The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

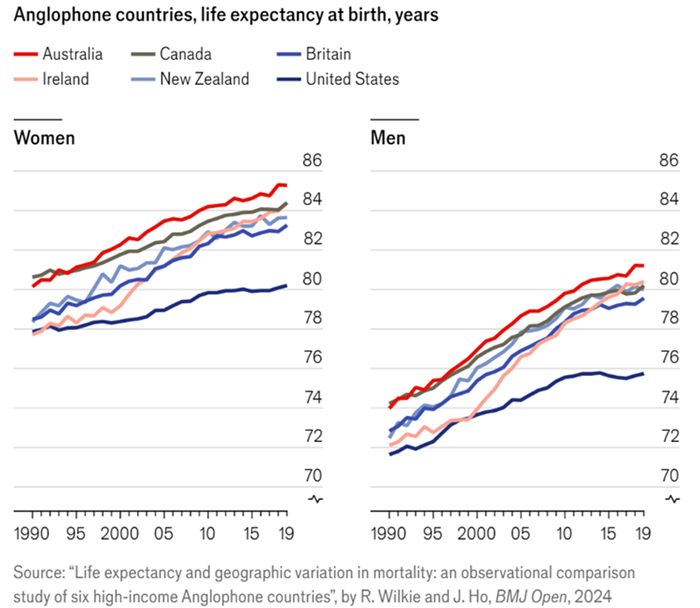

A new paper from medical journal, BMJ Open, has found that Australians far outlive people in other English-speaking countries. The gap is four years compared to the average American and two years to the average Briton.

The research reveals Australia trailed Canada’s life expectancy in the early 1990s but has since overtaken it, and we’ve extended the lead over Ireland, New Zealand, the UK and the US.

The average Australian today can expect to live to 83 years of age, with life expectancy for women at 85, and for men at 81.

The study shows that the US has been the worst performer since 2001. Life expectancy in America at age 65, especially, has deteriorated. And as the chart above attests, the situation for both men and women in the US has stagnated over the past 20 years.

Meanwhile, the UK has had the second lowest life expectancy for much of the past decade. And more recently, Ireland and New Zealand have almost caught up to second-placed Canada.

The research suggests the gaps in life expectancy at birth between the best and worst-performing Anglophone countries have widened over time. The gaps for men and women were 2.4 years and 2.9 years respectively in 1990, and they now stand at 4.8 years and 3.8 years.

Why Australians are better off

The big question is: why do we stand out compared to our English-speaking peers?

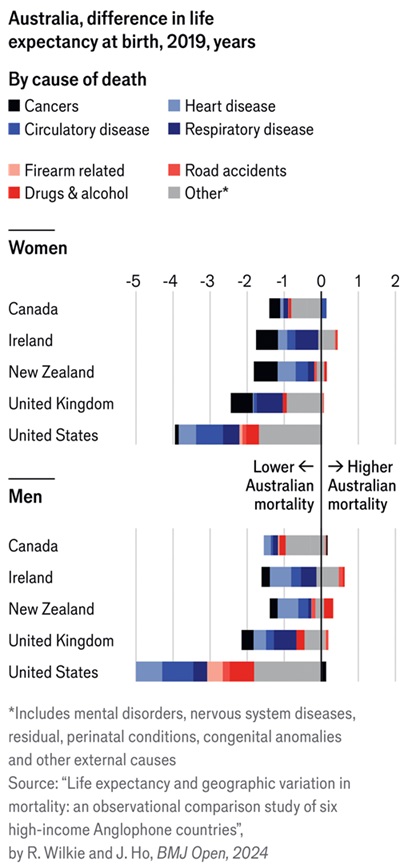

For a start, we’re healthier. Our young suffer fewer complications from pregnancies and births than other countries. This cohort is also less likely to die from drug overdoses, especially compared to the likes of the UK and US.

Our older people are less likely to die from chronic diseases such as heart disease and circulatory issues. And cancer mortality rates are generally lower here.

The authors also point to lower tobacco use in Australia as a contributor. Australia had a less severe smoking epidemic than other nations, and since the 1980s, tobacco-related deaths have shown more rapid declines here for both men and women. This has led to fewer deaths from respiratory diseases, cancers and circulatory diseases.

The paper reckons our health care system has helped too. Australia spends less on health care as a percentage of GDP (10.5%) than Canada, Britain or America, yet we have vastly lower rates of avoidable deaths than other Anglophone countries.

Another contributor to us living longer is having fewer road deaths than our English-speaking counterparts.

Fascinatingly, the study also raises the possibility of immigration being part of the reason for our better life expectancy numbers. Australia has the highest foreign-born share of population among its peers, at close to 30%. That’s about double the share of America and Britain. And prior studies have found that immigrants tend to have higher life expectancies than the native born. The paper admits that the role of immigration in Australia’s growing lead in life expectancy isn’t clear and needs further research.

It’s not all dandy

Though Australia heads the pack, the study says we still have work to do. We have the second-highest obesity rate, which impacts health and life expectancy.

Though Australia has the lowest disparities in life expectancy across the population compared to others, the gap between indigenous and non-indigenous people remains large. People in the Northern Territory, where Aboriginal and Torres Strait Islanders make up 31% of the population, live 6.2 years and 5 years less for men and women respectively, than the national average. A previous study found the gap in life expectancy between indigenous and non-indigenous people in the Northern Territory was 17 years.

Lastly, our life expectancy feats are less impressive when compared to the non-English speaking world. The paper says that we rank fourth for men and sixth for women versus other high-income countries. Japan, Switzerland, and Spain head the list.

A common misunderstanding

It’s worth noting a common misunderstanding when it comes to life expectancy figures. The average life expectancy of 83 is for an Australian at birth, not for an 83-year-old now. A person born in Australia in 1992 had a life expectancy of 74 years for men and 80 for women. In other words, the statistics quoted in the BMJ Open study overlook people who are already living and old.

The implications of living longer

While Australia’s increasing longevity is welcome, it has enormous implications for our health system, and indeed our financial system. Those implications aren’t covered in this study.

For instance, Firstlinks has published many articles on our ageing population and the need to design a better superannuation system. As Graham Hand wrote recently:

“There are an estimated five million Australians in or approaching retirement and drawing down their pensions…

While many large super funds such as REST and Hostplus can be confident their members will continue as net investors through all their years, other funds will remain in net outflow. Funds need to know the characteristics of their members, especially as many will switch to cheaper ETFs as their balances build.

Despite millions of members, most large super funds do not know their clients. They certainly don’t know the needs of their partners and families, and the problem becomes more acute the older the member. These funds need to understand the potential for longevity, plus know the correct legal treatment when their members die at the age of 65 to 75 and beyond.”

Our featured white paper this week from the Franklin Templeton Institute addresses this issue of what longer life expectancies will mean for financial services.

----

Meanwhile, my article this week looks at how investors often overestimate the risks in owning shares when the real risk is not owning enough of them to build real wealth in the long term.

James Gruber

Also in this week's edition...

Ashley Owen says that Australia has more listed companies per capita than any other country and we're also the world's best gamblers. The question is, whether there's a connection between the two.

It’s common to assume that once a member decides to wind up their SMSF, it should happen as quickly as possible. But Meg Heffron suggests that sometimes slowing down can be important, particularly if there are pensions involved.

Apart from “what will home prices do?" and "where are the best places to buy a property?" the main debate around the Australian housing market has been about poor housing affordability, occasionally interspersed with a scare that home prices will crash. But how serious should we take forecasts for a crash? And more fundamentally, how do we fix affordability? Shane Oliver has some answers.

Passive investing is all the rage, yet Emma Davidson believes there are signs that it's struggling to keep up in a world that's rapidly passing it by. With the rise and rise of private equity, the average retail investor isn't getting a representative slice of the economy through passive investing anymore, and they risk missing out on superior returns as a result.

US market concentration in large technology companies has captured investor attention. But how does this concentration compare to history and what typically follows periods of extreme concentration? MFS' Benjamin R. Nastou and colleagues investigate.

Two extra articles from Morningstar this weekend. Joseph Taylor highlights two earnings season losers that may have fallen too far and Mark LaMonica explains how BHP’s results show why he doesn’t touch miners.

Think US stocks and the Magnificent Seven are headed for a fall? Think again, says Franklin Templeton's Stephen Dover. He argues that macroeconomic conditions and secular trends are likely to play in their favour.

***

Weekend market update

On Friday in the US, stocks enjoyed a late rip higher ahead of the long weekend, with the S&P 500 rising nearly 1% to wrap up August with a near 20% year-to-date gain, while Treasurys came under some pressure with two-year yields rising four basis points to 3.91% and the long bond ticking to 4.2% from 4.15% Thursday. WTI crude fell below US$74 a barrel, gold pulled back to US$2,502 per ounce, bitcoin slipped below US$59,000 and the VIX settled south of 15.

From AAP Netdesk:

The Australian share market has finished higher, closing out August basically where it started despite a dreadful opening to the month. The benchmark S&P/ASX 200 index on Friday rose 46.8 points, or 0.58%, to 8,091.9, its highest finish since its all-time closing high on August 1. It finished the month down less than half a point from where it began as earning season drew to a close. The broader All Ordinaries on Friday gained 53.1 points, or 0.64%, to 8,316.7.

Eight of the ASX's 11 sectors finished higher on Friday, with consumer staples flat, health care down marginally and consumer discretionary shares dipping 0.5%.

The industrial sector was the biggest gainer, climbing 1.7% as Qantas rose 5.3% to a 14-month high of $6.71 and Downer EDI soared 16.7% to a two-year high of $5.59 after a well-received earnings report. The integrated services company said its full-year earnings were up 34% to $384.1 million and its utilities business had returned to profitability after being accounting irregularities marred its results over several years.

On the flip side, Ramsay Health Care dropped 6.8% to $41.55 despite the private hospital operator announcing it had nearly tripled its net profit, to $888.7 million. Margin recovery had been slower by cost inflation affecting the private hospital industrial, chief executive Craig McNally said.

Harvey Norman dropped 6.3% to $4.58 after the retail giant posted a $352.5 profit, down 35% from last year.

All of the big four banks finished higher, with ANZ up 1.2% to $30.40, NAB rising 0.6% to $38.17 and Westpac and CBA both climbing 0.5%, to $31.24 and $139.50.

In the heavyweight mining sector, BHP rose 0.6% to $40.77 and Rio Tinto climbed 1.4% to $111.55, while Fortescue dropped 1.6% to $18.27.

From Shane Oliver, AMP:

- Share markets mostly rose over the last week. The US S&P 500 fell earlier in the week on the back of weaker tech stocks as Nvidia’s earnings results beat but not by as much as had been priced into its share price, but ended the week up 0.2% boosted by okay economic data and low inflation data reinforcing expectations for Fed rate cuts. Eurozone shares rose 1.2% for the week and Japanese shares gained 0.7%, but Chinese shares fell 0.2%. Australian shares rose 0.9% as investors looked through softish earnings results to help from eventually lower interest rates ahead with gains in property, finance and resources shares offsetting falls in IT and retail stocks. Bond yields rose slightly. Oil prices fell despite a spike on the back of concerns about a political disruption to Libyan oil exports which accounts for just over 1% of global liquid fuel production. Metal prices fell but iron ore prices rose. The $A fell slightly after hitting $US0.68, with the $US up for the week.

- August saw shares put in a strong recovery from the slump at the start of the month. For the month US shares rose 2.3% and global shares rose 1.7%. Australian shares were flat, which is still not bad considering their 5.7% fall early in the month. However, shares remain at high risk of further falls and volatility over the next few months as: valuations remain stretched; investment sentiment is still relatively upbeat which is negative from a contrarian perspective; the AI boom in tech stocks is looking shaky with Nvidia down despite beating expectations; recession risk remains high in the US and Australia; and geopolitical risk is high particularly around the US election and the Middle East; and September tends to be the weakest month of the year for shares.

- The good news remains that global rate cuts are continuing as central banks like the Fed and ECB are shifting their focus from inflation to preventing a significant deterioration in jobs. Slightly softer than expected July core PCE inflation in the US leaves the Fed on track to cut in September, probably by 0.25% although a 0.5% cut is possible if upcoming jobs data is weaker than expected. Likewise, a fall in Eurozone inflation to a three year low in August leaves it on track to cut again in September. Two aspects of Fed Chair Powell’s Jackson Hole comments are of particular relevance to Australia. First, he noted that “we do not seek or welcome a further cooling in labour market conditions”. This is relevant for Australia because the rise and level of US unemployment at 4.3% is not that different to the rise and level of unemployment here at 4.2%. Second, he noted that “an important takeaway from recent experience is that anchored inflation expectations, reinforced by vigorous central bank actions, can facilitate disinflation without the need for slack.” If the US experience is any guide the RBA’s concerns about continuing excess demand may be overstated. Time will tell.

- Australian inflation for July provided no justification for another rate hike, but it won’t rush the RBA into a cut either. The July Monthly CPI indicator fell to 3.5%yoy with trimmed mean inflation dropping to 3.8%yoy. Both were a bit higher than expected, inflation is still too high particularly for services which is at 4.4%yoy, and the monthly CPI needs to be treated with caution as for July it only includes 60% of components.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

Quarterly ETFInvestor (ETF Market Data) from Morningstar

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Plus updates and announcements on the Sponsor Noticeboard on our website