The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Donald Trump campaigned to Make America Great Again (MAGA) but he’s only succeeded in making the rest of the world great again.

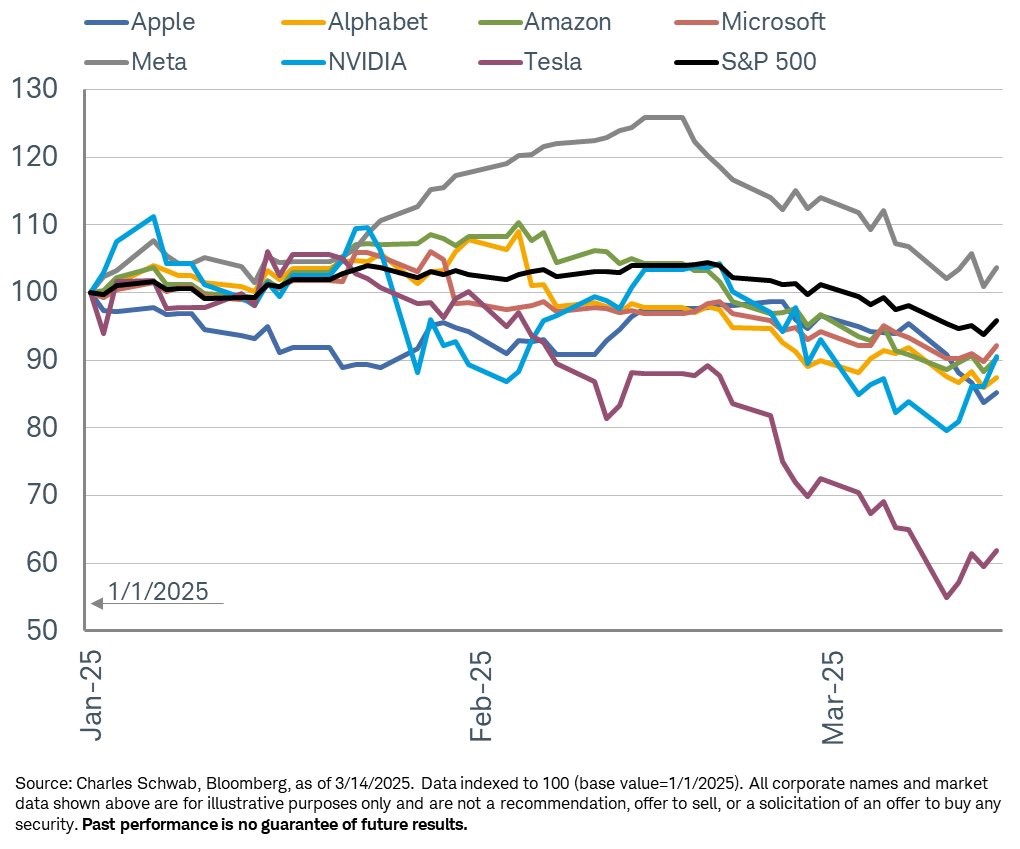

At the time of writing, the S&P 500 is down 4% year-to-date, and has fallen 10% from its highs. Meanwhile, the Nasdaq and Russell 200 have fared worse, having both fallen 8% this year and 14% from their highs.

That doesn’t quite reflect the degree of carnage in American markets. The average member of the Nasdaq index has dropped 32% from their highs, while for the Russell 2000, they’ve declined 26%.

Even the once-beloved Magnificent Seven are copping it. Six of the seven are down in 2025, with only Meta in positive territory (update: Meta also went negative as of Wednesday morning). Tesla has trailed the rest, getting whacked 38% this year, to lag every other company in the S&P 500.

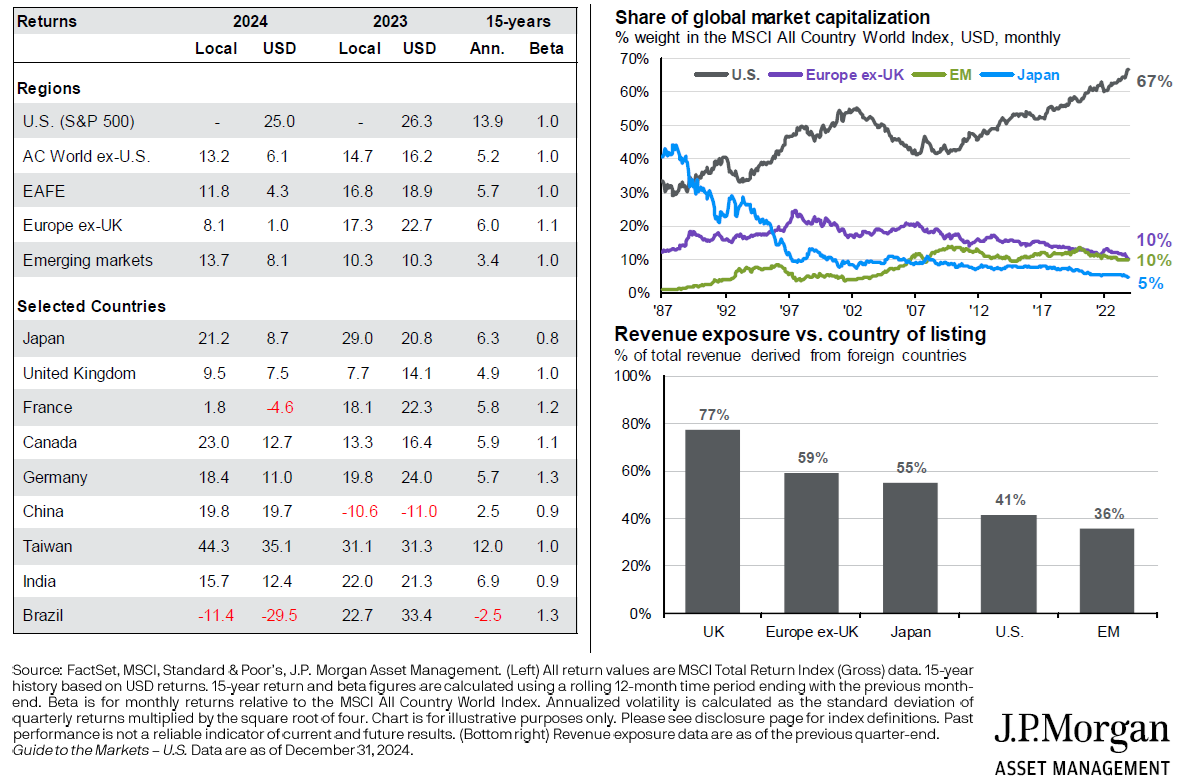

The rest of the world is having a better time of it. Developed European markets have risen 13% in USD terms in 2025, with Germany and France leading the way, up 20% and 14% respectively.

China has also found investor favour. It’s jumped 19% in USD terms year-to-date, helping Emerging Markets to a 4% gain this year (tech-laden Taiwan has lagged, as has India).

Reasons for the turnaround

Though Trump is getting the blame for the correction in US stocks, the truth is that he’s just been the trigger for an over-hyped and overpriced US market.

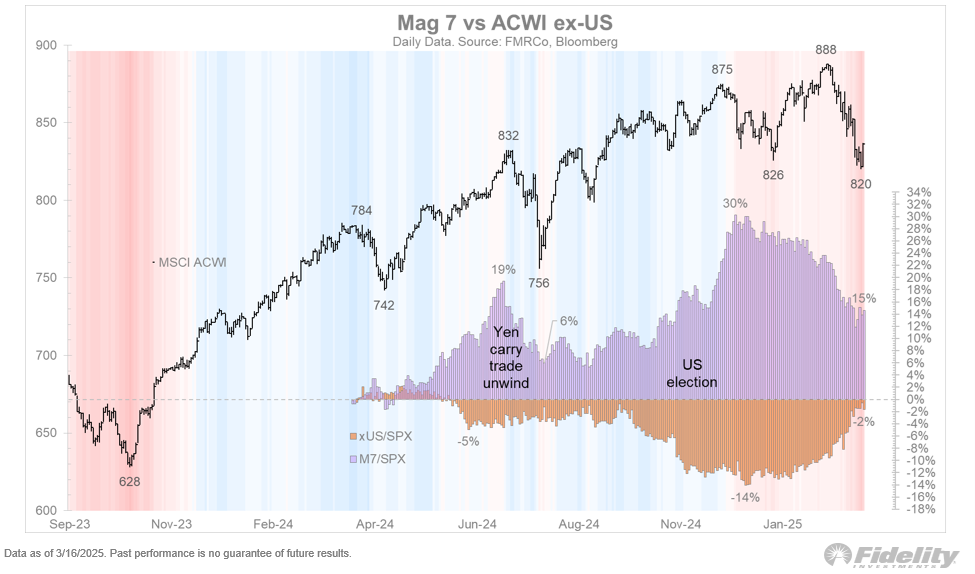

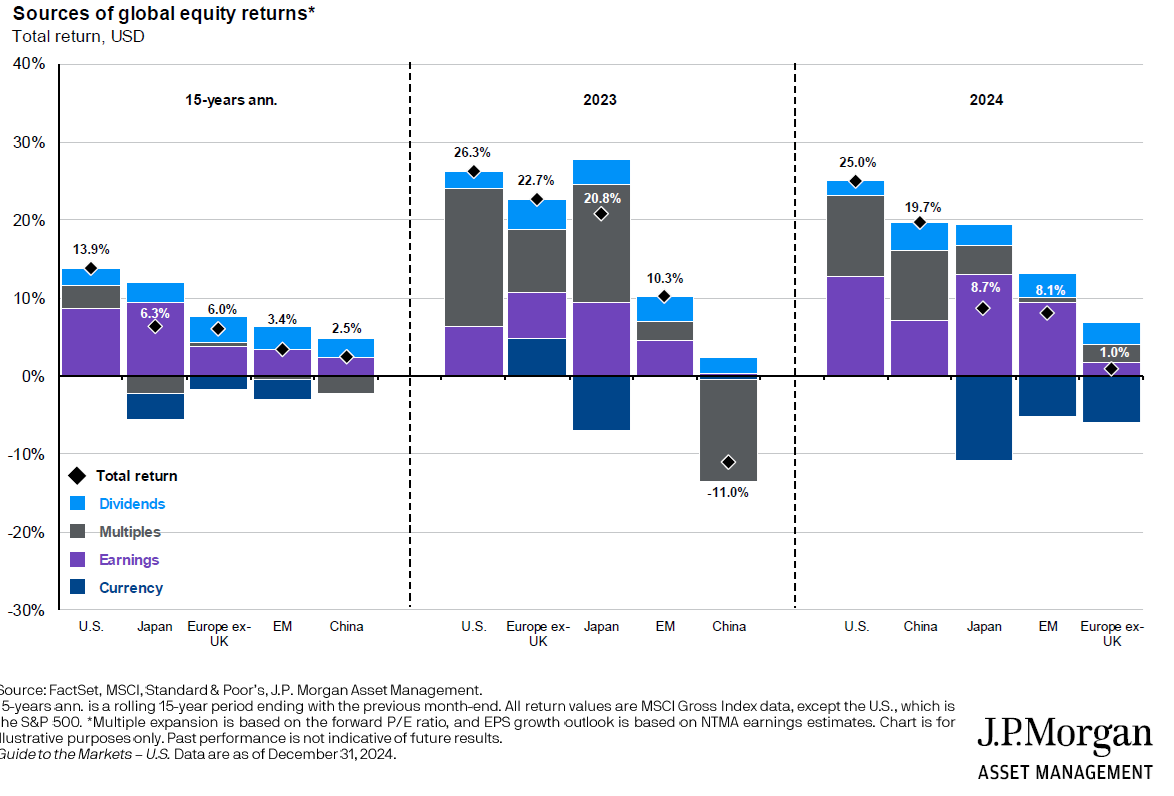

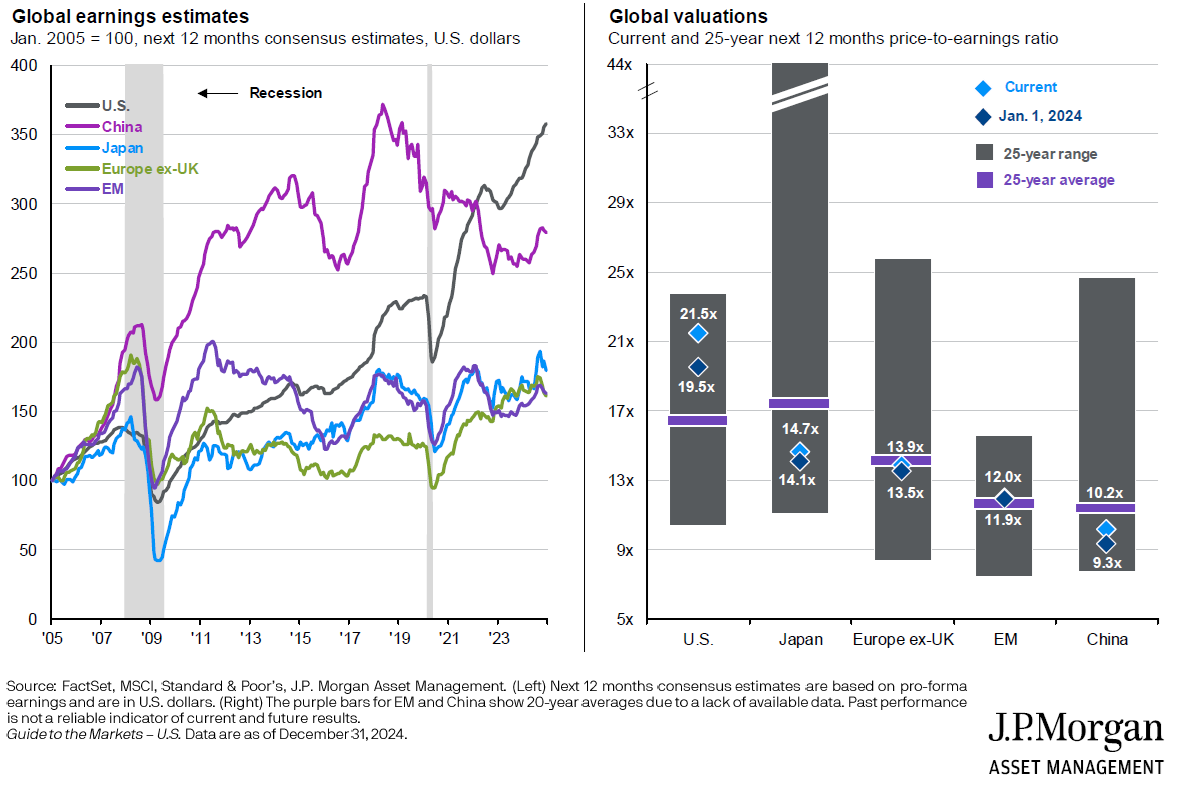

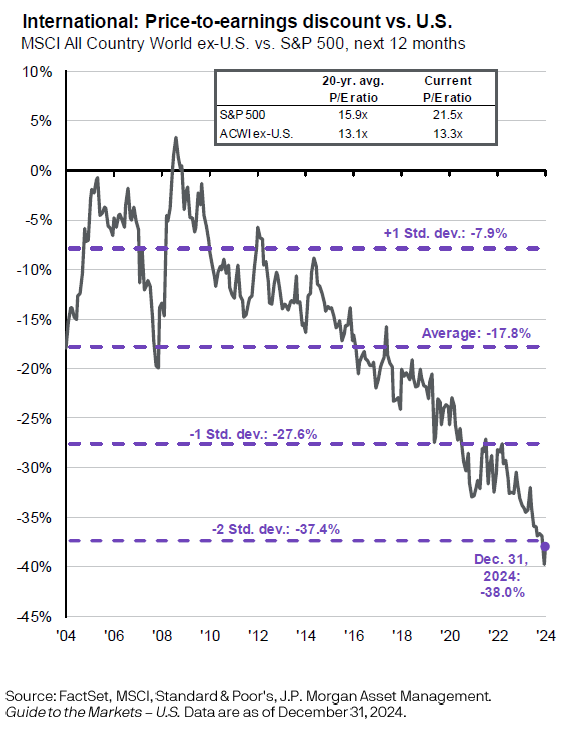

Until recently, America had crushed the rest of the world for 15 years. The S&P 500 returned 14% per annum between 2010 and 2024, compared to the world ex-US return of 5%.

That extraordinary run prompted talk of ‘US market exceptionalism’. The idea being that American companies were far superior to those of other countries, and that would remain the case for a long time.

Some of this talk was justified, given the superior earnings growth of US companies, especially the Magnificent Seven.

However, some wasn’t, as the earnings growth was accompanied by aggressive valuation re-ratings, particularly for the US tech stocks.

It resulted in the US trading at far higher valuations versus international stocks than historical norms.

Given the momentum in US stocks, both institutional and retail investors had piled into the market by the end of last year. US households had their highest exposure to American stocks in decades.

Similarly, institutional investors were ‘all-in’ on America. They effectively had to be by default because any institution that had been underweight the US had been demolished during the previous two years.

Seen through this lens, Trump has been the trigger for the correction, but any number of things could have led to a pullback in US markets.

Trump has poked the European bear

Inadvertently, Trump’s policies could be the catalyst for an economic turnaround in Europe.

From Australia, it’s hard to appreciate the shock that Trump’s protectionist policies have caused in Europe. In early February, the US Vice President JD Vance gave an extraordinary speech to a Munich security conference where he said that the greatest threat to Europe didn’t come from a nuclear-armed Russia currently waging war in Europe, but “from within Europe – the retreat of Europe from some of its most fundamental values, values shared with the United States of America.”

Former UK Prime Minister John Major, a Conservative euro-skeptic, said this after the speech:

“It’s extremely odd to lecture Europe on the subject of free speech and democracy at the same time as they’re cuddling Putin. In Mr. Putin’s Russia, people who disagree with him disappear, or die, or flee the country, or — on a statistically unlikely level — fall out of high windows somewhere in Moscow.”

The Vance speech solidified Europe’s suspicions that the trans-Atlantic alliance, in effect since the end of World War Two, was dead, and even NATO was in trouble.

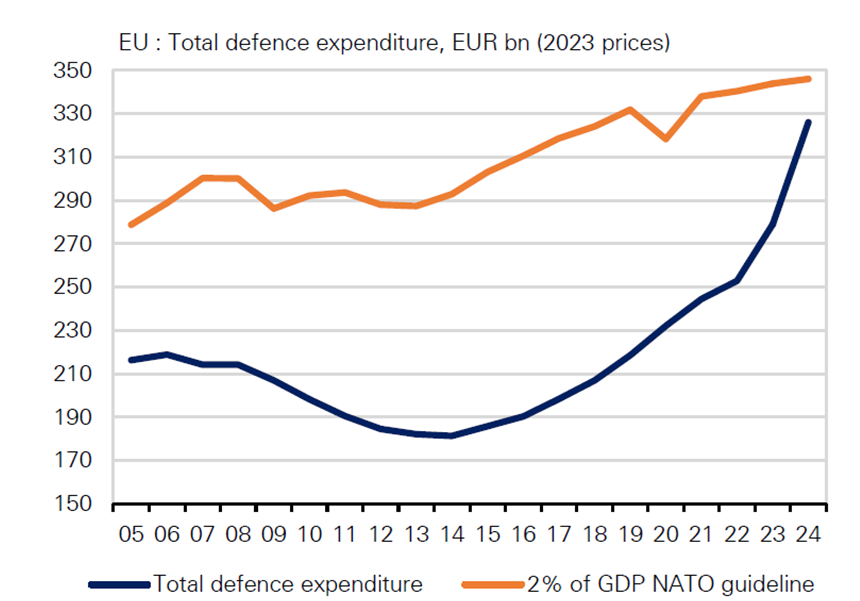

That meant they needed to rearm to protect themselves, without US help, and fast.

To be fair, they’d already started been doing this since Trump’s first term.

To deter Russia, experts believe that Europe will no need to lift spending on defence from under 2% to 3.5%.

It hasn’t taken long for countries to react. After decades of economic conservatism, Germany is seeking to introduce fiscal stimulus to pay for billions in spending on defence and infrastructure.

The planned infrastructure fund would spend 500 billion euros, or 12% of German GDP, on infrastructure, energy grids, and housing over the next 12 years. This fund alone would lift German and European real GDP growth by about 1% and 0.3% per year, respectively, over the coming decade.

In addition, if EU countries increase their defence budgets by 1.5% of GDP, as has been suggested, this would mean an additional 800 billion euros, or 4.3% of the EU’s GDP. If that’s implemented over the next 10 years, it could lift EU real GDP growth by further 0.3% per year.

All up, the measures could raise the EU’s GDP growth rate from the current 1.6% to 2.1% during the next decade – or towards similar levels to those estimated for the US over the same period.

It’s a gift for China

Meanwhile, China can hardly believe its luck. Trump has upended NATO, put massive tariffs on the supply chains of America’s largest industrial firms, created policy upheaval that’s sent US markets reeling, and frightening consumers into spending less – all of which could quickly send the US economy into recession.

China isn’t too concerned with the American tariffs against it either. Exports are only 20% of its GDP, and exports to America are less than 15% of these exports. Plus, China can find alternative destinations for its goods in Europe, Asia, and Africa.

Meanwhile, its ‘Belt and Road’ strategy may get a second wind as countries would prefer the ‘certainty’ of trade and business deals with China to the uncertainty of dealing with Trump and the US.

The big question for markets is around earnings

Will fiscal stimulus and better economic prospects lead to improved earnings from countries outside the US?

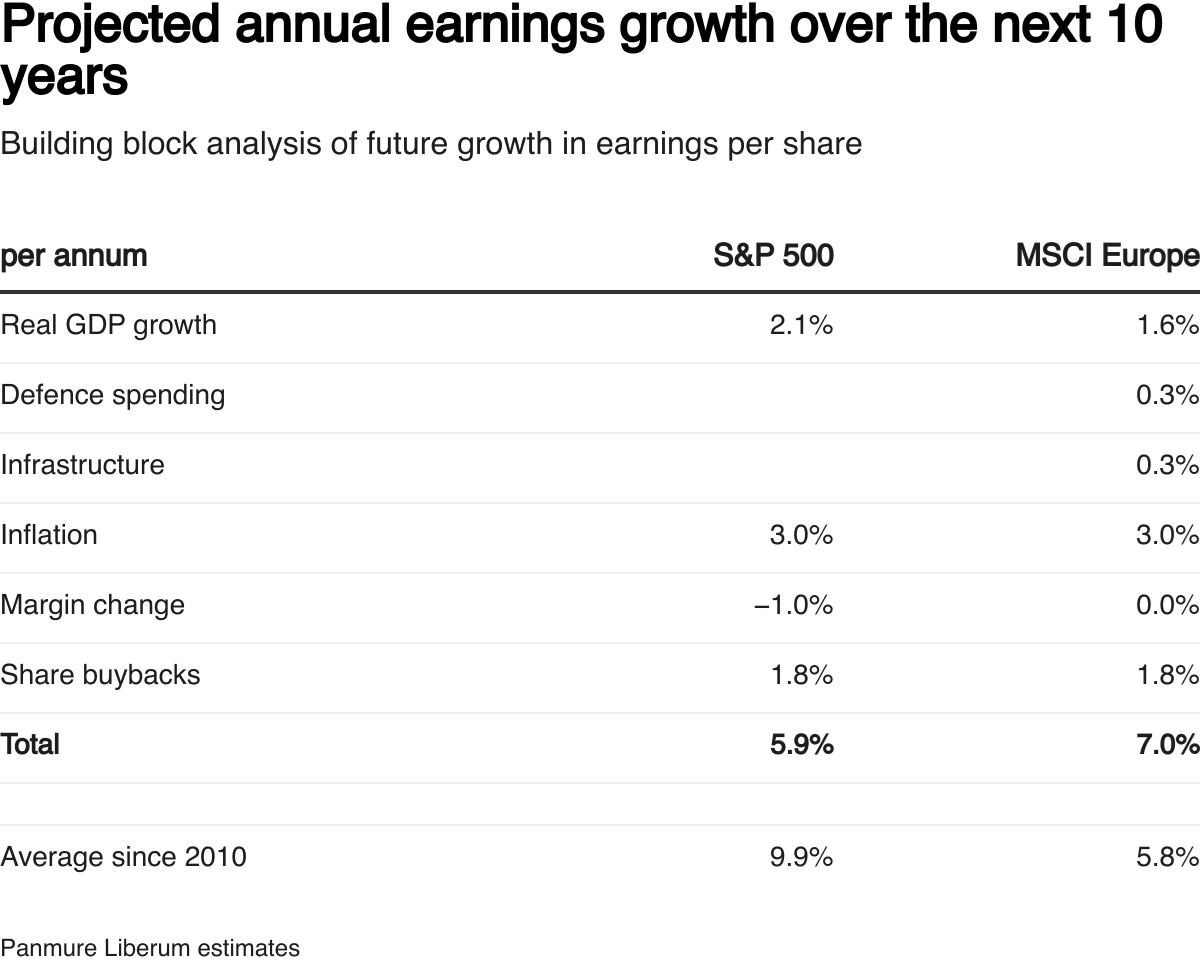

Fund manager, Joachim Klement, thinks they can. He estimates fiscal stimulus could translate to earnings growth of 7% in Europe compared to 6% growth in the US over the next decade.

If right, it would signal a major change in market and earnings leadership away from the US. And, Trump may have just kicked a massive own goal.

****

In my article this week, a common question that I'm getting from income investors is: with fixed term deposit rates falling and hybrids being phased out, where can I find yield? I run through the options, and the opportunities and risks involved.

James Gruber

Also in this week's edition...

Both experienced and novice investors are wondering why markets have corrected and what happens next. Ophir's Andrew Mitchell and Steven Ng guide us through the history of corrections and bear markets, and their underlying causes. What they find should give investors cause for optimism.

Ashley Owen's latest is provocative, suggesting that our large ASX companies are mostly century-old relics from the horse & buggy era, relying on domestic population growth, oligopoly pricing power, and gobbling up competitors for growth. By contrast, the US has had a continual process of innovation and renewal. Ashley looks at what that means for returns from both countries going forward.

Housing mobility is important for individuals and the broader economy. Andrew Barker and Aaron Korchak-Krzeczowski believe there are obstacles to greater mobility in Australia, and they propose several reforms to improve it, including policies to ensure greater rental security and encourage downsizing among retiree homeowners.

In recent months, there has been increasing concern and media coverage about delays in paying death benefits from superannuation funds. One of the fundamental issues is that under the law, super death benefits do not automatically form part of the deceased person’s estate. Nick Callil and David Knox think that needs to change.

Over the past few years, the Reserve Bank of Australia has copped its fair share of criticism. Yet, despite its flaws, Tim Farrelly reckons that it may just have engineered the rarest of beasts: the fabled soft economic landing. And for that, it deserves praise.

As part of their global exposure, Australian investors typically allocate mostly to Developed Markets equities, and a smaller portion to Emerging Markets. Platinum Asset's Cameron Robertson looks at the latter position and whether there might be a better way.

Two extra stories from Morningstar this weekend. Joseph Taylor looks at two ‘buy the dip’ candidates, while Shane Ponraj highlights a cheap company with strong growth potential.

Lastly, in this week's whitepaper, Alantra - a GSFM affiliate - run through their approach to finding the best global small cap opportunities.

****

On Friday, US stocks finished flat on the S&P 500 after recouping moderate early losses. Short-dated Treasurys continued to enjoy a bid with the two-year yield ticking to 3.94% from 4.06% Monday, while the long bond gave back some recent gains with a four-basis point increase to 4.59%. WTI crude consolidated above US$68 a barrel, gold pulled back to US$3,020 per ounce, bitcoin stayed at US$84,000 and the VIX logged its lowest finish of March at just over 19.

From AAP:

The local bourse on Friday overcome a choppy session to finish the day higher, while notching its best weekly performance for 2025. The S&P/ASX200 closed 0.17% to 7932.1, as the broader All Ordinaries edged up 0.12% to 8158.7. It was the top-200's first weekly gain in five weeks, as uncertainty around tariffs, global growth and rate-cut projections weighed on markets.

Six of 11 ASX sectors traded higher on Friday, led by a massive 3.9% gain in consumer staples.

The segment rally came after a supermarket industry inquiry cleared Woolworths and Coles of price-gouging and made no recommendations to break-up the oligopoly it found the two giants dominate. Woolies shares were up 6.3% by the close, as Coles gained 4.9%.

Industrials lifted 1.2%, as health care, IT stocks and telecommunications services led losses, losing 0.7% each.

Financials edged lower on Friday but were up 2% for the week, with the big four banks finally catching a bid after tepid earnings collided with lofty valuation concerns in February, sending the sector tumbling 13.5% from its peak.

Materials were up more than 2.5% for the week thanks to talks of domestic stimulus in China. BHP and Rio Tinto were both up 1% for the day.

From Shane Oliver, AMP:

Global share markets mostly rose over the last week from oversold conditions helped by an absence of new tariff comments from Trump and as the Fed helped calm recession and inflation fears. For the week US shares rose 0.5%, Eurozone shares rose 0.3% and Japanese shares gained 1.7% but Chinese shares fell 2.3% partly due to disappointing stimulus announcements. Bond yields mostly fell suggestive of growth worries but oil and metal prices rose suggesting little concern about growth, although copper and gold (which reached a new record high) are still being boosted by US demand ahead of feared tariffs. Safe haven demand and central bank buying also boosted the gold price. The $US rose slightly and the $A fell, and Bitcoin was little changed.

While the volatility in shares over the last few weeks has caused much excitement, so far it’s a bit of a non-event in an historical context. For example, US shares had a 10% top to bottom fall but as can be seen in the next chart its hardly unusual.

Source: Bloomberg, AMP

The Federal Budget on 25 March is likely to highlight a spendathon ahead of the election (mostly matched by the Coalition) and confirm a likely return to budget deficits. Much of the new spending has already been announced so there will likely be few surprises, but the Government will likely use the Budget as an opportunity to package up its already announced election policies with some new one’s ahead of the formal election campaign. The good news is that the revenue windfall from stronger than expected employment and commodity prices along with bracket creep will mean the starting point for the budget will be $10-15bn better this financial year and next. But the Government has already racked up an extra $37bn since January in new spending measures over the next four years as part of its election campaign - on Medicare, roads, the NBN, school funding, cheaper drugs, another freeze to deeming rates, subsidies to help metal producers, etc. And the Treasurer has indicated that another $1.2bn will be included for disaster recovery following Cyclone Alfred. However, there will still be some new measures in the Budget including:

- another round of $300 per household electricity rebates or something similar costing $3.5bn in the next financial year (otherwise average electricity bills could rise 30% or so reflecting another rise in underlying electricity prices on 1 July and the current gap between underlying and subsidized prices);

- more subsidies to support Australian industries affected by Trump’s tariffs and maybe more spending on Future Made in Australia subsidies (all of which is economically dubious and just another form of protectionism);

- more funding for a buy Australian campaign; and

- more defence spending to partly address Trump’s gripes that we only spend 2% of GDP on defence, but the problem is that getting defence up to 3% will add around $28bn to the deficit.

Netting this out will likely see this financial year’s budget deficit forecast revised down to around $17bn (from $26.9bn in MYEFO) and next year’s to $42bn (from $46.9bn) with deficits still projected out to mid next decade. The Government’s growth forecasts are likely to be revised down slightly for this year and next to 1.5% and 2.25%, with unemployment being revised down to around 4.2% and inflation forecast to remain around 2.5% helped by another round of electricity rebates. Net migration is likely to be revised down to around 300,000 from 340,000 for this financial year. We don’t expect the Budget to alter the outlook for interest rates but were it not for all the extra public spending RBA rates would be lower.

Curated by James Gruber and Leisa Bell

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly Bond and Hybrid updates from ASX

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

LIC (LMI) Monthly Review from Independent Investment Research

Plus updates and announcements on the Sponsor Noticeboard on our website