The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

In poker, the 'ante' is an amount of chips, or a compulsory bet, placed in the pot before any cards are dealt. Ante means 'before' in Latin. Its purpose is to force players to participate, to have a vested interest in committing to the round even if their cards are not initially strong.

The same 'table stakes' concept applies in funds management, and it is called 'Environment, Social and Governance'. Every fund manager has its own version of ESG to satisfy clients who will only invest based on ESG principles and beliefs. Go to any fund manager website and there will be an obligatory statement of a belief in ESG. It's the ante for playing the game.

In practice, commitment and interpretation are different. For some managers, it goes to the heart of their investment process, requiring an ESG approval before any company is considered for a portfolio. For others, it's a simple statement about avoiding the easy targets such as tobacco and weapons, then it's off to the races.

The regulator, ASIC, is watching the industry closely and has already commenced 'greenwashing' action against several funds which are not delivering on their social representations.

It is difficult to pin down how ESG principles translate into portfolio decisions. Fund managers want successful investments and it's easy to look the other way. Where, for example, does Qantas fit in ESG principles? The S is Social and the G is Governance. The new CEO has apologised for problems ranging from illegally sacking 1,700 ground staff, long delays contacting the call centre, selling tickets for cancelled flights, refusing to refund unused credits and involvement in Qatar Airways' request for extra flights. The Qantas fleet is now old and maintenance has been sent overseas to save costs. The brand damage will take years to repair yet shareholders widely applauded the tenure of former CEO, Alan Joyce.

I'll never forget a fund manager presentation to a large audience some years ago, where for the first 20 minutes, he droned on about how his commitment to ESG principles defined every portfolio decision. Then he explained why his number one investment was Aristocrat Leisure. Here is a company that designs poker machines to be as addictive as possible, promoting gambling to those who can least afford it. Australia has 20% of the world's poker machines with high per capita losses placing strains on vulnerable families. ESG can be defined and justified in many ways.

Another central focus of the Social 'S' is Diversity, Equity, and Inclusion (DE&I) and the case for fund managers to pay attention here should pay off in stock picking. Many fund managers who lead their businesses are Baby Boomers who were once the young superstars but are now an older generation. How much do they know about companies that cater to younger generations, 'Millennials' born 1981-1996, 'Generation Z' born 1997-2012 and 'Generation Alpha' born 2013-2025? The 'ante' for a 65-year-old Chief Investment Officer (usually white and male) is a 35-year-old (or younger) colleague to stay on top of new trends. This is not 'diversity for diversity's sake' but a genuine need to hear alternative views.

Take the great man, Warren Buffett, now 93-years-old, still highly active and reading for hours every day. He no doubt keeps abreast of many major issues, and his age has certainly not stopped him backing Apple as his largest position. But another major holding of Buffett is Coca-Cola, and it's easy to see why Buffett owns it. With over 200 brands, their drinks are consumed two billion times per day. But it is also facing serious challenges from younger brands, growing consumption of healthier drinks, non-traditional promotions through TikTok, Instagram and YouTube and the increasing role of influencer partnerships. Buffett says he drinks five cans of Coke a day but is he an impartial judge of the business?

History is replete with companies whose strength seems unassailable but who fail to move with fashions, technology and the tastes of new generations. I hope there's a young person in Warren's office.

Of course, many will point to Buffett's decades of success which make him arguably the world's greatest investor, with Charlie Munger. That's all true, but Ashley Owen writes this week that Berkshire Hathaway has struggled to keep up with the market index for over 20 years, and like many fund managers, the outperformance which makes his 'since inception' numbers look good was achieved decades ago.

In his celebrated 1958 book, Common Stocks and Uncommon Profits, Philip Fisher posed these questions about the ability of companies to continue to innovate:

“Does management have a determination to continue to develop products or processes that will still further increase total sales potential when the growth potential of currently attractive product lines has largely been exploited?”

“Are there other aspects of the business, somewhat peculiar to the industry involved, which will give the investor important clues as to how outstanding the company may be in relation to its competition?”

Investors should look for companies willing to disrupt themselves by reinventing their business and trying new ideas that give optionality on the future. And ask your friendly fund manager how they ensure they hear a diversity of views.

***

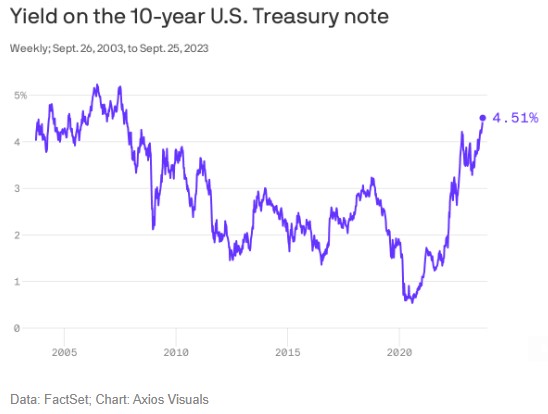

Stockmarkets are going through one of those tricky periods where the focus on rising rates is pushing down share prices, and it's difficult for investors to remain focussed on the long term. In Australia, we watch the cash rate more than any other rate, perhaps because so many of our loans are tied to it. In the US, the 10-year Treasury rate is as important as the Fed Funds rate, as it reveals much about interest rate and economic expectations. It has risen significantly recently, to levels not seen for 15 years, and investors and companies need to accept that the 'lower-for-longer' of 2019 to 2021 has gone. As the current Fed Funds rate is 5.5%, the 10-year shows an expectation of slower economic growth but not to such an extent that rates will fall dramatically.

Nevertheless, over the last 30 years, with many bumps along the way, US$100,000 invested in the US S&P500 would now be worth US$1.7 million. There are plenty of 'drawdowns', or market pullbacks, that caused great angst at the time, but who knows with hindsight when to get in and out? This table from Charlie Bilello shows Total Returns in each year since 1928 and the maximum drawdown for that same year, yet the market has averaged about 10% for nearly 100 years. Let's hope the future can be anywhere near as good.

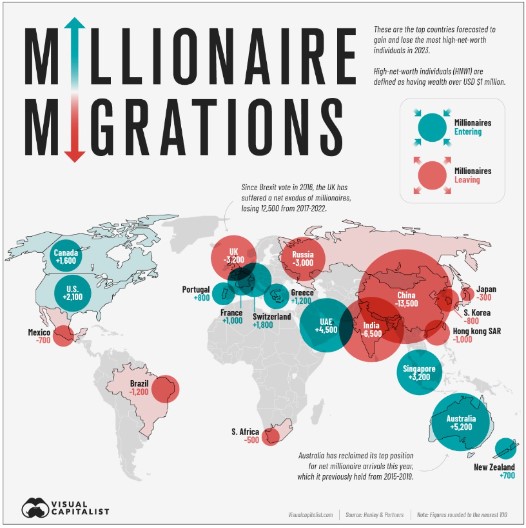

It has become commonplace for the media to report houses and apartments selling in Australia for $20 million, $30 million, $40 million and multiples more. Lendlease Property reported a $140 million sale at One Sydney Harbour in Sydney's Barangaroo and there are now plenty of $50+ million houses. In the entire world, it is forecast that Australia has reclaimed its position as the number 1 destination for millionaire migrants.

At the other end of the spectrum but still on property, The Sydney Morning Herald reported the death of a man who lived frugally in a derelict Clovelly home bought decades ago. It was "held together with weeks and pigeon poo". The man would visit the Clovelly Bowling Club every afternoon for a few beers and go home for a frugal dinner of baked beans. He lived "hand to mouth". The house sold for $4.55 million with the proceeds going to the Bill Crews' Exodus Foundation. The man could have been living a fine life with a combination of the Age Pension and a reverse mortgage, borrowing say $1 million at 22% loan to valuation. I doubt Mr Crews would have minded if the bequest was smaller. Don't forget to draw on all your resources to live a good retirement.

***

Moving on ... in my article this week, I look behind the intriguing contest between Magellan and Keybridge's Nick Bolton due to the discount in the listed Magellan Global Fund (ASX:MGF). Bolton is trying to force Magellan's hand to close or eliminate the discount and give value to his options (ASX:MGFO) but Magellan needs to ensure all unitholders are treated equally.

Graham Hand

Also in this week's edition...

Antipodes Partners' Jacob Mitchell identifies three features of global equities currently: a concentrated market, wide valuation dispersions and different cyclical and structural opportunities. Value stocks look especially cheap, according to Mitchell.

Australian banks have the ability to access emergency capital from the Reserve Bank by holding bonds to trade with the RBA. Jeremy Cooper believes super funds should have similar access to emergency funds. He suggests that it's unusual from a global perspective that the Treasury Department oversees super policy, and he'd favour a more formal relationship between the RBA and super funds.

While much of commercial property remains in the doldrums, industrial real estate continues to stand out. And Charter Hall's Steven Bennett says growth in online retailing and a shortage of facilities should continue to drive industrial demand and rents higher.

Aussie banks haven't had a great time of it over the past decade, though that could be about to change with higher interest rates, less competition and cost savings opportunities. Morningstar's Nathan Zaia suggests CBA is overvalued while Westpac can outperform.

Super concessions are forecast to overtake the cost of the Age Pension in the 2040s. Kaye Fallick reckons these concessions are creating a skewed system of reward for higher super balances in retirement and will widen the gap between rich and poor.

Two extra articles from Morningstar for the weekend. Mark LaMonica identifies four ASX stocks with sustainable and growing dividends, and the research team initiate coverage on 3 ASX stocks. with one undervalued opportunity among them.

Lastly, in this week's White Paper, First Sentier shares several tools for assessing the environmental risks of companies.

***

Weekend market update

On Friday in the US, the last session of the quarter was a bust for the bulls, as stocks reversed a-near 1% opening gap higher on the S&P to leave the broad index 25 basis points lower on the day. Meanwhile Treasurys likewise finished little changed with the two-year yield settling at 5.03% and the long bond at 4.73%. WTI crude slipped below US$91 a barrel, gold sank again to US$1,849 per ounce and the VIX bounced above 17.5.

From AAP Netdesk:

In Australia, the local share market closed modestly higher on Friday, but ended September with its worst monthly losses in a year.

The benchmark S&P/ASX200 index on Friday finished up 23.8 points, or 0.34%, to 7,048.6, while the broader All Ordinaries rose 27.2 points, or 0.38%, to 7,249.7.

The ASX200 finished the week down 0.3% and ended September down 3.5%, its worst month since a 7.3% fall in September 2022.

It also finished the third quarter down 2.15%, its worst quarter since a 12.4% drop in the second quarter of last year.

The ASX's 11 sectors finished mixed on Friday with seven up and four down.

Mining was the biggest mover, climbing 1.2% as BHP rose 1.2% to $44.25, while Rio Tinto added 1% to $113.55 and Fortescue gained 1.3% to $20.92.

Core Lithium soared 19.1% to a one-month high of 40.5c after announcing its first full-year profit as a lithium producer.

Core Lithium posted a net profit after tax of $10.8 million on revenue of $50.6 million, following its Finniss mine near Darwin going into production in October 2022.

The energy sector was slightly lower as Brent crude retreated from a 10-month high reached earlier in the week. Woodside and Santos both dropped 0.6%, to $36.49 and $7.90 respectively, while Whitehaven Coal fell 3.3% to $7.11.

Uranium stocks continued their bull run, however, with Deep Yellow up 1.9% to a nearly two-year closing high of $1.315, Boss Energy advancing 3% to a six-month high of $4.85 and Paladin Energy climbing 1.9% to a decade-high of $1.10.

The Big Four banks were mostly higher, with ANZ and NAB both up 0.7%, to $25.66 and $29.07 respectively. Westpac inched 0.1% higher at $21.15, while CBA was basically flat at $99.97.

From Shane Oliver, AMP:

- Global share markets fell again over the last week as bond yields rose further putting more pressure on share market valuations. Fed Chair Powell offered no objection to rising bond yields in a Q&A session and New York Fed President Williams said that rates may be “at or near the peak” but reiterated the Fed’s message about rates staying high for longer. For the week US shares fell 0.7%, Eurozone shares fell 0.9%, Japanese shares fell 1.7% and Chinese shares lost 1.3%. September lived up to its reputation as being a bad month for shares with US shares down 4.9% and global shares down 3.8%. Bond yields rose further, with the Australian 10-year yield rising to its highest since 2011. Metal prices rose but oil and iron ore prices fell. The $A was little changed, with the $US up slightly.

- From their July highs US shares have had a fall of 7% and global and Australian shares have had falls of 6%. Shares have become oversold and due for a bounce, but the risk of a further correction beyond any near-term bounce is high. The ongoing rise in bond yields on the back of central bank warnings of higher rates for longer have pushed the risk premium that the key direction setting US share market offers over bonds to its lowest in over 20 years.

- The RBA is expected to leave rates on hold at 4.1% on Tuesday. Since the last RBA board meeting the combination of softening full time jobs growth and a further fall in job vacancies, real retail sales continuing to fall and the underlying trend in inflation remaining down all against the background of tight monetary policy are consistent with the RBA remaining in 'wait and see mode' and therefore leaving interest rates on hold for the fourth month in a row. Our assessment remains that the RBA has done more than enough to control inflation and that rates have peaked ahead of rate cuts starting around June next year.

- However, the RBA is likely to reiterate its tightening bias “that some further tightening of monetary policy may be required” and the risk of another hike by year end has gone up to around 40% in our view with still sticky services inflation, increasing upside risks to wages growth, poor productivity and upside risks to inflation expectations posed by higher petrol prices. Against this though another rate hike would be very high risk as economic data is already slowing and we remain of the view that the risk of a recession is already around 50%. The money market is attaching a zero probability to a hike on Tuesday (which seems way too low), but 100% chance of a 0.25% hike by March next year.

Curated by James Gruber and Leisa Bell

This year’s conference is bringing high-quality industry insights, with an unmissable lineup of speakers. You'll also see me in conversation online on October 11, joined by Noel Whittaker and Danielle Ecuyer, two of the country’s most highly respected personal finance authors.

The event is in-person and digital, so you can access the conference however suits you best. To lock in your attendance, simply click here to register now. Tickets are just $27.50 for both days.

I look forward to seeing you there – come and have a chat.

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Plus updates and announcements on the Sponsor Noticeboard on our website