Generally speaking, investors aren't good at forecasting market returns. If they were, then stock prices would likely be much less volatile than they are and would generally be priced to give a reasonable real return every year, as everyone would know what to expect.

But in real life, forecasters’ predictions of stock returns and bond yields are all over the place compared to the reality.

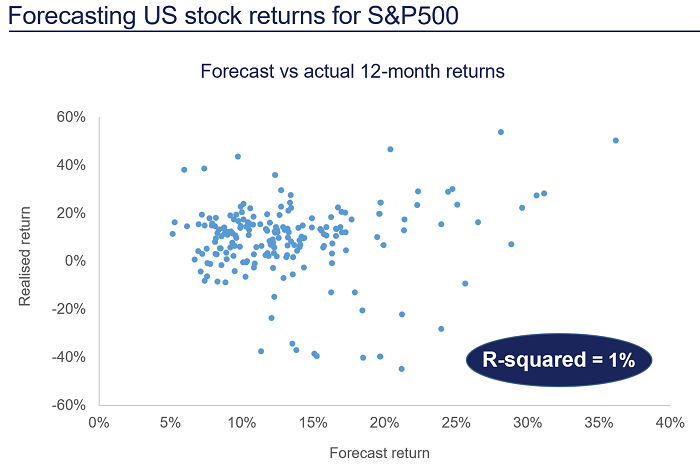

For example, if you use the Bloomberg best consensus forecasts for the S&P500 and plot the predicted one-year return against the actual return over a period of more than 15 years to 2021, you get a random scatter of points. Using a statistical measure known as R-squared, which measures the relationship between two variables, the relationship between forecasts and actual 12-month returns is just 1% out of 100%. Suggesting there is effectively no relationship between the two.

Source: Bloomberg best consensus S&P 500 12-month target price, Bloomberg, 2004 to 2021.

Just in case you think this is just an equity problem, a similar effect is evident if we look at bond returns.

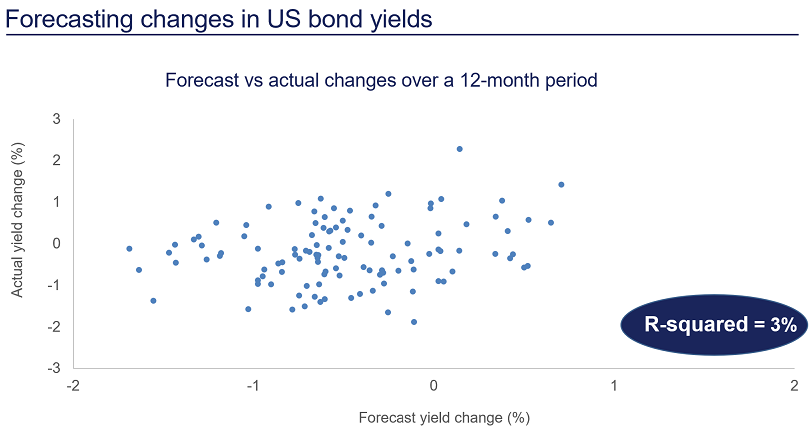

Theoretically, to accurately price bonds, investors only need to predict inflation and interest rates. But if you take a decade’s worth of data provided by the Philadelphia Fed Survey of Professional Forecasters and plot 1-year forecast changes in bond yields against the 1-year actual changes, you again get a random scatter of points, With a similarly low R-squared relationship measure of just 3%.

Source: Philadelphia Fed Survey of Professional Forecasters 1-year forecast for 10-year Treasury Yield, Federal Reserve Bank, Philadelphia, 1992-2001.

Meanwhile, large macro events such as recessions are arguably even harder to predict. Research by the International Monetary Fund (IMF) in 2018 showed that while economic forecasters are generally aware that recession years – where real annual GDP growth falls - will be different from other years, they tend to misjudge the scale of the recession. Forecasts are then not revised fast enough to avoid large errors, which means forecasts and reality don’t match up until the recession year is almost over.

Exploiting overconfidence

The good news is that you don’t have to be able to predict the future to find good investment opportunities. As contrarian investors, we have found some of our best opportunities on the opposite side of the most confident predictions.

When investors are overconfident with their forecasts, this tends to push the prices of these stocks up higher than they should, while the stocks they are ignoring or are less confident on could see their prices fall.

And it is in the areas where forecasts are the most bearish that we are currently finding some of the best contrarian opportunities. For example, stocks where Covid has temporarily disrupted their markets, or in so-called ‘ESG Orphan’ stocks that are discarded by investors who are more focused on things such as high emissions and coal production rather than the price.

Covid disruption

As the name suggests Global Payments is a payments company operating in 100 countries and processing about 50 billion transactions per year.

The payments space has attractive economics. It has high barriers to entry because you need huge scale to make any money and because trust is an important factor in winning business. The global payments sector grew at roughly 7% a year between 2014 and 2019, according to the latest Global Payments Report by McKinsey, yet despite a decline in revenues during Covid, the sector is expected to return to a long-term growth trajectory of 6-7% a year.

However, Global Payments itself has grown faster than this for two reasons.

Firstly, they are big in the credit card space and card payments, where volumes have been growing faster than cash and cheques. Secondly, the firm itself has been winning market share from their competitors.

So, fast growth, high barriers to entry, inflation proof – what’s not to like? The market should love this kind of company and indeed that has been the case up until now.

Historically, Global Payments has traded at a 30% premium to the price/earnings (P/E) of the S&P500 Index, but currently it is trading at around a 30% discount to the market on a P/E of only 15x. That is a good price for a great business, so what’s the catch?

There are four reasons why the market is concerned right now:

- The company’s payments volumes are heavily skewed toward small businesses that have not recovered as quickly post-Covid as larger companies.

- Credit cards have lost market share relative to debit cards.

- During Covid there were fewer transactions but in larger amounts, and margins on big payments are lower than for small payments.

- A number of new listings in the payments space created the impression that competition was increasing.

We believe all of these will fix themselves as the major economic impacts of Covid disappear into the rearview mirror.

Small businesses will recover, credit volumes will go back to normal just as they have done after previous recessions, payment patterns will do the same, and the market will come to realise that the newly listed companies are not true competitors for Global Payments.

This means currently you could pay 15x times earnings for a great business that is growing rapidly. We think that is good value in any market, but particularly good value in the current environment.

ESG orphans

Another unloved part of the market is what could be called the ‘ESG orphans’. There has been a tendency for institutional investors to divest from companies with high emissions, particularly companies with high emissions that come from coal.

They might be doing this for ethical reasons or because they’re forecasting that coal has no future, but to some extent it doesn’t really matter. The result of this indiscriminate selling is that the prices of companies that generate power using coal have fallen dramatically.

Now, while some of the selling is deserved, not all of it is. That’s because for some of these companies there is no place for coal in their future.

One such company is AES (NYSE:AES).

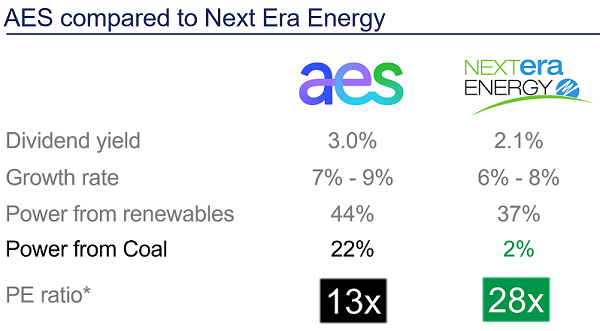

AES is a US power company that is attractively priced because it still has 22% of its power coming from coal generation, so it doesn’t look very green and would be excluded by many ESG-orientated funds.

You can see how their coal exposure has impacted their valuation by comparing AES to Next Era Energy (NYSE:NEE) – a power generator that lacks coal exposure. On the fundamentals AES looks to be more attractive: it has a higher dividend yield, slightly faster growth and a higher proportion of its power coming from renewables. However, you can see that AES has a much higher exposure to coal and that this is reflected in a much lower P/E multiple.

Source: Company reports. Refinitiv. * consensus earnings for Dec 22.

However, if you look a little deeper, AES is perhaps ‘greener’ than it seems.

AES owns a collection of renewable energy businesses including a joint venture called Fluence that is a top-2 installer of grid scale battery storage in competition with Tesla. In addition, it owns a large solar developer that it’s using to reduce its own (as well as other customers’) reliance on carbon energy, and as a result the company’s emissions are falling.

From 2018 to today AES has reduced its coal exposure from 50% down to 22% of the power it generates. Importantly the company is on track to eliminate its coal exposure by 2025.

So, in this example you could get a collection of green businesses growing at an attractive rate, but you only pay 13x earnings for them and you have the prospect that the P/E multiple could double once the coal exposure has gone.

Forecasting distractions

Clearly the evidence shows that investors can't forecast well. On the surface, that seems like bad news, but if you dig a little deeper, it quickly becomes evident that it can create opportunities for those investors that are prepared to think differently.

Shane Woldendorp, Investment Specialist, Orbis Investments, a sponsor of Firstlinks. This article contains general information at a point in time and not personal financial or investment advice. It should not be used as a guide to invest or trade and does not take into account the specific investment objectives or financial situation of any particular person. The Orbis Funds may take a different view depending on facts and circumstances. For more articles and papers from Orbis, please click here.