The Weekend Edition includes a market update (after the editorial) plus Morningstar adds links to two highlights from the week.

If you are wondering whether bankers are really so mean as to withhold interest rate increases on deposit accounts to make more profits, the answer is yes. I have sat on the Pricing Committees of three banks and this is a time to restore bank margins. I can quote John Maynard Keynes because I was a 'banker' for 20 years, and some of our pricing decisions were embarrassing and even nasty and took advantage of what we called 'retail inertia' (the decisions rather than the people were nasty).

"Capitalism is the extraordinary belief that the nastiest of men, for the nastiest of reasons, will somehow work for the benefit of us all."

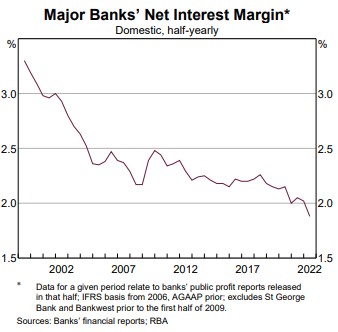

The vast majority of depositors either don't know how much their accounts earn or can't be bothered to change and hundreds of billions of dollars sits in savings regardless of the rate paid. The bankers take advantage of this and (as we used to say) 'milk' the basic transaction and savings accounts. In 2021, when cash and term rates fell to almost zero, there was nowhere to go on deposit accounts as rates could not move negative. At the same time, competition in the mortgage market intensified, and these factors drove a margin fall which the banks will now recover.

On the loan side, the five largest banks took little time on Tuesday this week to pass on the 0.25% cash rate increase into their variable rate mortgages. These major pricing decisions are always approved at Managing Director level, but the Pricing Committees were ready to press the button with pre-approval for whatever the Reserve Bank decided.

Depending on competition and success in holding back deposit rate increases, the major banks should be able to extract about 0.1% margin improvement for every 0.5% increase in the cash rate. Equity investors have flocked back to bank shares this week, not only due to expected margin improvements but also confidence that bad debts will not rise in a recession.

The interest rate on my SMSF's transaction account, which is holding more cash than ever, confirms I must find another home. Based on conversations during my presentation to the Australian Shareholders Association a couple of weeks ago, many SMSF trustees are in the same boat, holding lots of cash. Everyone needs to check their rates.

The Reserve Bank cash rate is now 2.6%, yet my bank is paying zero for balances below $10,000, and 0.7% to 0.8% for amounts below $100,000.

Of course, the banks will say there are alternatives, but they often come with well-designed hurdles to reduce their cost. Take the CBA Goalsaver account, which pays a decent 2.1% on all balances. However, nearly all of it depends on depositor behaviour and earning a 'bonus':

"Earn a variable bonus interest rate when you grow your savings balance each calendar month (excluding interest and bank-initiated transactions) ... The standard variable interest rate of 0.15% p.a. will apply if you don't meet the bonus interest conditions."

Make one withdrawal which reduces the monthly balance and there goes the 2%. Same with NAB's iSaver. It starts out well with an 'introductory' 2.3% for four months, but remember that 2.3% for four months is only 0.76% per annum. Then reality kicks is as the 'bonus' is lost:

"0.85% p.a. base variable rate + 1.45% p.a. fixed margin for 4 months. After 4 months, the base variable rate of 0.85% p.a. will apply."

NAB has said its deposit rates are "under review" - yes, with a plan to not do much - and no rates were increased at the same time as the loan rate announcements.

Macquarie Bank is moving more into the retail space with a new Savings Account and a 'welcome rate' of 3.7% for four months, but only on the first $250,000. Then it reverts to 2.75% or 2.35% for up to $500,000 and a miserly 1.5% over $1 million. It is, of course, only available to new customers. Banks do not reward loyalty.

ING Bank is expected to grab headlines with a new savings rate this week at around 4%, but there will be rules including making at least five card transactions a month and depositing $1,000 each month.

Bank of Queensland offers a Future Saver account paying 4% but it's only available to customers aged 14 to 35.

Ubank offers a base rate of 0.1% then a bonus of 3.25% if a $200+ deposit is made each month, but only up to $250,000.

None of this happens by accident, and it's not a way to encourage people to save more, however it is presented. It's designed to attract new deposits without paying existing savers, and then hoping those new customers do not cost too much. For savers, it's time-consuming to shift money around every few months or monitor whether their account will earn a 'bonus'.

Of course, there are smaller banks more reliant on the retail market and depositors are protected by the Financial Claims Scheme guaranteeing $250,000 per person per institution. Unfortunately, banks like Judo and MyState are more competitive in term deposits (such as a decent 3.6% for 12 months) which reduces liquidity if the money is needed quickly for another investment. There is also the pain of going through an account-opening process with all the ID and paperwork.

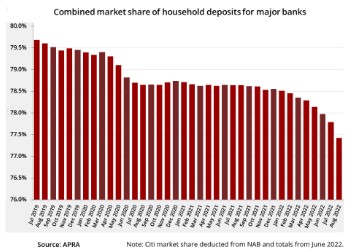

According to the newsletter Banking Day, the four majors are deliberately conceding ground on deposits to preserve margins, as shown in their share of household deposits.

Banking Day says:

"In August two of the major banks – Westpac and ANZ – suffered a net outflow of deposits as savers chased better deals at other institutions. According to APRA data, Westpac’s total deposits base contracted by more than A$3 billion in August while ANZ lost more than $2 billion of deposits."

More than at any time for at least 10 years, savers should take an active decision on their cash. Don't wait for your bank to meet the market, and the incentive to move will only increase. Despite the Reserve Bank slowing the pace of rate increases this week, the cash futures rate for mid-2023 is still around 3.6%.

In this week's edition ...

The majority of Firstlinks' readers have no intention of applying for the age pension, as our research shows a high proportion of self-funded retirees in our audience. The pension is not a level of retirement income to aspire to. However, most Australians will receive a full or part pension for many decades to come, and many older retirees worry about 'running out of money'.

What if, when a couple became eligible for the age pension, the Government offered a choice of $1 million or the current pension rate? Seems an easy decision - become an instant millionaire. Yet it's close to a line ball decision mathematically based on demographics, as the full age pension for a couple is over $40,000 a year forever, plus many other benefits and concessions. For a couple that also owns their own house and can access the equity in it, they are overstating the fear of actually 'running out of money'.

Kaye Fallick is more concerned about the lack of education, as many retirees are not receiving the financial skills and access to advice needed to take advantage of pension and superannuation opportunities. She asks what happened to all the schemes of the last 20 years that were supposed to help.

Along similar lines, Tim Howard of BT Financial Group checks in with his advisers to find the most-common topics for discussion with clients in recent months. These five items show the benefits of advice and why retirees need to know what is available. In the context of the first article above, it's good to see home equity access on the list. Is it finally coming out of the shadows as a retirement income device?

Then two articles from leading fund managers on how they identify companies and construct their portfolios.

Marcus Burns and Matthew Booker of Spheria look at how bubbles develop, especially in small listed companies, and how to avoid these overvalued companies whose share prices are more about hype than profits. And Brad Kinkelaar of Barrow Hanley describes why value investing has recovered ground in the last year and the sectors he is investing in.

Central bankers and investors are hoping high energy prices will be transitory, but what is happening in Europe and the consequences over a cold winter show the reliance on Russia for gas was a terrible mistake. Michael Collins explains why energy prices will stay higher for longer.

And still on global geopolitics, John West looks at Australia's most important trading partner, China, and reviews the power of its political elite. China will hold only the 20th National Congress of the Communist Party in a few weeks’ time on 16 October, but not everyone will be happy to extend Xi’s term of office.

Two additional articles from Morningstar for the weekend. Jocelyn Jovene asks whether tech stocks in Australia and the US will repeat a similar bubble burst as in the dotcom era of 2000, while Fernando Luque asks whether the current market looks expensive or cheap.

This week's White Paper is from Cromwell Property Group, explaining how ESG principles can guide investment decisions in commercial property, especially within a reuse-adapt-develop framework.

Finally, the Optus hack is a warning about online security, and we all need to focus more on password management and two-factor authentication (2FA). However, a security specialist sent me this graphic explaining how a fraudster acquiring personal details can arrange for the 'second factor' (such as receiving a code on a phone) can be sent to another phone. It's why access to personal details is especially worrying.

Graham Hand

Weekend market update

On Friday in the US, the S&P500 lost 2.8% and NASDAQ was down a large 3.8% as stock traders turned negative again following reassessment of hte Fed's inflation intentions.

From AAP Netdesk: The Australian share market recorded its first losing session in four days on Friday following hawkish comments by Federal Reserve officials and ahead of an important monthly US jobs report. The benchmark S&P/ASX200 index finished the day down 55 points to 6762.8, a drop of 0.8%. The index was up 4.5% for the week, its best performance for two years. However, that doesn't fully reverse the previous three weeks of losses.

The losses came after US Federal Reserve officials overnight emphasised the need for continued rate hikes, with Minneapolis Fed president Neel Kashkari declaring "we're quite a ways away from a pause".

Friday was generally negative for the ASX except in the energy sector, which rose almost 1% as oil prices climbed again following this week's OPEC+ production cuts. Woodside gained 0.2% but Santos was up 1.9%. Coalminers Whitehaven and New Hope were again setting fresh all-time highs, climbing 4.8% and 1.2% respectively. The mining sector was down 1.2% as BHP dipped 1.7%, Rio Tinto declined 1.4% and Fortescue Metals retreated 1.7%. All the big banks were modestly down. The ASX's small-cap cannabis stocks were rallying after US President Joe Biden pardoned thousands for marijuana possession and said his administration would review whether the plant should be in the same category as drugs such as heroin and LSD.

From Shane Oliver, AMP: Share markets had a bounce in the last week from oversold levels and lots of negative investor sentiment after falling back to around their June lows. The bounce was helped along by the UK tax backflip, softer US manufacturing and jobs data which may take pressure off the Fed in a 'bad news is good news' way and, for Australian shares, the dovish RBA hike.

However, the bounce was short lived with solid US jobs data being seen as keeping the Fed hawkish for now so US and European shares fell sharply on Friday paring gains for the week, but still leaving them above their lows. Over the week as a whole US shares still rose 1.5% and Eurozone shares gained 1.3%. Japanese shares rose 4.5% as did Australian shares with both missing out on the Friday fall which came after US jobs data.

Shares have effectively made a double bottom but the tech wreck and GFC bear markets saw several similar big 5% plus rallies that proved short-lived only to see the bear market resume. And from a macro perspective the risks are most likely still on the downside in the short term as central banks remain hawkish, recession risks are high and still rising, the conflict in Ukraine looks likely to escalate, oil prices could move higher on OPEC’s move to cut oil production and earnings expectations are still being revised down.

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from Bell Potter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

LIC (LMI) Monthly Review from Independent Investment Research

Plus updates and announcements on the Sponsor Noticeboard on our website