The RBA’s October 2021 ‘Financial Stability Review’ (FSR) comes in the wake of APRA’s announcement earlier in the week to increase the minimum interest rate buffer it expects banks to use when assessing the serviceability of home loan applications. In that context, the October FSR was expected to have a stronger than usual emphasis on housing-related risks. And the RBA didn’t disappoint.

Prudential controls starting

Recall on Wednesday that APRA announced that authorised deposit taking institutions (ADIs) will need to assess new borrowers’ ability to meet their loan repayments at an interest rate that is at least 3% above the loan product rate. This is an increase of 0.5% on the previous 2.5% minimum interest rate buffer (note that some lenders had already applied a rate above 2.5%).

As we wrote at the time, the move by APRA will strengthen serviceability standards. But we do not think the increase of 50bps on the minimum interest rate buffer was enough to materially shift the outlook for the housing market in 2022 (see here).

The FSR adds a lot more colour to the household debt and housing-related issues that are currently weighing on the RBA’s mind. To be clear, the RBA has expressed concerns around the overall level of household indebtedness for some time, but without doubt those concerns have been notched up more recently given the acceleration in borrowing.

The FSR notes:

“there has been a build-up of systemic risks associated with high and rising household indebtedness. Vulnerabilities could build further if housing market strength gives way to exuberance, with expectations of further price rises leading borrowers to take on greater risk and banks potentially easing lending standards”.

The move by APRA earlier in the week sought to address those risks. But if credit growth remains stronger than income over coming months, pressure is likely to intensify for APRA to make some more policy changes.

On that front, an entire section of the FSR was devoted to “Mortgage Macroprudential Policies”.

RBA wants macroprudential to take house price burden ...

It is crystal clear that the RBA will seek to have any concerns around an overheated housing market addressed through more macroprudential policies from APRA. Rapidly-rising home prices or an acceleration in household debt because of record low rates will not directly feed into the RBA’s decision making around when they commence normalising rates.

Put another way, the RBA’s focus for monetary policy is squarely on the inflation target and achieving full employment. The RBA considers the financial stability component of the charter to be best addressed via macroprudential policies.

... but it didn't in the past

This hasn’t always been the case.

In September 2014, the RBA Governor at the time, Glenn Stevens, stated on the case for more monetary policy easing to stimulate the economy,

“while we may desire to see a faster reduction in the rate of unemployment, further inflating an already elevated level of housing prices seems an unwise route to try to achieve that”.

Governor Philip Lowe took a similar mindset to his first few years in the top spot. But now the RBA is fixed on getting inflation and wages up given many years of undershooting their inflation target on an underlying basis.

Overall, the FSR today paints the picture of a central bank that will be playing very close attention to the housing market and the dynamics around new lending, debt repayment and leverage.

A selection of charts and commentary

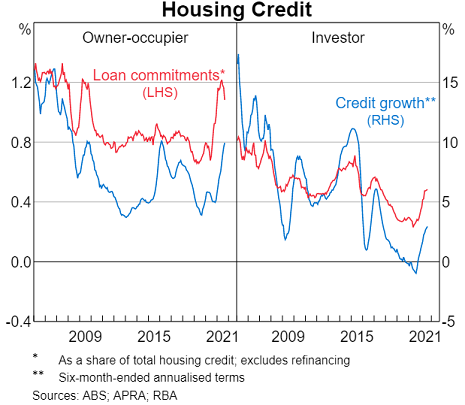

There are concerns around the acceleration in new lending and credit growth given already high debt to income ratios in Australia.

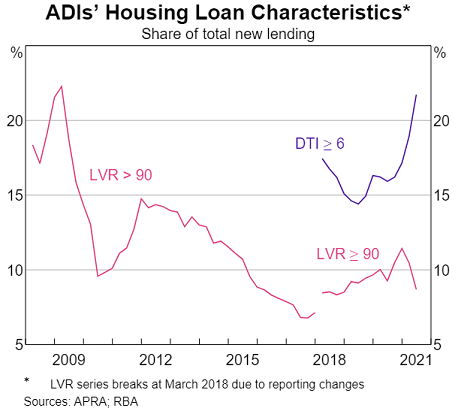

The RBA finds that lending standards remain sound but that the share of lending at high debt to income ratios has risen quickly.

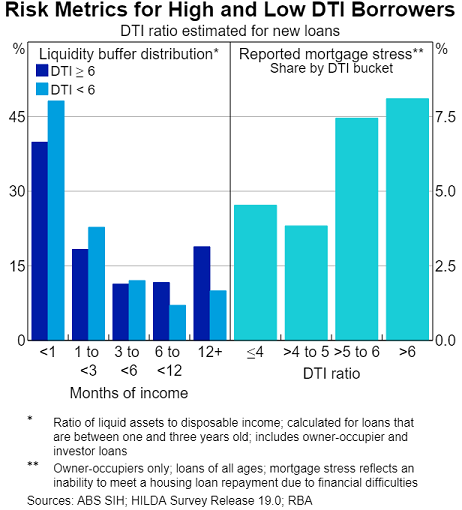

Borrowers with high debt to income rations more often experience mortgage stress, although in the case of investors, liquidity buffers are often higher.

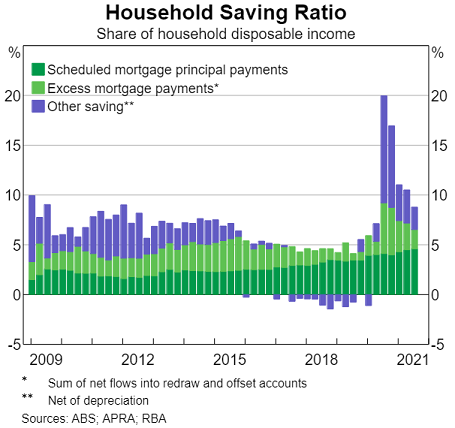

Household savings have lifted through the pandemic. Some of these savings have been put towards additional mortgage repayments.

Gareth Aird is Head of Australian Economics and Kristina Clifton is a Senior Economist with the Global Economic & Markets Research (GEMR) team at Commonwealth Bank of Australia. This report is not investment research and nor does it purport to make any recommendations. Rather, this report is for informational purposes only and is not to be relied upon for any investment purpose.