The one-year anniversary of the low point in the S&P 500 index during the pandemic was 23 March 2021, so we want to put the trailing one-year return of 77% into context as we look ahead.

This was a rare event

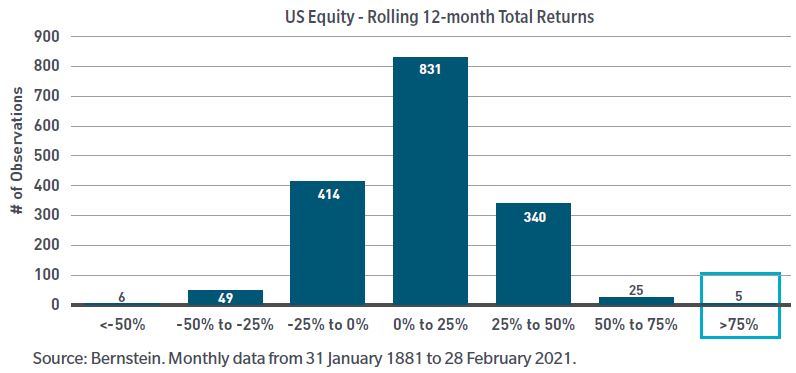

With the help of Bernstein Research, we calculated trailing 12-month returns for every month-end beginning in 1882. We then aggregated all the return streams into buckets, as shown below. So, how rare was this past year’s return? Extremely.

Exhibit 1: Only a handful like it

All five previous examples of 75% or greater 12-month trailing returns occurred during the Great Depression of the 1930s, another period of extraordinary government economic intervention.

What’s unique about the response to the coronavirus pandemic is the speed at which the US economy exited the recession once the US Federal Reserve put a floor under credit risk.

Markets may be short term, but they’re not dumb

Financial markets are a discounting machine. They tend to ignore seemingly material factors such as high unemployment while zeroing in on things that really matter, such as free cash flow generation.

For instance, in the quarters preceding Franklin D. Roosevelt’s New Deal, investors looked through intense economic pain and suffering in anticipation of an explosion of economic growth in 1934. What followed was a strong, but short-lived, business cycle. After the effects of the early-New Deal stimulus had worn off in 1937, worries about deficits resulted in spending cuts and the economy contracted again. Financial markets anticipated that too, as evidenced by the rollercoaster market returns throughout the 1930s.

Bringing it back to the present day, following the lows of last March, the beneficiaries of the initial phase of the rally were stay-at-home stocks such as streaming services and video conferencing providers.

However, as the weeks passed, investors began to look though the uncertainty surrounding the virus to what could be a massive snap-back in US economic growth in the second half of 2021. They switched their focus, shifting capital away from free-cash-flow compounders — companies that are typically more in control of their own destinies — and toward the stocks and credits most leveraged to the economic outlook: cyclicals.

The significant outperformance of companies with highly indebted balance sheets or lower-quality income statements is characteristic of the early phase of a market cycle. Regardless of quality, those companies that are most directly leveraged to a rebound in economic growth have historically become market darlings. That pattern played out during the previous two business cycles, after the collapse of the dot-com bubble and again in the wake of the global financial crisis.

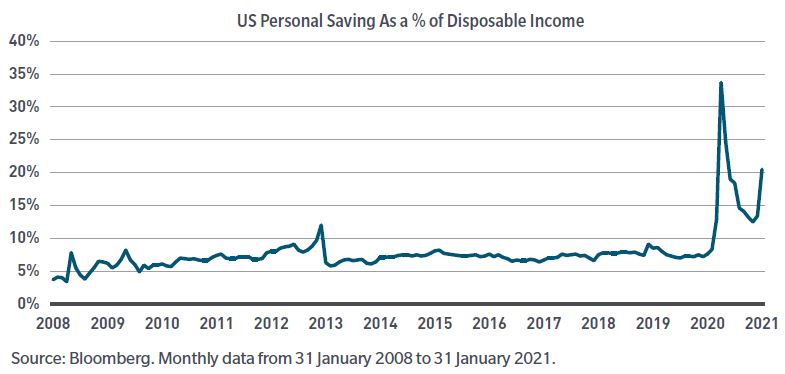

I don’t discount what the market is signaling. It may be short term, but it’s not dumb. The combination of an exceedingly high US savings rate (thanks to pandemic-driven government transfer payments) and pent-up consumer demand (after more than a year of lockdowns) should lead to an enormous pop in economic growth.

Exhibit 2: US stimulus has ballooned savings

Cross-cycle compounders will replace cyclicals

Most investors focus on the near term. That will probably never change. Therefore, it comes as no surprise that the market’s ability to predict what will happen in the short term is strong but weakens over the medium and long term. That’s why our focus is always on the out years.

At some point, as they always do, financial markets will look through the coming eye-popping economic statistics. They will begin to discount what business fundamentals will look like without the tailwind of exceptionally accommodative fiscal and monetary policy.

And if history is any guide, we expect that as policy normalises, investors will pivot back to the type of cross-cycle earnings-compounders that make up many of our core holdings. These 'compounders' grow or 'compound' their earnings better than lesser companies across cycles as their revenues hold up in difficult conditions. They deliver strong cross-cycle earnings growth.

Cyclicals will have had their day, as they often do in the early phases of a market cycle, but we believe secular trends will win out in the long run, rewarding patient investors as the cycle matures.

(Editor's note: A stock is secular when company earnings remain relatively constant regardless of other trends. Examples are consumer staples or products that households consistently use. A cyclical stock's price is more affected by changes in the economy).

Robert M. Almeida is a Global Investment Strategist and Portfolio Manager at MFS Investment Management. This article is for general informational purposes only and should not be considered investment advice or a recommendation to invest in any security or to adopt any investment strategy. Comments, opinions and analysis are rendered as of the date given and may change without notice due to market conditions and other factors. This article is issued in Australia by MFS International Australia Pty Ltd (ABN 68 607 579 537, AFSL 485343), a sponsor of Firstlinks.

For more articles and papers from MFS, please click here.

Unless otherwise indicated, logos and product and service names are trademarks of MFS® and its affiliates and may be registered in certain countries.