The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Today’s newsletter marks a special occasion for Firstlinks – the publication of the 600th edition. Starting in February 2012, Firstlinks has become one of the must-read publications in the financial industry. We’ve published about 4,000 articles and an estimated six million words from hundreds of different writers.

The occasion is tinged with some sadness as co-founder and driving force, Graham Hand, isn’t here to celebrate it. However, I can hear him in my ear now telling me to get on with the job and ensure that the newsletter is even better over the next 12 years.

Firstlinks will evolve over time though the mission will stay the same: to provide readers with quality, independent writing on key investment strategies and ideas.

To our community of readers, thank you. We appreciate your support and if you haven’t already, please spread the word about Firstlinks.

Finally, a big shout-out to our sponsors and third-party writers – without them, this publication wouldn’t be possible.

Recently, I attended a unique event with a crowded room of mostly financial advisers. Hosted by Pinnacle, the ASX-listed house of boutique fund managers, it featured six of their global fund managers who offered starkly different equities strategies and market insights.

First up was Hyperion’s Jolon Knight. Knight outlined how Hyperion invested in structural growth and innovation leaders. Their companies are disruptive, have strong competitive advantages and are capital light which leads to higher returns on capital. Top holdings in its global fund are Tesla (NASDAQ: TLSA), Amazon (NASDAQ: AMZN), and Microsoft (NASDAQ: MSFT).

Hyperion’s focus on growth stocks has served it well. Last year, the fund returned a stellar 52.5%. Its long-term track record is good too, with annual returns of 20.3% since inception in 2014.

In his presentation, Knight addressed worries about market concentration in US tech stocks. He said they were overplayed and that stock returns have always been concentrated, citing data from Henrick Bessembinder that 2.4% of listed companies account for all net global stock market wealth creation over the past three decades.

As to the other current concern about valuations of markets, Knight was equally dismissive, suggesting that investors have worried about this every year over the past decade, and yet markets have marched higher.

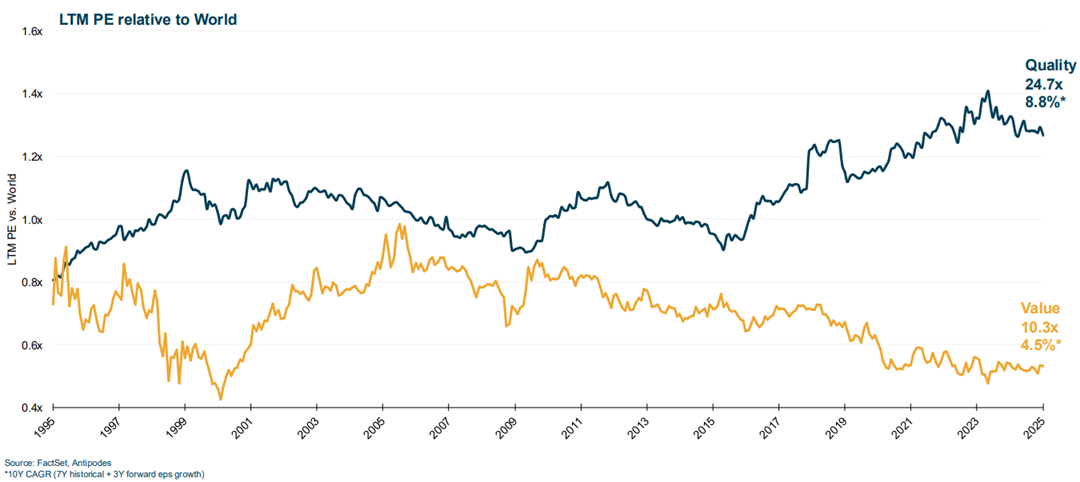

Next up was Antipodes CIO, Jacob Mitchell, whose take on markets was almost diametrically opposed to Knight’s. Antipodes strategy is one of ‘pragmatic value’ which involves seeking mispriced opportunities relative to the underlying resilience and growth in businesses.

As you can imagine, the global fund has struggled somewhat, thanks to value stocks being in the doghouse.

In his presentation, Mitchell said that, yes, there was a bubble and it’s in ‘quality’ stocks.

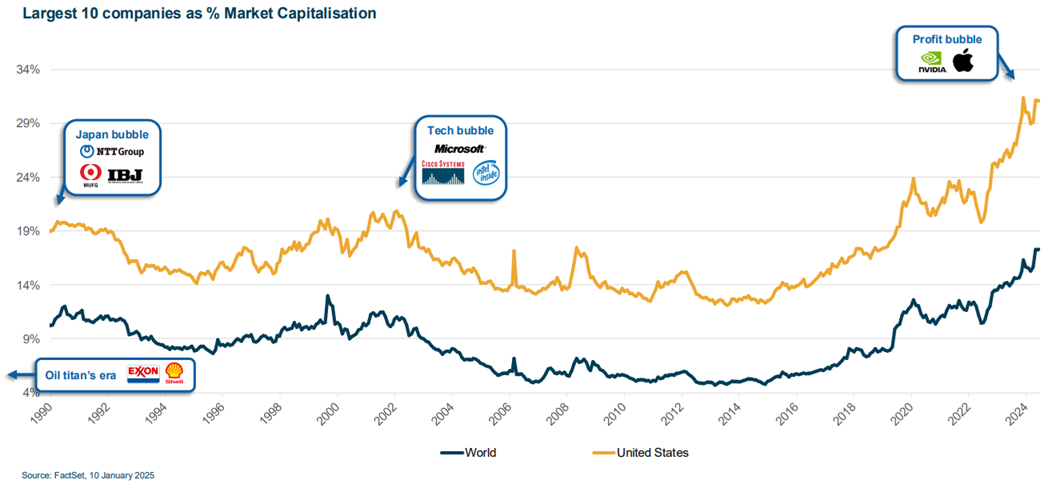

Unlike Knight, Mitchell also laid out the case for why US market concentration poses significant risks. He said market concentration wasn’t just a US phenomenon but a global one.

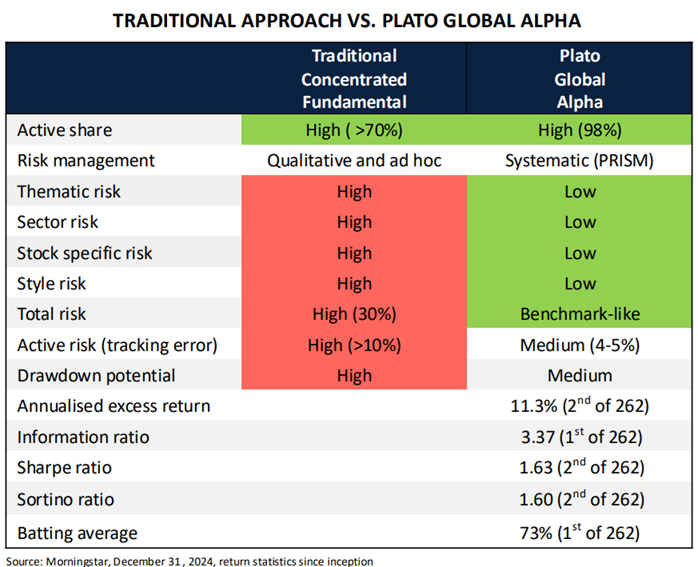

Plato’s David Allen then offered a different view of things. Allen runs the Global Alpha fund, which is a long/short aiming for consistent outperformance across market cycles. The fund has a shorter track record than Hyperion or Antipodes, though has performed well thus far.

Allen explained how his fund was different to competitors: it relies heavily on quantitative rather than qualitative processes and therefore takes less overall risk.

He said his fund takes the best value, growth and other opportunities to create an all-weather portfolio. And on the short side, he leaned on a proprietary +100 red flags system to detect shorting opportunities. The red flags track things such as management stock sales, employee ratings, auditor track records, and accounting manipulation.

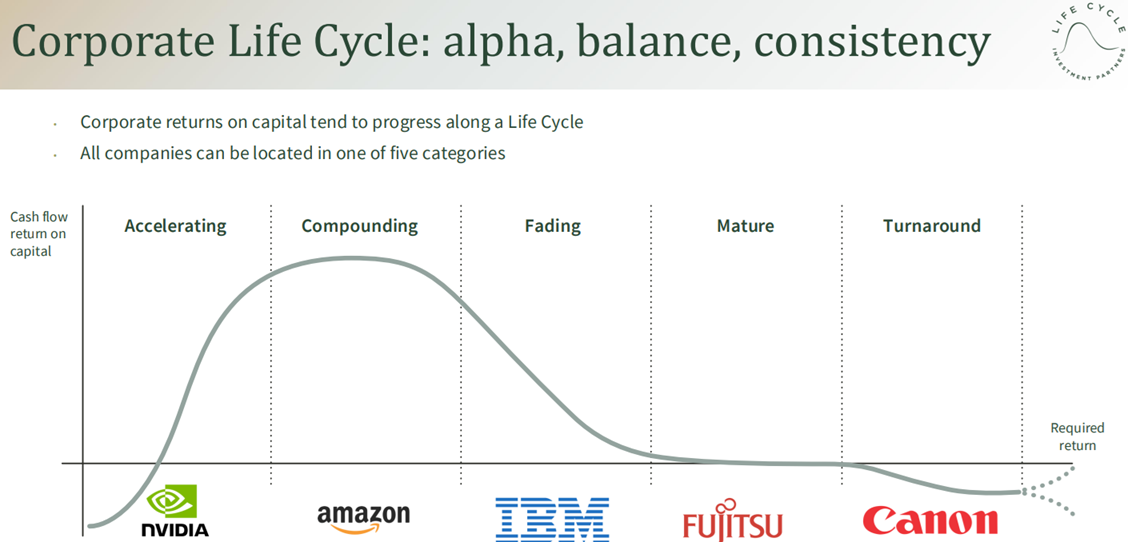

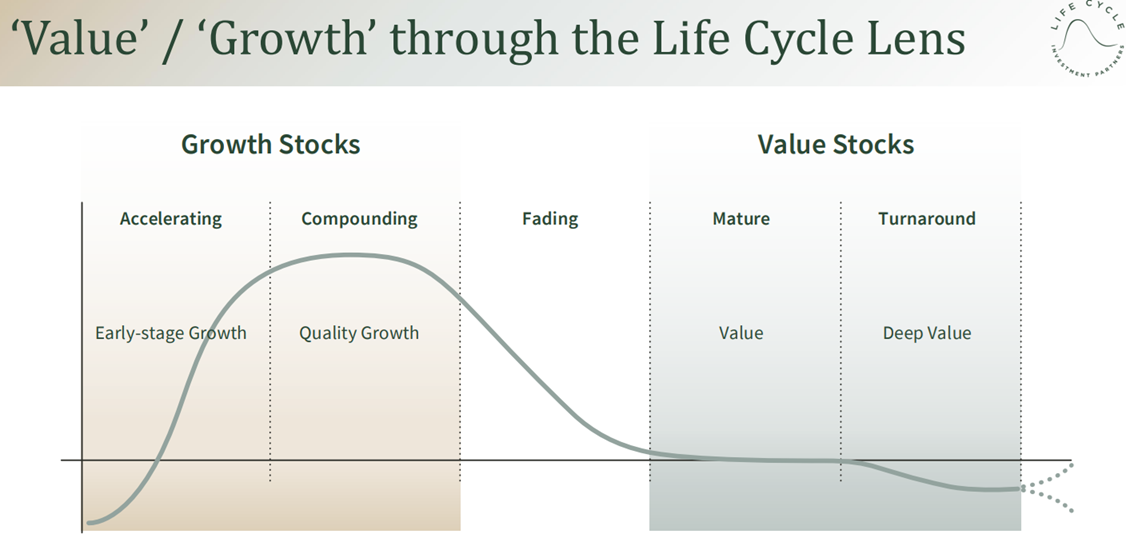

A new member of the Pinnacle stable is Life Cycle Investment Partners and its UK-based manager, Peter Rutter, outlined how his fund provided a different type of all-weather portfolio.

He spoke of how businesses have life cycles: they first accelerate, then compound, before fading, and maturing, and then eventually turning around (hopefully). And returns on capital tend to track this life cycle.

Rutter’s fund invests across all the different phases of the corporate life cycle. That means it invests in tech and airlines, and everything in between.

Unlike the other funds, Resolution Capital is more niche, and Sarah Lau gave an overview of its Global Listed infrastructure Fund. She detailed how the nuclear power renaissance and the fastest electricity growth since the invention of air conditioning – thanks to AI – is turning previously mundane infrastructure stocks into significant opportunities.

Last on stage was Firetrail’s James Miller, who spoke of his company’s focus on investing in companies that were adapting to the future, such as agricultural machinery giant, John Deere (NYSE: DE). That said, he was cognizant of current risks, especially of high market valuations.

What to make of the different strategies and views?

At the end of the event, my head was spinning. Six different global equity strategies with six very different market insights.

Then I wondered what the room of advisers thought of it. I spoke to one at my table from a family office. He said he owned the Hyperion and Plato funds. When I pressed him on Hyperion, he said that “you own it if you think interest rates are going down”. But he noted that you needed to be aware of the “downside capture” – referring to the financial term, downside capture ratio, which measures how well an investment performs relative to a benchmark index during a down market.

Put simply, he was telling me that you want to own growth funds when rates are declining, though look out if they’re going the other way.

It gave some useful clues about how he thought about fund managers. Yes, he examined their track records, the managers themselves, the processes, and a myriad of other things. But he also thought of how these funds fit into his overall portfolio.

I imagine that Hyperion would serve a specific purpose in his portfolio, while Plato would serve another. Other funds would have alternative purposes. And I assume that the goal would be to create a portfolio that outperforms across a market cycle.

Why not just go for managers with great long-term track records? Well, the risk is that you might crowd into funds with similar characteristics and risks. For instance, you might be all-in on ‘growth’ funds which have had fantastic returns in recent decades, though it may not remain that way forever.

Source: Firetrail

Why not just own the ‘all-weather’ funds like Plato or Life Cycle? These types of funds are likely to have their own idiosyncratic risks. For instance, one of my questions of Life Cycle would be how their fund managers and analysts can be experts across all five different phases of a business cycle, and the companies in each phase. Having been a fund manager myself, I would suggest that being good at one style of investing, such as value, is hard enough. Being good at five requires a lot of work and even more skill.

A portfolio view

Too often people see stocks and funds in isolation ie. if I own this stock or fund, I’ll outperform. But the question you should be asking is what purpose this stock or fund serves in my portfolio. And, how does it complement other stocks or funds in your portfolio.

* Disclosure: Pinnacle affiliates Resolution Capital and Antipodes are Firstlinks sponsors.

My article this week looks at Warren's Buffett's annual shareholder letter and how what he leaves unsaid speaks volumes...

James Gruber

Also in this week's edition...

With the arrival of the new year, the first members of ‘Generation X’ turned 60, marking the start of their collective journey towards retirement. Harry Chemay asks whether Gen Xers and our retirement system are ready for the transition?

Kaye Fallick is back, this time with an article canvassing four thought leaders in the retirement industry to find out their best ideas on how to fix our broken retirement income system.

Star stock picker, Jun Bei Liu, has just formed a new investment firm, Ten Cap, and today she provides her thoughts on an odd and wild reporting season and the outlook for the Australian market.

The 2015 Paris Agreement on climate targets is in jeopardy, thanks to the US withdrawal from the agreement and Trump's vow to "drill, baby drill", according to Tony Dillon. He says it has major implications for the push towards net zero emissions, including for Australia.

MFS' Rob Almeida believes the US has started a new capital cycle with funding driving investment in tangible assets instead of dividends and buybacks. That will lead to a regime change in stock markets with a different set of winners and losers.

Commercial property has had a horrid two years and the big question is whether the worst is behind us. Colin Mackay of Cromwell Funds Management says there are signs it might be.

Two extras from Morningstar this weekend. Brian Colello reflects on Nvidia’s latest results, while Joseph Taylor weighs up Guzman y Gomez and Reece’s earnings season slump.

Lastly, in this week's whitepaper, Kevin Hebner of TD Epoch - a GSFM affiliate - investigates a topic that's dominating news headlines: Trump, tariffs, and the new global economic order.

****

Weekend market update

On Friday, US stocks staged a strong bounce, accelerating upwards into the bell to leave the S&P 500 with a 1.6% advance and recoup more than half of this week’s losses, while Treasurys also enjoyed a bid with two-year yields dropping below 4% for the first time since October. WTI crude edged lower at US$70 a barrel, gold retreated to US$2,858 while snapping an eight-week winning streak, bitcoin rebounded above US$84,000 and the VIX ebbed below 20.

From AAP netdesk:

The local share market's slide intensified on Friday, with the bourse falling to its lowest level in eight weeks after US President Donald Trump affirmed tariffs are coming. The benchmark S&P/ASX200 index fell 1.16%, to 8,172.4 while the broader All Ordinaries fell 102.2 points, or 1.2%, to 8,403.9. The ASX200 declined 1.5% for the week following its 3% loss last week - its worst loss in more than two years. It dropped 4.2% for February, its worst monthly drop since a 7.3% slide in September 2022.

Every ASX sector except telecommunications finished in the red, with technology, consumer staples and materials/mining all down more than 2%.

BHP lost 2.5% to $39.04, Fortescue fell 3.7% to $16.51 and Rio Tinto retreated 2.9% to $113.37.

Star Entertainment Group was the worst performer in the ASX200, plunging 15.4% to a three-week low of 11 cents after the embattled casino operator said it was waiting to receive one or more bailout offers that could save it from insolvency.

Endeavour Group retreated 7.1% to a two-week low of $4.17 as the bottle shop operator and pub owner reported its half-year profit was down 15.1 per cent to $298 million.

Coles dropped 2% and Woolworths fell 2.3%.

The big four banks were mixed, with NAB dropping 0.4% to $35.30 and ANZ dipping 0.3% to $29.79 while Westpac rose 0.6% to $31.81 and CBA added 0.3% to $156.74.

Harvey Norman rose 2.6% to $5.22 after the retailer posted a first-half profit of $400.3 million, up 41.2% from a year ago.

Digital property settlement platform Pexa Group and family location-sharing app Life360 also did well after releasing earnings, rising 8.1% to $12.31 and 7.2% to $23.30 respectively.

From Shane Oliver, AMP:

Global share markets mostly fell again over the last week on the back of increasing concerns about the economic outlook with weaker data out of the US and new tariffs from Tariff Man along with concerns the AI share boom may be over. Despite a bounce on Friday on the back of dip buying and hopes the 25% tariffs on Mexico and Canada won’t go ahead on Tuesday, US shares fell 1% for the week and are down 3.1% from their recent high. Japanese shares fell 4.2% for the week and Chinese shares fell 2.2% but Eurozone shares gained 0.2%. Bond yields fell on the back of concerns about growth. Oil, metal, gold and iron ore prices all fell. And Bitcoin fell again with the fall in US shares. All the tariff talk and concerns about global growth saw the $US rise and the $A fall. After a brief relief rally on seemingly false hopes US tariffs won’t be as bad as feared, it looks like the $A is on its way to a retest of its February lows.

Our view has long been that this year would see more constrained, but still positive share market returns as central banks including the RBA continue to cut interest rates boosting growth and profits and Trump’s more negative policies are constrained by a desire to see share market’s ultimately rise with his more positive policies dominating.

However, we continue to see a high likelihood of a 15% plus correction along the way reflecting stretched valuations and Trump’s more negative policies around trade and government spending and the risks around this are rising. Back in 2016 I worried that Trump would staff his administration with crackpots. By and large he didn’t and it led to constant team turnover but there were several adults in the room providing a brake on more extreme policies. This time around it seems there are a lot less with Trump appointing loyalists and being far better organised. There is much in Trump’s platform that makes sense from a rationalist economic perspective - notably tax cuts, smaller government and deregulation. But at present it seems his administration is going off the deep end with numerous extreme measures, including:

- multiple new (sometimes contradictory) tariff announcements every few days - the latest being on copper (this will have a “big impact” according to Trump), a 25% tariff on the EU (“which was formed to screw the US”), another 10% tariff on China on 4 March and the 25% tariffs on Canada and Mexico to start on 4 March (although they may still be headed off). All of which along with the uncertainty of more to come will wreak havoc with global trade, add to Americans’ cost of living and add to business uncertainty. And its increasingly likely Australia will face US tariffs too whether it’s on steel and aluminium or something else – but just remember Australian exports to the US are a small part of our economy and the real threat is from reduced global trade due to the tariffs hitting our exports;

- talk of an External Revenue Service to collect tariffs and replace income tax – yes tariffs will raise revenue but at best they will raise a fraction of income tax revenue and common sense tells us that if tariffs are raised to a level that production is shifted back to the US (as Trump says he wants) then the tariffs will raise no revenue as there will be no imports to tax;

- talk that the “the world owes us billions” for the security the US provides - much of the rest of the world will differ on this;

- DOGE undertaking heavy handed public service cutbacks (helped by an AI assessment of “what did you do last week?” and pitting Federal colleagues against each other) causing mayhem in public services and lots of legal challenges;

- Trump appearing to side with Russia against Ukraine; and

- Trump reposting a video seemingly confirming his envisioned transformation of Gaza into something like this…

Maybe it’s not all as crazy as it looks to many, but a new kind of smart! But the manic announcements out of the White House are running big risks with the US economy evident in falling US consumer confidence and business conditions and rising consumer inflation expectations. In terms of the latter Trump has managed to do what 9% inflation in 2022 didn’t, ie push US 5 to 10 year inflation expectations to their highest in nearly 30 years. This will worry the Fed and risk higher than otherwise interest rates. In terms of the hit to the Federal public service - it employs 1.5% of US workers but there’s twice that dependent on government contracts.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from Bell Potter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Plus updates and announcements on the Sponsor Noticeboard on our website