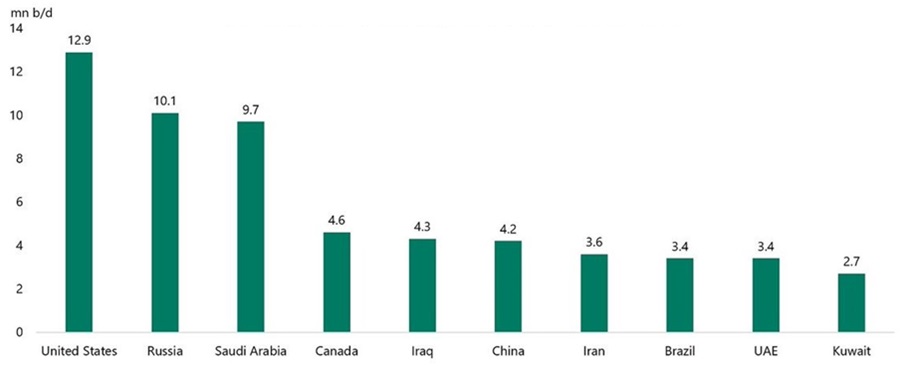

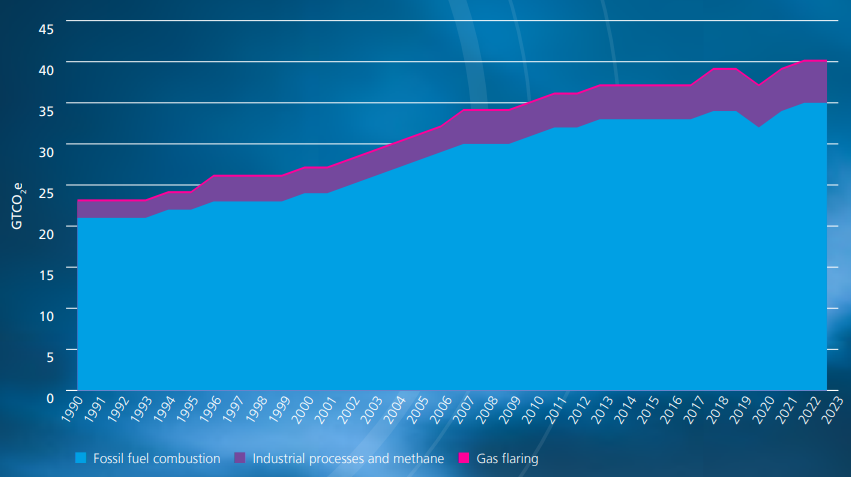

On the production side, the US is now the dominant oil producer. America produces 12.9 million barrels per day of crude oil. That’s nearly 30% more than the 10.1 million barrels per day that Russia produces and 33% more than Saudi Arabia.

Figure 4: Global crude oil and condensate production 2023, selected countries

Source: Apollo

US dominance in oil production has only happened recently. It passed Russian and Saudi production in 2018, after being far behind a decade ago.

Figure 5: Average annual crude oil and condensate production from top three global producers (2013-2023)

Source: U.S. Energy Information Administration (EIA)

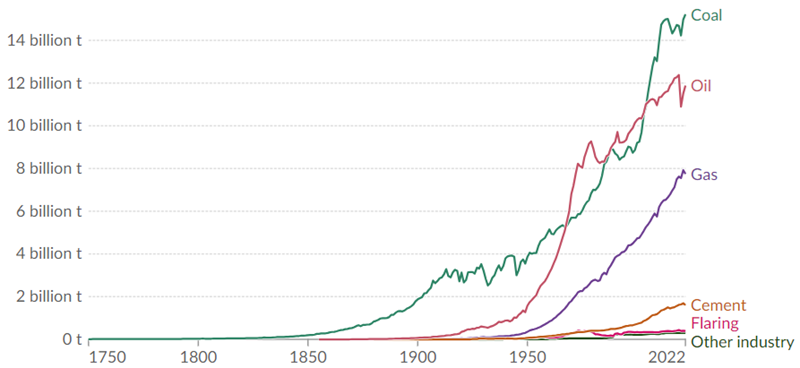

It means that not only does America have cheap oil to fuel its needs for decades to come, but it changes the geopolitical equation as they no longer depend on other countries for oil imports.

Figure 6: Production vs consumption by region: North America

Source: Energy Institute’s ‘Statistical Review of World Energy’

For coal, global production reached its highest ever level in 2023. Nearly 80% of coal supply comes from the Asia Pacific region, including Australia. Meanwhile coal consumption increased 1.6% last year. China remains the largest consumer by far, accounting for 56% of world consumption. Interestingly, India has also exceeded the combined consumption of North America and Europe.

For gas, production was flat last year. The US is the largest producer of gas, delivering about 25% of the world’s supply. Global gas demand was also steady last year and is only marginally above pre-Covid levels.

It’s a different story for solar and wind. Their capacity grew 67% in 2023, much of it from China. China’s installed wind capacity now equals that of Europe and North America combined.

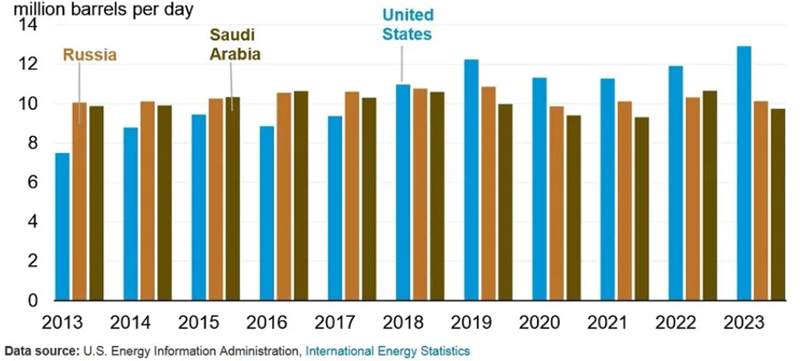

Meantime, greenhouse gas emissions from energy use are continuing to climb. In 2023, they climbed 2.1% to beat record levels set the year before.

Figure 7: Global energy related greenhouse gas emissions

Source: Energy Institute’s ‘Statistical Review of World Energy’

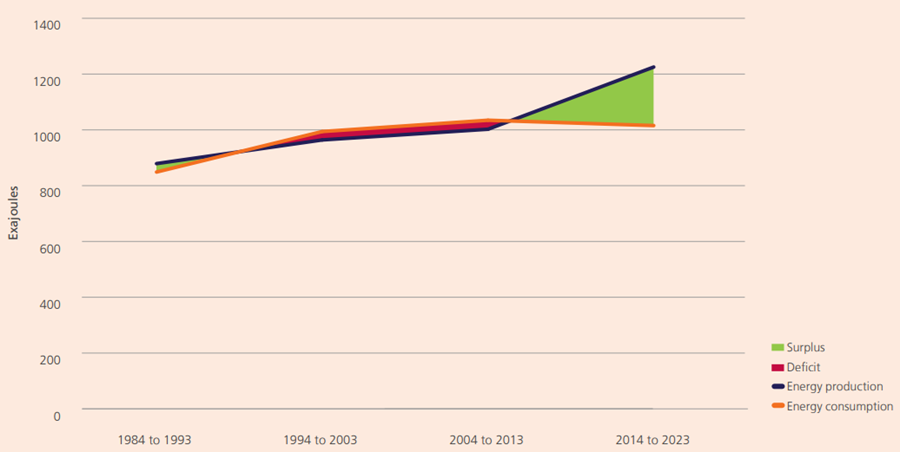

The biggest culprit for energy-related emissions continues to be coal, followed by oil.

Figure 8: Global CO2 emissions by fuel or industry

Source: Our World in Data

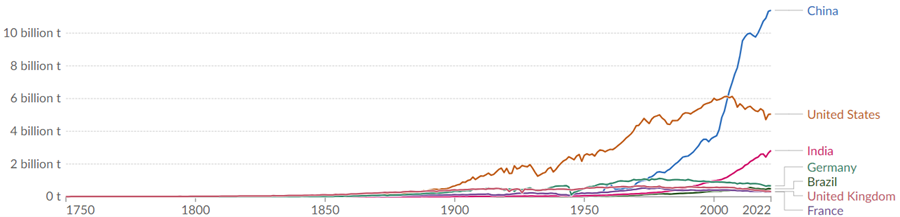

In terms of countries, Asia is the biggest CO2 emitter, with China far ahead of other countries.

Figure 9: Annual CO2 emissions

Source: Our World in Data

Energy underlies everything in the modern world

For up-to-date science on energy and climate change, I consulted various sources, though found academic Vaclav Smil’s work to be the most objective and factual. His latest book, How the World Really Works, is especially useful.

The book first provides context for how much energy that we have at our disposal. Where once we had to rely on our physical labor to power things, now that’s rarely the case. And that’s been driven by the extraordinary rise in the use of fossil fuels.

Smil says his calculations show “a 60-fold increase in the use of fossil fuels during the 19th century, a 16-fold gain during the 20th century, and about a 1,500-fold increase over the past 220 years”.

Much of what we take for granted has been fuelled by this increase in usable energy:

“An abundance of useful energy underlies and explains all the gains – from better eating to mass-scale travel; from mechanization of production to transport to instant personal electronic communication – that have become norms rather than exceptions in all affluent countries.”

Smil emphasizes that energy, and the conversion of it, is central to modern life. It’s also central to our economic system. Smil quotes physicist Robert Ayres who said that “the economic system is essentially a system for extracting, processing and transforming energy as resources into energy embodied in products and services”.

Some forms of energy are more useful than others

Fascinatingly, given the debate on nuclear power in Australia, Smil says the science is definite – nuclear power is the most reliable form of electricity:

“… large nuclear reactors are the most reliable producers of electricity: some of them now generate it 90-95 percent of the time, compared to about 45 percent for the best offshore wind turbines and 25 percent for photovoltaic cells in even the sunniest of climates – while Germany’s solar panels produce electricity only about 12 percent of the time.”

Smil says green sources of electricity don’t have the energy density of liquid hydrocarbons and aren’t suitable for things like transport. And he believes scale is a big problem for renewables:

“In large, populous nations, the complete reliance on these renewables would require what we are still missing: either mass-scale, long-term (days to weeks) electricity storage that would back up intermittent electricity generation, or extensive grids of high-voltage lines to transmit electricity across time zones and from sunny and windy regions to major urban and industrial concentrations.”

Smil notes that even if a country rapidly turns to renewables, it will continue to rely heavily on fossil fuels for its energy needs. He cites the case of Germany which generates about half of its electricity from renewables yet the share of fossil fuels in the country’s energy supply has only fallen from 84% to 78% over the past two decades. Also, the world’s dependence on fossil fuels has only decreased from 87% to 85% (note these figures are a little outdated as the book was written in 2022. Fossil fuels as a percentage of primary energy usage is down to 82%) over the past 20 years, despite a 50-fold rise in renewables.

Smil thinks that decarbonizing modern long-distance transport is especially problematic. Yet the problems with the developed world’s rush to renewables and net zero emissions don’t stop there. He says a rapid shift is impossible without accepting a significant drop in our living standards:

“Both the high relative share and the scale of our dependence on fossil carbon make any rapid substitutions impossible: this is not a biased personal impression stemming from a poor understanding of the global energy system – but a realistic conclusion based on engineering and economic realities.”

Food, glorious food

Smil is also sceptical of a rapid transition to net zero because of the centrality of fossil fuels in food production. He says such production relies on two things: the sun and fossil fuels. Fossil fuels power field machinery like tractors, transportation of harvests from fields to storage and processing sites, and irrigation pumps. They are also essential to the production of fertilisers and chemicals which feed into agriculture.

Smil says how fossil fuels will be replaced by renewables in the production of food is unclear.

The four pillars of modern civilization

Smil says the world relies on four key materials: cement, steel, plastics and ammonia. It cannot do without any of them. The world consumes about 4.5 billion tons of cement, 1.8 billion tons of steel, 370 million tons of plastics, and 150 million tons of ammonia, and they aren’t readily replaceable by other materials – not soon and certainly not on a global scale.

And all four materials depend heavily on fossil fuels.

Smil also points out that green electricity relies on these materials too. Wind turbines need enormous amounts of cement, steel, plastics, and ammonia, which all in turn require fossil fuels.

Another example is electric cars. A typical lithium car battery weighing about 450 kilograms contains about 11 kilograms of nickel, more than 40 kilograms of copper, and 50 kilograms of graphite – as well as 181 kilograms of steel, aluminium, and plastics.

To drive his point home, Smil says that for 25-50% of the global car fleet to become EVs by 2050, it would need 18-20x the amount of today’s lithium, 17-19x the cobalt, and 28-31x the nickel.

Global warming is real

If you’re thinking Smil is a fossil fuel fanatic, you’re wrong. He says global temperatures have undoubtedly risen over the past century. The temperature averaged across global land and ocean surfaces is almost 1 degree above the 20th century mean. The five warmest years in the past 140 years have happened since 2015, and nine of the 10 warmest years have been experienced since 2005.

Smil says recent studies show that a 1.5 degree increase in temperatures would be tolerable, but the problem is we may hit that mark within the next 15 years.

Smil doesn’t wade into the debate about whether human beings are behind the increase in temperatures. However, he does link the rise of fossil fuels with climate change.

He says though decarbonization is unrealistic, there are a lot of different things that can be done to reduce emissions without impacting our standard of living, including:

- Simple technical fixes from mandating triple-glazed windows to designs for more durable cars

- Halving food waste

- Reducing global meat consumption

A swipe at Elon Musk and co

Finally, Smil takes a large whack at the tech billionaires who believe technology can solve all of our problems:

“Despite the near constant flood of claims about superior innovations ranging from solar cells to lithium-ion batteries, from the 3-D printing of everything (from microparts to entire houses) to bacteria able to synthesize gasoline. Steel, cement, ammonia, and plastics will endure as the four material pillars of civilization; a major share of the world’s transportation will be still energized by refined liquid fuels … grain fields will be cultivated by tractors pulling plows, harrows, seeders, and fertilizer applicators and harvested by combines spilling the grains into trucks.”

----

In my article this week, I outline how a recent health scare has changed my investment plans.

James Gruber

Also in this week's edition...

We're hearing growing calls from the likes of YIMBYs (Yes in my backyarders) for Australia to increase housing density in inner city suburbs to ease the affordability crisis. David McCloskey and Bob Birrell think that would be an error. They suggest that it hasn't worked in the past and won't work in future. Instead, they offer alternative solutions to address the problem.

Like many others, Ashley Owen thinks Commonwealth Bank is headed for a fall from current expensive valuations. If right, he believes it will be a significant drag on the overall share market in coming years. Ashley says it's a risk that investors need to consider when deciding on how to allocate assets for long-term portfolios.

There's been a lot of commentary from economists and the media of late about how budget deficits create inflation. Clime's John Abernethy takes issue with that. And he says there's nothing wrong with fiscal deficits if they're appropriately set for desired economic outcomes such as attacking the cost of living, the cost of doing business or the cost of housing.

Life expectancy numbers are often interpreted as the likely maximum age of a person, but that's incorrect. The odds are in favour of people outliving life expectancy estimates, and that needs to be taken into account in financial planning, according to David Orford and Jim Hennington.

2024 started with incredibly strong market returns, although this moderated in the second quarter. Yet, David Pennell says the period has been one of positive dividend growth for investors allocating to global equities.

Former ACCC Chair, Rod Sims, is fired up about the downfall of Rex. He thinks it's principally due to a bizarre government policy that prevented Rex from getting crucial landing slots at Sydney Airport. Without those slots, the airline couldn't fly the highly profitable capital city routes.

Two new articles from Morningstar for the weekend. Mark LaMonica explores the merits of paying down your mortgage instead of investing. Shani Jayamanne highlights 3 ASX shares that have slumped to very cheap prices.

Lastly, in this week's whitepaper, Schroders details its current views on markets and different asset classes.

***

Weekend market update

On Friday in the US, stocks edged higher after a wild week as corporate earnings remain upbeat though investors await an important US CPI report next week. The S&P 500 and Nasdaq ended 0.5% higher while the Dow was up 0.1%. Brent crude oil rose 0.7% to US$79.73 a barrel, while gold marignally increased by 0.2% to US$2,413 an ounce. The VIX closed down 3.42 points at 20.37, after spiking above 65 at the height of recent investor panic.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

Monthly Investment Products update from ASX

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website