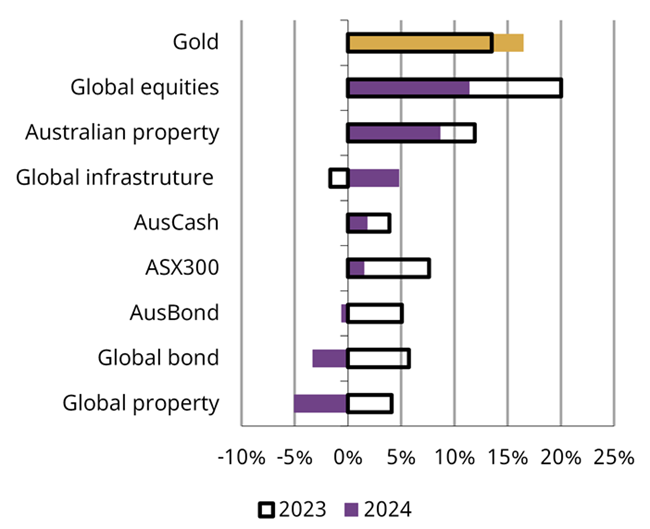

Gold has performed well so far in 2024. In fact, the year-to-date return of 16% makes gold, in Australian dollars, one of the best-performing assets locally and globally (Chart 1). Strong central bank purchases, spikes in geopolitical risks and investor bullish positioning have pushed gold further into all-time-high territory.

Chart 1: Gold outperformed in 2024

Major asset performances (in AUD) in 2023 and so far in 2024*

*As of May 2024. Based on LBMA Gold Price PM, MSCI World Index, ASX REITs Index, Bloomberg AusBond Bank Bill Index, ASX300 Index, FTSE Global Infrastructure Index, Bloomberg AusBond Composite Index, Bloomberg Global Agg Index and FTSE Nareit Developed Index. All calculations in AUD. Source: Bloomberg, World Gold Council

As gold has reached record highs in recent months, a common question from investors is: “Has gold run its course and, if not, when would be a good entry point?”

While demand drivers remain supportive of gold, an equally important question at present for Australian investors is – “How is your portfolio set up for ‘higher for longer’ inflation and rates?”

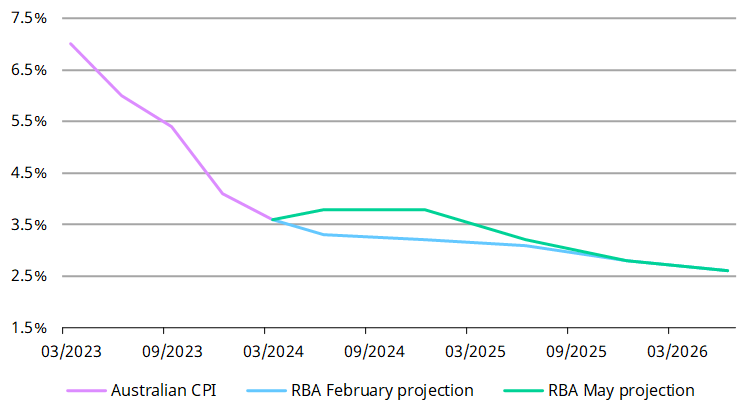

Inflation has come down in Australia, but not at the pace the Reserve Bank of Australia (RBA) expected. According to the latest information, inflation grew by 3.6% y/y in Q1, slightly higher than the consensus expectations of 3.4%.[1] Similarly, both core CPI (excluding food and energy) and the trimmed mean measure for Q1 also came in above expectations.

At its May meeting the RBA revised its inflation projections higher (Chart 2) citing the stronger labour market and higher petrol prices as main drivers.[2]

Chart 2: The RBA is re-thinking inflation prospects

Quarterly Australian CPI and the RBA’s projections after Q1*

*As of May 2024. Based on RBA projection at their March and May meetings. Source: Bloomberg, World Gold Council.

This has raised concerns about the effectiveness of the RBA’s current disinflation efforts, leading local investors to intensify their expectations that rates will stay higher for longer.

Implications for local portfolios

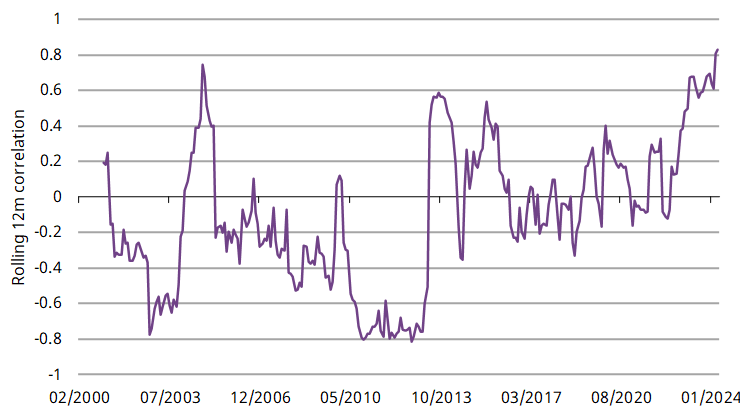

The combination of high inflation and elevated interest rates has led to a rising correlation between Australian equities and bonds over past years (Chart 3). As interest rates climb, bond prices fall and equities suffer due to a lower net present value of future earnings discounted by a higher rate. And rising inflation erodes the real value of both bonds and equities.

Chart 3: Australian equities and bonds are now moving in the same direction

Rolling 12-month correlation between Australian equities and bonds*

*As of May 2024. Based on monthly returns of ASX 300 Index and Bloomberg AusBond Composite Index. All calculations in AUD. Source: Bloomberg, World Gold Council

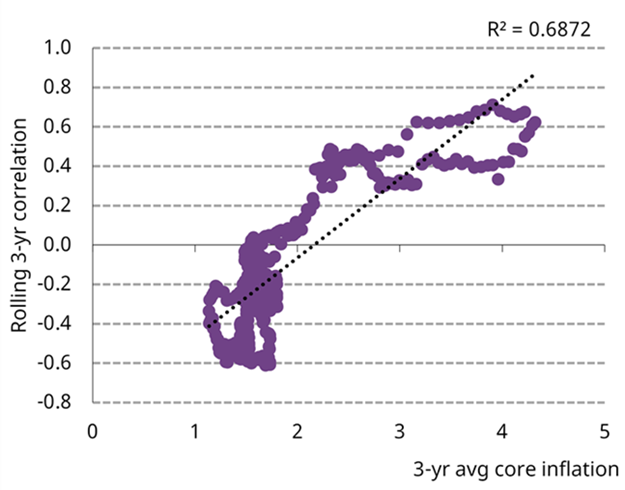

And the elevated inflation weakens the appeal of bonds as a diversifier (Chart 4). At inflation levels below 2%, the correlation between global equities and global treasuries has been negative, providing diversification. But at levels above 2%, this relationship starts to break down.

Chart 4: Sticky inflation comes with elevated correlation between bonds and equities in general

Conditional rolling 3-year correlation between global stocks and bonds*

*Based on monthly returns of MSCI World Index, Global Treasury Bond Index and G7 Core Inflation between January 1990 and May 2024. Source: Bloomberg, World Gold Council

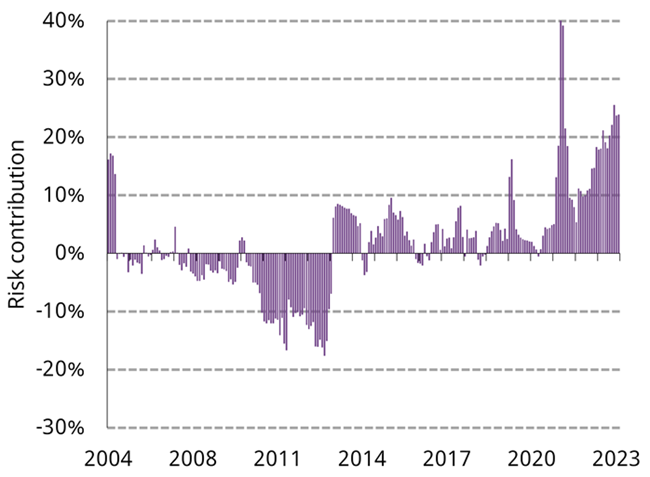

A positive correlation between bonds and equities undermines the value proposition of bonds as a portfolio diversifier. And it results in Australian bonds contributing a much larger share of total portfolio risk (Chart 5).

Chart 5: Bond’s risk contribution to the portfolio has been surging

Risk contribution of bonds in a 60/40 portfolio*

*Based on monthly returns between January 2000 and May 2024. The hypothetical portfolio assumes a 60% allocation to ASX 300 Index and a 40% allocation to Bloomberg AusBond Index. Risk contribution is calculated as: asset weight X asset volatility X asset correlation with the portfolio. Source: Bloomberg, World Gold Council

Looking ahead, rates are not likely to go much higher. This may improve the return prospect of fixed income assets. But risks exist: persistent inflationary pressures remain the primary obstacle to monetary easing.

The lessons here are twofold:

- the contribution to portfolio risk from bonds is now much greater

- there is no guarantee that bond and equity correlations will turn negative again or remain stable, particularly considering the potential for inflation volatility.

It is important, therefore, to have assets that can help in these scenarios rather than relying solely on government bonds as a portfolio diversifier.

Gold as a shining diversifier for Australian investors

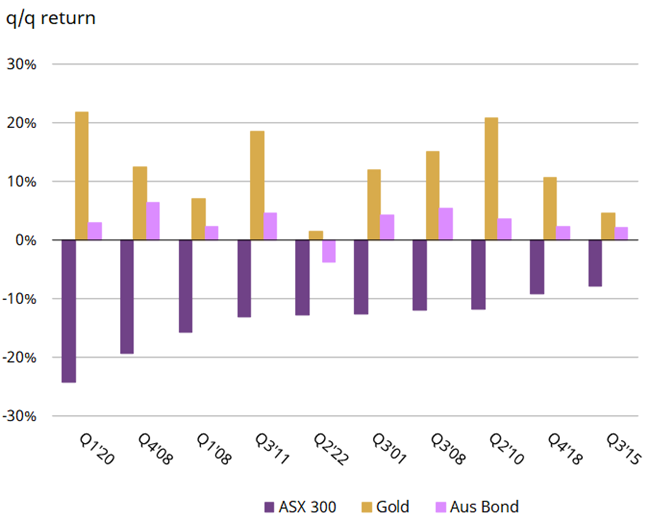

Gold has been an effective diversifier for equity risks. Our analysis shows that gold, in AUD, held up well and provided attractive returns when local stocks suffered the most severe pullbacks in history (Chart 6).

Chart 6: Gold has provided positive returns during Australian equity market pullbacks

Performances of gold and bonds during the worst ten quarters of Australian equities*

*Based on quarterly returns of Bloomberg AusBond Composite Index, ASX300 Index and LBMA Gold Price PM in AUD between January 2000 and May 2024. Source: Bloomberg, World Gold Council

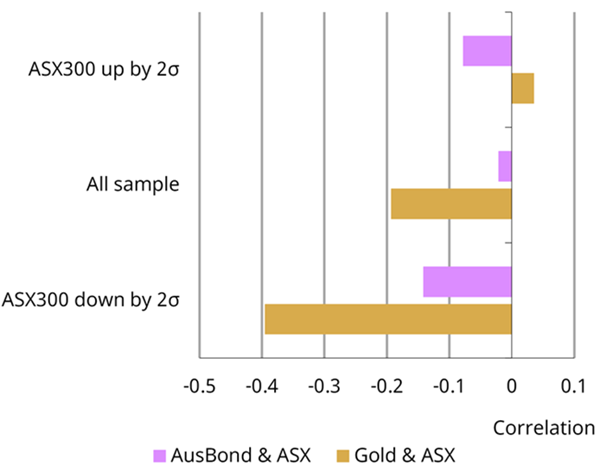

But we understand that consistent negative correlation is not the Holy Grail for investors. While it protects investor portfolios in market downturns, it can also undermine overall gains. As such, it is important to highlight gold’s unique relationship with equities: providing downside protection and sharing upside potential (Chart 7).

And this unique characteristic stems mainly from gold’s diverse drivers: it fulfils both safe-haven demand and wealth expansion needs in its capacity as a financial asset and a consumer good.

Chart 7: Gold offers the correlation investors want

Correlations of gold and bonds with Australian stocks over the past 30 years*

*Based on weekly returns of Bloomberg AusBond Composite Index, ASX300 Index and LBMA Gold Price PM in AUD between May 1994 and May 2024. Source: Bloomberg, World Gold Council

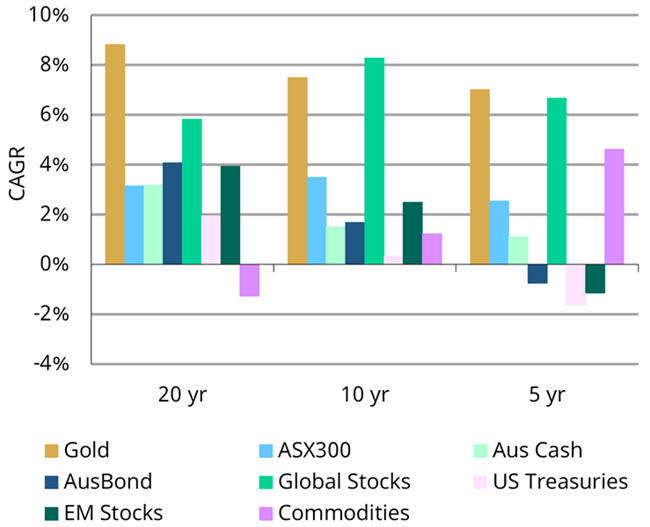

Our research shows that investors can benefit from taking a longer-term strategic view when it comes to gold. Looking beyond gold’s short-term performance, historical data shows that it has provided a 9% average annual return since 1971 in AUD (Chart 8). And with geopolitical risks spiking more frequently, and central bank gold purchases extending, we are confident that gold will remain an important strategic component of modern portfolios.

Chart 8: Gold has provided attractive long-term returns

Gold and other major asset performances during different periods*

*As of May 2024. Based on LBMA Gold Price PM, MSCI World Index, MSCI EM Index, Bloomberg AusBond Bank Bill Index, ASX300 Index, Bloomberg AusBond Composite Index, Bloomberg US Agg Index and Bloomberg Commodity Index in AUD. Source: Bloomberg, World Gold Council

Conclusion

In its recent meeting the RBA revised up its expectations for future inflation, causing investors to anticipate a much higher rate in Australia than previously. The combination of sticky inflation and elevated rates usually leads to increasing correlation between bonds and equities. As inflation is likely to remain stubbornly elevated, the correlation between bonds and equities could remain high, reducing diversification within portfolios.

We believe it is important for investors to utilise gold’s role as an effective diversifier – across various rates, inflation, and volatility environments. While gold provides downside protection when equities pull back as a safe haven, it also benefits from economic prosperity when stocks rise through consumer demand.

Gold’s attractive long-term return combined with its performance amidst geopolitical and macroeconomic uncertainty, make gold a key component of robust investment strategies.

Ray Jia a Senior Research Analyst at World Gold Council, a sponsor of Firstlinks. This article is for general informational and educational purposes only and does not amount to direct or indirect investment advice or assistance. You should consult with your professional advisers regarding any such product or service, take into account your individual financial needs and circumstances and carefully consider the risks associated with any investment decision.

For more articles and papers from World Gold Council, please click here.

[1] Based on Australian quarterly CPI as of Q1 2024.

[2] In Brief: Statement on Monetary Policy – May 2024 | RBA