The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

In 1920, the world was still recovering from the momentous loss of life and geopolitical turmoil caused by the Great War. To protect domestic industries, especially agriculture, the US decided to increase tariffs on foreign goods by four-fold. Those tariffs stayed in place for nine years.

At the same time, Congress was debating a cut to immigration after a large influx of southern and eastern Europeans following the war. In 1921, it passed the Emergency Quota Act, which ultimately led to an 80% fall in immigrant numbers to the US.

Major tariff hikes and savage immigrant cuts would normally hit economic growth and result in higher inflation. Yet, instead, we got the ‘roaring 20s’.

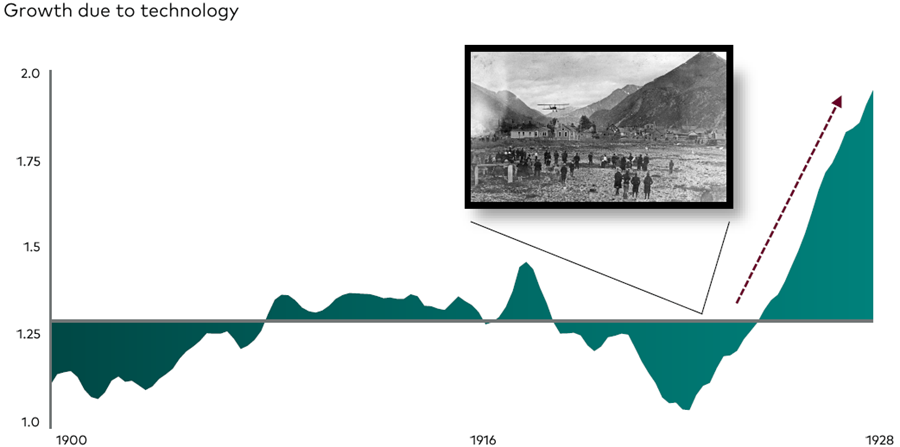

How did this happen? The photo below offers a clue.

Source: Vanguard

The photo was taken in a small Alaskan mining town in 1920. The plane in the picture was one of four planes making their first long-distance flights from the US to Alaska.

Not only were airplanes changing the world at that time, but the diffusion of electricity was too. Electricity had been around for three decades by then, but it was only in the 1920s that it was used more fully to generate cheap power for the US economy.

These technological trends were enough to overcome the powerful deflationary forces of tariffs and immigration cuts and propel America’s economy over that next decade.

A change few saw coming

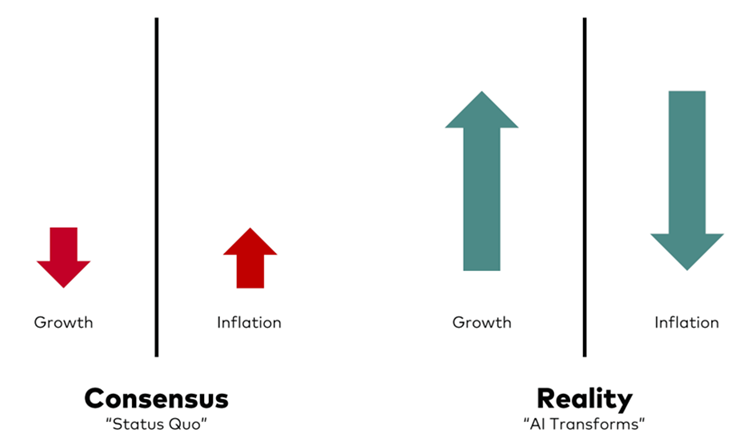

Source: Vanguard

Parallels to today

Vanguard’s US-based Global Chief Economist, Joe Davis, told this story to financial advisers in a recent presentation in Australia.

He went on to draw parallels between the 1920s and today. Like then, Trump is now hiking tariffs, though they’re nowhere near as harsh as those implemented a century ago. Also, he’s looking to slash immigrant numbers, raising concerns about the impact on economic growth.

However, like in the 1920s, Davis thinks that technological change can outweigh these growth dampeners to lift US economic productivity and tame inflation.

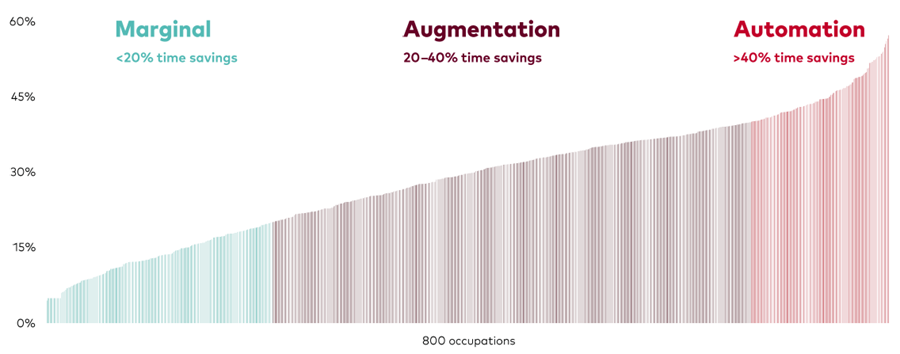

Source: Vanguard

Calculating AI’s impact

It’s all well and good to suggest that AI will transform the economy, but Davis has put numbers on the impact that the technology will have.

He’s mapped out 800 different occupations and calculates the effect that AI will have on each of them. He puts the impact into three categories:

Marginal. <20% time savings.

Augmentation. 20-40% time savings (where AI augments a current job).

Automation. >40% time savings.

Here are the results of his research.

AI’s future impact

Source: Vanguard

Davis calculates that AI will lead to 20-40% in time savings in more than half of all occupations. Also, the number of occupations that will be augmented or automated by AI outweighs those where it will have a marginal impact by a factor of four to one.

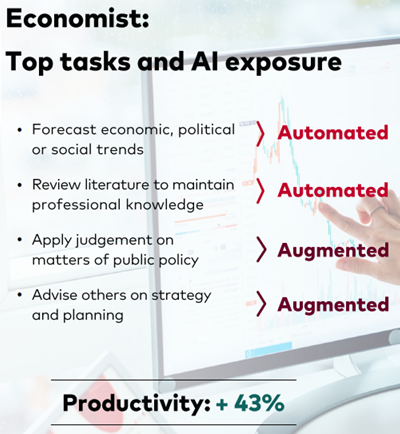

He gave an example from his own profession: an economist. He outlined how he asked ChatGPT to build an inflation prediction model and give a 100-word summary. Davis says AI can do this task in less than a minute compared to the five hours or so that it would take an economist. And he’s calculated that AI will lift productivity in the economist profession by 43% over the next decade.

Source: Vanguard

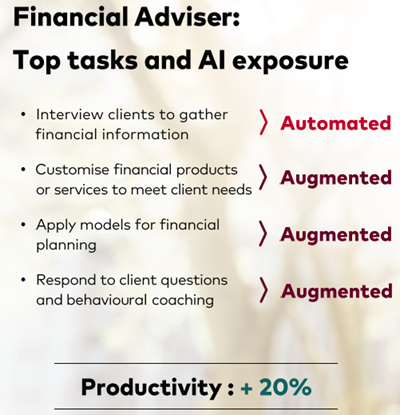

Davis gave another example of a financial adviser, and a breakdown of which tasks could be augmented and which could be automated:

Source: Vanguard

He thinks interviews with clients to gather financial information can be automated, though I’m not so sure. As for other tasks, Davis says AI can augment the work of advisers.

At the presentation, I talked to a financial adviser who detailed how he’d automated his administrative tasks as well as client letters and other tasks via AI. He says this led to two of his employees being made redundant. However, AI has allowed him to focus on the most value-added parts of his job – talking with current and prospective clients.

This story amplifies much of what Davis’ presentation was addressing.

Investment implications

So, we can look forward to surging US economic growth and muted inflation, according to Davis. What does this mean for markets? It’s here that Davis has some surprising conclusions.

He believes that if you believe in the AI transformation, you should own the broader market rather than tech stocks.

Davis thinks overweighting US tech is a mistake for two reasons:

- Much of the upside potential in US tech stocks is already priced in.

- The tech sector doesn’t usually outperform during periods of technological transformation. He expects some future tech stars to emerge, but there will be a large percentage of those in the sector that flop. For every Amazon that emerged from the Internet bubble, there were dozens of startups that failed. Davis also harkened back to the 1920s, where it wasn’t technology companies that ultimately benefited most.

If he’s right and AI is a transformative technology with positive economic outcomes, Davis expects AI’s influence to emerge most in sectors outside of tech, like healthcare, finance, and manufacturing.

For these reasons, he says investors should own value stocks over growth ones, like tech. And he expects the broader US market to outperform the US tech sector moving forwards.

My take

Davis offers an intriguing and compelling view of the future of AI and its impact on the economy and markets.

Yet, I’m sceptical of his forecasts on productivity growth from the tech transformation. Economists love to use numbers because they can seemingly give certainty to future outcomes. Unfortunately, the future is inherently uncertain.

Even Mike Cannon-Brookes, the boss of Atlassian, recently said in a company conference call that anybody who thinks they know what AI will do in a few years is kidding themselves.

I see three current issues with AI:

- It regurgitates rather than creates. Ask the AI engines to be creative, and they are found wanting.

- It sides with consensus over individual thought and truth. AI trawls through public data and often sides with what the majority think of an idea rather than the truth, or original thought.

- It makes us dumb. AI is providing shortcuts to research and writing, yet it's often in the process of research and writing where hard fought knowledge is won.

That said, Davis may be right about AI being a fillip for economic productivity. And I suspect he will be proven correct about AI being more positive for non-tech companies than the AI providers themselves.

* Disclosure: Vanguard is a sponsor of Firstlinks.

In my article this week, I cover the latest investment update from one of the most powerful fund managers in the country, Jon Pearce of UniSuper. Pearce warns that after two years of stellar returns, he expects markets will be flat this year, with the potential for a correction of 10% or more. Though cautious on short term, he's more positive on the long term outlook.

James Gruber

Also in this week's edition...

Clime's John Abernethy says Governments and policymakers have failed us for decades on housing, and it risks creating an underclass in a society that supposedly boasts one of the world's highest standards of living. He puts forward nine ways to fix the housing mess - some of them controversial and radical - before it's too late.

Meanwhile, Yunho Cho and colleagues investigate the impact of stamp duty on the housing market, and how reforming the tax could help mobility and improve overall welfare for households.

Australia has one of the world's highest dividend yielding sharemarkets, providing substantial benefits to investors and retirees. Despite this, Ashley Owen says that individuals often seek higher yields, to their detriment.

Schroders' Andrew Fleming wants MIGA - to make income great again. By this he means the market has rewarded unprofitable businesses with promises of future riches over the past few years, but that may be about to turn, highlighting recent updates from companies such as Domino's Pizza and Boral.

There are two articles on the US market. The first is from Eric Marais of Orbis who breaks down the key drivers of recent US market returns, such as revenue, margins, and valuations, and looks at how these drivers will shape future performance. Meanwhile, Tarek Abou Zeid and colleagues at Man AHL highlight how diversification in portfolios will become important once 'US exceptionalism' fades.

Two extra articles from Morningstar this weekend. Jon Mills weighs up BHP after its dividend cut and Nathan Zaia shares his view on NAB after a tough week.

Lastly, in this week's whitepaper, Fidelity shares insights on AI, China, and the new Trump administration, along with compelling investment ideas, from Fidelity International's more than 100 analysts across the world.

****

Weekend market update

In the US on Friday, shares closed sharply lower after reports showed both business and consumer optimism sank this month as President Donald Trump presses ahead with his effort to impose tariffs and slash the federal bureaucracy. The S&P 500 shed 1.7%, the Nasdaq Composite slumped 2.2%, and the Dow Jones tumbled 1.7 per cent %. 10-year Treasury yields fell eight basis points to 4.43%. Brent crude oil slipped below $74 a barrel.

On Friday, the Australian share market suffered its worst weekly loss in more than two years after giving up ground each day, while the local currency has climbed to a two-month high. The benchmark S&P/ASX200 index on Friday shed 0.32% to 8,296.2, while the broader All Ordinaries fell 0.36% to 8,570.9. For the week, the ASX200 shrunk 3.03%.

The ASX's losses came even as three firms were buoyed by M&A activity.

Domain Holdings soared 40.1% to a three-year high of $4.37 as Nasdaq-listed CoStar Group, the owner of Homes.com, lobbed a $2.65 billion takeover offer for the Aussie property listing firm.

Nine Entertainment, which owns a 60% stake in Domain, jumped 20.1% to a nearly one-year high of $1.73, while realestate.com.au owner REA Group sunk 11.3% to a one-month low of $236.18 on the prospect of its competitor getting a well-funded new owner.

In health care, Mayne Pharma soared 33.1% to a 10-month high of $7.20 after agreeing to be acquired by US-based Cosette Pharmaceuticals in a $672 million deal.

Telix Pharmaceuticals also had a strong day, climbing 13.8% to an all-time high of $30.12 after the Melbourne-based radiopharmaceutical company beat guidance by posting $783 million in full-year revenue, up 56% from a year ago.

QBE rose 3% to $20.68 after the insurance company announced a full-year profit of $1.8 billion, up from $1.3 billion in 2023.

"We beat our plan for the year, continue to demonstrate greater resilience and are excited about our prospects for the year ahead," said group chief executive Andrew Horton.

On the flip side, Spark New Zealand sunk 19.3% to a decade-low of $2.13 as NZ's leading telecommunications firm slashed its full-year guidance after a tough first half.

Austal climbed 13.2% to $4.04 after the shipbuilder announced its half-year net profit had more than doubled to $25.1 million, and had record work in hand of $14.2 billion.

The big four banks all finished in the red, with CBA falling 2.6% to $151.73, ANZ dropping 1.4% to $28.79, Westpac dropping 0.6% to $31.03 and NAB dipping 0.1% to $31.03.

In the heavyweight mining sector, BHP grew 2.8% to $41.26, Fortescue climbed 2.3% to $18.65 and Rio Tinto advanced 2.8% to $123.49.

From Shane Oliver, AMP:

Share markets fell over the last week on the back of concerns about the economic outlook. The key US share market fell 1.7%, with Trump’s policies appearing to depress consumer confidence and business conditions data and with options’ expiries adding to weakness on Friday. Eurozone shares also fell 0.3% and Japanese shares fell 1%, but Chinese shares rose 1%. Australian shares fell 3% for the week on the back of disappointing earnings news particularly from the banks and cautious RBA comments on the outlook for further interest rate cuts. The falls were led by financials, energy and retail shares. Bond yields fell in the US on concerns about growth but rose in Europe, Japan and Australia. Oil and copper prices fell on global growth concerns, but gold rose to a new record high and the iron ore price rose. Bitcoin fell with US shares. The $US and the $A were little changed.

Shares remain vulnerable to increased volatility and a correction. The key risk factors are stretched valuations, Trump’s tariffs and other policies potentially adding to US inflation and cutting into global and Australian growth and various geopolitical risks. So, we continue to see a high likelihood of a 15% plus correction at some point this year. But ultimately, we still see shares doing okay this year as Trump’s more negative policies are constrained by a desire to see shares rise at the same time that some of his policies reinvigorate the US, and with most central banks including the RBA continuing to cut rates boosting growth and profits.

The loud daily noise out of the Trump Administration continues and will be an ongoing source of volatility for investors.

- Trump’s extraordinary tirade against the Ukrainian President Zelinsky reinforces his “America first” approach (maybe he is trying to send a message to other countries not to pick a fight with big neighbours that want to take them over like Panama, Greenland and Canada!) and will add to geopolitical uncertainty with a clear implication being an ongoing increase in defence spending (good for defence related shares). This is particularly likely to be the case in Europe and could help reinvigorate short term growth there, despite the obvious longer term negatives.

- Trump’s deregulatory focus continues to gather momentum with Trump signing an executive order to bring independent regulatory agencies (like the Fed with respect its regulatory responsibilities, the Securities Exchange Commission and the Federal Communications Commission) under his control meaning all regulations will be reviewed by the White House.

- Progress towards resolving Trump’s tax and fiscal agenda in Congress is slow. DOGE won’t find enough spending cuts to offset the cost of extending the 2017 tax cuts and enacting more tax cuts without cutting into things like Medicaid. This is creating pushback from some House Republicans and there is a high risk of a Government shutdown on 14 March when government funding runs out. Fortunately, shutdowns tend not have major economic or market consequences. The bigger threat is the debt ceiling, but it won’t be reached till the September quarter.

The good news is that we got a break from formal new tariff announcements over the last week…but they are still coming with Trump reiterating that he will likely impose tariffs on cars, semi-conductors and pharmaceuticals with this likely to be around 25% and a formal announcement likely soon after his trade policy reviews are complete by 1 April. This will also be when other tariffs will be announced including around “reciprocal tariffs.” As with steel and aluminium and potentially reciprocal tariffs, Australia is also likely to be caught up. Last year we exported about $2.1bn of pharmaceuticals to the US, bigger than the $800m of steel and aluminium. But as with the latter the case for an exemption is high because the US has a trade surplus with Australia. But an exemption is not assured. Its worth reiterating though that steel, aluminium and pharmaceuticals exports to the US are only a small proportion of the Australian economy at just 0.11% of GDP and the bigger threat to Australia from Tariff Man comes from the indirect effect of a global trade war with the US leading to the less demand for our exports.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly Bond and Hybrid updates from ASX

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website