The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Imagine a multi-asset fund manager listed on the ASX. It’s been successful for decades by mostly investing in Australian equities, bonds and listed property/infrastructure, and that success had resulted in it gathering a large amount of funds under management. They start to gradually diversify into other assets such as overseas and unlisted investments. Then, they announce that they’re going to move much more aggressively into these newer areas. They say it will not only help with diversification but also prospective returns.

What would happen to the share price of this fund manager? As a best guess, the market would look sceptically at the announcement, and analysts would ask hard questions about the move to diversify beyond the manager’s core competencies. There’d also be queries about the risks involved given the poor track record of Australian companies which have ventured overseas.

While the above example is simplistic, the strategy of this fictional multi-asset manager is analogous to that of many of our large super funds. Yet, there’s been barely any questions asked about how the size of the super funds is essentially forcing them to diversify further into alternative and international assets, and the risks that this entails.

To infinity, and beyond

First, let’s put the size of our super funds into perspective.

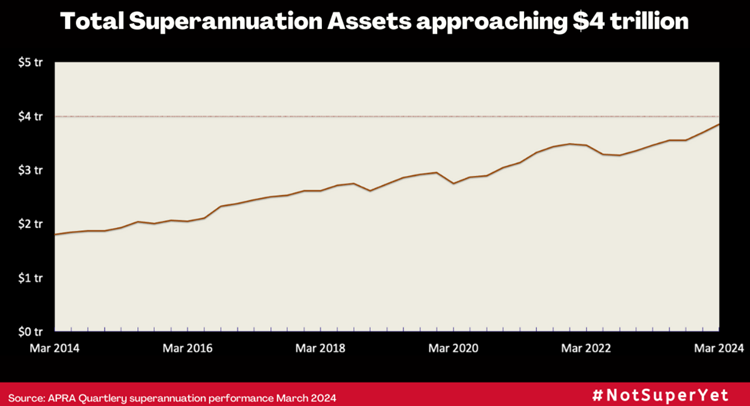

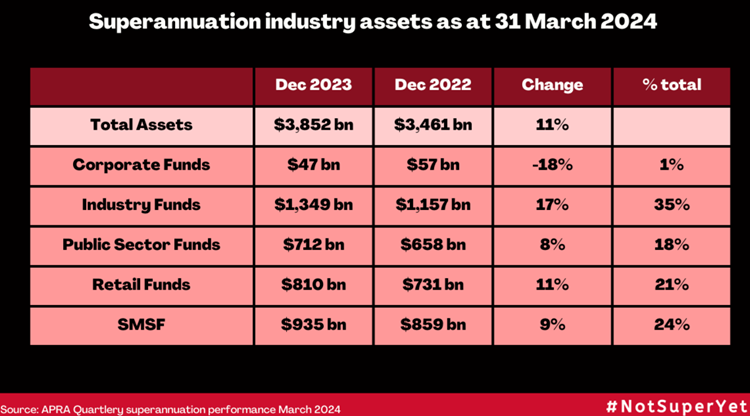

New figures from APRA this week show that superannuation assets will soon hit $4 trillion. In the year to March, total super assets increased 11% from $3.46 trillion to $3.85 trillion. Over the past decade, super assets have approximately doubled.

The industry superannuation funds' share of assets continues to grow, reaching 35% at end-March, with corporate funds being the main losers and SMSFs holding steady.

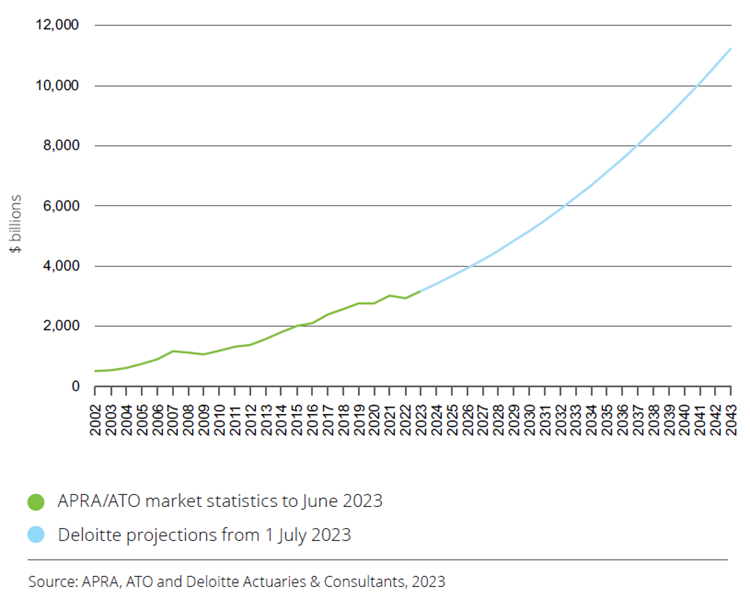

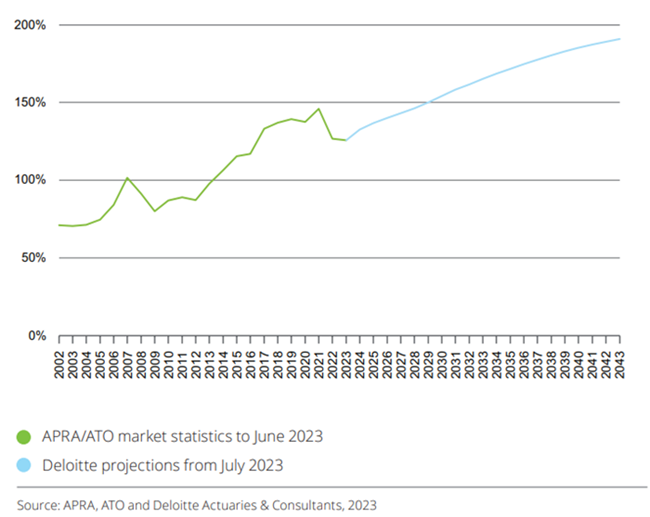

Australia’s pension assets are the fourth largest in the world. Super assets are now 145% of total GDP, compared to 108% a decade ago – the fastest growth versus GDP of any country.

Residential property is still the largest asset in Australia by far, at more than $10 trillion, or 2.6x the size of super funds.

However, Deloitte projects that super assets will grow to about $11 trillion by 2043, or close to 200% of Australia’s GDP.

Total superannuation assets

Superannuation assets as a proportion of nominal GDP

A recent KPMG report suggests that super funds are about to be hit by a wave of Baby Boomer outflows, yet this is likely a significant overreaction. It’s true that some of the large retail super funds are experiencing net outflows as their clients withdraw money. However, industry super giants are still growing strong. Net-net, super assets are expected to still increase significantly in coming decades.

Size is already creating challenges for super funds. These funds have always had a lot of equities exposure – initially primarily in Australia, though now more internationally.

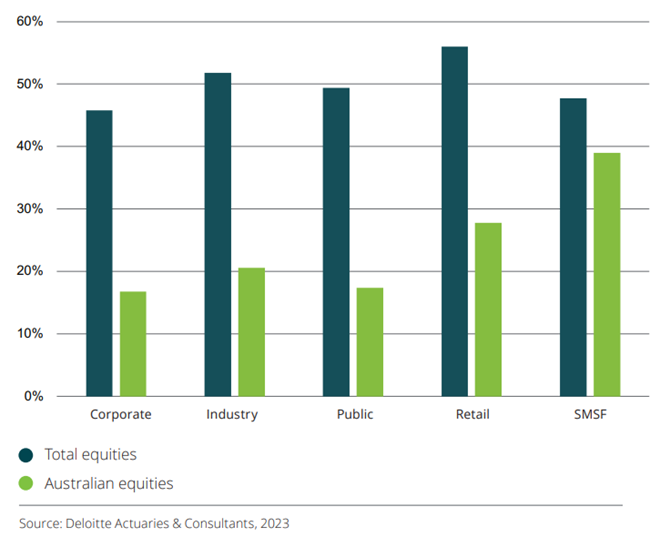

Super fund allocation to equities

The reason for having greater holdings in international stocks is not only to get exposure to sectors and returns that Australia may not offer, but also because the super funds are simply getting too big for the Australian share market.

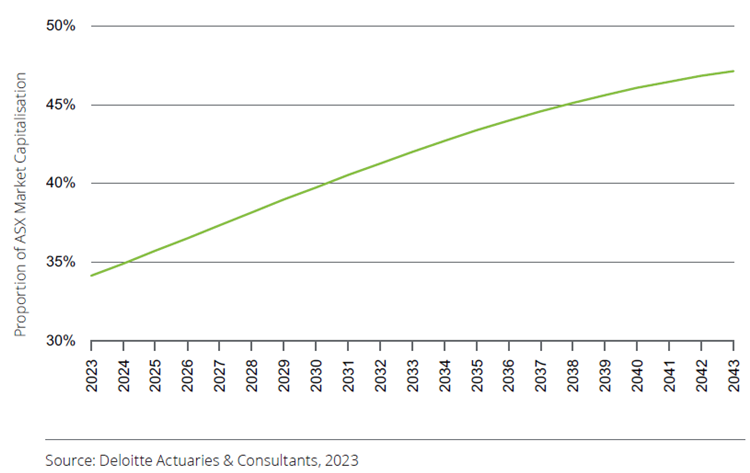

Deloitte estimates that investments by super funds were 34% of the total market capitalization of the ASX. And it expects that share will grow to almost 50% by 2043.

Proportion of ASX market capitalization represented by super funds

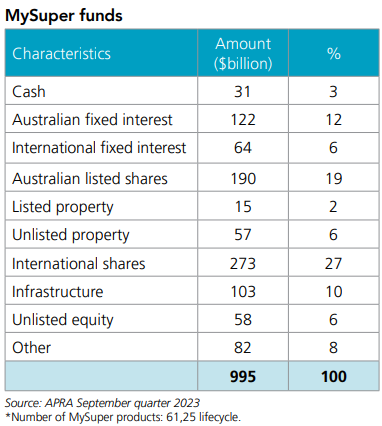

Super funds’ diversification beyond Australia has accelerated of late. NAB’s Super Insights Report suggests that allocations to offshore investments by funds rose to 47.8% in 2023, up from 46.8% in 2021, and 41% in 2019.

The funds have also been diversifying into unlisted assets, which now account for about 20% of total industry allocations.

Maintaining domestic allocations “not practical”

Australian Retirement Trust’s Head of Investment Strategy, Andrew Fisher, had some fascinating things to say about the challenges faced by mega funds at the Morningstar Investor Conference in Sydney last week. He said it’s “not going to be practical” for the larger funds to continue to maintain the current level of domestic allocations.

“I’d be lying if I said $280 billion of assets to invest is not a challenging task at times”, he said.

“It is a lot of money and we’re forecast to go to $500 billion by the end of the decade, those are the internal numbers we’re dealing with.

“Realistically, it’s not going to be practical for us to continue to maintain the level of domestic allocations, particularly listed market equity allocations that we have.”

It’s not just an equities issue. With Australia being one of the first countries to privatise infrastructure, locating opportunities in the domestic market has become more challenging, according to Fisher.

“The market is finding new and innovative ways to create infrastructure - digital infrastructure is quite popular now - but realistically, there’s some underdeveloped markets offshore where we’re likely to see better opportunities,” he said.

Fisher suggested that the fund still holds a “strong preference” for domestic investment where possible.

“Our members are Australians, their liabilities are linked to Australian inflation, and the best protection against that is investments in the domestic economy.

“We certainly will be strongly committed to investing domestically, but there is an inevitability with scale that we’re going to have to increasingly move offshore, and also an inevitability with being one of the first mover countries in the infrastructure space - there’s only so much infrastructure that can be sold,” he remarked.

It explains why Australian Retirement Trust opened its first overseas office in London in mid-March.

On the same panel as Fisher at the Morningstar conference, UniSuper’s Head of Private Markets, Sandra Lee, said her fund had taken a different tack to investing internationally. Rather than launching an office overseas, UniSuper has chosen to partner with “high quality managers” operating globally.

Lee pointed to the “complexity in going overseas”, including currency hedging and finding a common language with a different team of co-investors.

Sizeable issues

There are two key challenges that size brings to Big Super. First, concerns returns. Consider Australian Retirement Trust mentioned above. It manages $280 billion. To get a 7% return, it needs to make $20 billion a year. If its funds increase to $500 billion by 2030 as they project, then they’ll need to make $35 billion. Earning that sort of money is far from easy.

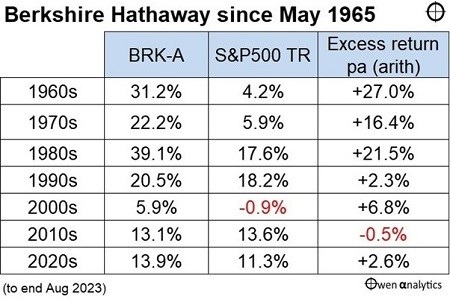

Warren Buffett once said that “it’s a huge structural advantage not to have a lot of money.”

“Anyone who says that size does not hurt investment performance is selling. The highest rates of return I’ve ever achieved were in the 1950s. I killed the Dow. You ought to see the numbers,” he said.

Buffett isn’t lying. While he spoke of his hedge fund above, even the numbers from his listed company, Berkshire Hathaway, show that his outperformance has dwindled as Berkshire has become larger.

The other risk that size can bring is if diversification becomes ‘diworsification’. The core expertise of super funds has traditionally been in Australian listed stocks, bonds, and real estate. Deeper moves into international equities make sense though require a broader skillset.

The funds’ increasing exposure to unlisted assets also brings opportunities and risks. Yes, private assets are currently offering higher returns than stocks and bonds. The trade-off is that they’re illiquid and offer much less transparency.

You don’t have to look far to see the risks with unlisted assets. Whether it be current wrangling over Healthscope’s debt, the yo-yo valuations of Australian tech startup Canva as revealed by Franklin Templeton (though not by Australian super fund holders), and redemptions being frozen at several large private equity funds.

There’s plenty that the large super funds must deal with, and getting the rewards versus risks right will be a big task in the years ahead.

***

In my article this week, housing looks like becoming a key election battleground as the Liberal Party proposes to cut migration numbers to "restore the Australian dream" of home ownership. It got me thinking about this idea of The Australian Dream. Where did it come from? What does represent? Is it still relevant? And, is it the best definition of success and prosperity?

James Gruber

Also in this week's edition...

The introduction of a tax on the unrealised gains accumulated in superannuation funds greater than $3 million in value may also become an election issue. Clime's John Abernethy hopes it does, but he also challenges our politicians and bureaucracy to think in different ways to utilise the strategic and unique benefits of our massive superannuation. One idea: infrastructure bonds.

We're often quoted life expectancy at birth but what matters most is how long we should live as we grow older. Graham Hand says that it's surprising how short this can be for people born last century, so make the most of it.

What can poker teach investors? Ophir's Andrew Mitchell and Steven Ng say one key concept is what poker players called 'resulting'. That is, the tendency to judge a decision based on its outcome rather than its quality. It's something that happens a lot in investing, though should be avoided at all costs.

Should you buy and hold an artificial intelligence portfolio? John Rekenthaler looks back at the performance of Internet stocks to see if it offer clues about the wisdom of such a strategy.

MFS' Robert Almeida thinks we're entering a new, higher cost environment that will hit the P&Ls of companies in many sectors. He's more bullish on commodities, as there's a supply shortage and increasing demand via mega trends including AI and green energy.

Electric vehicle demand has stalled, surprising many. What's behind the slowdown, and is it a temporary blip or something more long-term? The Firetrail team provides some answers.

Two extra articles from Morningstar this weekend. Jon Mills makes a case for Newmont shares and Joseph Taylor looks at the valuation of Soul Patts' big three equity holdings.

Lastly in this week's whitepaper, Payden and Rygel, an affiliate of GSFM, breaks down the opportunities in securitised credit.

***

Weekend market update

On Friday in the US, stocks ended the month in fitting fashion, as a ferocious late rally pushed the S&P 500 from the red to a near 1% advance on the session, extending May’s gains to north of 5%. Treasurys enjoyed a moderate bid across the curve, with 2- and 30-year yields declining by three and four basis points, respectively, to 4.89% and 4.65%, while WTI crude fell to US$77 a barrel, gold retreated to US$2,328 per ounce and bitcoin edged lower at US$67,600. The VIX tumbled below 13.

From AAP Netdesk:

The Australian share market on Friday finished on a high note, snapping its three-day losing streak with gains that accelerated in the late afternoon to close out May firmly in positive territory. The benchmark S&P/ASX200 index on Friday rose 30 points in the final 30 minutes of trading to finish up 73.5 points, or 0.96%, to 7,701.7, while the broader All Ordinaries rose 74.9 points, or 0.95%, to 7,970.8. A day after erasing all its gains for the month, the ASX200 ended up finishing the month up 0.49%, defying the adage "sell in May and go away". It lost 0.34% for the week, however - its second straight week in the red.

All of the ASX's sectors except for property finished higher on Friday, with consumer staples the biggest mover, rising 1.9% as Woolworths added 2.0%.

In the heavyweight mining sector, goldminers shone. Northern Star added 2.8%, Evolution added 2.4% and West Africa Resources rose 7%. Elsewhere in the sector, BHP gained 0.5% to $44.51 and Rio Tinto added 1% to $128.96, while Fortescue edged 0.2% lower at $24.74.

In the health care sector, Telix Pharmaceuticals and Avita Medical both posted double digit gains on the back of some good news for both companies. Telix soared 15.3% to an all-time high of $18.15 after positive data from a small clinical trial evaluating its potential prostate cancer treatment, while Avita Medical added 12.4% to a six-week high of $2.99 after receiving US approval for an advancement in its spray-on skin treatment for burn victims.

All of the big retail banks were higher, with CBA up 1.3% to $119.54, NAB adding 0.9% to $33.91, ANZ advancing 1.2% to $28.25 and Westpac climbing 0.2% to $25.98.

In other news, fast-food chain Guzman y Gomez on Friday announced it would list on the ASX in late June, once it has completed a $242.5 million public offering, the second biggest of the year. At the offer price, Guzman will have a market capitalisation of $2.2 billion, making it a likely ASX200 component.

From Shane Oliver, AMP:

- Major global share markets fell over the last week, as higher bond yields weighed. For the week US shares fell 0.5%, Eurozone share lost 1%. Japanese shares fell 0.4% and Chinese shares fell 0.6%. This still left US shares up 4.8% in May and global shares up 3.8% after the weakness seen in April. Bond yields pushed higher again, not helped by weak bond auctions in the US possibly suggesting that investors may be getting concerned about the widening US budget deficit which is now above 6% of GDP and will likely worsen if Trump wins the upcoming election. Oil, metal and iron ore prices fell, but the $A rose helped by a slightly weaker $US.

- Australian inflation surprisingly rose in April. The uptick in the Monthly Inflation Indicator to 3.6%yoy from 3.5%yoy was disappointing and contrary to our own expectations for a fall. The main drivers were weather related food prices, tobacco, health insurance premiums, fuel prices and continued rapid increases in rents and general insurance. Worryingly for the RBA, underlying measures of inflation edged higher with the trimmed mean inflation rate rising to 4.1% with ongoing sticky services inflation.

- The further uptick in inflation keeps the risk of another RBA rate hike high and reinforces that rates will be high for longer. This was reflected in money market expectations that swung back towards pricing in the risk of another rate hike and pushed back expectations for a rate cut till late next year.

- But inflation is likely to resume its downtrend and the economy is looking weaker, so we still see the next RBA move as being a cut. The RBA is likely to again consider the case for another rate hike at its 18 June meeting just like it did at its May meeting. However, while the risk of another hike is high (particularly in August if June quarter inflation is higher than the RBA expects) the most likely scenario is that rates will remain on hold: the rise in monthly inflation to 3.6%yoy in April may not have been a surprise to the RBA as its forecasting 3.8%yoy inflation this quarter; the monthly CPI Indicator is very volatile; much of the monthly rise in May looks to have been seasonal with the CPI up 0.7%mom but the seasonally adjusted CPI up 0.2%mom; May tends to be a weaker month with the CPI falling in 4 of the last 6 Mays; cost of living measures will help pull down headline inflation in the second half of the year; and weak spending in the economy (evident in retail sales and construction over the last week) will continue to bear down on inflation by making it harder for companies to raise prices. In short, the April rise in inflation is not enough to push up the RBA’s inflation forecasts for inflation to be back in the target band in 2025 and 2026, which would be necessary for it to hike again.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

LIC Quarterly Report from Bell Potter

Australian ETF Review from Bell Potter

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website