The demographics of how long we will live reveal some surprising statistics, especially in Australia. We frequently hear about people living into their nineties, and even one hundred years or more, but we read less about the other side of the demographics: how short many lives will be.

According to the Australian Bureau of Statistics, the life expectancy median for males born in 2022 was 81 years and for females, 85 years. But what about the expected years of life remaining for a person at a given age? The statistics overlook people who are already living and old. There will be many people alive now who will not reach 81 or 85 years.

If age 81 concerns anyone due to its life brevity, it is worth preparing for a future that makes the most of life’s opportunities now. The remaining expectancy might be 20, 30 or 40 years but nobody knows. A person born in 1955 to 1960 may expect to live until they are 70 or so but they may live an extended time. The longer someone lives, the longer they can expect to live.

The main message is that 81 is the expectancy, or median for men, at birth, not for a 81-year-old now. A person born in 1992, about 30 years ago, had a life expectancy of 74 years for males and 80 for females, a gap of almost six years. The Beatles were fresh on the stage and at the start of their lives, but 'When I'm 64' was considered old.

Maybe dying at the age of 65 to 70, even now, is not so unreasonable based on the original expectations.

Deaths in Australia, 2021

This latest expectancy based on deaths (not expectancy based on birth) in 2020-2022 included the three years of COVID and it is reflected in the death rates. The death rate before 2022 was lower than in previous years due to preventative measures during the pandemic. But in 2022, the number of deaths in Australia rose to almost 200,000 in one year, up from 171,469 the year before. Australia should not expect as many as 200,000 in future years for a while but the number will be up there eventually.

The latest statistics on deaths from the Australian Institute of Health and Welfare (AIHW), 2021, shows death by age with a median of 79 for men and 85 for women. These numbers are based on the 2021 data including the 171,469 in 2021 deaths during the COVID period.

The statistics published by the ABS (due in a few months) for the end of 2024 will cover the 2023 year, and it will be revealing whether Australia holds the 200,000 deaths year level.

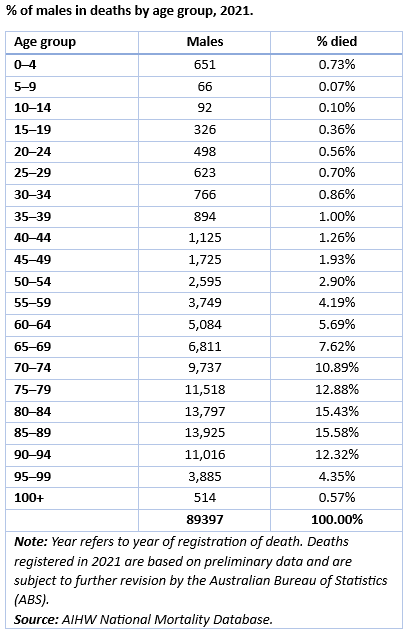

Back to the detailed in the 2021 AIHW data, when total deaths were 171,469, with 89,397 men and 82,068 women, drawing out the statistics for men shows:

- 4.4% of men died before the age of 40

- 10.3% of men died between the ages of 40 and 59

- 13.3% of men died between the ages of 60 and 69 (that’s 28% by 69)

- 23.8% of men died between the ages of 70 and 79 (that’s 52% by 79)

- 31.1% of men died between the ages of 80 and 89 (that's 83% by 89)

- 17.1% of men died over the ages of 90

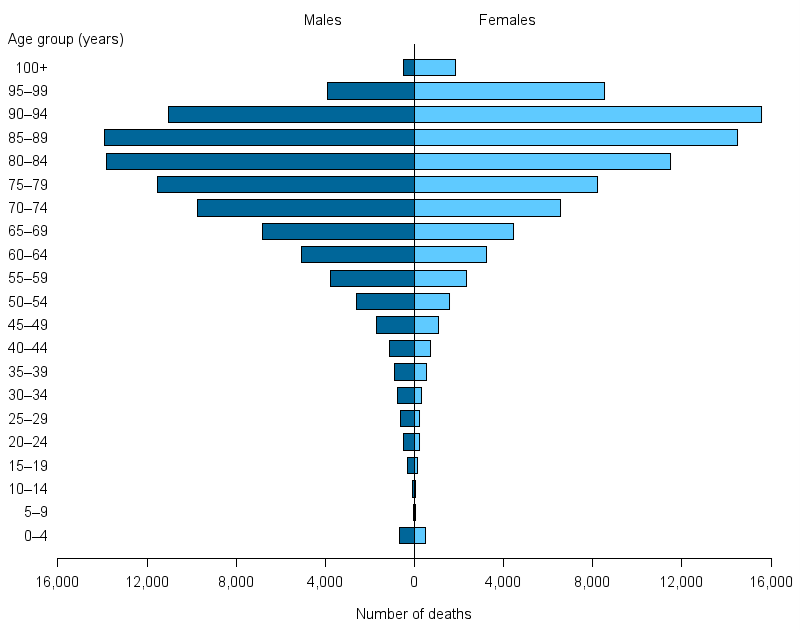

Deaths in Australia by sex and age group, 2021

Source: AIHW National Mortality Database; Table S2.1.

While plenty of males in particular are living beyond the age of 69 and 79 – that is, people alive now, not their current expectancy – but also a surprising number of 28% are expected to die before they reach the age of 70. While cures for many diseases such as cancer and heart conditions are improving, everyone should consider what life will be like with earlier health problems.

Also consider the ‘average’ couple. She is typically two years younger than her husband but lives longer, with a period of dependency. On average, he dies several years before she does and she has often been the carer. She becomes dependent after he dies which is one reason why there are many more women in aged care.

Life expectancy and an aging population

In the 1960s, men lived 14 years less and women 11 years less than now (which in my case, was only 67 years at birth). Remarkably, between 1964 and 2021, the median age at death increased from 68 years to 79 years or 11 years longer, but the vast majority of people now expect to live well beyond 68 years.

(And the world was a vastly different place when Australians born at the beginning of the 20th century had a life expectancy of 51 years for males and 55 for females).

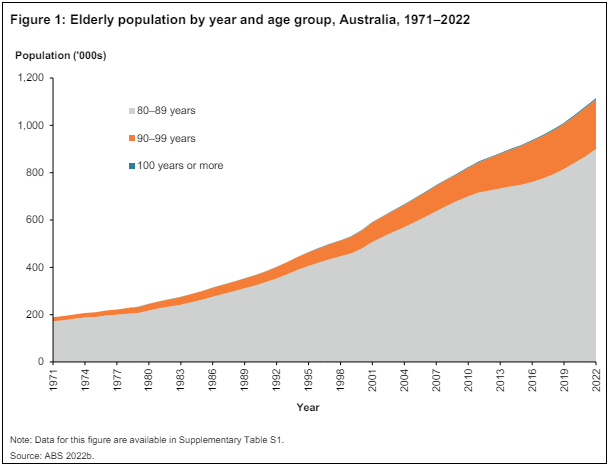

Changes in Australia’s demographics have other surprises. In 1971, people aged 80 years or more made up only 1.4% of the population, but that is now 4.3%. Instead of 188,819 people over 80 in Australia in 1971, there were 1,115,297 in 2022.

Figure 1 shows the increase since 1971 (and I was born in 1957, so that’s 14 years). While the median life expectancy of men is about 80 now, half of them will live beyond 80 and half will die by this age.

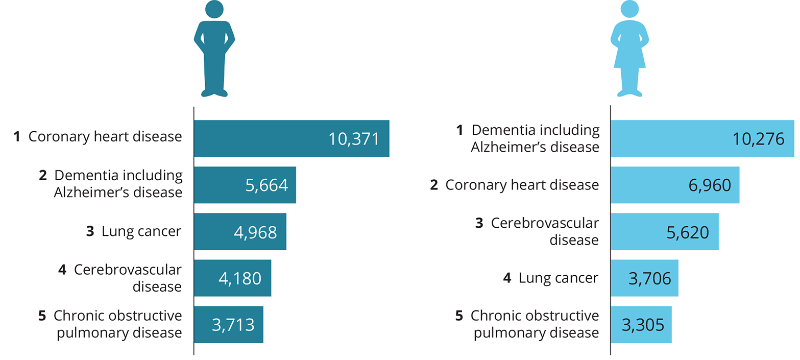

Leading causes of death

There are numerous differences in the reason men and women die, with men of coronary heart disease (10,371 (12%) deaths) and women from dementia including Alzheimer’s disease (10,276 (13%) deaths). The chart below shows the five leading categories.

Leading underlying causes of death in Australia, by sex, 2021

Source: AIHW National Mortality Database; Table S3.1.

The leading causes of death also vary by sex and age. For example, chronic diseases feature among people aged 45 and over, while death among younger people up to the age of 44 includes accidents and suicides.

Other implications of ageing and death

Another reason to understand both the ages and causes of deaths is to help to design a better superannuation system. There are an estimated five million Australians in or approaching retirement and drawing down their pensions. Balances and liquidity needs to meet their members' requirements although neither super funds nor SMSFs know when the money will run out.

While many large super funds such as REST and Hostplus can be confident their members will continue as net investors through all their years, other funds will remain in net outflow. Funds need to know the characteristics of their members, especially as many will switch to cheaper ETFs as their balances build.

Despite millions of members, most large super funds do not know their clients. They certainly don’t know the needs of their partners and families, and the problem becomes more acute the older the member. These funds need to understand the potential for longevity, plus know the correct legal treatment when their members die at the age of 65 to 75 and beyond.

Concluding remarks

This article focusses on the ages at which people die rather than longevity expectations when they are born. How to live longer and how to ensure a retiree does not run out of money are subjects for another day.

Life expectancy statistics from the ABS have a reference period of 2020 to 2022 and were released on 8 November 2023. The next release is 8 November 2024 so the numbers in this article are not as out of date as they may appear.

Thanks to demographer David Williams for his comments on his My Longevity website (www.mylongevity.com.au). And if anyone is offended by the title of the article, deaths in Australia and how long people will live are referenced by the ABS in its reports.

Graham Hand is Editor-At-Large for Firstlinks.