The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

New ATO figures show the estimated assets of SMSFs have reached $1 trillion for the first time. The assets were up 3.2% during the September quarter and up 10.9% year-on-year.

Source: ATO, Firstlinks

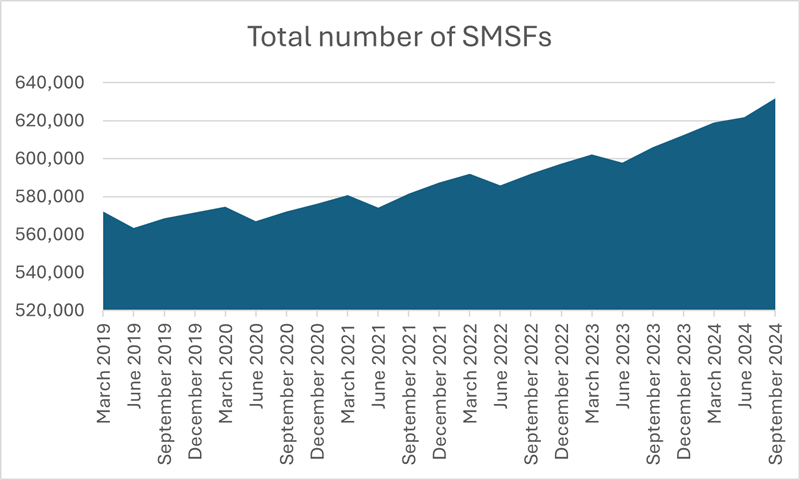

The increase in assets was partly driven by a rise in the number of SMSFs. That number has reached 621,809, up 1.6% on the quarter, and 4.3% for the year to September.

Source: ATO, Firstlinks

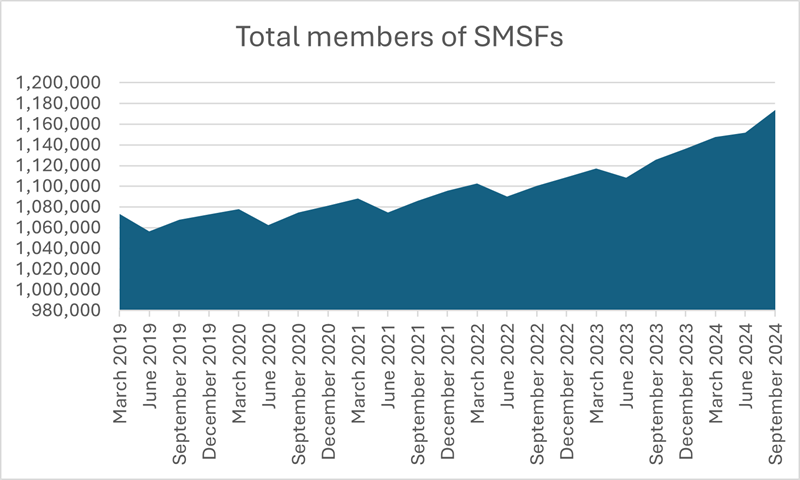

There are 1.15 million SMSF members, split 53%/47% between men and women. The average SMSF member continues to be middle aged or older, with 85% being 45 years or more.

Source: ATO, Firstlinks

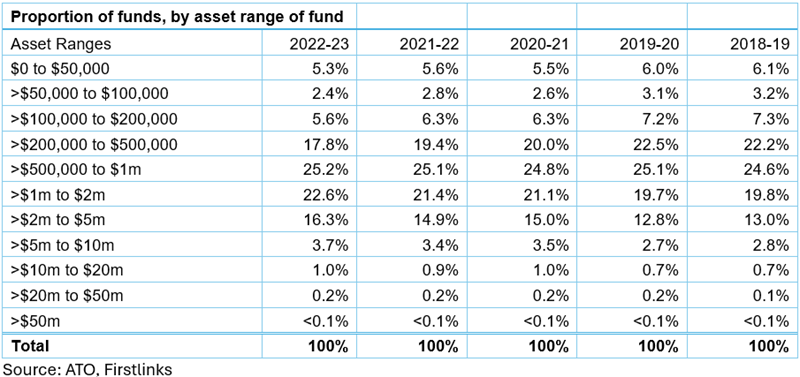

The data for SMSF asset ranges is somewhat dated, going back to June 2023. It shows two-thirds of SMSFs have assets between $500,000 and $5 million. About 5% are above $5 million.

Source: ATO, Firstlinks

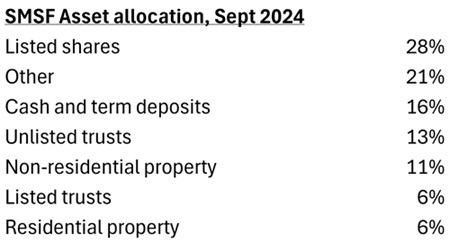

Figures for how SMSFS are allocating their assets are more up to date. The top asset types held by SMSFs are listed shares (28%) followed by cash and term deposits (16%) and unlisted trusts (13%).

Source: ATO, Firstlinks

That asset allocation hasn’t changed much since the start of the year. Listed shares have declined 1% over the first nine months, while cash has risen 1%, unlisted trusts are unchanged, and non-residential property is marginally down.

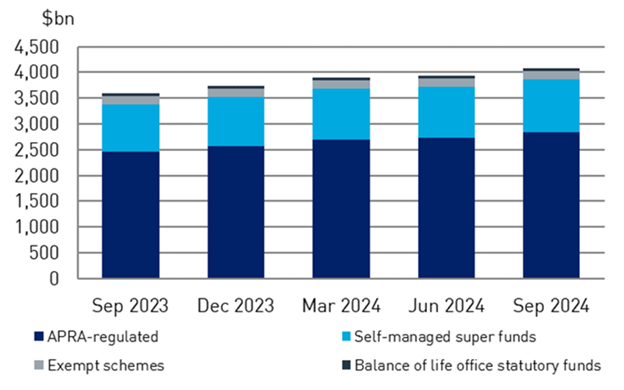

A separate report from APRA shows total assets in superannuation have topped $4 trillion. These assets increased 3.7% over the quarter to September and 13.4% year-on-year, driven by strong asset returns.

Most super assets are in APRA-regulated funds ($2.8 trillion out of $4.1 trillion), followed by SMSFs.

Assets of superannuation entities

Source: APRA

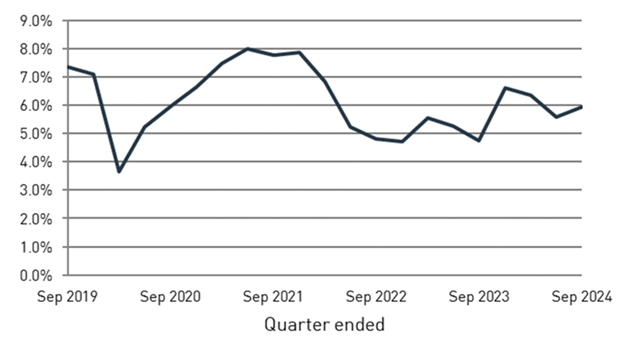

The five-year annualised rate of return for super funds was 5.9% to September this year.

Five year annualized rate of return

Source: APRA

----

In my article this week, I look at a new report from ANZ and CoreLogic that reveals some mind-boggling figures on the affordability of housing in Australia. The report shows that only 10% of the housing market is genuinely affordable for the median income family, and that drops to 0% for those on low incomes. Depressing as that is, it may be bullish for the apartments, which are already showing signs of outpacing house price growth.

James Gruber

Also in this week's edition...

The Future Fund has received a lot of press, yet there’s been no mention of how much the fund has deviated from its original purpose of meeting the burgeoning unfunded liabilities of Commonwealth defined benefit schemes. That’s probably because these liabilities have rocketed to an estimated $290 billion, and the politicians benefiting from the schemes are doing their best to hide the issue, as John Abernethy details.

Australians have been moving from regional areas to cities for decades, attracted by the employment prospects, higher wages, and other factors. Now, Michael Brennan and the team at consultant e61 say that allure of the cities may be fading due to costs, especially housing, outpacing wages. It’s potentially a big opportunity for the regions.

Firstlinks typically steers away from ‘stock-picking’ articles, which are more than adequately covered elsewhere, yet Andrew Mitchell of Ophir has written something unique to warrant an exception to the rule. Here, Andrew provides an inside track on how he stared down short sellers and gained conviction in a stock, and why the story may not be finished yet.

Recently, lawyer Greg Russo gave us an overview on the nuts and bolts of family trusts. He’s back today to do something similar on testamentary trusts. He considers the role that testamentary trusts can play in a well thought-out estate plan.

Many investors love nothing more than certainty and it’s why black-and-white views often get the most publicity. Neuberger Berman’s Joseph Amato is built different and believes a more nuanced approach is warranted after the election of Donald Trump. He breaks down his views on stocks, bonds and other assets.

On a lighter note, the team at UniSuper have come up with a list of book and podcast recommendations for the summer holidays. Uncover the genius behind a secretive hedge fund, debunk healthcare myths, and explore the Cuban Missile Crisis in gripping detail.

Two extra articles from Morningstar for you. Sim Mody highlights our cheapest ASX small-cap picks and Shane Ponraj warns investors away from an overpriced healthcare stock.

Lastly, in this week’s whitepaper, Schroders explains the role that private assets can play in portfolios.

****

Weekend market update

U.S. stocks finished off their best month in a year on Friday, with the Dow and S&P 500 clinching fresh record closing highs to cap off a blockbuster November. The Russell 2000 finished Friday just shy of what would have been its first record close since November 2021. On Friday, the S&P 500 rose 0.6%, and the index gained 5.7% this month. The Nasdaq Composite gained 0.8% and the index rose 6.2% this month. Crude oil ws 0.8% down to US$68.15 a barrel, gold was 0.3% higher at US2,674 an ounce, and Bitcoin was 2.6% to the better at US97,546.

From AAP Netdesk:

The local share market on Friday capped off a tumultuous month with a late afternoon comeback, nearly managing to finish the day in the green. After being down by as much as 0.6% in late morning trading, the ASX200 gained steadily to finish the day down just 8.1 points, or 0.1%, at 8,436.2. The benchmark index gained 0.5% for the week - hitting new record highs Monday and Thursday - and rose 3.4% in November, its best monthly gain since July. For the year it is up 11.1%, with December traditionally a strong month for shares. The All Ordinaries on Friday lost 0.9% to close at 8,699.1.

Seven of the ASX's 11 sectors finished lower on Friday, consumer discretionaries were flat and energy, tech and materials gained ground.

BHP rose 1.3% to $40.57, Fortescue climbed 1.6% to $18.99 and Rio Tinto added 0.9% to $118.24.

Resolute Mining rose 4.8% as the goldminer announced it had paid another $US50 million ($77 million) to the government of Mali - on top of $US80 million ($123 million) already paid - to resolve supposed tax issues that resulted in the surprise detention of Resolute's CEO and two other employees earlier in November.

The big four banks were mostly lower, with ANZ and NAB both dropping 1.1%, to $31.17 and $39.10, respectively, while Westpac edged 0.1% down at $33.36. CBA was the outlier, flat at $158.58.

Select Harvest fell 5.4% to $3.69 as the nut-grower said it had swung to a $1.5 million profit for the financial year ended September 30, after a $114.7 million loss the previous year.

Cyclopharm rose 7% to a six-week high of $1.68, after earlier in the week receiving its first order of its lung imaging agent Technegas from the US Veterans Health Administration.

Looking ahead, next week the Australian Bureau of Statistics will release third-quarter gross domestic product figures on Wednesday.

From Shane Oliver, AMP:

Despite lots of noise around Trump, including tariff posts, political uncertainty in France and another elevated inflation reading in the US, the combination of mostly solid US economic data, ongoing expectations for central bank rate cuts and news of a cease fire between Israel and Hezbollah saw global shares continue their trend higher over the last week. For the week, US shares hit a new high and rose 1.1%, Eurozone shares rose 0.3% and Chinese shares rose 1.3% helped by rumours of more stimulus but Japanese shares slipped 0.2%. Helped by the positive US lead and optimism about stronger earnings ahead Australian shares rose to a new high and ended the week up 0.5% led by gains in health, property, IT and consumer stocks. Bond yields fell helped by news that hedge fund manager Scott Bessent has been nominated as US Treasury Secretary and that Trump’s tariff plans may be tempered. Oil prices fell on the back of the Israel/Hezbollah cease fire and gold prices also fell but metal and iron ore prices rose. Bitcoin fell but as with the recent pullback in gold its fall looks like a correction ahead of further gains which will likely take it above $US100,000. The $A rose slightly with the $US falling.

November saw strong gains in share markets with global shares up nearly 5% and Australian shares up 3.4% helped by optimism around Trump’s win. However, there was a big divergence between the US share market which rose 5.7% and Eurozone and Japanese shares which fell 0.1% and 2.2% respectively partly on concerns about the negative impact on their exports from Trump’s tariffs.

Trump tariffs are coming, but there will be lots of twists and turns. Trump’s social media posts indicating a 10% tariff on China and 25% on Canada and Mexico from day one created a bit of volatility causing a brief refocus on the negative aspects of his policies. Here are nine key points regarding his tariffs:

- We are back to social media posts as the new channel for US presidential announcements. But Trump’s comments can be erratic and contradictory as Trump likes to be unpredictable to unsettle the other side, so they need to be treated with caution.

- The tariffs cover 43% of US goods imports and could add up to 0.9% to US core (ex food and energy) prices.

- That the tariffs were linked to the flow of drugs from China and drugs and immigrants (from Mexico and, oddly, Canada) rather than economics and trade makes it look like these tariffs are a negotiating tactic and may not be implemented or may be quickly removed if deals are struck on drugs and immigration. In 2019 Trump announced a similar tariff on Mexico only to back down when an immigration deal was reached.

- Consistent with this while Trump is saying from day one its likely he will give countries a chance to negotiate before the tariffs hit.

- While a 10% tariff on China is far less than the 60% talked about in the campaign – which may be seen as good news for Australia given our exposure to China - the fact that its related to drugs and not trade suggests there is still more to come. And this applies to other countries.

- The threatened tariffs on Mexico and Canada indicate countries with free trade agreements with the US may not be safe – this may include Australia although the US’ trade surplus with us may ultimately see us spared from Trump’s general tariff.

- The team he has chosen including his Trade Representative, Jamieson Greer, all support the use of tariffs to varying degrees.

- While these tariffs may not ultimately be implemented the uncertainty they cause, with likely more to come, will be a dampener on business confidence, which will likely cause bouts of volatility in investment markets even if the tariffs escalate and then de-escalate as deals are struck.

- Finally, and looking through the short term noise, various constraints should help to limit how much Trump can do on the tariff front: Trump won the election on cost of living concerns and if he adds to the cost of living via higher prices there will be a popular backlash; Trump is sensitive to the share market and if it starts to fall he will back off like he did in 2019 after a plunge in the second half of 2018 partly on the back of the then trade war; and his nomination for Treasury Secretary, hedge fund manager Scott Bessent, qualifies as an “adult in the room” and is likely to try and limit anything that causes a sharp rise in US bond yields. Of course, Bessent is just one voice.

The bottom line is that there is a long way to go regarding tariffs in the US, the story could take various twists and turns, this could cause significant volatility in investment markets but ultimately various constraints will limit what Trump can do on tariffs versus his more market friendly policies regarding tax cuts and deregulation.

Curated by James Gruber, Joseph Taylor and Leisa Bell

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

VanEck webinar: ETFs and market distortion: Myth or Reality, Dec 10 2024

Australian ETF Review from Bell Potter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Plus updates and announcements on the Sponsor Noticeboard on our website