The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

In 2001, Jim Collins released his bestselling book, Good to Great: Why Some Companies Make the Leap ... and Others Don't. In the book, Collins set out to identify the universal distinguishing characteristics that cause a company to go from good to great. He found characteristics such as Level 5 leadership, a culture of discipline, the hedgehog concept, and the flywheel.

If these concepts sound like corporate gobbledygook, that’s because they are. A former business consultant, Collins couldn’t resist vague consultant-speak and trying to fit backward-looking data and themes into a coherent, or in this case, not so coherent whole.

The book came to mind after recent revelations of Warren Buffett’s sell-down of Apple (NYSE: AAPL), which I wrote about here. Buffett identified a great company in Apple in 2016 and bought it at a low valuation. The valuation is much steeper now though I suspect that’s not the only reason why Buffett is selling. I think Apple has gone from a great business to a good business, and could turn into a mediocre one, and Buffett knows it.

Why? Because Apple has built several great growth businesses, first with the iPod and iPhone and then the iPad. If it can’t build another growth business from here, revenue growth is likely to be anaemic and current valuations don’t reflect that. And it means returns from the stock could be below-average or even miserable over the next decade.

Source: Morningstar

It got me thinking about other businesses which may be turning from great to good, or perhaps average. I’m going to suggest the big 4 banks, CSL, and Mineral Resources are heading that way, and that there are five tell-tale signs which show why.

The decline of the big 4 banks

It’s been bizarre to witness soaring bank stocks over the past year, despite recent trading updates showing that their earnings are going backwards. The future looks bleak too. Credit growth is mediocre after a four decade binge driven by Australia’s housing bubble. Recent data shows that most bank loans are going to the wealthy, and the remainder of the population is being shut out. Combine this with greater competition in the mortgage space, and it’s hard to see how this gets better.

It's true that the banks’ deposit base looks as solid as ever. Though online banks and fintechs are nibbling away at this as well.

Cost cutting will get harder too. Yes, the banks can shut down more of their branches, yet a lot of that work has already been done. Technology could help, however progress will probably be slow.

All up, the earnings picture for the Big 4 banks looks poor, and that’s without assuming any rise in bad debts, which remain at historically low levels.

The banks’ big advantage is that they operate in an oligopoly backed by government. But that won’t stop them going from good, or even great businesses, to average ones.

Source: Morningstar

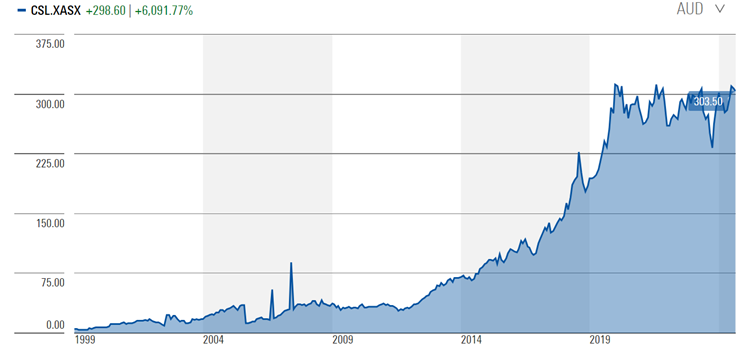

CSL: a big boat proving harder to move

After IPO’ing at $2.40 in 1994, CSL (ASX: CSL) has been a wonderful Australian success story. It’s one of the few Australian companies that’s become a global leader in its field. And shareholders have benefited mightily, with the stock price up around 375x (split-adjusted) over the past 30 years (excluding dividends).

Source: Morningstar

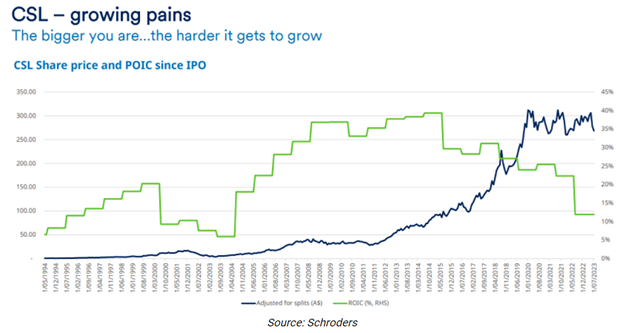

With a market capitalization of $148 billion, though, size is becoming more of an issue. Growth is proving more difficult to come by, and acquisitions harder to find. This is best illustrated by the following chart.

The chart shows that returns of capital have plummeted since 2015. In that year, CSL acquired the flu vaccine business of Novartis. Despite the success of this business, returns have declined. That trend has accelerated following the 2022 purchase of Vifor.

This doesn’t rule out that returns may improve from here, but I’d suggest that the glory days of CSL are behind it, and tougher times may lay ahead.

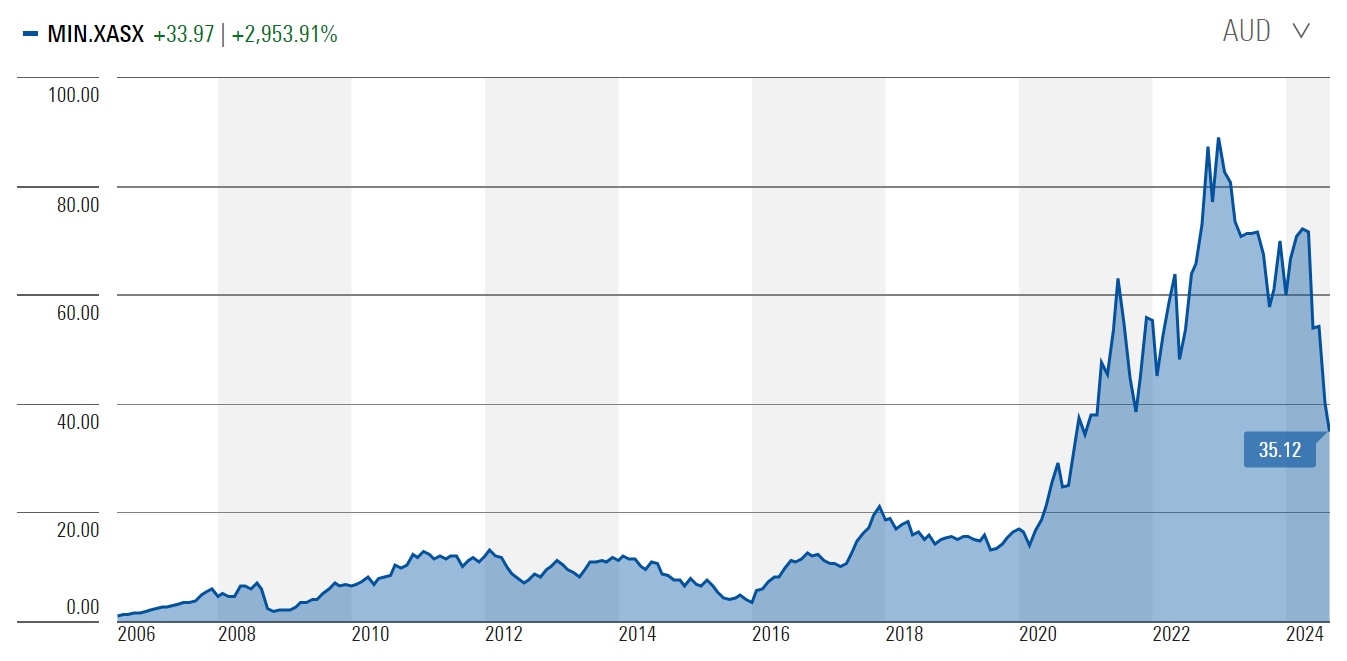

Mineral Resources’ red flags

Mineral Resources (ASX: MIN) has been another fantastic success story. It IPO’ed in 2006 at 90 cents and peaked above $96 early last year, before plummeting back to today’s price of close to $35.

Source: Morningstar

The company owns a great mining services businesses that generates prodigious and relatively steady cashflow. It also has solid iron ore assets. However, the company piled into lithium mining at exactly the wrong time and piled on debt too. That’s left a company vulnerable to two things it can’t control: commodity prices and interest rates.

Chris Ellison is a successful entrepreneur who may have taken one too many risks. His recent erratic behaviour isn’t reassuring.

5 tell-tale signs of great companies going bad

Here is my list of some of the tell-tale signs when wonderful businesses may be turning into mediocre ones:

- Long growth runways get shorter. It could be a technology that’s maturing as with Apple, or a cyclical trend such as credit growth that’s running out of steam a la Australian banks.

- Size limits growth. It’s much harder to grow when you’re a huge company versus being a minnow. CSL is the latest example of this.

- Acquisitions go bad. Many companies will reach for acquisitions to kickstart growth. Research suggests that most M&A is value destructive, and there’s been a long history of Australian companies making bad acquisitions, especially overseas.

- Management turns awry. Buffett loved that Apple was buying back stock when the share price was cheap several years ago. He’s likely less enamoured with recent purchases when the stock is arguably expensive. Bad management can turn a great company into a mediocre one.

- New competition bites. Wonderful businesses and sectors attract competition. That competition can eventually make headway and destroy companies which fail to adapt. Look at traditional department stores, television operators, phone companies, and the list goes on.

----

In my article this week, I look into whether it's possible to build a bulletproof investment portfolio that will perform well in any economic environment. So-called 'All Weather' portfolios have become trendy thanks to hedge fund titan Ray Dalio, and I run through what these portfolios are and their pros and cons.

----

And for those who are interested, I recently appeared on Morningstar's Investing Compass podcast talking about Australian stocks to buy and hold forever. Enjoy.

James Gruber

Also in this week's edition...

This week, APRA announced its long awaited proposed changes to bank regulatory capital funding. In short, the hybrid market for Australian banks will be phased out. BondAdvisers' Charlie Callan and Jack Pobjoy delve into the detail of the announcement and the potential opportunities and pitfalls ahead.

Schroders' Martin Conlon says plenty of money is sloshing around and it's ending up with those more inclined to invest than spend it, which is driving asset prices and markets higher. That's benefiting financial assets over real assets, and growth stocks over value ones. Conlon doesn't think this is sustainable, and he explains why.

The latest house price data shows Sydney continues to have the most expensive median dwelling value, but the gap between it and mid-sized cities like Brisbane and Adelaide has narrowed substantially. And, amazingly, Melbourne's housing values are now the sixth lowest across the eight capital cities. Tim Lawless details the key drivers of these trends.

Another ASX reporting season is over, and Hugh Dive lays out the key themes that came from it, including green shoots in consumer spending, signs of China's economic malaise, and higher interest rates having a different impact across companies. He identifies the winners and losers, and what's ahead for markets.

News Corp's plans to sell Foxtel are surprising given that streaming assets Kayo, Binge and Hubbl look likely to go with it. Harry Morrow and Tom Keir believe this and recent events in the US show the bind that legacy TV businesses find themselves in.

Artificial intelligence is taking the world by storm but how will it impact the investment industry? Man AHL's Harry Moore and colleagues reveal how their company is using AI to get a competitive edge.

Two extra Morningstar articles this week. Joseph Taylor highlights an out of favour ASX share that is awash with cash, while William Kerwin looks at Apple after its latest product launch.

Finally, in this week's whitepaper, the Franklin Templeton Institute examines how global equities have performed during previous Federal Reserve easing cycles.

***

Weekend market update

Friday the 13th was another lucky day for the bulls in the US, as the S&P 500 added another 0.5% to finish with a steep 3.2% advance to swiftly erase the bulk of last week’s selloff in a similar fashion to that seen in early August. Treasurys rallied as well with two-year yields diving another seven basis points to a fresh year-to-date low of 3.57%, while the long bond ebbed to 3.98% from 4% Thursday. WTI crude ticked above US$69 a barrel, gold remained red hot at US$2,581 per ounce, bitcoin jumped to near US$60,000 and the VIX settled south of 17.

From AAP Netdesk:

The local share market on Friday climbed for a second day, with goldminers in particular posting solid gains as the yellow metal changed hands at its highest-ever level. The benchmark S&P/ASX200 index on Friday closed a whisker under 8,100, rising 24.2 points to a 10-day closing high of 8,099.9. For the day it was up 0.3% and for the week it gained 1.1%, more than making up for last week's losses. The broader All Ordinaries on Friday rose 30.4 points, or 0.37%, to 8,323.5.

The top four gainers in the ASX200 on Friday were all goldminers, with Perseus Mining, West African Resources, Capricorn Metals and Red5 rising between 10.2 and 8.2%. Evolution Mining grew 6.9% to a three-week high of $4.32, Newmont added 3.9% to $78.70 and Northern Star advanced 3.7% to an almost four-year high of $15.60.

Elsewhere in the mining sector, BHP rose 2% to $39.60, Rio Tinto added 0.9% to $111.42 and Fortescue finished 5% higher at $17.50.

Overall four of the ASX's 11 sectors rose on Friday and five fell, with the bourse's two consumer sectors finishing basically flat.

The mining sector was the biggest gainer, rising 2.3%, followed by real estate with a 1.1%.

Goodman Group climbed 2.4% to a six-week high of $35.38.

All of the big four banks finished lower, with NAB dropping 1.2% to $38.28, CBA dropping 0.9% to $141.65, Westpac dipping 0.6% to $32.10 and ANZ falling 0.5% to $31.15.

Looking forward, the Federal Reserve's rate-setting committee will meet on Tuesday and Wednesday. Of 101 economists polled by Reuters, 92 expect the Federal Open Market Committee will cut interest rates by 0.25% and nine are predicting a supersized cut of 0.50%.

Curated by James Gruber, Joseph Taylor & Leisa Bell

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website